Offshore drilling gearing up towards the Energy Transition

Sustainability and being part of the energy transition has become an integral part of drilling contractors' strategies in recent years, as drillers attempt to 'out-green' each other. Prompted by governments and the financial markets, international drilling contractors and operators have realised they need to be part of the solution in reducing emissions and achieving Net Zero targets as soon as possible.

As news reports focus on climate-related global events such as heatwaves, floods and wildfires, and the new Intergovernmental Panel on Climate Change (IPCC) report sees the UN Secretary General call for an end to new fossil fuel exploration and development, all stakeholders in the drilling industry are the subject of increasingly stringent regulations and under greater pressure from investors, the media and the public. Moreover, they have to plan for this in a volatile oil price and low day rate environment.

In all but the most rapid energy transition scenarios, IHS Markit expects demand for oil and gas to continue rising for at least another decade and remain considerable for many years after - thus the offshore drilling industry has an important role to play in a sustainable energy future, ensuring this demand is met with responsible operations that reduce the impact on the environment.

To comply with the more stringent regulations and emissions targets that are being set, offshore rigs are required to use best available technology to operate with the least possible damage to the environment and reduce Green House Gas (GHG) emissions in a timely and efficient way. How companies transform themselves to become greener while investing in new technology and producing returns is the real challenge.

International drilling contractors leading by

example

International drillers are trying to achieve their Energy

Transition goals via low-carbon solutions, through reducing Scope 1

emissions, which come from engines used for power generation. This

involves optimising drilling through new systems centered around

energy efficiency and reduced fuel use by varying energy loads.

This helps rigs to drill faster and smarter, reducing costs and

fuel consumption.

Currently at the forefront stands Maersk Drilling, with an

ambitious climate target: a 50% C02 emissions intensity reduction

from drilling operations by 2030. A number of years ago Maersk

Invincible in Norway became the first jackup to run on shore-power,

delivering huge yearly reductions in CO2 and Nitrogen Oxides (NOx)

emissions. This method is now being explored in other

regions.

In addition, Dolphin Drilling, COSL and Transocean have achieved

ISO 50001 certification through Energy Management Systems, reducing

energy consumption, environmental impact and increasing

profitability.

Below, IHS Markit lists the most common initiatives being undertaken by drilling contractors.

Reducing fuel consumption by optimising rigs' power

plants

Various contractors have improved engine efficiency in terms of

diesel consumption by installing hybrid power with batteries,

closed bus systems, and electrification from shore.

Since 2019, Seadrill-managed semi West Mira and Transocean semi Transocean Spitsbergen have had hybrid power plants using Energy Storage Systems (ESS) to reduce fuel consumption. Both units are harsh-environment deepwater semis, and the economic incentives were provided by the Norwegian NOx Fund, an initiative dedicated to reducing NOx emissions. It contributes a grant of up to 80% of project costs, subject to verification of the emission-reducing upgrades. Transocean is also looking at placing more energy storage systems on another eight rigs.

A number of contractors have implemented power optimisation to improve fuel efficiency. COSL Drilling Europe has developed an Energy Control System that reduces the number of active generators on rigs and increases efficiency. Valaris' use of 'Green Dynamic Positioning' mode in benign conditions during non-critical operations is ready to be deployed on most of its Dynamically Positioned (DP) assets. Engine optimisation is planned on one drillship in 2021 and is in the pre-FEED stage on the remainder of the floater fleet. Transocean currently has most of its active fleet modified for closed bus, two engine DP operations (running the minimum number of engine rooms possible at any time - to reduce carbon emissions).

Odfjell Drilling installed the Siemens Energy BlueDrive DC-Grid solution on Deepsea Atlantic and Deepsea Nordkapp. which allows peak shaving of drilling loads, so fewer generator sets can run at higher and steadier loads — reducing fuel consumption and carbon emissions. The contractor is looking at the opportunity to include this on Deepsea Stavanger, Deepsea Aberdeen, and Deepsea Yantai at a later stage.

