As lithium-ion battery materials evolve, suppliers face new challenges

Lithium-ion batteries (LIBs) began to impact the rechargeable or secondary battery market for portable electronic devices at the turn of this century. Nickel metal hydride (NiMH) rare earth-containing batteries, the main competitor two decades ago, quickly lost share to LIBs due to the combination of superior rechargeabil- ity, higher energy density, and lower size and weight.

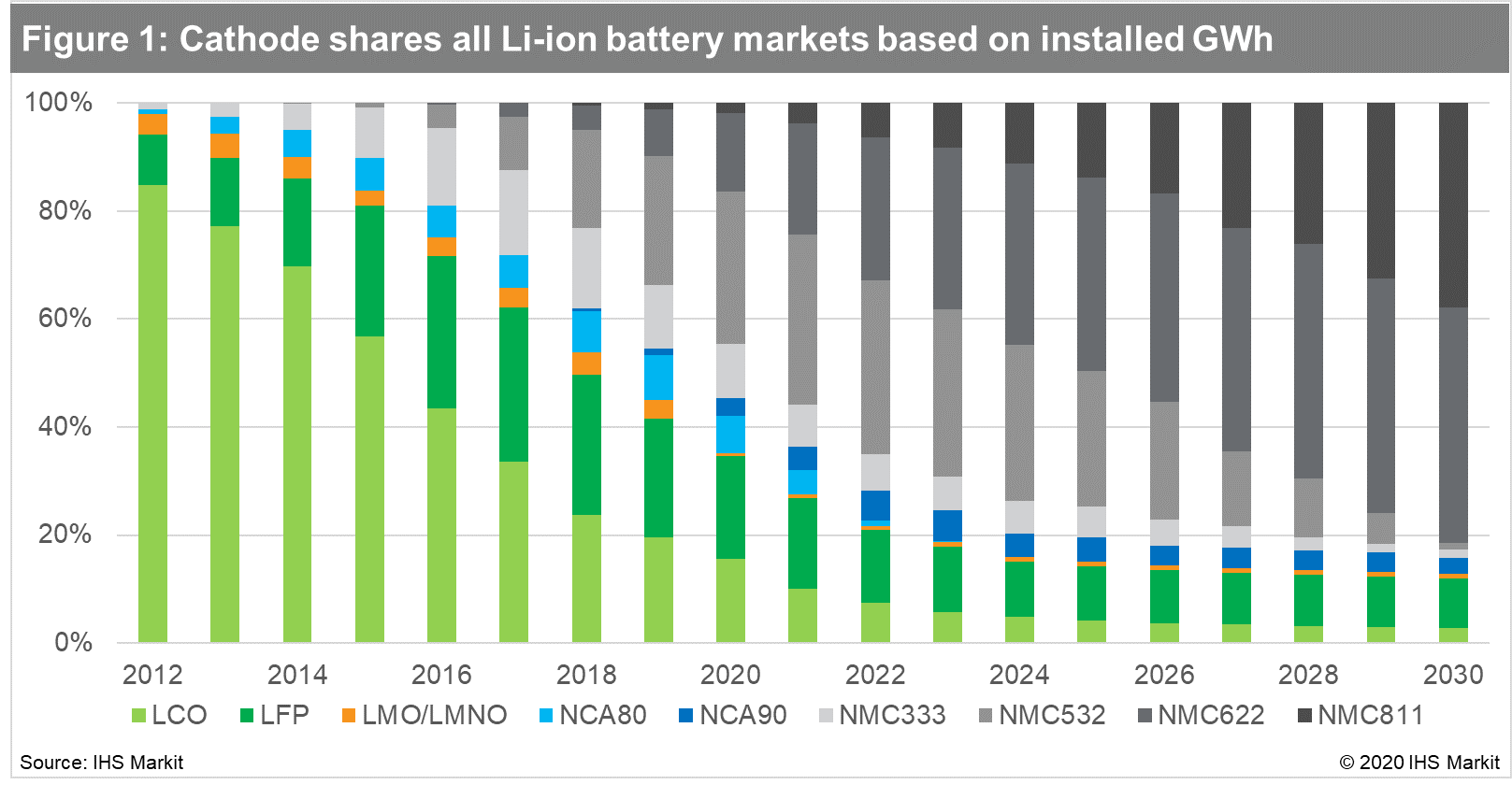

All LIBs have one element in common, lithium. Yet the

combination of cathode materials, the beating heart of the battery

cell, is in constant flux. Lithium cobalt oxide (LCO) cathodes,

which have a 60% cobalt content and are installed in the bulk of

smart phones and laptops, are steadily losing market share to

higher energy density lithium nickel manganese cobalt oxide (NMC)

cathodes. NMC cathodes have a lower cobalt content, less than 20%,

and they power high-performance long-range electric vehicles

(EVs).

