M&P’s Assala deal would solidify its Gabon position, but coup casts uncertainty

Maurel and Prom SA's $730 million acquisition of Gabon-focused Assala Energy, owned by private equity fund Carlyle Group, was intended to strengthen the company's position in the country. Due to close between the fourth quarter 2023 and the first quarter of 2024, it is now likely to be delayed due to a military coup which occurred in Gabon on 30 August 2023.

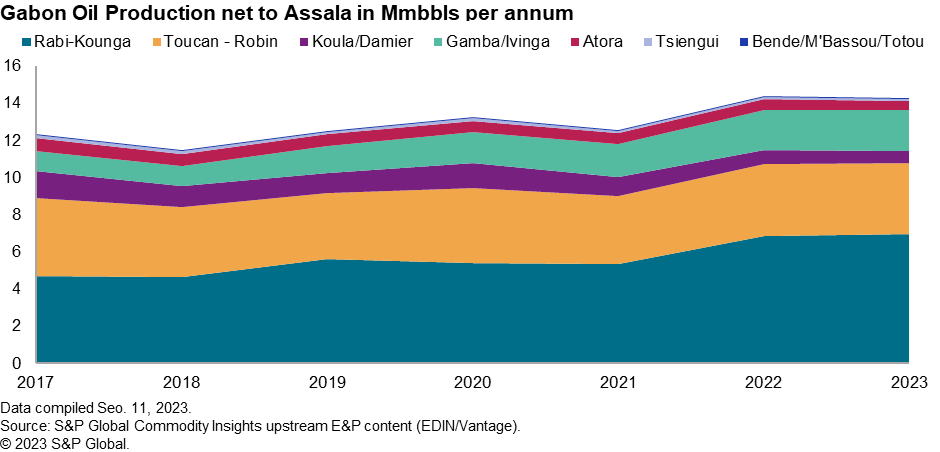

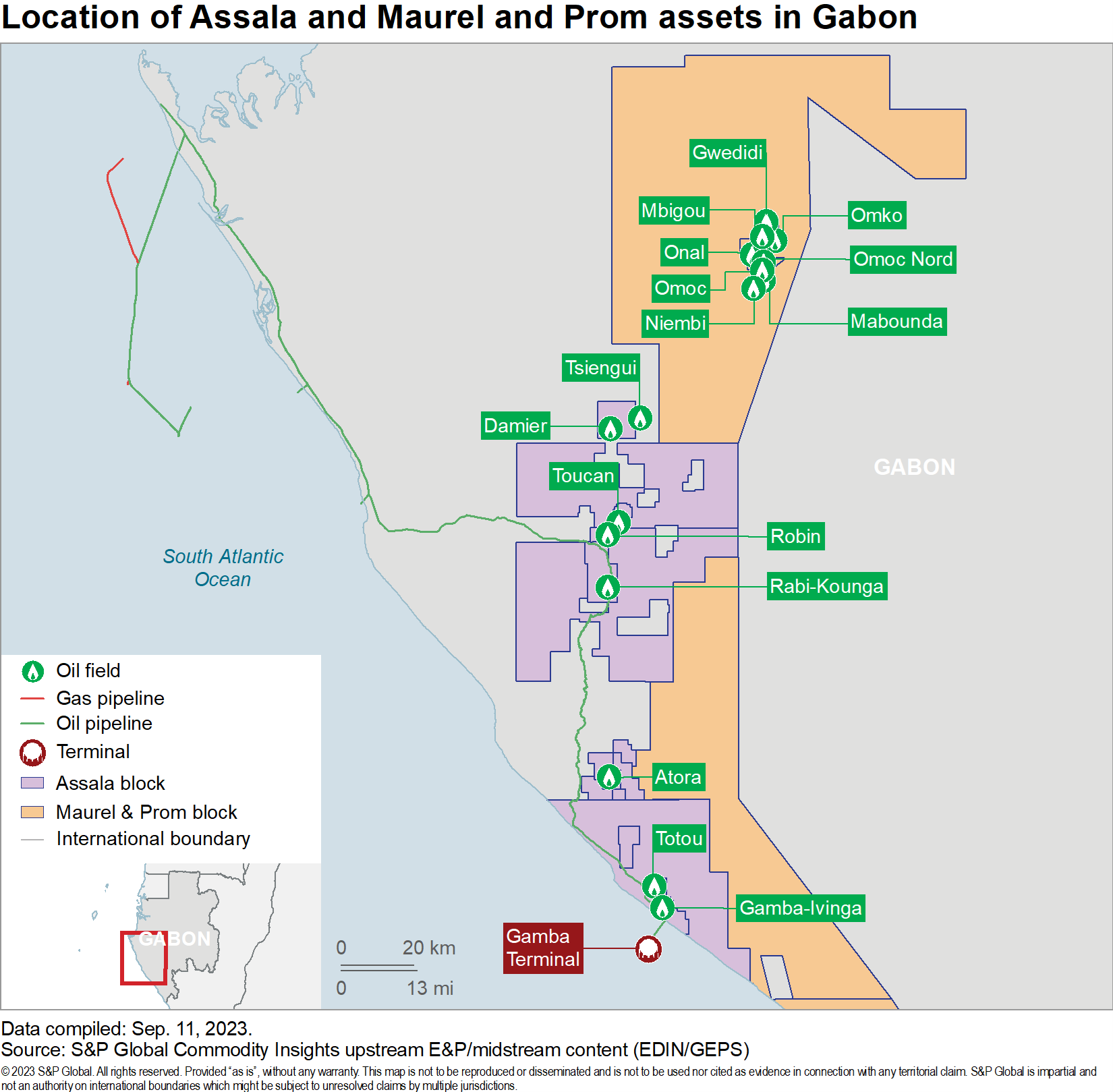

Since the acquisition of the assets from Shell in 2017, Assala has invested more than $1.3 billion and, increased production by ~9,000 barrels per day (bbls/d). Together with M&P's existing portfolio, the combined output would then account for around 30% of the country's production with the potential to increase further. The proximity of M&P's existing assets in Gabon will mean that it will be able to synergize costs, personnel and infrastructure across its entire Gabonese portfolio.

In its current form the proposed deal would consolidate M&P as a dominant producer onshore Gabon, and it would also strengthen its relationship with the Gabonese government, as the deal allows the state to increase its share in Assala Gabon from 25% to 27.5%, with the option to increase it by a further 12.5% over the next five years. However, the timing and shape of the proposed transaction remains unclear given the August coup, in which long-serving President Ali Bongo Ondimba was removed from power and replaced by Republican Guard leader General Brice Oligui Nguema. The new military leadership dissolved government institutions and pledged to hold new elections, targeting a return to civilian rule within two years. The new government will probably approve the Assala deal in some form eventually, though such an approval may only occur once a new constitution has been passed, the power struggle in ruling elite has eased, and the functioning of hydrocarbon sector institutions returns to a semblance of normality.

