Line 5 shutdown could create a logistical scramble, reducing competitiveness of crude oil producers and refiners

A shutdown of Enbridge's Line 5 could create a logistical scramble for both North American crude producers and the refiners that transform the raw material into key consumer fuels. Crude producers in western Canada and the Bakken would lose a significant pipeline route and would face lower netbacks as their crude was forced to more distant markets via more expensive modes of transportation such as rail or truck. Refiners that rely on deliveries via Line 5 would face higher costs relative to their competitors, potentially threatening their economic viability.

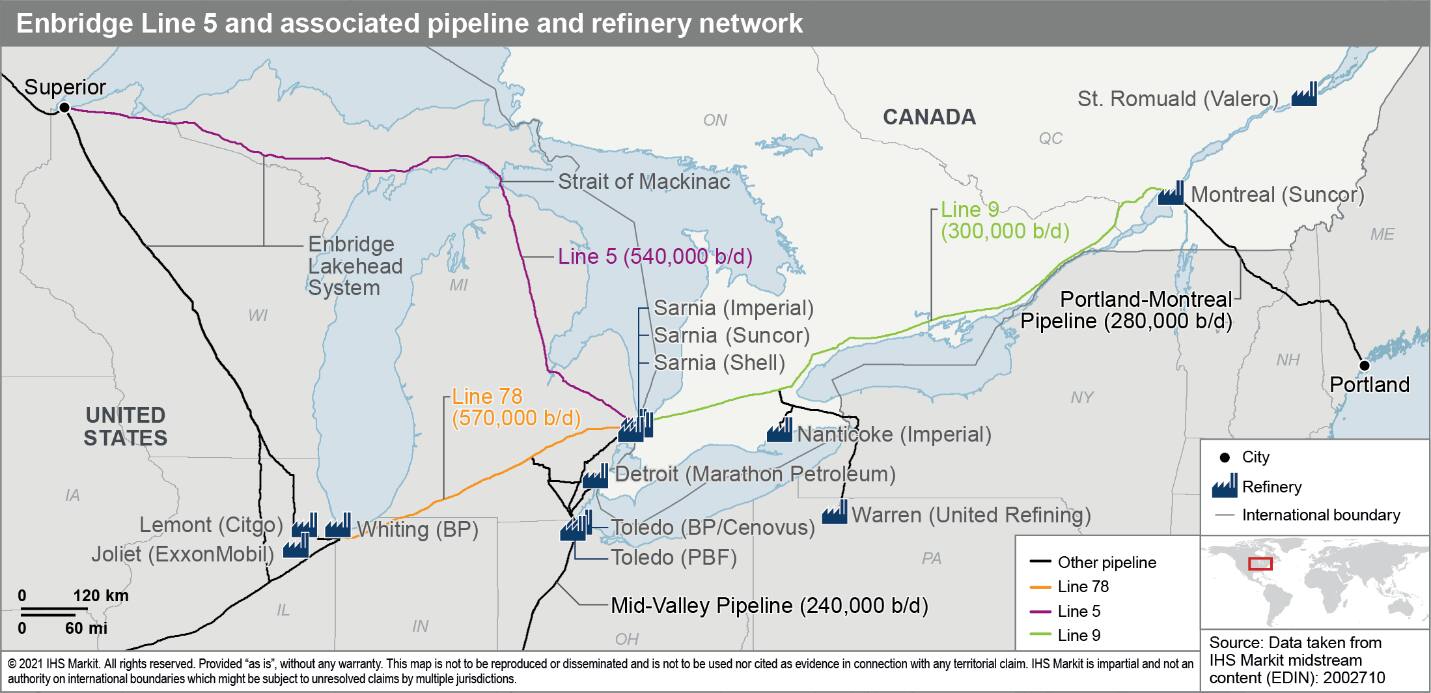

On 13 November 2020, Michigan governor Gretchen Whitmer filed a legal action seeking the closure of Enbridge's Line 5, by 12 May 2021. At issue is the potential for a spill as the pipeline crosses the Great Lakes through the Straits of Mackinac, a major transportation route connecting Lake Michigan and Lake Huron. Line 5 runs from Superior, Wisconsin to Sarnia, Ontario, and together with Line 78 forms a critical part of the Enbridge Mainline system out of western Canada. Line 5, which typically runs full, has the capacity to ship about 540,000 b/d of light crude and natural gas liquids (NGLs) to refineries in Detroit, Michigan; Toledo, Ohio; Warren, Pennsylvania; and Ontario and provides crude oil interconnections to Montreal, Quebec.

Enbridge has filed a complaint seeking an injunction to prevent the shutdown, stating that pipeline regulation is a US federal matter, and not a state one. Despite the 12 May deadline, the case could continue to wind its way through the court system for the foreseeable future, depending on legal developments. Enbridge has also been advancing a separate project to bury the Strait of Mackinac pipeline crossing in a tunnel 100 feet below bedrock, although that project, if fully approved, would not be completed until late 2024.

What would be the impact of a Line 5 shut down? Mainline capacity beyond Superior, excluding Line 5, is just under 2 million b/d. US Federal Energy Regulatory Commission (FERC) data indicate that Mainline deliveries beyond Superior have regularly exceeded this level. It is therefore unlikely the full volume of crude oil that moves on Line 5 would be able to clear the market on the Mainline system in the event of a shutdown. Netting out the 75,000-85,000 b/d of NGLs transported by Line 5, more than 400,000 b/d of crude would need to find alternative markets or modes of transportation.

Moreover, effectively all western Canadian and Bakken crude oil grades would lose some degree of market access via pipeline, not just the light crude that moves on Line 5. This is because with Line 5 shut, refineries formerly served by it would nominate shipments on Line 78, almost doubling demand for Line 78 space. As part of Enbridge's common carrier Mainline system, Line 78 would have to be apportioned dramatically, reducing access to all refineries proportionally.

Other pipelines that ship Canadian and Bakken grades to the US Midwest are effectively at capacity, and a permanent shutdown of Line 5 could increase the call on crude-by-rail shipments from western Canada and the Bakken. If the displaced crude cannot access the market via pipeline and/or must travel farther afield, crude oil producers could see their netback prices decline in order to clear the market.

What about the refining sector in the affected markets? There are nine refineries served by the Line 5/78 system with collective crude oil distillation capacity of more than 1 million b/d; these plants produce over 400,000 b/d of gasoline, 200,000 b/d of diesel and 150,000 b/d of jet fuel. Some of these refineries have access to other pipeline systems that would mitigate their supply impacts to some degree from a Line 5 shutdown, but others would lose a substantial portion of pipelined supply. The refiners impacted by a Line 5 closure would have to decide to operate at reduced rates or source crude oil using more costly transportation mechanisms. Some refineries would likely fall to a competitive disadvantage relative to refineries in their market still able to receive their full crude slate by pipeline.

Access IHS Markit's full report, The threat of Enbridge

Line 5 shutdown looms, via the link on the right side of this

page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.