Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 30, 2024

Pakistan getting ready to launch first offshore bid round

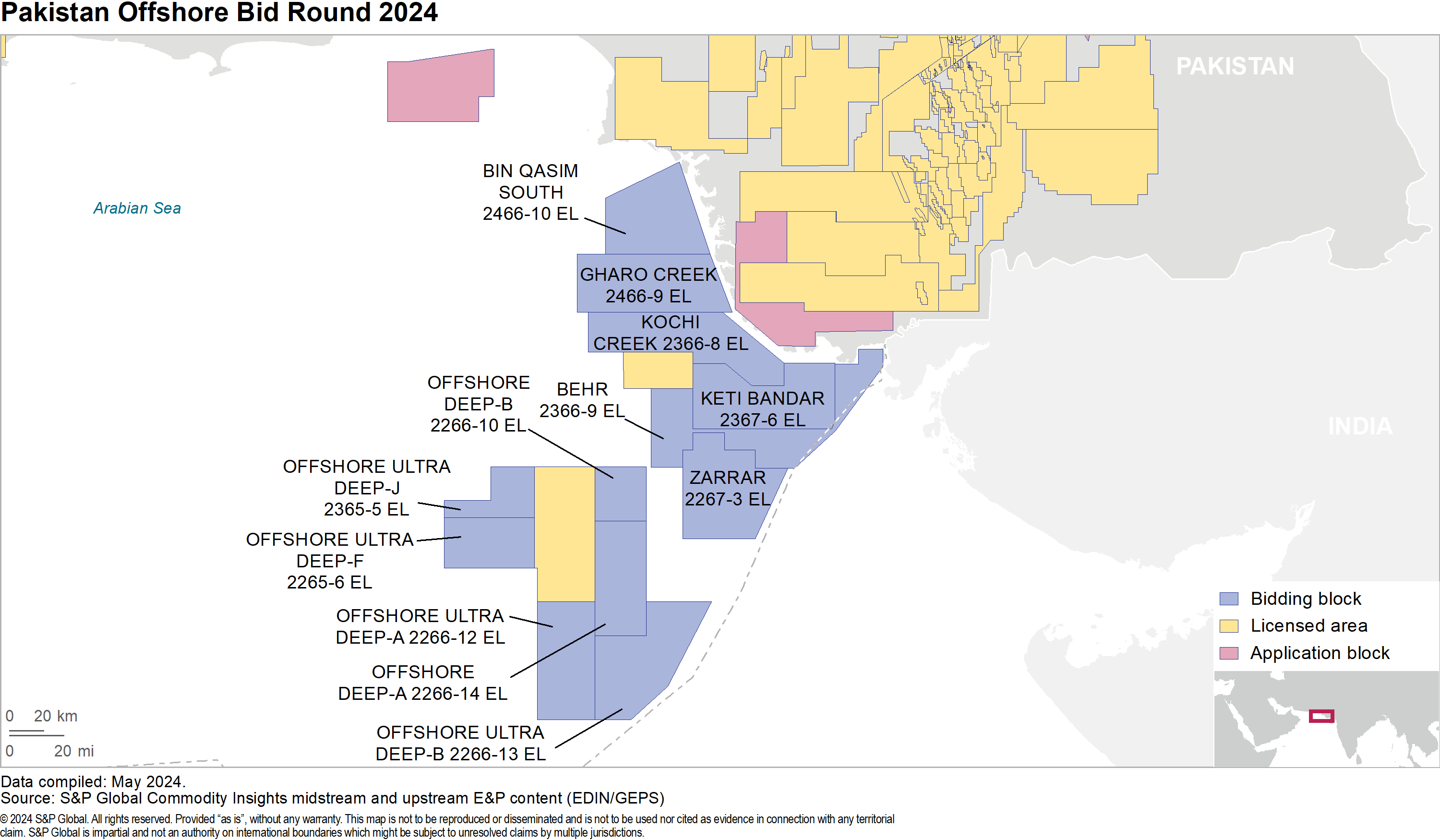

The Government of Pakistan plans to launch an offshore bid round 'Offshore Bid Round 2024' in third quarter 2024 by offering 12 offshore blocks for competitive bidding. This is believed to be the first offshore bid round in the country, and it will be followed by another offshore bid round in 2025 with 11 blocks offered.

