Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 01, 2018

NOC competition in domestic basins continues to heighten as sovereign parents address domestic energy market imbalances

IHS Markit has identified NOC competition in domestic basins as one of its top 10 upstream issues for 2018.

After retreating from the M&A space over 2014–17, national oil companies (NOCs) are reemerging as asset and corporate acquirers. However, this return to the M&A space comes with a new focus, as the Asia NOCs in particular redirect their spending toward domestic/regional basins and assets.

This includes expanding energy linkages with Russia, a move core to both the “One Belt, One Road” strategy adopted by the Chinese government and its NOCs, and to India NOCs ONGC and OIL as they seek to take advantage of the limited competition for Russia assets resulting from US and UN sanctions.

This shift in growth strategy does not preclude a reassessment of exploration entry into emerging basins worldwide, in part because entry costs are much less expensive than the corporate and asset acquisitions undertaken in the previous rounds of international investment activity. However, combined with a renewed focus on producing or near-sanction assets, the Asia NOCs are unlikely to reemerge as competitors in frontier basins or in the booming unconventional resource space in North America.

National oil company retreat from M&A space

One of the most notable strategic adjustments in the upstream sector over the past decade has been the withdrawal and redirection of M&A spending by the NOCs and, in particular, by the resource-seeking Asian NOCs.

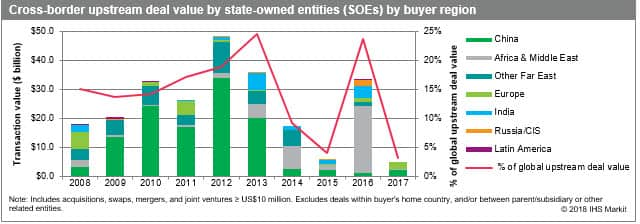

Disciplined by the disappointing performance of corporate and asset acquisitions secured over 2010–13 in North America (Nexen acquisition), Europe (Talisman portfolio in the North Sea), South America (Bridas in Argentina, Repsol in Brazil), and Africa (Talisman in Sudan, Chad)—many acquired at then-record corporate and asset valuations—and responding to government demands for cost control as oil and gas prices retreated in late-2014, the NOCs as a group pulled back on M&A spending. Correcting for the $11.3 billion acquisition by QPI and Glencore of a 19.1% stake in Rosneft (later sold on in large part to China SOE CEFC China Energy Company Ltd. in 2017), the NOCs accounted for a minor 5% of worldwide, cross-border deal value over 2015–17.

Figure 1: Cross-border upstream deal value by state-owned entities (SOEs) by buyer region.

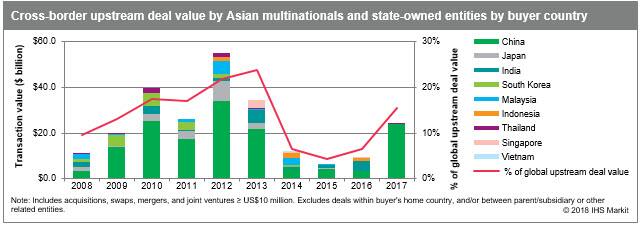

The Asian NOCs that led the surge in NOC M&A deals over 2010–13 have been notable in this strategic adjustment. From a peak of roughly $55 billion in 2012 (led by China at $34 billion), M&A spending by the Asian NOCs averaged $9 billion per annum over 2014–16 and only $7 billion over 2014–17 if one excludes the $9 billion acquisition by CEFC of a 14.16% equity stake in Rosneft from QPI and Glencore.

Figure 2: Cross-border upstream deal value by Asian multinationals and state-owned entities by buyer country.

Asia NOCs reemerge with narrowed regional focus

The last few quarters have witnessed a tentative reemergence of the core Asia NOCs in the M&A space. However, there is a notable shift in strategic focus in terms of both asset type and geography. Gone are the aggressive moves into emerging basins (Sub-Saharan Africa, South America) and unfamiliar asset types (oil sands). These efforts are being replaced by a focus on producing assets and resource developments nearing sanction.

The narrowed geographic focus is perhaps best personified in the “One Belt, One Road” strategy adopted by the Chinese government and now being pursued by the Chinese NOCs. This focus on domestic and regional energy sources—extending throughout the Australasia and Far East region and up into the vast resource holdings of Russia and the CIS—is a far cry from the unstructured and unconstrained “Go Out” directive that drove Chinese NOC upstream investment over 2010–13.

