Middle East oil and gas majors striking a balance between providing low carbon intensity energy supply and moving towards net-zero emissions

Following the UN Climate Conference, COP26, in Glasgow in 2021 and the subsequent COP27 event in Egypt this year, major Middle East E&P companies are performing a balancing act of producing sustainable low-carbon intensive energy, amid accelerated momentum towards net-zero emissions. Operators, however, are at the same time responding to a surge in demand for a secure and affordable energy source, as well as trying to fill the gap in the supply disruption, triggered by the current and ongoing conflict between Russia and Ukraine. And this all comes at a time just as the global economy contends with inflation and starts to recover from the effects of the coronavirus disease 2019 (COVID-19) pandemic.

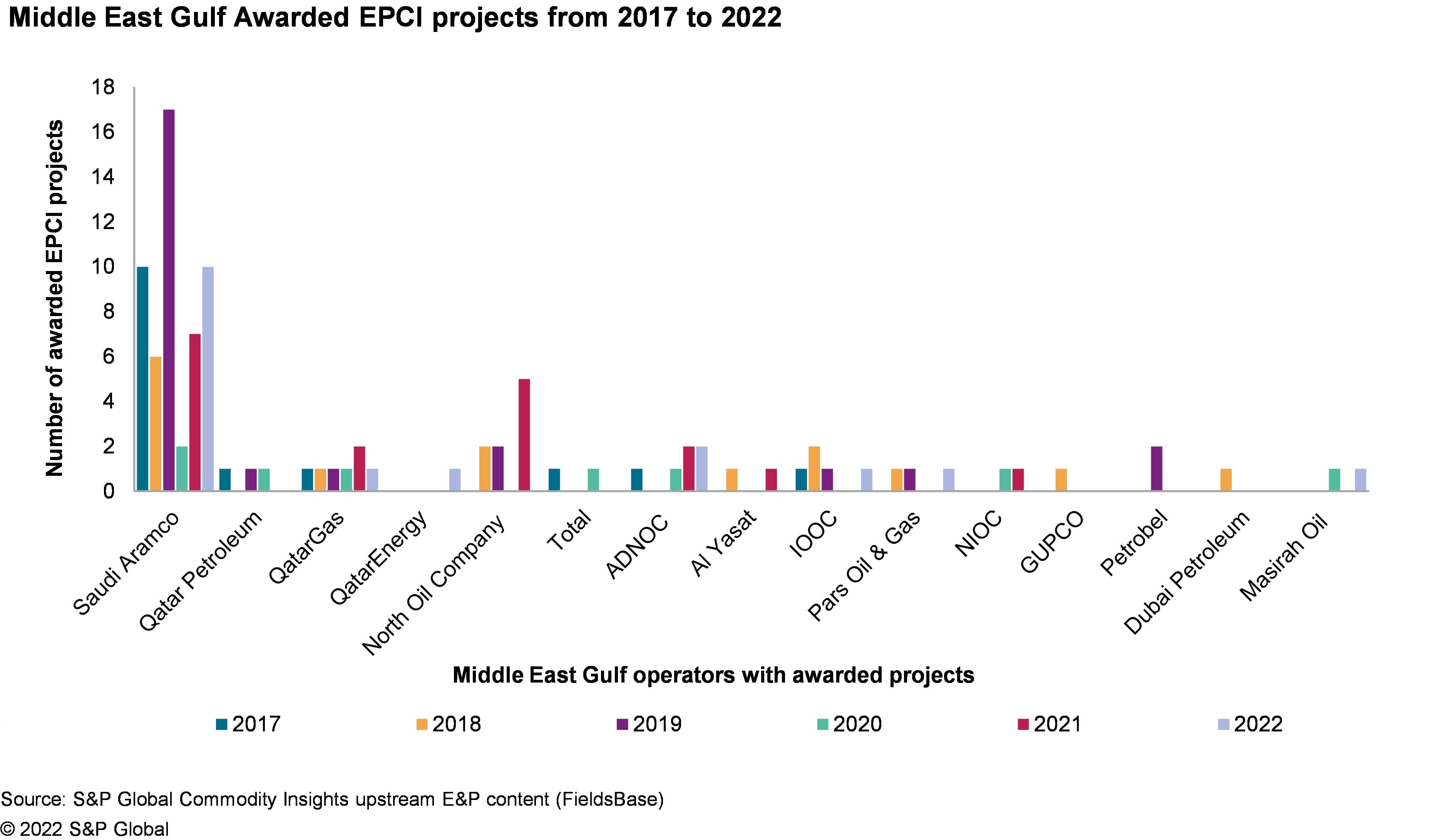

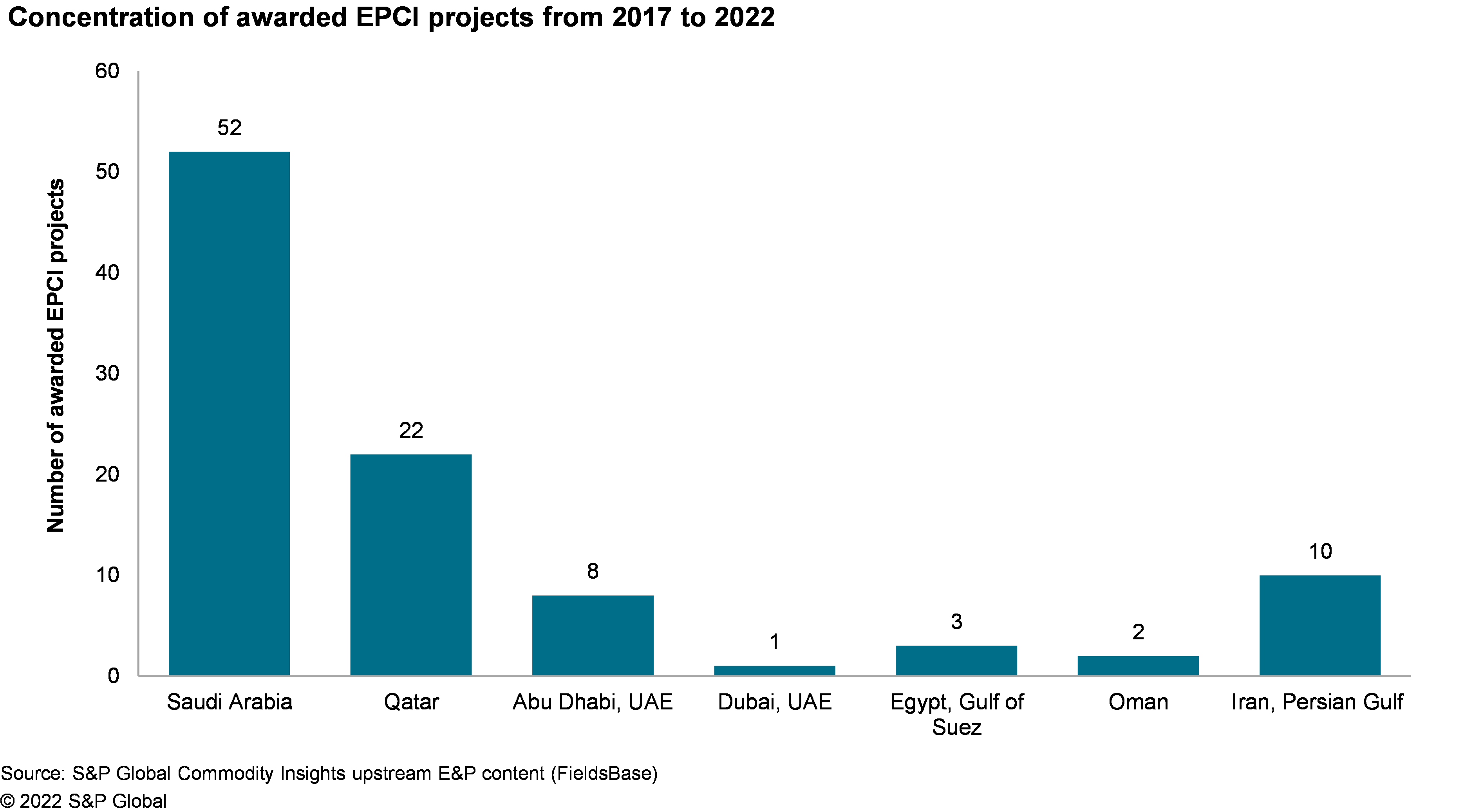

Saudi Aramco has consistently led the Middle East Gulf region in the engineering, procurement, construction, and installation (EPCI) contracting front for offshore field development projects from 2017 to October 2022. Based on FieldsBase from S&P Global Commodity Insights, Saudi Aramco awarded a total of 52 EPCI offshore projects during this period. Previously, the highest number of EPCI contracts awarded was in 2019, a year prior to the pandemic, with 17 projects in total, while during the onset of the pandemic in 2020, Saudi Aramco only had two visible awarded EPCI programmes. From a production capacity of 12 million barrels per day (MMb/d), Saudi Aramco is set to raise this to 13 MMb/d by 2027.

In line with the firm's net-zero ambition to 2050, Saudi Aramco launched in October 2022 a USD 1.5 billion sustainability fund to invest in technology that will further lower greenhouse gas (GHG) emissions across its assets, in addition to other solutions already in place or in the development stages.

