North America floating rig market update

State of the market

The floating rig market in the US Gulf has been relatively flat since the beginning of the year, but there was a slight improvement in May. Total utilisation in January was at 65.2% and marketed utilisation was at 84.9%. While the numbers did not change much over the subsequent months, total utilisation rose to 65.8% and marketed utilisation climbed to 86.1%. Canada has remained at 100% utilisation this year with total supply and total contracted remaining at three units.

Demand outlook

Demand in the region will remain flat during 2020. Total demand for the year is expected to average 23.1 drillships and 7.4 semis. US Gulf drillship demand is estimated to start the year at 20.7 units and rise to a peak of 25.0 by November, but end the year at 24.6 units. Demand for only one drillship is expected in Canada late in the late first quarter 2020, lasting until around the middle of the second quarter. Semi demand in Canada during 2020 is projected to be 4.0 units throughout the year. Meanwhile, the US Gulf is estimated to start the year with demand for 3.0 semis and finish the year at 4.0 units.

New rig requirements

There were no new requirements during May.

Chartering activity

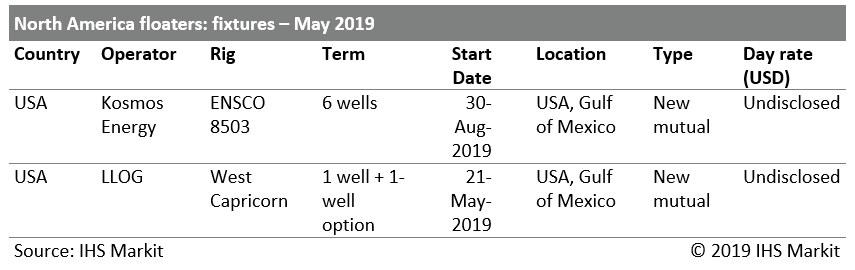

A couple of semis were granted new charters during May. Kosmos Energy awarded a six-well contract to EnscoRowan semi ENSCO 8503 starting around the middle of the third quarter. Meanwhile, LLOG secured Seadrill semi West Capricorn for a one well plus one-well option charter, which began operations at the end of May.

Source: North America floaters: fixtures - May 2019

Market developments

Towards the end of May, Suncor proposed the Tilt Cove Exploration Drilling Project, and the Canadian Environmental Assessment Agency must now decide whether a federal environmental assessment is required. All comments were due by 16 June 2019. Suncor's programme is for Exploration Licence 1161 in the Jeanne d'Arc Basin. Water depths range from 61 m to 87 m (200-285 ft). The target spud date for the first well is July 2021.

Depending on the results from the initial well, up to 12 wells could be drilled over the term of the licence, which expires in 2028. Suncor noted that drilling activities will not be continuous. The operator anticipates up to 120 days for each well and has indicated it would use either a semi or a jackup for the work, should the project go forward. Suncor is the operator with 40% interest. Partners are Husky Oil and Equinor, each with 30% interest.

Gain insight into every rig, vessel and platform at sea including work, maintenance and availability schedules, day rates, contract details, technical specifications, future demand and more with Petrodata by IHS Markit.

Lisa McConnell is a Senior Rig Specialist at IHS Markit.

Posted 27 June 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.