Ithaca Energy: Transformational growth through M&A to IPO

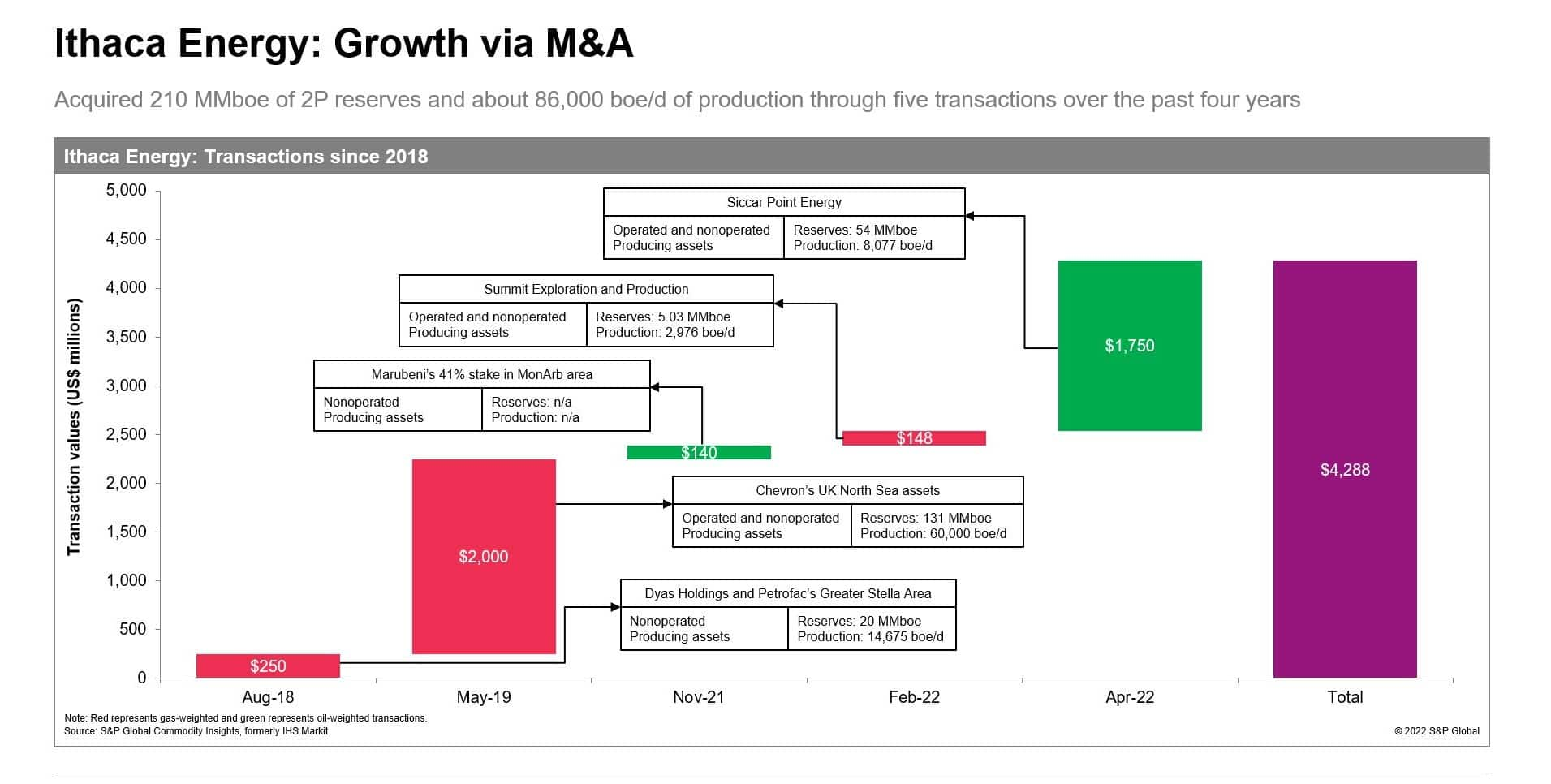

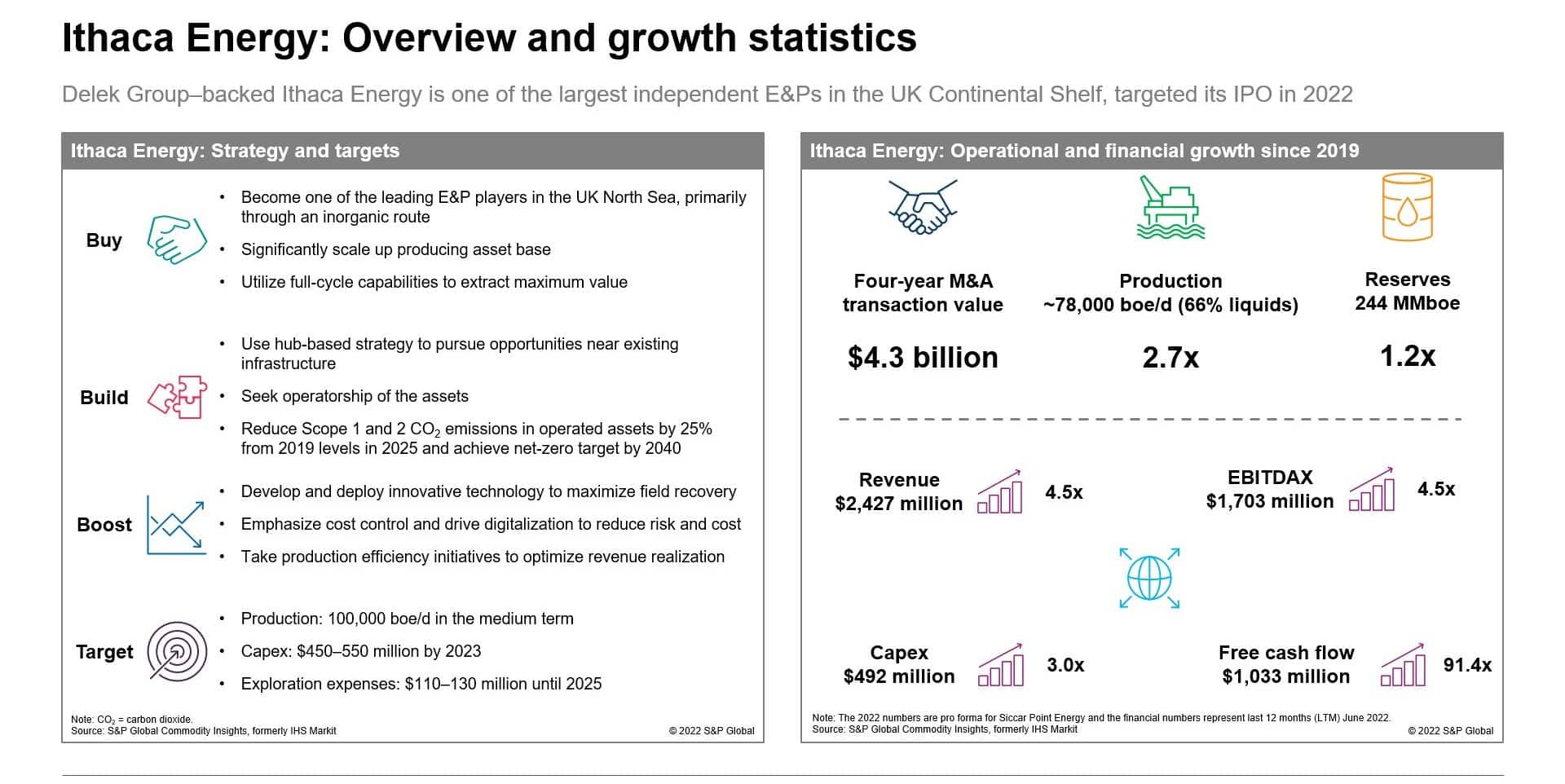

Delek Group-backed Ithaca Energy is one of the largest independent oil and gas companies on the UK Continental Shelf (UKCS). Following Delek's acquisition of Ithaca in 2017, Ithaca registered a rapid growth via its inorganic strategy and acquired assets worth $4.3 billion in 5 different transactions. The acquisitions included Chevron's UK North Sea assets for $2 billion in 2019 and corporate acquisition of Siccar Point Energy for $1.75 billion in 2022. The Chevron deal added 60,000 boe/d of production and 131 MMboe of 2P reserves to Ithaca's portfolio.

The acquisitions have provided a significant upside to the company's overall performance. Ithaca recorded a production and reserves growth of 2.7x and 1.2x, respectively. Multifold growth was witnessed in revenue, EBITDA and cash flow as well. Ithaca further wants to grow its portfolio in the North Sea and has laid out a buy, build, and boost strategy to achieve a production of 100,000 boe/d in the medium term. Ithaca's current portfolio consists of 29 producing fields, located primarily in the central North Sea and West of Shetland areas of the UKCS. The undeveloped Cambo and Rosebank fields are expected to support Ithaca's future organic growth. Ithaca has also committed to lowering its emissions and aims to reduce Scope 1 and 2 CO2 emissions in operated assets by 25% from 2019 levels by 2025 and achieve net-zero target by 2040.

Ithaca completed an initial public offering (IPO) on the London Stock Exchange (LSE) in November 2022 where the company raised £262.5 million (US$303.6 million), represents about 10.4% of enlarged share capital. The IPO was priced at 250 pence per share, the bottom end of the offered range of 250-310 pence a share, with an implied market capitalization of £2.5 billion (US$2.9 billion). The company aims to reduce its indebtedness from the IPO proceeds which will enable the company to have an independent capital allocation policy. Ithaca's IPO was the largest UK-based E&P company IPO on the LSE in nearly 5 years, following Energean's IPO in early 2018. Ithaca's IPO shows possible investor confidence in oil and gas companies amid the Russia-Ukraine crisis that is highlighting the importance of energy security and the value generated by the E&P companies following a sharp rally in the commodity prices. The London listing would provide the company an access to a wider range of capital-raising options in the future. This will also help the company to grow organically by building upon its undeveloped Cambo and Rosebank assets, enhance shareholder returns and pursue value accretive M&A, furthering its buy, build, and boost strategy.

Learn more about our research and insight capabilities through our Companies & Transactions Service.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.