Completion of an EPCI project could take between two to five years, depending on the complexity and scale of the work scope. Repercussions of the COVID-19 pandemic have delayed projects that were awarded several years prior to the pandemic, which were either completed in 2021 or are being completed in 2022 or in 2023. Moreover, EPCI contracts that have been awarded this year would likely be concluded between 2024 to 2027. Offshore EPCI campaigns are expected to be continuously brought to tender in the Middle East in the years ahead. Investments in EPCI projects could either aid in sustaining or increasing production capacity to contend with the natural decline in the output of existing and producing fields. Global primary energy demand is expected to increase by 23% from 286 million barrels of oil equivalent a day (MMboe/d) in 2021 to 351 MMboe/d by 2045, in parallel with the global economy that is forecast to double the size it was in 2021 and the population to rise to 9.5 billion in the same period, according to the Organization of the Petroleum Exporting Countries (OPEC) World Oil Outlook 2022.

Whilst in Abu Dhabi, located in the United Arab Emirates (UAE), Abu Dhabi National Oil Company (ADNOC) has fast tracked its production capacity increase to 5 MMb/d by 2027 from the initial target in 2030. The company has so far awarded six offshore EPCI contracts from 2017 to October 2022, while its subsidiary Al Yasat, awarded two development projects. Included on the list of awarded contracts is a project related to a USD 3.8 billion high voltage direct current (HVDC) subsea transmission network with total installed capacity of 3.2 Gigawatts for offshore production operations. The HVDC