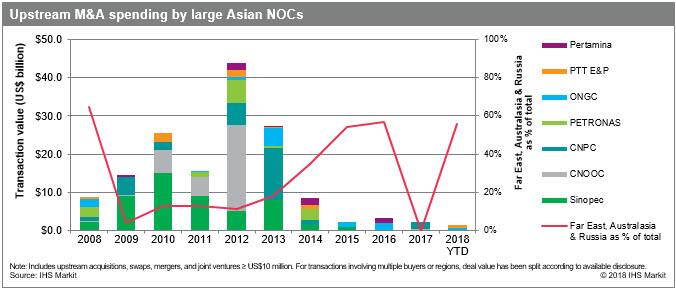

Figure 3: Upstream M&A spending by large Asian NOCs.

In India, state NOC Oil & Natural Gas Company (ONGC) has been arguably the NOC most positively impacted by the extended fall in oil prices, which drove the elimination of heavy product subsidies paid directly from ONGC’s budget during periods of high oil prices. ONGC has taken advantage of this budget boost—and of the limited competition for Russia assets because of US and UN sanctions—to secure equity positions in large Russian producing assets, most notably the Vankor field. This strategic shift toward enhanced exposure to Russian resources and production has been followed by fellow NOC Oil India Limited (OIL), leading a consortia of India SOEs in securing a 23.9% stake in Vankorneft and 29.9% in LLC Taas-Yuryakh.

ONGC has also been investing heavily in the India hydrocarbon sector, including the late-2016 acquisition of offshore assets from Gujarat State Petroleum Corporation (GSPC) and the January 2018 announced $5.7 billion acquisition of a 51.11% stake in Hindustan Petroleum Corporation Ltd. (HCPL).

This focus on regional basins is being mirrored in Indonesia, Malaysia, and Thailand where host governments have directed their NOCs to address the weakening domestic energy market fundamentals brought on by rapid growth in petroleum product demand and falling production from maturing domestic assets. A key element in this enhanced regional investment is the securing of acreage and assets positions held by western IOCs as they move to rationalize their holdings, freeing up capital to support their deepening positions in the US Onshore unconventional resource space.

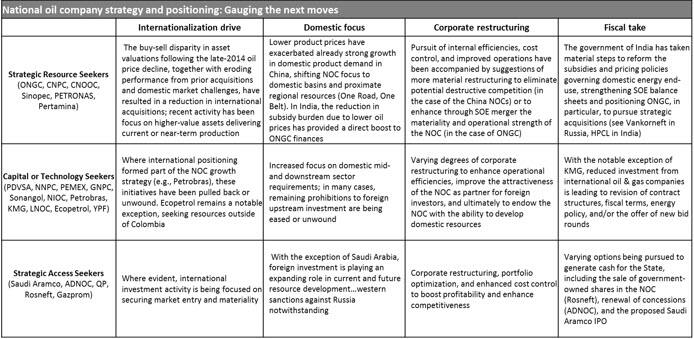

The table below provides some further thoughts on the direction of NOC upstream positioning over the short-term.

Figure 4: National oil company strategy and positioning: Gauging the next moves.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnoc-competition-domestic-basins-continues-heighten-sovereign-parents-address-domestic-energy-market-imbalances.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnoc-competition-domestic-basins-continues-heighten-sovereign-parents-address-domestic-energy-market-imbalances.html&text=NOC+competition+in+domestic+basins+continues+to+heighten+as+sovereign+parents+address+domestic+energy+market+imbalances","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnoc-competition-domestic-basins-continues-heighten-sovereign-parents-address-domestic-energy-market-imbalances.html","enabled":true},{"name":"email","url":"?subject=NOC competition in domestic basins continues to heighten as sovereign parents address domestic energy market imbalances&body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnoc-competition-domestic-basins-continues-heighten-sovereign-parents-address-domestic-energy-market-imbalances.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=NOC+competition+in+domestic+basins+continues+to+heighten+as+sovereign+parents+address+domestic+energy+market+imbalances http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnoc-competition-domestic-basins-continues-heighten-sovereign-parents-address-domestic-energy-market-imbalances.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}