Proximity, proximity, proximity – The key to the proppant market

With the proppant market greatly oversupplied, the cost for the product itself has been falling rapidly. Getting sufficient proppant to location and on-time, however, poses great challenges.

Of course, within the Permian many bottlenecks and constraints have been persistent over 2018, and ironically the greatest upstream constraint, takeaway capacity, may be easing constraints and pressure on the proppant market simply by moderating all the activity that requires material as an input. Nevertheless, the transportation infrastructure is still strained, and logistics solutions and the proximity of supply have become the focus of cost savings and innovation for operators and service companies.

Driving improvements in capital efficiencies through a focus on evaluating every opportunity for cost savings throughout the total cost value chain has become the ongoing objective of operators and service companies. Consequently, the supply side sources providing sand, logistics, and storage have been forced to adapt to provide cost-efficient, continually value-added "last mile" and on-site storage solutions, in addition to the tailored mix of sand required that is a fit for purpose solution.

Given the complexity and cost of these delivery services, there seems to be an increasing preference towards sourcing solutions from the closest possible regional mines, as many operators have now accepted lower-quality regional sand (relative to "Northern White" sand sourced from the Northern United States) in exchange for the reduced cost.

The trade-off between short-term cost savings versus long-term well productivity is still up for debate with many, however there is no debate with the current sand sourcing strategy; in real estate it's "Location, Location, Location", and in the proppant market, it's "Proximity, Proximity, Proximity".

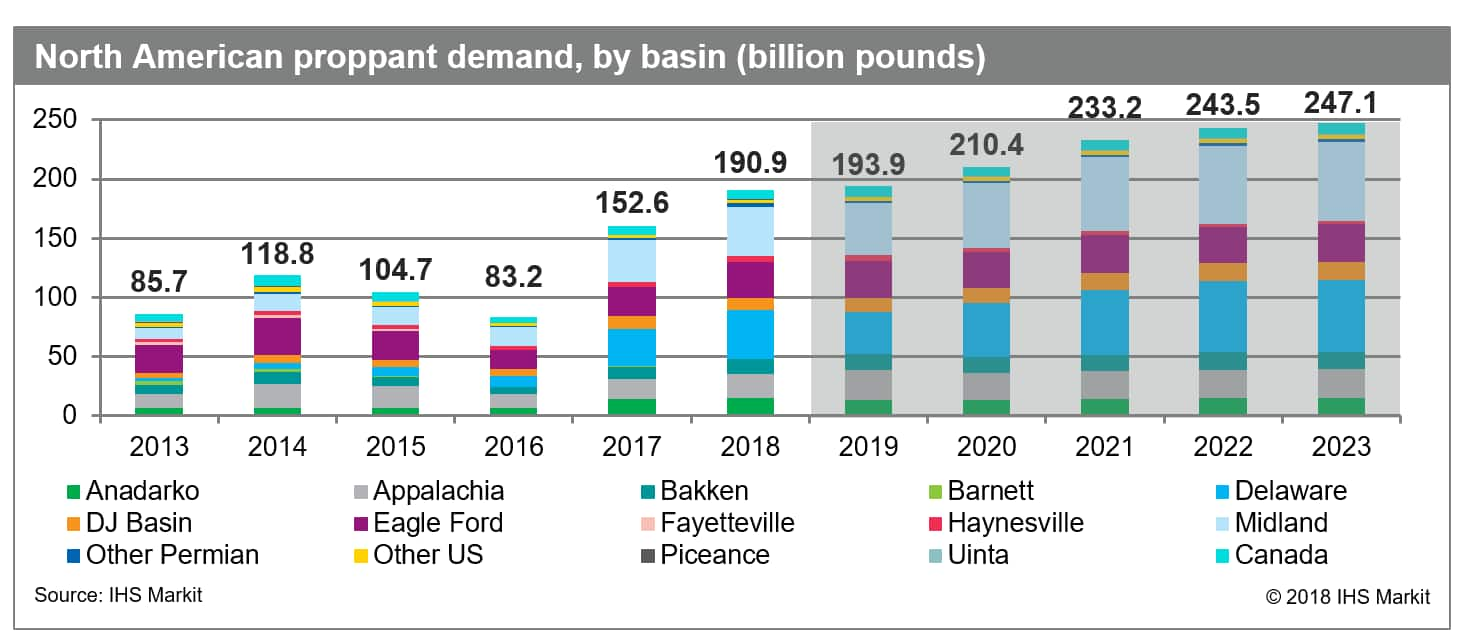

Figure 1: North American

proppant demand by basin

Figure 1: North American

proppant demand by basin

IHS Markit expects sand demand to sustain an estimated 5% compound average growth rate from 2018 through 2020, with sand demand by mass representing 96% of the overall market in 2018 (resin-coated and ceramic proppants make up a negligible portion of the market). Furthermore, IHS Markit's analysis concluded that sand demand continued to reach record highs into 2018-Q3, despite the impending slowdown in activity in the Permian from the short-lived capacity constraints anticipated from 2018-Q4 to 2019-Q3.

Even so, market supply significantly outstripped demand, mainly due to the hasty ramp-up of regional/in-basin sand within the Permian. IHS Markit believes there will not be a significant tightening of the supply/demand gap until the early part of 2020, when bottlenecks on takeaway capacity are eased and operators unleash their previously restrained activity with refueled budgets.

IHS Markit's Costs & Technology team recently released the results of its annual proppant survey, based on responses from operators, oilfield service companies, proppant logistics providers and proppant suppliers.Request access to our analysis of the 2018 survey's results, and an extract from our latest quarterly proppant research report.

Learn more about our coverage of the onshore materials market.

David Vaucher is Associate Director, Research &

Analysis at IHS Markit.

4 January 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.