North America gas prices could fall in October, but look stronger for 2021

Natural gas prices could continue to struggle early in the 2020/21 winter heating season, but IHS Markit sees a strong rebound in 2021, according to its latest "North American Short-Term Outlook," released on September 25.

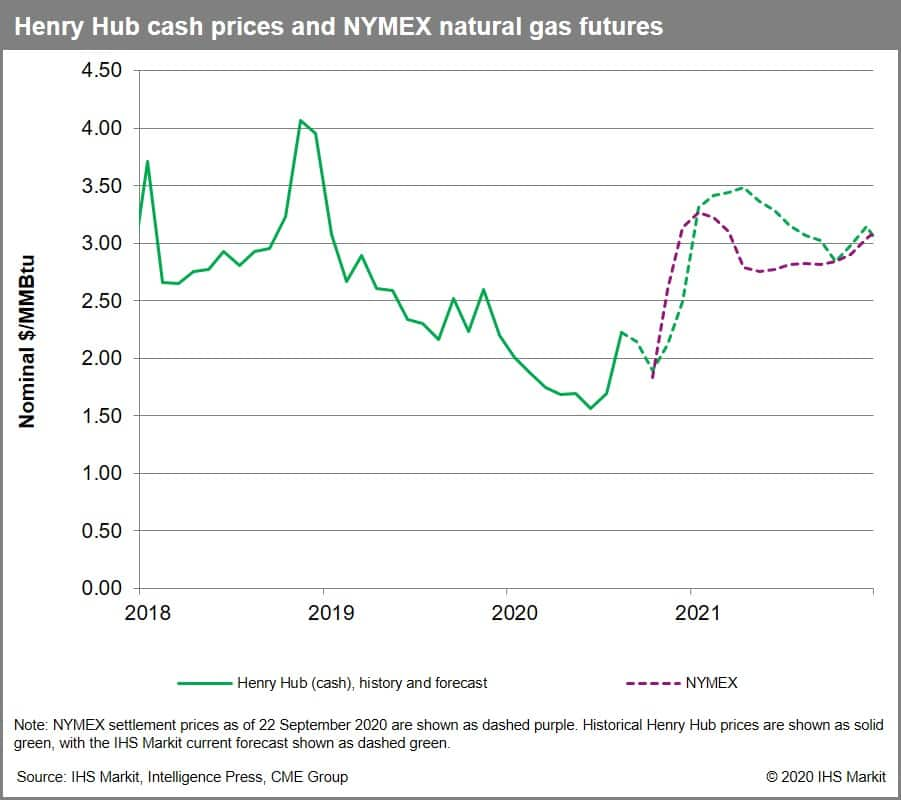

"After a decline of $0.50/MMBtu summer to summer, the apparent supply excess could send prices still lower in October," wrote Matthew Palmer, senior director for IHS Markit. "But our latest forecast is for Henry Hub prices to climb more than $1/MMBtu in 2021 as production output continues to drop through next spring."

IHS Markit forecast the average Henry Hub price for 2020 at under $2.00/MMBtu back in August 2019, as lower-48 production was poised to keep storage inventory levels well above the five-year average. While the stage for low prices was set last year, COVID-19 effectively acted as an accelerant in 2020, impacting demand and speeding up production declines to pull the market back into balance. Henry Hub is expected to rebound to the low $3.20s for 2021 and remain above $3.00 in 2022 and 2023.

As producers commit to working within their toughest capital spending constraints in years, IHS Markit is forecasting a decline in US gas production in both 2020 and 2021. "We do not expect production to resume material growth until summer 2021 or to approach the November 2019 record of 95.4 Bcf/d until late 2023," said Jack Weixel, senior director for IHS Markit.

The producing areas to watch are the Haynesville and Appalachian, as well as any type of surge from the Permian if oil prices rebound strongly.

On the demand side, power demand has been strong this year, but the primary growth driver for 2021 and the extended forecast is LNG feed gas demand. "We expect US LNG feed gas demand in 2023 to double from the 2019 level, to 12.0 Bcf/d," added Palmer.

Assuming that domestic demand this winter paces the 10-year average, prices could respond sharply, given lower levels of production and additional LNG feed gas demand. Higher gas prices could also result in higher levels of coal to gas switching as coal inventories have risen over summer 2020. always, the weather is a wildcard, the analysts said, as is COVID-19 this year, but "we expect our baseline forecast for natural gas storage inventories to move into deficit to the five year average to be realized over the course of winter 2020/21," said Weixel.

Reprinted from PointLogic News. For more, visit the PointLogic website.

Contributors to the report:

Jack Weixel is a senior director on the Gas, Power, and

Energy Futures team at IHS Markit.

Matthew Palmer is senior director, Global Gas at IHS

Markit.

Anusha DeSilva is associate director, North American

natural gas, at IHS Markit.

Kevin Adler, author of the article, is an editorial director, natural gas at IHS Markit.

Posted on 28 September 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.