A strong portfolio

M&P's interest in Assala is based on the company's attractive portfolio of producing and exploration assets and associated infrastructure. In 2017 Carlyle bought Shell's onshore assets and related infrastructure in Gabon for a reported amount of USD 628 million which included five operated licenses (Rabi, Toucan/Robin, Gamba/Ivinga, Koula/Damier and Bende/M'Bassou/Totou (BMT)), four non-operated assets (Atora, Avocette, Coucal and Tsiengui West) as well as all the associated infrastructure which included onshore pipelines and the Gamba export terminal. Assala then bought Total's interest in the Rabi license for approximately USD 100 million in 2018 and in 2019 was awarded three onshore exploration licenses as well as a 25-year extension for the Atora, Toucan/Robin, Rabi and BMT licenses. Finally in March 2021, Assala negotiated an interest swap with Perenco concerning the Rabi II, Atora II, Avocette, Coucal and Dianongo blocks. Currently Assala operates three exploration licenses and six development areas and a non-operated interest in the Tsiengui West License in Gabon.

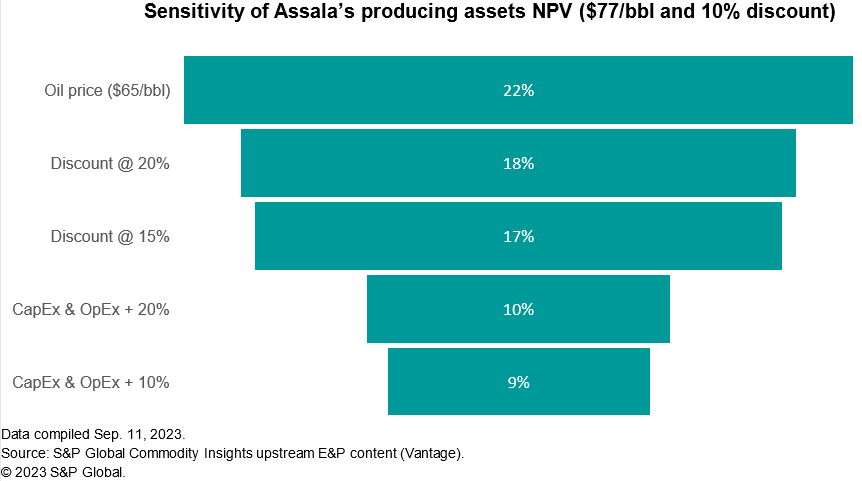

The deal is stated to include the acquisition of 97 million barrels (MMbbls) of 2P reserves as of 31 December 2022. The current portfolio valuation of the producing assets assuming a base case brent price of $77/bbl, is valued to be roughly between $1 - 1.5 billion. Various scenarios were run to take into account the recent cost escalations and inflation as well as the discount rate applied to ascertain the robustness of the portfolio.