Installing Selective Catalytic Reduction (SCR)

systems

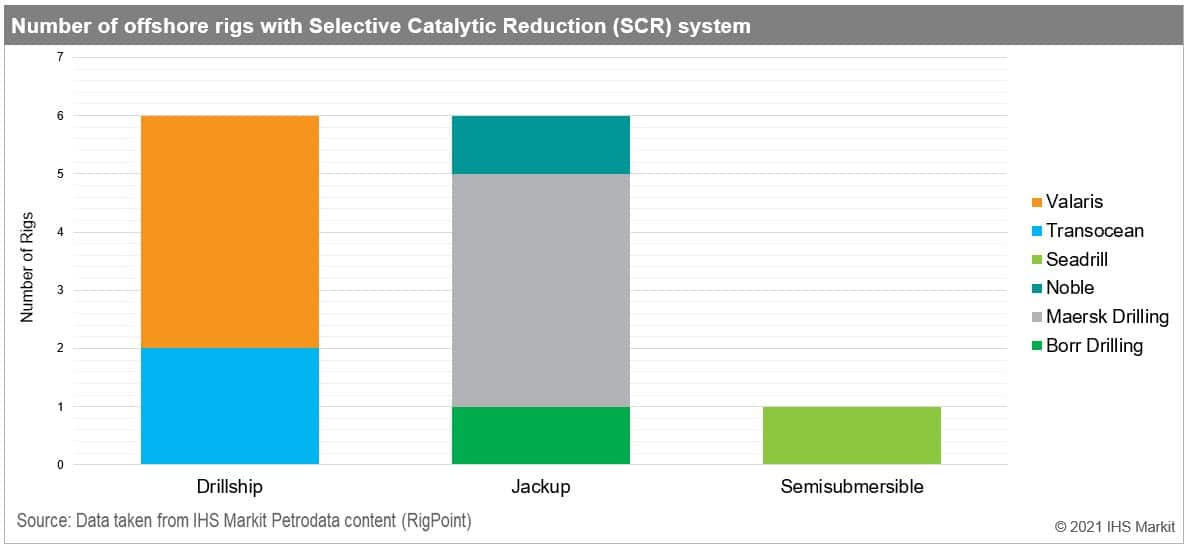

In the past year, at least 13 rigs owned by Valaris, Transocean,

Seadrill, Noble, Maersk Drilling and Borr Drilling have been

confirmed as having Selective Catalytic Reduction (SCR) systems

onboard, an emissions control technology system which uses ammonia

injection to convert NOx into harmless water and nitrogen. This is

expected to reduce NOx emissions by up to 98%. The chart below

shows the composition of rigs with SCR. This information can now be

retrieved from IHS Markit's RigPoint/RigBase

databases.

European operators remain at the forefront in incentivising the drilling industry to invest in greener technologies, not only in Europe but also globally, as recently demonstrated by Equinor in Brazil. The operator has recently contracted drillship West Saturn and fuel consumption is expected to be reduced by between 10-15% with the introduction of a combined hydrogen and methanol injection system along with other energy efficiency upgrades. With these modifications, emissions of CO2 are expected to reduce by between 10-15%, and NOx by between 30-80%. It is understood Equinor will compensate Seadrill for the fuel consumption savings to justify the investment.

Increasing efficiencies by using data analytics in

internal emissions monitoring

Valaris, Noble, Transocean, Stena, Maersk and Saipem are using

their own analytics software packages to monitor and reduce fuel

and emissions on rigs. For example, Valaris has the Valaris

Intelligence Platform (VIP) which allows real-time tracking and

analytics of GHG emissions and fuel efficiency through Power BI

dashboards being deployed across the fleet. Currently it is on 14

rigs, and there is a goal to have it fleetwide by the end of

2021.

Transocean is installing its Smart Equipment Analytics (SEA) tool

on 19 rigs. This is a dashboard that provides real-time data for

monitoring equipment health, inferred emissions, energy

consumption, and power plant performance. Stena has its Energy and

Emissions Meters on Stena Carron and Stena IceMAX. Roll out is

planned for the rest of Stena fleet.

