North American pressure pumping horsepower demand is projected to increase significantly through 2023

The service sector has reached a point where supply of available equipment and accessible labor force are struggling to meet strengthened activity demand. Despite renegotiated contractual agreements and increased activity on the back of seasonal and transitory headwinds subsiding, inflationary pressures faced by service companies show no sign of abating. Input costs for major components such as proppant, chemicals, spare parts, engines, and electronics have all registered multiple increases in the past few months. Persistent upside service pricing is coinciding with modestly improving cash flows for pressure pumping providers. However, headwinds related to staffing incremental crews and pricing that is still below what is required to achieve an appropriate return on capital will lead to minimal capacity additions by service companies. North American horsepower demand is projected to increase 45%, from an average of 218 active fleets in 2021 to an average of 316 fleets in 2023.

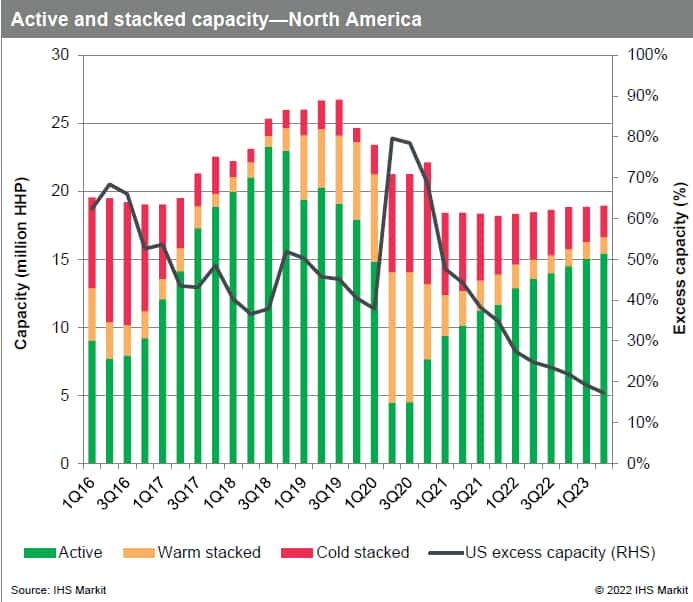

Figure 1: Active and stacked capacity in North America

The frac market is still undergoing the process of absorbing existing capacity. US market surplus horsepower capacity will decline from 41% in 2021 to 25% in 2022 on the back of accelerating fleet reactivations and permanent equipment retirements. Across the board, service companies have exhausted their reactivation capex and are focused on increasing profitability by leveraging their current active fleet capacity. Bifurcated equipment trends will prevail in 2022, in the face of dual-fuel pump conversions and e-frac fleet deployments constrained by extended lead times for various raw materials and manufactured components. Apparent shortage of high-quality equipment is being exacerbated by prolonged fleet reactivations, which continue to be hindered by supply chain pressures. Our outlook by the end of 2022 is that approximately 40-50% of horsepower supply capability in North America will have the ability to utilize gas-to-power fleets.

The 'PumpingIQ Q2 2022' full report is available to our Connect subscribers.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Oil and Gas Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.