Microinverter and power optimizer market proves its resilience through COVID-19 pandemic

The module level power electronics (MLPE) market is currently dominated by two suppliers, Enphase and SolarEdge. Enphase innovated in this space early in the growth of solar market with microinverter technology. SolarEdge, on the other hand, offers a competing solution consisting of power optimizers paired with a solar inverter. Both suppliers have grown rapidly, especially in the United States which is now the largest market for MLPE globally.

COVID-19 continues to cause disruption to target MLPE markets of residential and commercial installations

The MLPE market was initially impacted by COVID-19 due to manufacturing being slightly delayed in February as both SolarEdge and Enphase manufacture some of their products in China. Both suppliers mitigated the impact by using air freight on occasion to meet strict delivery timelines for some customers due to safe harbor orders in the United States as well as by ramping up production in other locations outside of China such as Mexico for Enphase and Israel, Hungary and Vietnam for Solaredge. As the COVID-19 pandemic reached key MLPE markets such as the United States and Europe in March, both Enphase and SolarEdge reported a significant slowdown in recent earnings calls in demand in Q2 2020, especially in April, with demand gradually recovering through June.

Enphase, whose demand comes primarily from residential installations, noted that the decline in shipments of 45% quarter-over-quarter (Q-o-Q) was in large part due to workplace disruptions and social distance requirements which negatively impacted door to door sales for residential installers. On the supply side, Enphase reported that it worked with contract manufacturers to reduce production to mitigate the risk of over-supply in the channel and shifted production to Mexico to reduce the impact of 25% tariffs in the United States on Chinese-made PV inverters.

SolarEdge similarly reported a reduction in shipments in MW terms of 56% Q-o-Q in the United States due to COVID-19. SolarEdge noted that while they saw an overall recovery from April through June in the United States, however the recovery in the commercial segment was slower compared with the residential segment. Recovery in the commercial and industrial segment may be slower through the second half of 2020 as businesses downsize their budgets or push projects due to economic uncertainty stemming from the COVID-19 pandemic.

MLPE market expected to recover in H2 2020

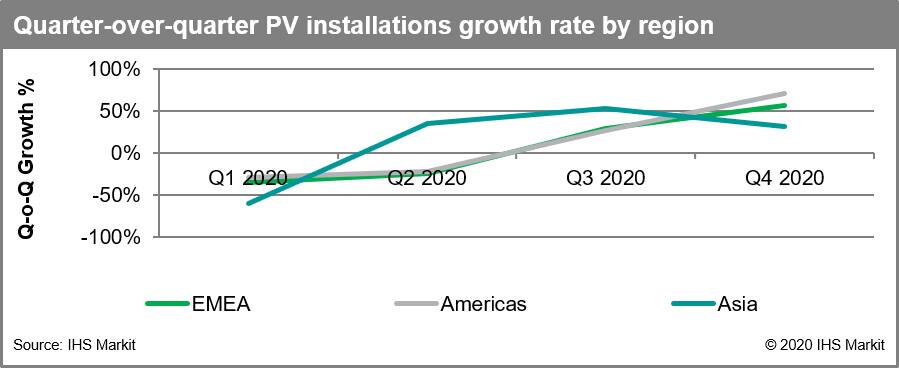

Even as the COVID-19 pandemic continues to impact the primary MLPE market of the United States, MLPE demand is expected to rebound through the rest of the year as IHS Markit forecasts global PV installations to grow by 43% in Q3 compared to Q2, with one of the main target growth markets of the Europe expected to grow at 29% in Q3. Accordingly, both suppliers reported increased visibility into orders and installations in the beginning of Q3 and are forecasting increasing revenue quarter-over-quarter.

Each supplier is responding to this expected growth in demand by boosting production. Enphase is setting up a new manufacturing location in Chennai, India to help meet expectations around growing demand. Production is scheduled to commence as early as Q4 2020. This new location is in addition to production in Mexico which Enphase continues to ramp up. Similarly, SolarEdge continues its plans to ramp manufacturing in Israel specifically to serve growing demand in the United States.

Additionally, as demand continues to grow, MLPE suppliers are developing new sales. For example, microinverters are increasingly being built into modules at the factory, sold as a single product known as an "AC Module". Therefore, Enphase announced a partnership with Hanwha Q Cells to develop new AC modules in June 2020. It also announced a new line of AC modules with SunPower under the "Maxeon" brand. A similar sales channel exists for SolarEdge in the form of "smart modules", or power optimizers built into modules at the factory. SolarEdge continue to offer smart modules products from a variety of module partnerships. IHS Markit expects shipments of AC modules and smart modules to grow as installers look for ways to reduce costs and labor time.

