PETRONAS announces exit from South Sudan as the NOC evaluates its international upstream portfolio

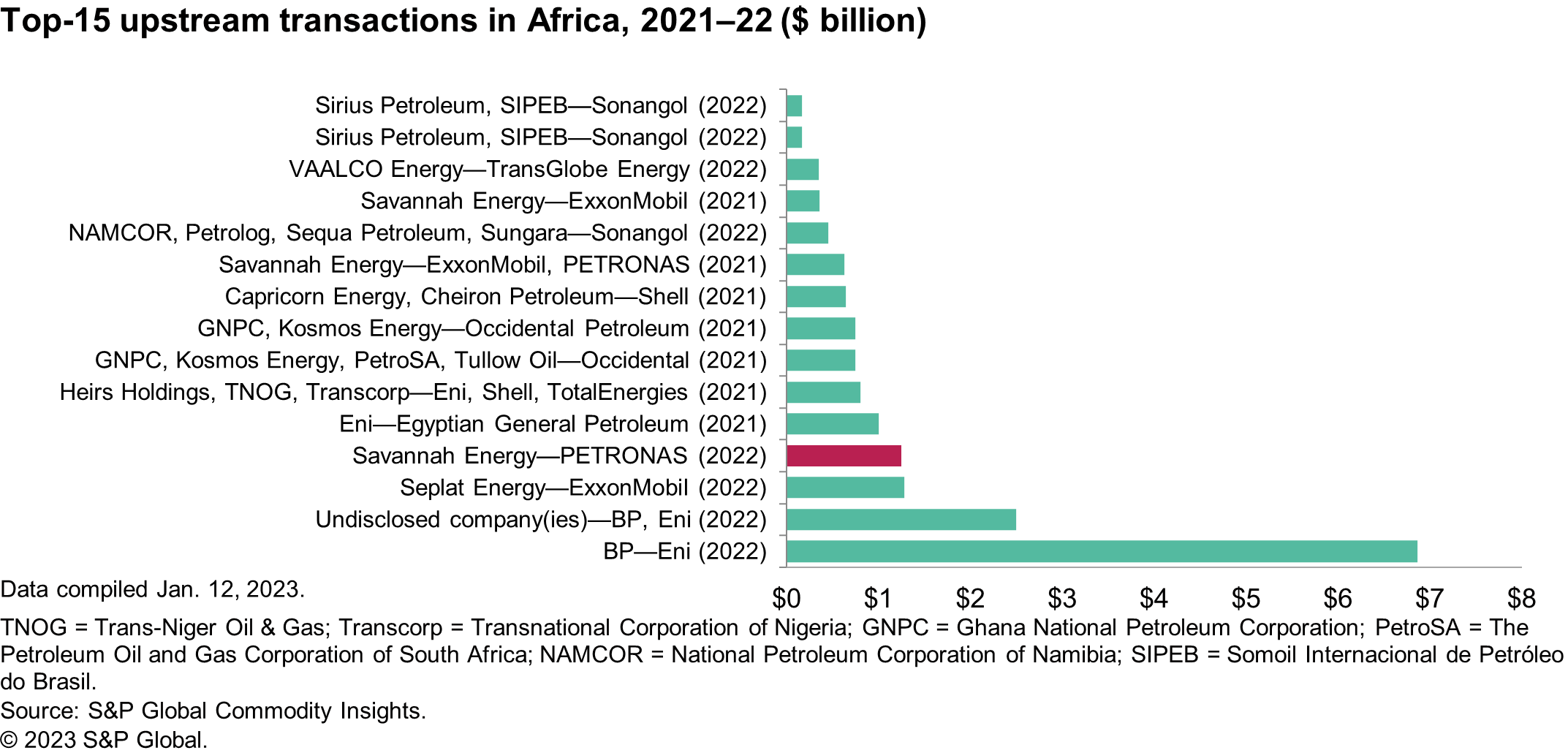

In December 2022, PETRONAS and Savannah Energy entered into a share purchase agreement to sell the Malaysian state-owned company's entire oil and gas asset portfolio in South Sudan for a total cash consideration of up to $1.25 billion. Upon completion of the transaction, Savannah will acquire PETRONAS's interests in three joint operating companies which operate Blocks 3 and 7 (40% working interest); Blocks 1,2, and 4 (30% working interest); Block 5A (33.9% working interest).

