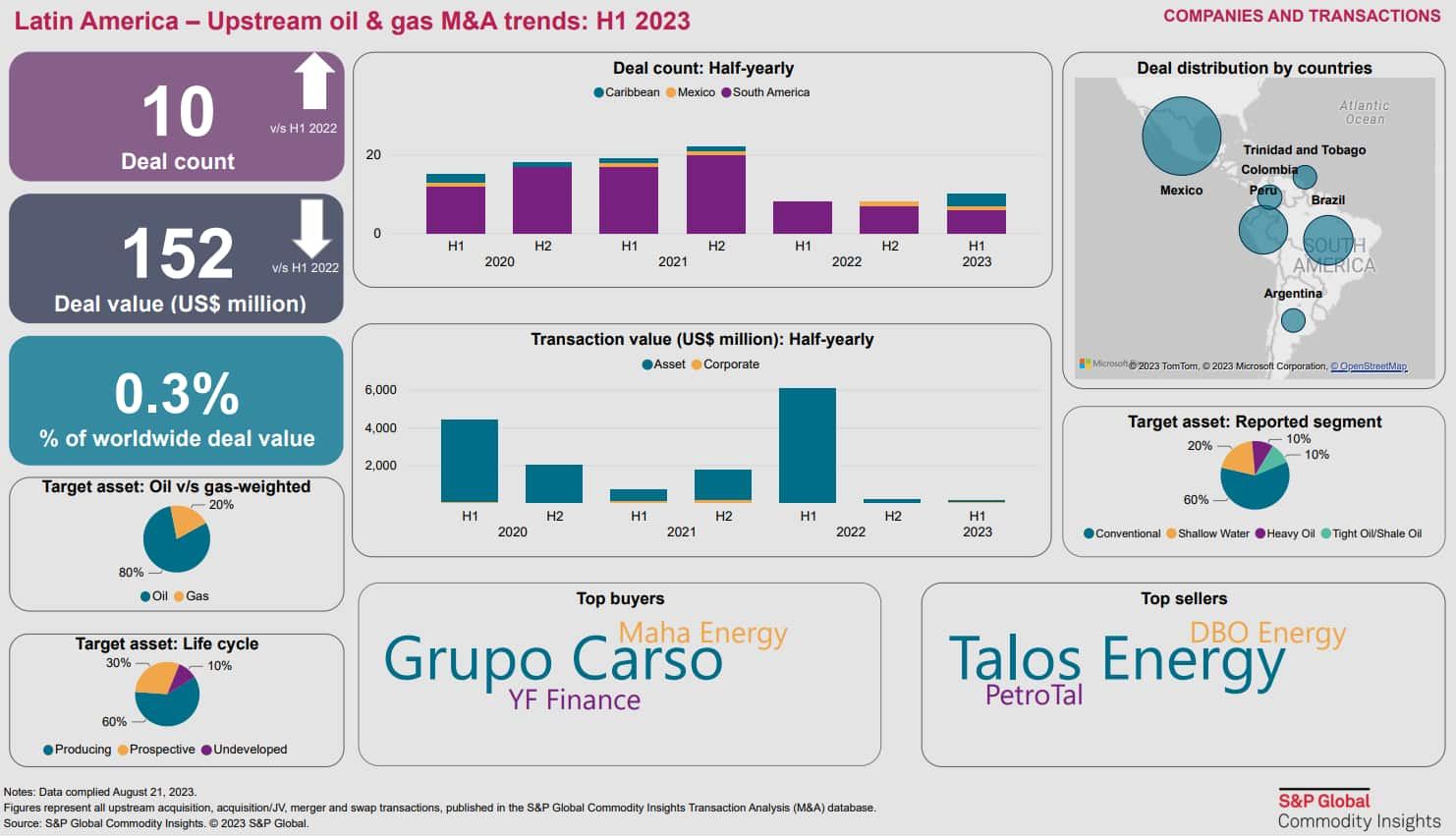

Latin America – Upstream oil & gas M&A trends: H1 2023

Commodity price volatility combined with a halt to Petróleo Brasileiro SA's (Petrobras) divestment program due to government decree resulted in a significant slowdown in upstream M&A activity in Latin America in the first half of 2023. In the absence of Petrobras's large divestments in Brazil - the main driver of activity in the region - we expect diminished regional transaction value and deal flow. During the first half of 2023, transaction parties were a mix of public and private companies, with no deals involving global integrated oil companies and national oil companies. M&A activity in the Caribbean region (featuring Trinidad and Tobago) has been growing, owing partly to the E&P success in Guyana and Suriname, and remains a key area for E&P investment. Argentina is also attracting some interest, including the Vaca Muerta. Brazil, Colombia, Mexico and Peru were each represented by a single deal. In the top acquisition in the first half of the year, Talos Energy Inc. partnered with Grupo Carso, SAB de CV to benefit from the conglomerate's presence in Mexico and global commercial experience as the company advances the offshore Zama oil field toward final investment decision and first production.

Learn more about our research and insight capabilities through our Companies & Transactions Service.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.