North America NGL

Rapid oil and gas production in the United States necessitate new infrastructure projects thatsupport upstream activity, increasing the production rates of oil, natural gas, and natural gas liquids (NGL) while simultaneously connecting suppliers to end-use markets. In response to elevated 2018 prices, crude oil production and associated natural gas production increased. US natural gas production rose from 76 billion cubic feet per day (Bcf/d) early in the year to 87 Bcf/d at year's end, a net 14.5% or 11 Bcf/d rise equivalent to the net gain realized between 2012 and 2017.

The prolific, highly economic unconventional oil sub-plays in the Permian basin and other unconventional oil plays such as the South Central Oklahoma Oil Province (SCOOP) and Sooner Trend Anadarko Canadian Kingfisher (STACK) were focal points in the oil drilling activity boom, bringing associated natural gas and NGLs. Other unconventional oil plays like the Bakken and Niobrara shales have also provided incremental associated natural gas and NGL volume and production support. This trend is expected to continue over the next three to five years, necessitating infrastructure capacity additions.

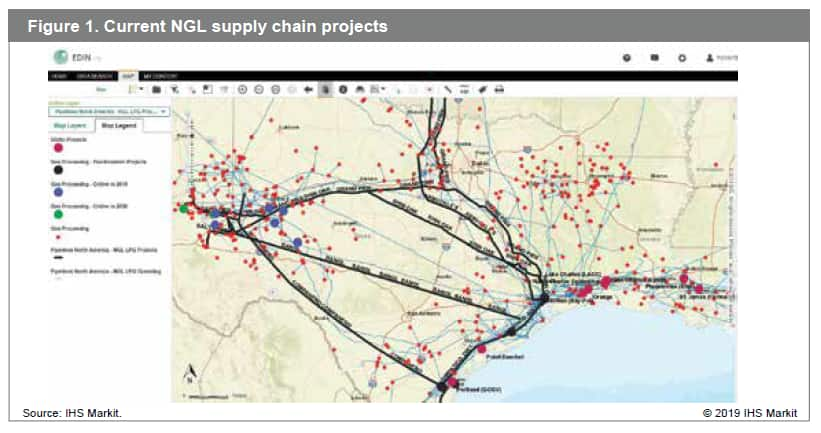

Correspondingly, pipeline capacity constraints developed for crude oil, natural gas, and the NGL infrastructure. Upstream companies' volumetric needs do not always match midstream asset capabilities, and at times infrastructure investment lags upstream activity. For example, in the first half of September 2018, ethane prices spiked from 41 cents per gallon (cpg) to 61 cpg over a two-week period, thanks to a shortage of NGL fractionation capacity in Mont Belvieu. Midstream capacity additions are needed across the NGL supply chain, connecting increasing supplies with rising demand. Figure 1 illustrates new NGL supply chain projects, which are described in the following sections.

Permian Basin

NGL produced in the Permian and delivered to the US Gulf Coast will be greatly affected in the coming months by major projects from Enterprise Products Partners, Targa Resources, and EPIC Pipeline.

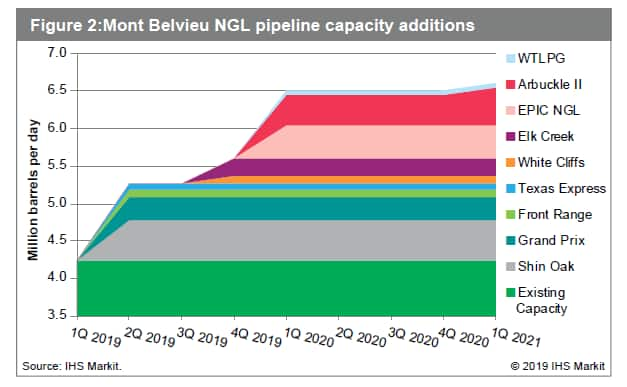

- Enterprise Products Partners - Enterprise is cementing its dominance in West Texas with intense growth projects. The Shin Oak NGL pipeline is a 550 thousand barrels per day (MBPD) pipeline connecting production from the expanding Orla gas plant to Mont Belvieu. Orla will be expanding by 200 million standard cubic feet per day (MMscfd) just as Shin Oak comes online in second quarter 2019. Further, Enterprise is in the process of commissioning their Seminole NGL conversion project. The 260 MBPD Seminole pipeline runs from the Permian to Mont Belvieu. The conversion is expected to be complete by April 2019 with limited service in February and March 2019. Moreover, two 150 MBPD fractionators under construction in Mont Belvieu are scheduled for completion in 2020. This brings Enterprise to a nameplate fractionation capacity of 1 million BPD in Mont Belvieu and 1.5 million BPD company-wide (see Figure 2).