Subpar returns to PETRONAS from its South Sudan asset portfolio

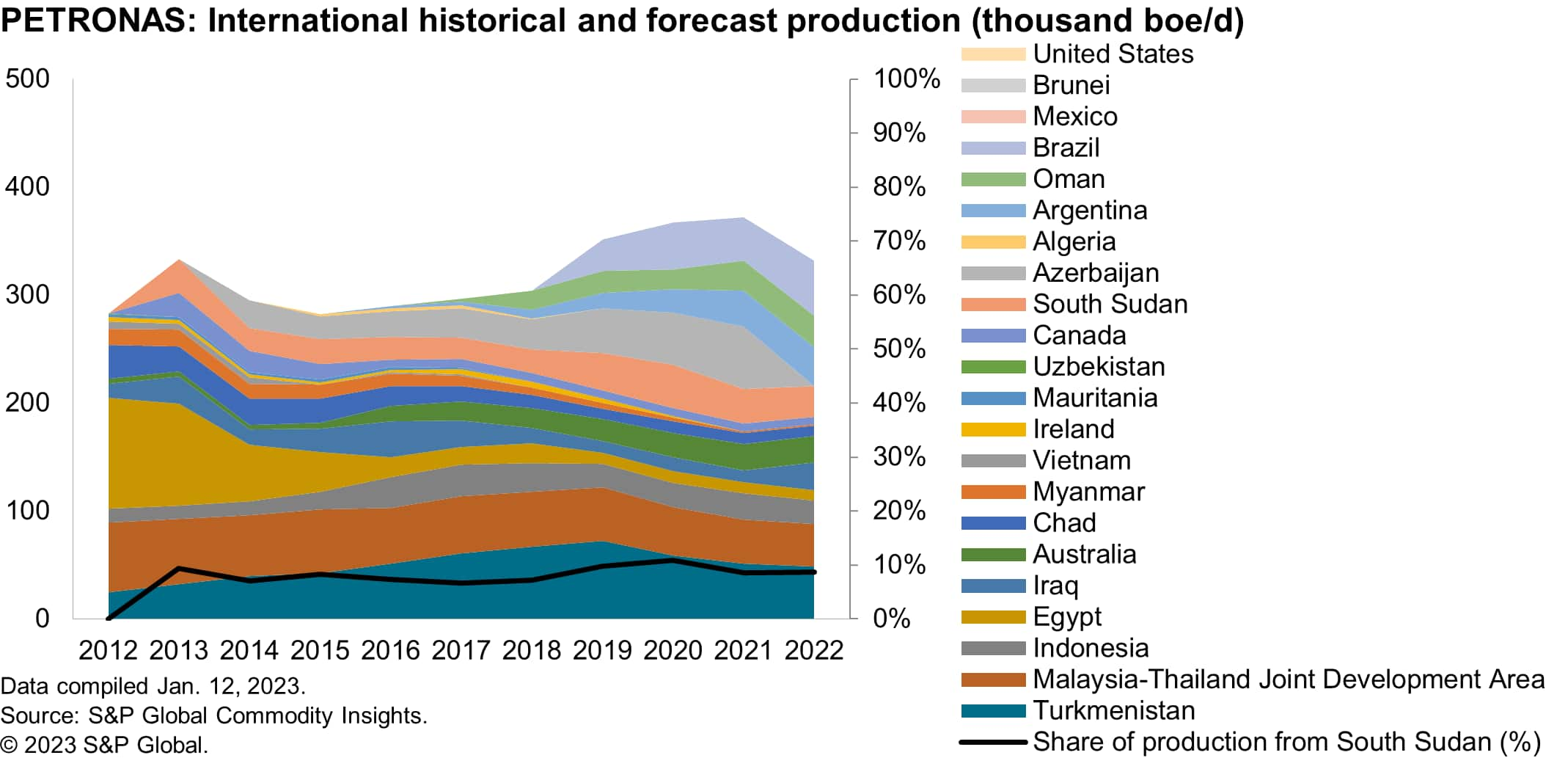

During 2002 to 2011, production from Sudan and South Sudan constituted more than 25% in PETRONAS's international production; followed by a dip in output in 2012, primarily owing to shut-ins related to the Sudanese conflict that led to South Sudan's independence. Post-2012, PETRONAS's investments in Sudan and South Sudan struggled with reduced production, resulting in revenue losses for the NOC. In 2020, media reports indicated that PETRONAS decided not to participate in South Sudan's 2021 licensing round. Further in 2022, media reports indicated that PETRONAS and partner CNPC were unwilling to finance more long-term development operations in South Sudan. Various factors such as a sharp decline in production with limited opportunity for material growth, geopolitical tensions, and reduced investor interest in South Sudan, together contributed to PETRONAS's decision to pursue divestiture of its assets in the country.

PETRONAS's oil-weighted portfolio in South Sudan will provide Savannah Energy a growth opportunity

The acquisition fits appropriately with Savannah's strategy of expanding and focusing on the delivery of 'Projects that Matter' in Africa. Currently Savannah sources its oil and gas output solely from Nigeria and recorded a production of around 16,000 boe/d in 2021. Post-acquisition, Savannah anticipates new production volumes from Greater Pioneer Operating Company (GPOC)-operated Blocks 1, 2, and 4 Expansion, which is expected to come onstream in 2028 comprising of five discoveries.

PETRONAS's international strategy will focus on monetizing unconventional resources in Argentina and Canada while maximizing value from assets in Brazil and Turkmenistan

PETRONAS's international expansion priorities have shifted toward developing a tighter portfolio of lower-risk assets that can deliver production growth; simultaneously, the NOC is seeking to expand its investment in the low-carbon business. PETRONAS will prioritize unconventional investments in South and North America (Argentina and Canada) and the Middle East (Abu Dhabi, Oman). Conventional assets in focus include Brazil, Mexico, Turkmenistan, Iraq, and Vietnam. The NOC also had a good year in 2022 with eight significant discoveries across its portfolio in Malaysia, Suriname, and Brazil.

***

This blog is an extract from the study and the full report is

available for S&P Global Commodity Insights Connect platform

Companies and Transactions subscribers only.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.