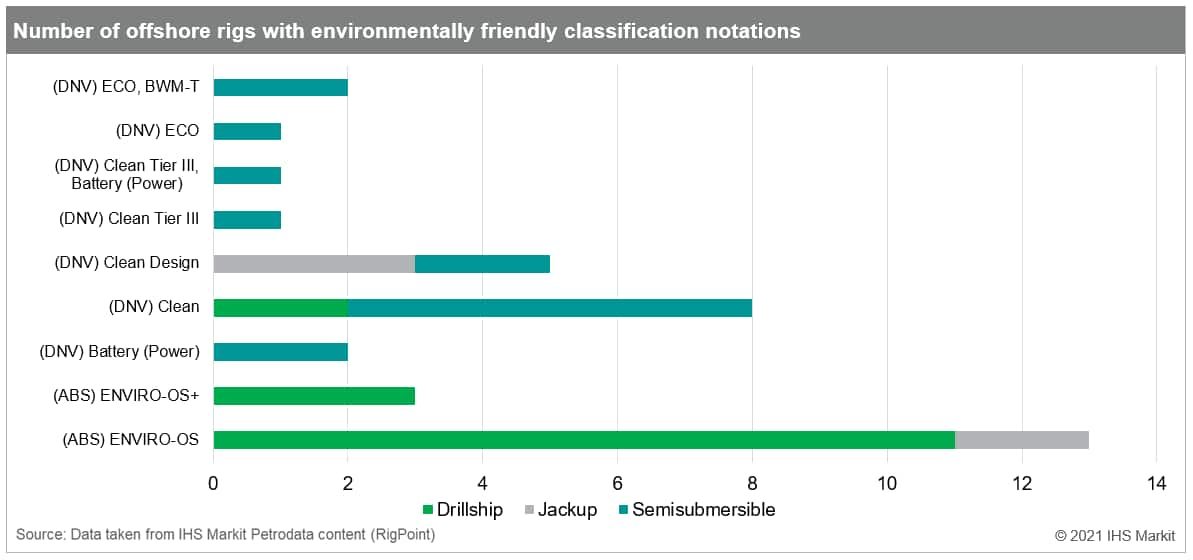

Green class notations

Some major drilling contractors such as Valaris, Transocean and

Seadrill have had a long-standing interest in sustainability

efforts and many designs or recent upgrades have allowed rigs to be

certified for environmentally friendly classification notations.

The classification societies provide class notations that reflect a

rig's technology to reduce its environmental footprint. The

American Bureau of Shipping (ABS) has class notations

'ENVIRO' and 'ENVIRO+'. It recently introduced

the the Low Emissions Vessel (LEV), NOx-Tier III, EEDI-Ph3

notations. DNV has the 'Clean' and 'Clean design'

notations. IHS Markit's rig database RigPoint provides

information on the rigs that have rig class notations. Currently

there are 36 rigs with any of these classes, illustrated in the

graph below.