The above diagram shows that the valuation of the producing asset portfolio is most sensitive to the oil price and the discount rate applied. Despite this, it remains an attractive investment option with the NPV decreasing by only around 20% at an oil price of $65/bbl.

Furthermore, there is additional potential benefit to be gained and Assala has a number of development plans for the next few years. These include a debottlenecking project and the tie-back of the Damier field in 2024 in the Awoun contract block as well as a number of infill wells and workovers with over 12 infill possibilities and 70 workovers identified in the Rabi-Kounga field alone. There is also the potential to develop the N'Gongui discovery appraised in late 2022 located within the Mutamba Iroru II exploration license. Assala hired two permanent workover units assigned to the Gamba/Ivinga and Rabi-Kounga fields as well as two land drilling rigs for their past development campaigns. This, combined with renewals of the production contracts, would allow approximately 0.5 billion USD in value to be unlocked.

The valuation of the assets exceeds the announced transaction price of the deal, but this can be explained due to there being a number of uncertainties around the parameters used when doing the valuation as part of the acquisition as well as the roll-over of the 600 million USD reserve-based lending facility that was transferred to M&P.

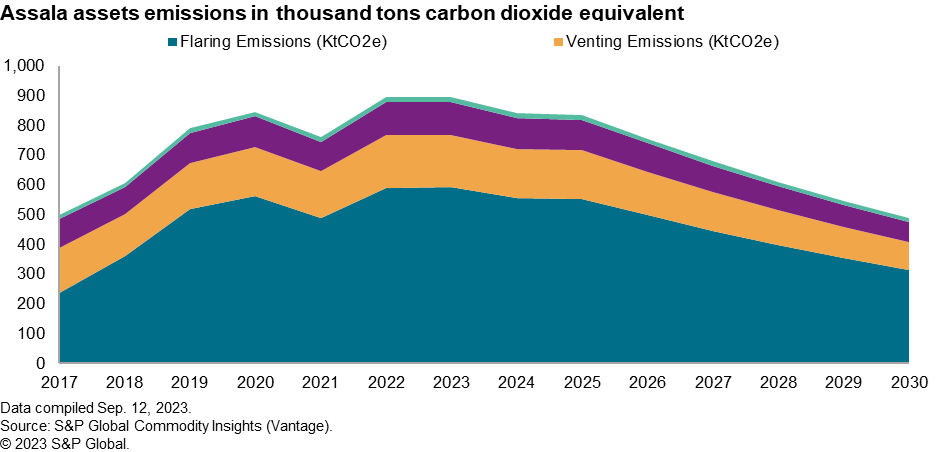

The energy transition is a critical component of investment and Assala is committed to this and has reduced carbon emissions by 20% from 2020 to 2021 by methane leak detection and prevention, gas re-injection and the reduction of flaring and aims to be carbon neutral by 2050.

M&P eyes growth potential

The above analysis is for the potential upstream value of the newly signed deal, but excludes the additional value add from the infrastructure that was included. M&P already operate the Ezanga license in Gabon and the addition of the midstream infrastructure will enable M&P to optimize operations and costs across all their assets.

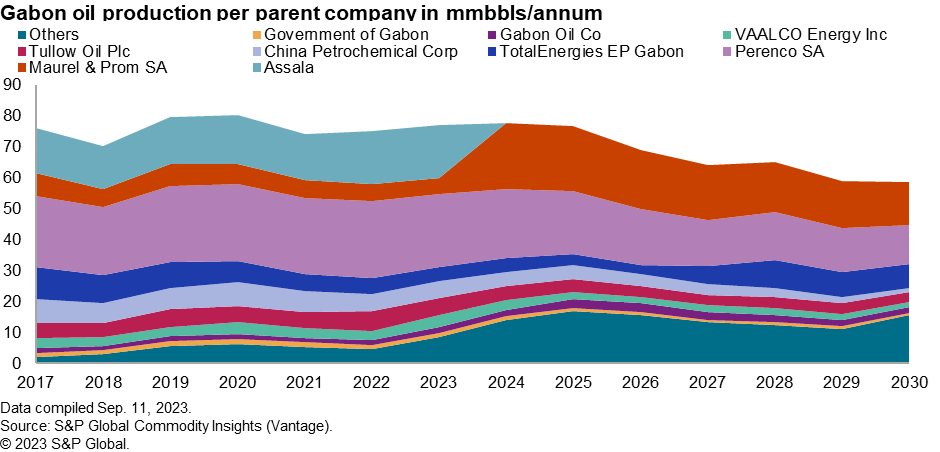

Net production to M&P from the Ezanga License was around 16 thousand barrels per day (Mbbl/d) in the first half of 2023 and with the addition of the Assala assets, M&P's net production in Gabon would increase significantly to ~60 Mbbl/d. This will make M&P the second biggest oil producer in the country after Perenco, should the transaction go ahead as planned.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.