Key trends for India’s power and renewables markets in 2023

As 2023 kicks off, India shows resilience to handle price shocks. Electricity demand in 2022 grew by 8.7% after continued recovery from COVID-19-related disruptions and intense heat waves that swept the country during a prolonged summer. On the supply side, coal generation increased by 8.7%, resulting in higher emissions. Energy security and affordability remained top priority in 2022 to navigate the energy crisis. Hence, efforts to improve domestic coal production, mandates for coal imports, and an emphasis on expanding local manufacturing remained interesting developments in 2022.

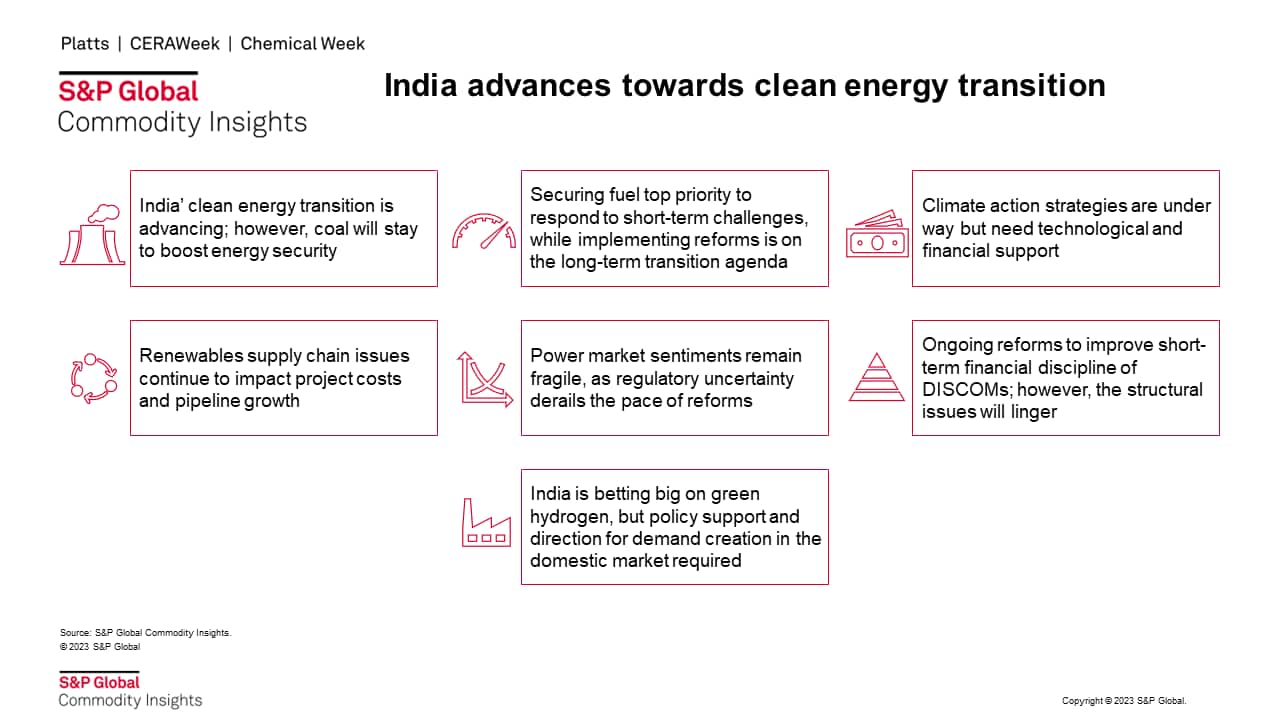

In 2023, India will gear up to implement energy transition strategies by addressing issues related to energy security. These include building local supply chains, securing domestic fuel resources, deepening power sector reforms to address structural issues, and continuing to adopt new and clean technologies by creating demand and infrastructure. The following are the key trends for the India power and renewables market:

Energy Security and transition intertwines

- India's clean energy transition is advancing; however, coal will stay to boost energy security. Announcements for coal sector for some brownfield expansion projects, delays in retirements or even lifetime extension plans for old thermal plants, and liquidation or revival of part of stalled private sector projects is on the cards.

- Securing fuel is top priority to respond to short-term challenges, while implementing reforms is on the long-term transition agenda. India's coal production to increase, however, import dependence may also continue in the power sector to fulfil the rising demand in 2023. Meanwhile, to boost gas demand government will adopt strategies to shield against the rising price volatility.

Renewable additions grow

- The total installed capacity reached 410 GW, of which renewable capacity is 121 GW at the end of 2022. Although missing the 175 GW target for 2022 by about 30%, India's renewable sector continues to grow driven by policy focus on clean energy resources with about 90% of capacity additions in 2022 coming from renewables. There are more than 70 GW in the renewables pipeline in different stages of development as of the end of 2022. However, about 40% of this pipeline is delayed beyond its schedule and may be marred with high risk of further delays or even cancellations in the current high-cost environment.

- Renewables supply chain issues continue to impact project costs and pipeline growth. While the supply chain pressures may ease, for example, global solar module prices again start going down, but impact on project costs will not translate in 2023. Tender volumes are taking a hit with capacity awarded falling by about 40% in 2022 as market awaits stability.

- Lack of support mechanism to keep offshore wind from taking off. India is planning to issue one of its first offshore seabed lease rights tender for 4 GW of offshore wind projects off the coast of Tamil Nadu. It may be challenging to finance the offshore wind projects in India, which have higher execution risks, a complex project development cycle, and a lack of local expertise in the technology and no fiscal support mechanism.

Reform agenda for markets

- Power market sentiments will remain fragile with elevated power prices in the short-term market. While the pace of reforms remained encouraging in 2022, with implementation of general network access (GNA), the ancillary services market (ASM) for tertiary reserves, and new deviation settlement mechanism (DSM) structure. However, hiccups in the DSM with unrealistic high prices, and grid instability would require the regulator to focus on stabilizing the market.

- Renewable Energy Certificate (REC) market goes through an overhaul, but regulatory uncertainty around implementation of new rules with no floor pricing remains. The suspension of the floor price may affect small-scale renewable developers with higher costs and economic models based on REC revenues, but at the same time, removing the floor may help drive the demand for RECs for obligated consumers.

- Ongoing reforms may improve short-term financial discipline of DISCOMs; however, the structural issues will linger. Proposed amendments through the Electricity (Amendment) Bill, 2022, aim to address the chronic issue of non-cost-reflective tariffs, a mandate for progressively cost-reflective retail tariffs, and rationalization of tariffs and cross-subsidies. However, this issue may not see any near term change due to political factors.

Big plans on climate

- Climate action strategies are under way but need technological and financial support. Implementation of low-emission strategies will be the priority for 2023, including the carbon market framework. Access to low-cost, long-term financing remains a key challenge for the required leapfrogging of renewable additions.

- India is betting big on green hydrogen across sectors; however, it's a long road for its adoption. In January 2023, the government approved the National Hydrogen Mission, with financial support of $2.4 billion and target of minimum 5 MMt green hydrogen production per year. Currently, majority of the players are looking for hydrogen electrolysis technology partners and awaiting policy directions for demand creation in the domestic market as green hydrogen is uncompetitive compared with alternate fuels.

For more information on this research and the service it comes from, please visit the Asia Pacific Regional Integrated Service page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.