NMC technology is experiencing a noticeable shift from cobalt-rich

to nickel-rich cathodes, as seen in the Figure below.

In general, a higher cobalt content correlates with a more

expensive battery, and higher nickel content equals greater energy

density. Energy density is proportional to the range that the EV

can drive on a single charging cycle. Lithium iron phosphate (LFP)

and lithium manganese oxide (LMO) began to be phased out of the

market because of low energy density. LFP, however, remains in the

running thanks to its inherent safety, low cost, and independence

of the cobalt and nickel supply chain. IHS Markit is forecasting a

resurgence in LFP in EV's, whilst also continuing to gain market

share in e-buses, and grid storage applications. Lithium nickel

cobalt aluminum oxide (NCA) cathodes, used by Tesla, are forecast

to lose share over the next five years.

Will nickel challenge cobalt's crown?

Probably yes, but not so fast. Today, LIBs count for over

half of global cobalt consumption. Despite the migration towards

high-nickel cathodes, total cobalt demand is expected to double by

2025, with demand driven by EVs. Cobalt is necessary for the

structural stability of the battery. Lack of structural stability

results in decreasing cycle life and a sharp loss in storage

capacity.

Is cobalt the blood diamonds of

batteries?

The sources of cobalt include: large-scale mines (78%), artisanal

and small-scale mining (12%), and recycling (10%). The use of

cobalt is associated with considerable reputational risk for the

automotive and electronics industries. Large-scale mines frequently

rely on dubious practices around acquiring and maintaining mining

licenses. Artisanal and small-scale mines are sometimes illegal.

They often use irresponsible practices and inadequate equipment,

putting the health of workers at risk. About 2% of the total cobalt

supply is mined by child labor.

The supply of mined raw materials is highly concen- trated in the

Democratic Republic of Congo, which poses a risk to the robustness

of the entire supply chain. Approximately 99% of cobalt is

extracted as a byproduct of copper and nickel mining, which makes

it greatly dependent on future supply and demand developments of

those materials. The processing of raw materials into cathodes,

cells, and batteries is concentrated in Asia, particularly mainland

China - which also poses a risk to the security of the supply

chain.

