Mexico's energy opening – New updates

New details on bid rounds include acreage for unconventional energy resource areas. Mexico's opening continues to advance on schedule.

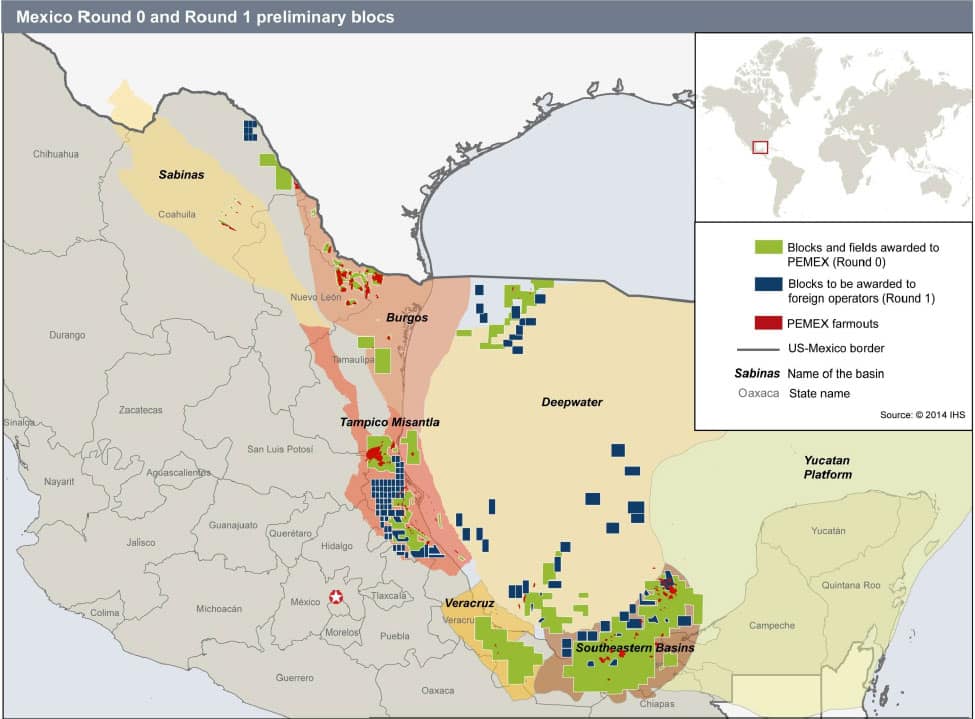

Earlier this year, this blog published an article on the potential for the Eagle Ford Formation in Mexico in context with Mexico's Energy Reform. In summary, the Eagle Ford and Haynesville equivalents are present south of the Rio Grande in several basins (see figure 1) and Pemex has extended the known oil, wet gas and dry gas windows from the US into Mexico. The opening of the country to outside energy companies continues to move forward with the Energy Reform after 78 years of being closed.. Recent updates for bid rounds and the rollout of the reform follow where unconventional energy and other opportunities may certainly be present.

Round 0 On August 13, 2014, President Nieto signed new laws completing the legislative phase of the Mexico Energy Reform. Mexico's Energy Secretariat (SENER) announced the results of the 'Round 0', where PEMEX was allocated 100% of the areas holding proved and probable reserves (2P) it requested back in March 2014. These areas represent 83% of the total 2P reserves of the country, holding 20.5 billion barrels of oil. PEMEX was also allocated 67% of the prospective areas it requested, holding an estimated 22.1 billion barrels of oil.

PEMEX Contracts Migration and 'Farm-Outs' Mexico's state goal is for PEMEX to remain a viable company and an important partner for moving the reform forward. To help reach this goal, PEMEX's President disclosed the company's strategy for the association with other companies in order to carry out major projects.

PEMEX will seek to migrate 22 'Exploration and Production Service Contracts' and 'Financed Public Works Contracts' into the new type of contracts which are now allowed by the Hydrocarbons Law. Migration of existing contracts into new comprehensive contractual designs for the reform is in a date driven process--beginning with 11 existing fields in the southern region, Poza Rica-Altamira and Burgos Basin, plus 11 additional fields in Chicontepec and Burgos. PEMEX's President said that they would like to have the first 11 contracts migrated in six months' time and the remaining 11 during the first half of 2015. This process will not need to be carried out through a bid round since they already have partners working in them. However, the National Hydrocarbons Commission, the Energy Secretariat and the Finance Secretariat will have to authorize the type of contract to be used and the terms and economic conditions of the contracts.

In addition, and probably the most important PEMEX task in the short term, the company will seek 'strategic partners' for the development of 10 fields allocated to PEMEX during the 'Round 0'. Partners should complement the capital, knowledge and operational capacity of PEMEX in these 10 highly technical and complex, capital intensive or otherwise strategically important projects. PEMEX calls this process the 'farm-outs', after a term that is widely used in the international upstream petroleum industry. This plan is, at the same time, divided into four association packages, comprising:

- Mature fields (Onshore: Rodador, Ogarrio, Cardenas-Mora; Offshore: Bolontikum Sinan and Ek)

- Heavy oil fields (Ayatsil-Tekel-Utsil)

- A giant deepwater natural gas field (Kunah-Piklis)

- Discoveries in the Perdido area (offshore) (Trion and Exploratus)

According to the SENER and PEMEX schedules, the 'farm-outs' are expected to be ready between November 2014 and December 2015. According to the Hydrocarbons Law the process of choosing partners for PEMEX for the 'farm-outs' must be made through a bid round organized by the National Hydrocarbons Commission (CNH). PEMEX estimates that investments of USD 76 billion for the next 10 years are needed to develop the areas covered by the 'Contracts Migration' and 'Farm-Outs'.

Round 1 The SENER also announced that 169 areas covering 28,500 Km2 will be offered during 'Round 1'. The bid round will include all sorts of fields including onshore, shallow and deep water and unconventional areas. According to the SENER, the areas on offer hold 3.8 billion barrels of oil reserves (2P) and 14.6 billion barrels of oil prospective resources, and USD 8.5 billion per year between 2015 and 2018 are needed to develop them. The bid round basis, as well as the model contracts and fiscal regime to be used for the different areas on offer, are still being discussed. The SENER schedule establishes that these conditions will be published between November and January 2015 and the contracts are to be awarded between May and September 2015.

Figure 1 Mexico Round 0 and Round 1 Preliminary Blocks

The IHS Energy Petroleum Economics & Policy Solutions service (PEPS) provides a wealth of new details on Mexico's opening, including the Hydrocarbons Law, royalties, exploration and production taxes, production sharing and other fiscal terms. Carlos Bellorín, Senior Petroleum Legal Analyst; Alexander Macgregor, Senior Petroleum Legal Analyst and Philip Ortiz Bukowski, Petroleum Legal Analyst are the key PEPS analysts contributing to the detailed analysis. Learn about other E&P Solutions for Mexico.

Posted 7 October 2014

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.