North Sea CCS: Consistent policy support is key to unlocking investment in offshore carbon storage

The North Sea basin is emerging as a global hotspot for carbon capture and storage (CCS) development on the back of strong policy momentum.

Over the several years, the North Sea hydrocarbon producers have accelerated efforts to develop offshore CCS based on their extensive upstream expertise. Norway and the Netherlands are on track to launch full-scale facilities by 2024, while the UK could have its first project commissioned by mid-decade. Government policies are focused on securing a resilient role for the oil and gas industry (including the service industry) in the ongoing energy transition and reaching ambitious emissions reduction targets over the longer term.

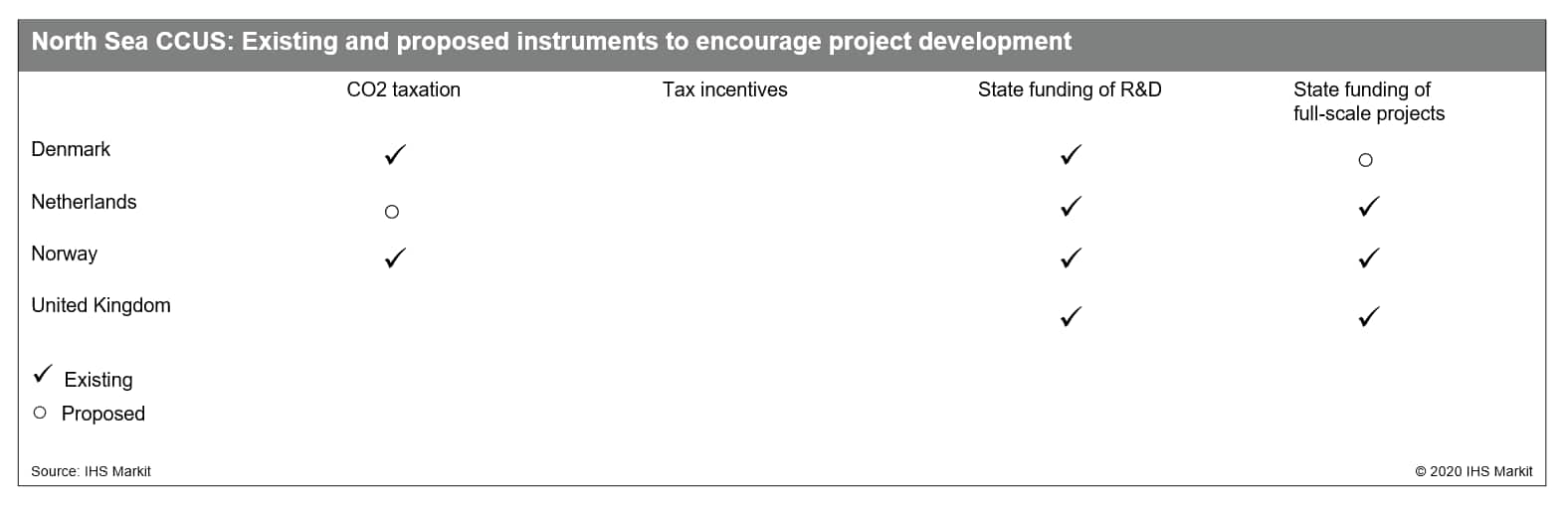

In Denmark, Norway, the Netherlands, and the UK, broad political consensus underpins supportive policies aimed at unlocking the CCUS potential of their respective offshore areas. Each host government is committed to using offshore oil and gas infrastructure and depleted reservoirs for the transportation and storage of carbon dioxide.

Figure 1: North Sea Carbon Capture, Utilization and Storage

Norway remains a regional leader

Norway has been a consistent proponent of CCS projects, and successive governments have played a major role in providing policy support for the oil and gas sector's efforts to deploy the technology at scale. Both of Norway's largest political players, the right-wing ruling Conservative Party and left-wing opposition Labor Party, recognize the state's key role in developing the CCS sector through direct operational and financial participation.

State-owned enterprise Gassnova is tasked with advising the government on CCS as well as integrating and streamlining the CCS chain. The enterprise also owns a majority stake (77.5%) together with partners Equinor (7.5%), Shell (7.5%), and Total (7.5%) in the Technology Centre Mongstad (TCM), the world's largest research center for the development and testing of carbon capture technology. In October 2020, the minority Conservative-led coalition proposed to invest around USD1.8 billion the Northern Lights CCS project, the country's first full-scale offshore CCS facility, which is scheduled for commissioning in 2024.

Shifting funding priorities have undermined UK CCS policy

The UK's ruling Conservative Party has made investment in CCS a key pillar of its effort to decarbonize the economy. Opposition parties also support the technology, and the Scottish National Party (SNP) is spearheading efforts to develop a CCS industry in the region. Although the UK government has regularly provided funds for CCS research and demonstration projects, progress on launching full-scale developments has been limited so far due to significant and frequent shifts in state funding.

The deprioritization of budget spending on CCS by the Treasury in 2015 took over USD1 billion of potential CCS funding off the table, prompting the cancellation of two projects - White Rose (Capture Power Limited) and Peterhead (Shell) - that had already signed front end engineering design (FEED) contracts. Progress on another facility, Summit Power Group's Caledonia Clean Energy Project, has stalled since 2018 due to protracted government review and the lack of financial support beyond an initial USD5 million for research and feasibility studies. In the first half of 2020, the government announced a further USD1 billion for future CCS projects, but the amount could be revised, particularly as the government prioritizes efforts to mitigate the economic fallout from the COVID-19 pandemic.

Netherlands and Denmark ramp up efforts to capitalize on offshore carbon potential

In the Netherlands, state-owned enterprises - Gasunie and EBN together with two port administrations - have played a key part in the implementation of the first full-scale CCS projects (Porthos and Athos) and are likely to remain the drivers of such developments in the foreseeable future. In addition, the government has developed a competitive mechanism to allocate budget funding to CCS projects. However, the magnitude and duration of the Netherlands' subsidies will be limited to encourage cost improvements, and CCS project performance is likely to be subject to close government scrutiny to ensure efficient spending of budget funds.

In June 2020, the Danish government and major political parties concluded a national climate agreement that outlines measures to reach long-term emission reduction targets, including the deployment of CCS technology at scale. The government plans to facilitate the construction of offshore CCS projects through a combination of state financing and green taxes to incentivize carbon capture in the industrial sector, although it has yet to detail the process for allocating government funding, initially set at around USD554 million for the period from 2024 to 2030.

Supportive CCS policies in the North Sea basin could attract new investment from upstream companies with existing infrastructure and new investors that are seeking to benefit from the energy transition. Clear policy and regulatory frameworks coupled with durable government commitments to incentivize offshore carbon storage through budget funding and state operational participation are likely to remain crucial factors in the development of a CCS hub in the North Sea.

Learn more about our petroleum risk solutions.

Aliaksandr Chyzh is a Senior Research Analyst with the Petroleum Sector Risk team at IHS Markit.

Posted 19 November 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.