Europe to be key growth market for MLPE despite intense competition

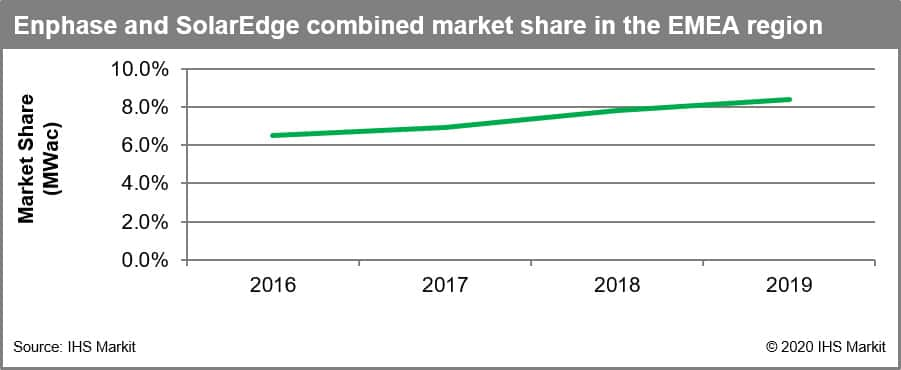

The United States accounts for the majority of global MLPE shipments. However, suppliers such as Enphase and SolarEdge have been expanding their business into new markets, especially in Europe. IHS Markit estimates that their combined market share has grown from 6.5% in 2016 to 8.4% in 2019 and expects overall shipments to continue to grow in Europe.

However, although Enphase and SolarEdge command a dominant lead in the MLPE industry, competition threatens to erode their market share and profits, particularly in Europe. PV inverter prices in Europe are generally more competitive than in the United States due to a much wider range of suppliers active in the region. In particular, Chinese suppliers, offering aggressively priced single-phase inverters have increased their presence dramatically in Europe over the past few years. Equally in the United States, these two leading MLPE suppliers account for the majority share of PV inverter shipments particularly in residential, however both suppliers are not immune to increased competition and potential price erosion. Import tariffs from Chinese-made inverters are keeping new entrants at bay for now, however a reversal in tariff policy could open the door for new competition. As a result, the leading MLPE suppliers are expanding into new lines of business both in order to offer complete energy management solutions to their customers and also to diversify into new markets.

MLPE suppliers target commercial and utility-scale solar segments for next phase of growth

A critical pillar of growth for both Enphase and SolarEdge is to expand into larger system sizes. The residential sector has been the largest market for the MLPE industry. However, installers and customers have gradually increased their adoption of microinverters and power optimizers for commercial installations. SolarEdge in particular has rapidly expanded its business to serve the commercial sector and stated in its Q2 2020 earnings report that 56% of its global shipments were for commercial installations. Furthermore, SolarEdge has indicated that it will launch a 380 kW inverter for utility-scale solar segment as it expands its portfolio offering. The vast majority of microinverters have been shipped to residential installations and adoption in commercial installations has been relatively low. Suppliers have begun offering larger microinverters capable of operating with more than one module such as "2-in-1" and "4-in-1" microinverters. Multi-module microinverters offer a more attractive solution for commercial installations in terms of simpler installation and a lower price on a dollar-per-watt basis. As Enphase continues to expand its microinverter business, it announced it will launch a commercial microinverter 'IQ 8D' product by end of 2020 in order to increase its penetration in commercial (>10kW) installations.

Energy storage market offers big potential to increase revenue spend per install by homeowners

Enphase launched its new residential storage solution, Encharge in Q2 2020. Storage will be one of the keys for Enphase to provide a more comprehensive energy management system for their customers. SolarEdge is expected to continue to grow its non-solar products, mainly lithium ion batteries from its subsidiary Kokam. It reported revenues from non-solar products in Q2 2020 to be $21.8 million. Additionally, it plans to grow Kokam's manufacturing capacity by 10X in 2022. The energy storage market is another important opportunity for both Enphase and SolarEdge to grow revenue. IHS Markit forecasts that global energy storage revenues, including batteries and energy storage inverters (PCS), to grow at a CAGR (19-24) of 18% to reach just under $8 billion. If Enphase and SolarEdge are able to leverage their leading positions in the MLPE industry to capture market share in energy storage solutions, they will see even stronger revenue growth.

Learn more about the IHS Markit solar PV research.

Miguel De Jesus is a solar market analyst for the Clean Energy Technology team at IHS Markit.

Posted 14 August 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.