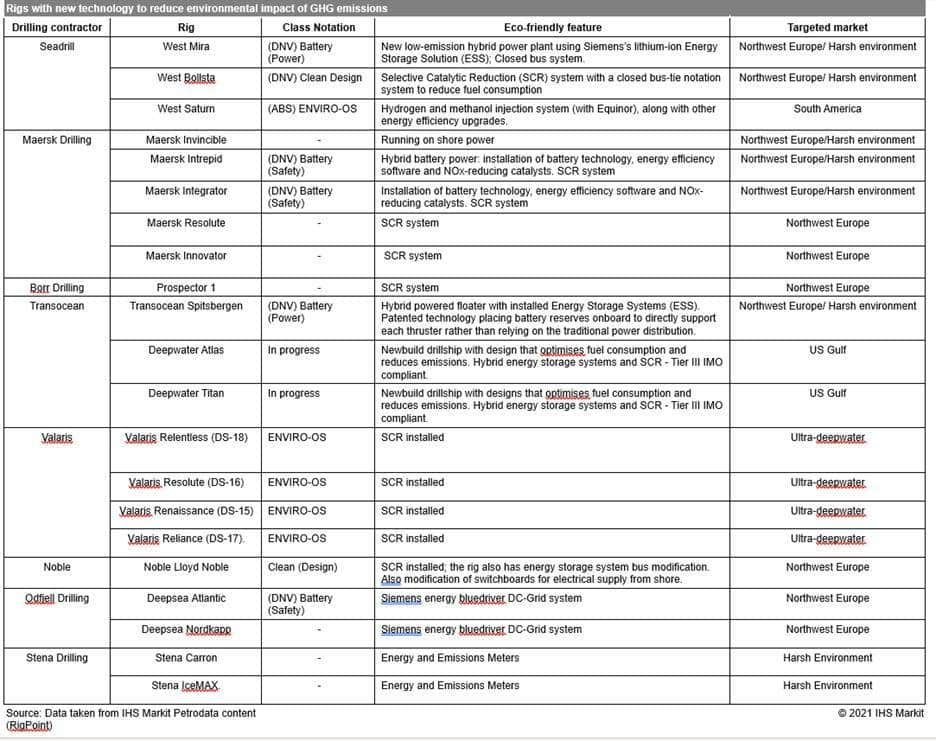

Below is a summary of the recent new technology implemented on offshore rigs to reduce GHG emissions. This information can now be retrieved from RigPoint and RigBase.

Alternative opportunities, creating

partnerships

The Energy Transition can create new business opportunities for

drilling contractors, as new technologies required to tackle

emissions reductions need skills and capabilities found in the

drilling industry: for example, using rigs for other purposes such

as Carbon Capture and Storage (CCUS), and Geothermal energy.

Stena is investing in DCarbon X, which will use drilling units to explore for geothermal energy, CO2 and other gas storage locations that DCarbonX has identified. Others are investing in low-carbon technologies such as Odfjell Drilling investing in the Offshore wind power company Oceanwind AS, which has the Odfjell Oceanwind's WindGrid™ hybrid solution for micro-grids enabling up to 70% reductions in carbon emissions. It owns Mobile Offshore Wind Units (MOWUs) to supply electricity to 'off-grid' or 'micro-grid' consumers, that could be used for offshore rigs.

Carbon Capture and Storage (CCS) projects are becoming increasingly important globally, and drilling contractors are creating partnerships with operators and industry participants to collaborate in reducing the environmental footprint. For example, in Australia, the federal government encourages upstream and industrial firms to support carbon-reduction projects. This aided BPH Energy's CCS-Baleen well, for which a rig contract will be announced soon, and Victoria CarbonNet CCS project off Victoria which used jackup Noble Tom Prosser to drill the first well for testing the seabed for CCS purposes. The CarbonNet Project was established in 2009 by the Australian and Victorian Governments as part of a suite of solutions that have the potential to reduce CO2 emissions. In addition, Saipem is designing a jackup for re-injection of CO2.

In Denmark, Maersk Drilling is participating in Project Greensand. This is a CO2 storage consortium formed by INEOS Oil & Gas Denmark and Wintershall Dea, providing an opportunity for offshore rigs to be used to repurpose existing oil and gas wells for CO2 injection. The project aims at building infrastructure and capabilities that will enable CO2 captured in onshore facilities to be transported offshore for injection and storage beneath the seabed. Maersk Drilling is also investing in innovation such as alternative fuel types for the rigs.

Concluding remarks

Industry players are becoming acutely aware of the need to step up

their green credentials. The focus has been on upgrading existing

rigs to reduce their environmental impact despite the capital

intensity. Most recent upgrades have been in Northwest Europe and

deepwater areas, where government support, or operator partnerships

justify the investments. The main driver recently has been

operators stipulating increased focus on such upgrades as they have

emissions targets to meet. As the industry is facing a difficult

time securing funding, operators and government incentives, and

increasing the profitability of the drilling industry will be key

in being able to handle the investments in new technology to

continue the 'green-ing' of the sector.

Currently, there is no widely-used certificate or benchmark through which drilling contractors can measure themselves against their peers, but operators and contractors need to work together to decide standards on emission reduction and energy efficiency in rigs. And even in the future, having the industry agree on matters like alternative choices of fuel.

IHS Markit Petrodata's platforms RigPoint and RigBase now provide customers with the ability to search for the relevant environmentally focused green modifications per rig.

RigPoint/RigBase by IHS Markit is the leading and most trusted information source for the global offshore drilling rig market. The platforms provide data and reports on the industry dating back to 1984 and offer unparalleled information on rig supply, demand and specifications. It is maintained by a team of analysts with a combined 90+ years of experience on reporting the offshore rig market, with access to IHS Markit's deep knowledge and understanding of upcoming exploration plans, field developments and the upstream sector, provided by around 900 analysts and experts.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.