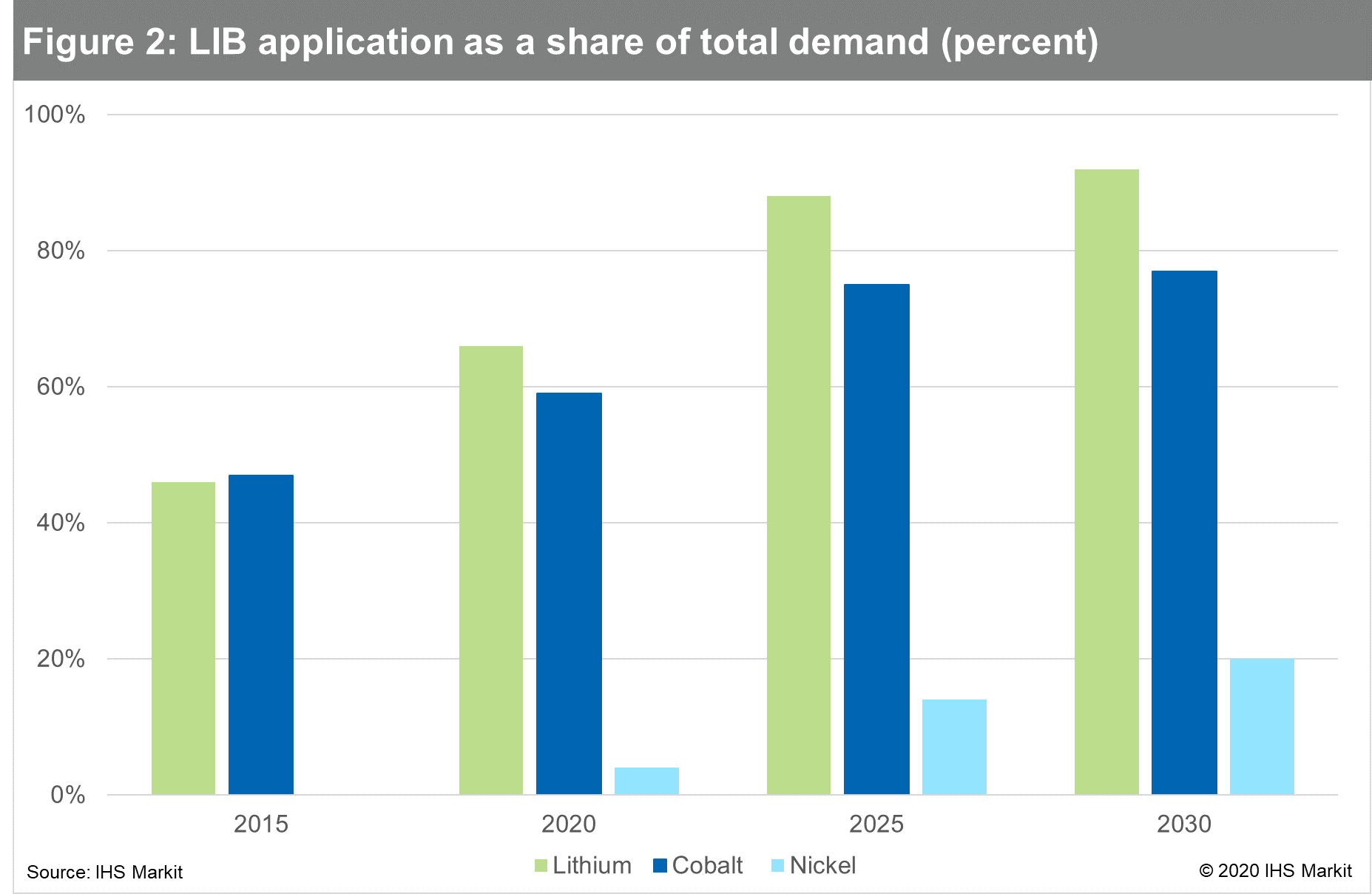

By 2030, over 80% of lithium will be mined for

EVs

In 2000, about 9% of lithium produced was used for batteries. By

2020, this share rose to 66% and it is forecast to reach over 90%

by 2030. Other lithium applications - including ceramics, glass,

and lubricants - still play an important role, but they tend to

grow along with GDP. Lithium raw materials and chemicals suppliers

had to respond quickly to produce different high-specification

materials and production quantities. While demand for lithium and

cobalt is already dependent on the battery market, less than 5% of

nickel is consumed in LIB manufacturing. Most nickel is consumed in

the manufacture of stainless steel. As shown in Figure below, the

growth of cobalt in LIBs will begin to slow, whereas nickel

consumption will increase significantly.

Sourcing of lithium raw materials and chemicals is

changing

Lithium is mined from both hard rock and underground

brine deposits. Lithium containing spodu- mene ore is mined from

open pits and typically concentrated by flotation methods on site.

Australia is the largest producer and exporter of spodumene

concentrate. Spodumene concentrate is converted into lithium

carbonate or lithium hydroxide, primarily in China. Most

brine-based lithium mining capacity is located in Chile and

Argentina. Brine is extracted from salars (salt-encrusted

depressions in the earth) and pumped into evaporation ponds, where

the power of the sun concentrates the brine. Lithium carbonate is

precipitated using soda ash or lime and can be further processed

into lithium hydroxide, which is required in new high-nickel

battery cathode chemistries.

The US was the biggest producer of lithium until 1997, utilizing

Nevada's brines and North Carolina's spodumene belt. For two

decades, brine-based production from Chile and Argentina dominated

the supply landscape, due to lower production costs. Emergence of

several Australian spodumene produc- ers over recent years has

changed this situation, and spodumene capacity now accounts for

more than two-thirds of lithium supply.

Other chemicals, electrolytes, and anodes play a

role

Electrolytes serve as a medium to transport lithium ions between

the cathode and anode in a battery cell. Typical liquid

electrolytes are mixtures of solvent (80%) and lithium salts and

additives (20%). The most widely electrolytes are used in the

majority of LIBs, and work is under way to develop ceramic (solid),

gel, and polymer electrolytes with even better electrochemical

performance. Electrolytes are currently produced in China, Japan,

and the US, but the development of Europe's own battery supply

chain has led to major investments in local producers, who could

commence production within the next five years.

LIB anodes are produced from spherical graphite. Graphite mining

and processing is linked to environ- mental pollution, so there is

less interest in expanding graphite-producing capacities globally.

China has large capacities in both the mining and processing

stages. Mozambique and Madagascar have ramped up capacity at new

mines over the last five years, with most output destined for China

for processing. Silicon, a more environmentally sustainable anode

material, could replace graphite in the future. Graphite and

silicon-blended anodes are already being used in combination with

some high-nickel NMC and NCA cathodes.

Supply should meet demand, but type and quality are

constantly evolving

Lithium, cobalt, and nickel production capacity should meet the

surge in demand. Established players are incrementally increasing

capacity, and many new producers are eager to gain their slice of

the electro- mobility cake. Cathode raw material suppliers will

have to remain flexible in their choice and quality of chemicals

offered so they can effectively supply this dynamic lithium-ion

battery revolution.