The 2024 bid round will include six shallow-water blocks (<200 m water depth), two deepwater blocks (200 m to 1,000 m) and four ultra-deepwater blocks (>1,000 m) covering a total acreage of around 23,700 sq km. A summary of the available blocks is provided in the table below.

Pakistan Offshore Bid Round 2024 | |||

No | Block | Area (sq km) | Water Depth (m) |

1 | Behr 2366-9 EL | 2,481 | < 200 |

2 | Bin Qasim South 2466-10 EL | 2,022 | < 200 |

3 | Gharo Creek 2466-9 EL | 2,453 | < 200 |

4 | Keti Bandar 2367-6 EL | 2,465 | < 200 |

5 | Kochi Creek 2366-8 EL | 2,450 | < 200 |

6 | Zarrar 2267-3 EL | 2,425 | < 200 |

7 | Offshore Deep-A 2266-14 EL | 1,774 | 200 - 1,000 |

8 | Offshore Deep-B 2266-10 EL | 834 | 200 - 1,000 |

9 | Offshore Ultra Deep-A 2266-12 EL | 2,055 | > 1,000 |

10 | Offshore Ultra Deep-B 2266-13 EL | 2,452 | > 1,000 |

11 | Offshore Ultra Deep-F 2465-6 EL | 1,374 | > 1,000 |

12 | Offshore Ultra Deep-J 2365-5 EL | 900 | > 1,000 |

As of May 22, 2024 | |||

Source: S&P Global Commodity Insights upstream E&P content (GEPS/EDIN). | |||

© 2024 S&P Global | |||

Pakistan's offshore region consist of two geological basins, Indus and Makran, separated by the Murray Ridge, and the offered blocks will be located in the Indus Offshore. The country's total offshore area is about 282,600 sq km, with the Indus Offshore Basin covering an area of 157,850 sq km. The Indus Offshore is the second biggest delta fan system in the world after the Ganges in Bengal with a sedimentary sequence up to 10 km thick.

Considering the size of the offshore region of Pakistan, exploration activities have been limited to date. Only 18 exploratory wells, including three deepwater and 15 shallow-water wells, have been drilled. Only one shallow-water well, Pak Can 1, was reported to have encountered minor gas and it was plugged and abandoned (P&A) by Oil and Gas Development Company Ltd in February 1986. Kekra 1 was the last offshore well drilled in the country which was P&A by Eni in May 2019 after encountering gas shows. It was a deepwater well located at a water depth of 1,900 m in the Offshore Indus-G block and the license was subsequently relinquished.

Although the Indus Offshore has not encountered any commercial success so far, the adjacent Indian offshore Kutch Basin however, confirms the presence of a working petroleum system through a number of gas discoveries. Likewise, the proven plays in the onshore Indus Basin may extend into the offshore part of the basin but no offshore well so far has attempted to target those plays.

The government revised the terms of the offshore petroleum policy in 2023 by offering more incentives to the investors. The gas price will range from $7/MMBtu to $9/MMBtu, and there will also be a bonanza of $1/MMBtu over well head gas price for the first three discoveries. The revised terms also include a four-year holiday on royalty, and 85% cost recovery. A significant amount of 2D and 3D offshore seismic data has been acquired which is available from the petroleum ministry.

In conclusion, the government anticipates a strong response from investors for its inaugural offshore licensing round considering it has introduced favorable terms and conditions to attract investment. The potential of the Indus offshore region is also considered promising, and the domestic demand for natural gas is substantial in the country which continues to grow, ensuring a ready market for any new discoveries.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpakistan-getting-ready-to-launch-first-offshore-bid-round.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpakistan-getting-ready-to-launch-first-offshore-bid-round.html&text=Pakistan+getting+ready+to+launch+first+offshore+bid+round+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpakistan-getting-ready-to-launch-first-offshore-bid-round.html","enabled":true},{"name":"email","url":"?subject=Pakistan getting ready to launch first offshore bid round | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpakistan-getting-ready-to-launch-first-offshore-bid-round.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pakistan+getting+ready+to+launch+first+offshore+bid+round+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpakistan-getting-ready-to-launch-first-offshore-bid-round.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}