project will reduce ADNOC's carbon footprint in offshore operations by more than 30% with the utilisation of Abu Dhabi Transmission and Despatch Company's (TRANSCO) power network coming from Abu Dhabi's solar panels and nuclear power plant. ADNOC's GHG reduction strategies towards net-zero emissions by 2050 include carbon capture, utilisation, and storage (CCUS), improving efficiency in energy use, and developing low carbon solutions like clean hydrogen and liquefied natural gas (LNG), among others.

Over in Qatar, QatarEnergy, formerly known as Qatar Petroleum until mid-October 2021, has positioned a low carbon liquefied natural gas (LNG) production and supply as a cleaner energy source. QatarEnergy targets to expand its LNG production capacity from 77 million tonnes per annum (MMtpa) to 126 MMtpa by 2027. The first phase of expansion in the North Field, also known as the North Field East (NFE) project, will raise Qatar's LNG output capacity from its current 77 MMtpa to 110 MMtpa. The second phase, North Field South (NFS), will further boost this capacity to 126 MMtpa. QatarEnergy subsidiary Qatargas is involved in both expansion programmes. To ensure a low-carbon footprint LNG, these projects will be integrated with a carbon capture and sequestration technology. QatarEnergy's sustainability actions also involve flare and methane emissions reduction, energy efficiency and developing renewable energy capacity like solar of 2 to 4 GW by 2030. Additionally, it is looking into hydrogen solutions.

Reducing emissions to ensure a sustainable supply of affordable lower carbon intensity power source in the energy mix and transition sphere will be one of the key strategies and a continuing challenge for Middle East Gulf oil and gas operators going forward.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.