- Targa Resources - Targa is strategically increasing its presence in the Permian with investments from Stonepeak Infrastructure Partners. Targa's NGL growth projects include the 300 MBPD Grand Prix pipeline, which is expandable to 550 MBPD and expected in service by second quarter 2019. Targa will construct over 200 miles of high-pressure rich gas-gathering pipelines in the Delaware basin as well as four 250 MMscfd gas processing plants from first quarter 2019 to second quarter 2020. Targa is also constructing three new fractionation trains in Mont Belvieu, which will add 320 MBPD of capacity. These fractionators will come online in stages from second quarter 2019 to second quarter 2020.

- EPIC Pipeline - EPIC was formed in 2017 to meet infrastructure needs in the Permian Basin and Eagle Ford Shale. EPIC announced two pipelines dedicated to crude oil and NGL service to Corpus Christi, Texas. Phase one of the pipeline runs from the DLK Black River gas plant to the Delaware Basin Midstream terminal and came online in March 2018. It is served by five gas plants with a combined capacity of 1 Bcf/d. Phase two, which started in June 2018, extends the line to Benedum, Texas. Phase three will run to Corpus Christi, Texas and is scheduled to be in interim service in third quarter 2019. When finished, the pipeline will have a throughput capacity of 440 MBPD.

Soaring crude oil transportation demand led EPIC to designate phase three for crude service until construction on the EPIC Crude Oil Pipeline and first EPIC NGL fractionator is complete in early 2020. A second fractionator is expected in service in 2021. Both fractionation trains are in Corpus Christi and have capacities of 100 MBPD each.

Cushing Hub - SCOOP/STACK Oklahoma and Mid-continent NGL production from Mid-continent will see significant near-term increases from projects by DCP Midstream and ONEOK, Inc.

DCP Midstream - DCP completed major projects in the DJ Basin in 2018. The 200 MMscfd Mewbourn 3 and 300 MMscfd O'Connor 2 gas plants will increase the company's processing capacity in the region to more than 1 Bcf/d by second quarter 2019. DCP plans to expand its existing NGL pipeline capacity at the same time. The partnership announced a 100 MBPD expansion for the Front Range pipeline, bringing total takeaway to 250 MBPD. An expansion of 90 MBPD was also announced for the Texas Express pipeline, bringing nameplate capacity to 370 MBPD. In May 2018, DCP announced that the Southern Hills NGL pipeline will connect the DJ Basin to Cushing, Oklahoma and beyond via the White Cliffs pipeline. The White Cliffs pipeline, formerly in crude service, is expected to have a total capacity of 90 MBPD and is scheduled to be in service in fourth quarter 2019. White Cliffs is expandable to 120 MBPD.

ONEOK, Inc - ONEOK announced multiple new infrastructure projects in 2018 with a capital expenditure of over $2B, including:

- The 400 MBPD Mid-continent to gulf coast Arbuckle II NGL pipeline slated for first quarter 2020 with a 100 MBPD expansion in first quarter 2021

- The 240 MBPD Williston Basin to Conway Elk Creek NGL pipeline, expected in service at the end of 2019

- Two 200 MMscfd gas processing facilities at its Demicks Lake complex in McKenzie County, North Dakota, slated for first quarter 2020 and first quarter 2021 service

- A 60 MBPD expansion of its West Texas LPG (WTLPG) pipeline system, planned for first quarter 2020.

- Two 125 MBPD fractionators in Mont Belvieu, Texas, expected in service first quarter 2020 and first quarter 2021

Thus, 2019 will register net additions of 1.3 million BPD of NGL pipeline capacity and 305 MBPD of fractionation capacity on the US Gulf Coast. In 2020, another 900 MBPD of pipeline capacity is scheduled, with 1.2 million BPD of fractionation capacity on the US Gulf Coast.