Prospects for gas in South Africa and Nigeria Power Sectors

In South Africa and Nigeria, the successful development of gas infrastructure is essential to meet reliable supply and electrification targets and is expected to drive economic growth. Prospects for the increase in the gas-fired generation in the future total power mix in South Africa and Nigeria relies on the respective governments' political will to implement a series of planned actions.

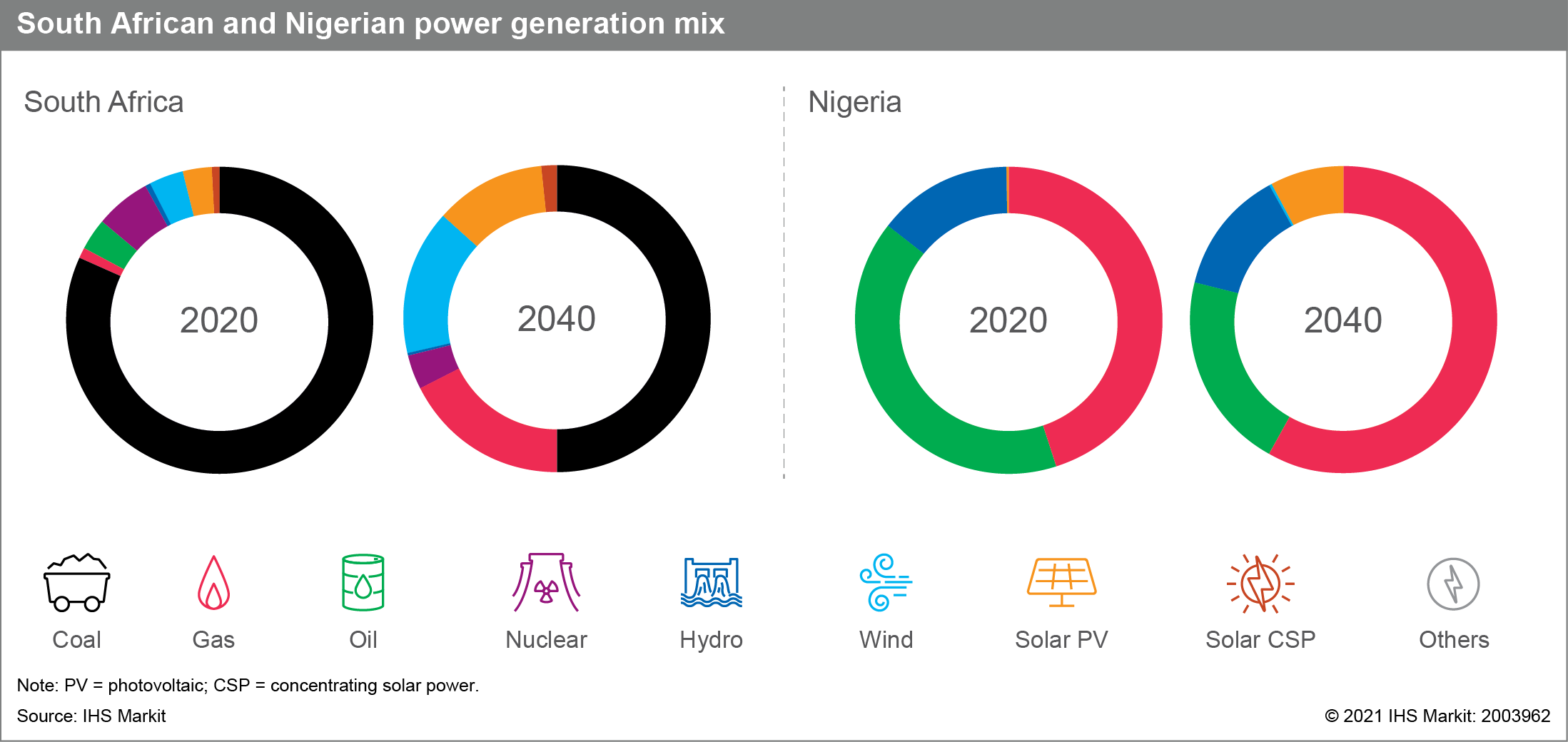

South Africa is undergoing an energy transition out of coal power dependence, where gas is seen as a transition fuel. But developing gas infrastructure is a major policy challenge. In 2020, South African gas consumption is estimated to be very low (5.1 Bcm), mostly sourced through the declining pipeline imports from Mozambique (90%) and the remainder from domestic production (10%). Declining domestic production requires LNG imports as an alternative gas supply to meet the domestic demand. However, South Africa does not have any LNG infrastructure to import gas at present, but it has proposed to develop new LNG terminals starting from Coega. South African gas demand is expected to double by 2040, relying on the LNG imports and domestic supplies from Brulpadda and Luiperd fields. In the domestic power sector, gas will be playing a major role in the diversification of the power generation mix, as its share is expected to increase from 2% in 2020 to 8% in 2040.

Nigeria has enough gas availability but lacks reliable gas distribution infrastructure and a competitive domestic market. The Petroleum Industry Bill (PIB) 2021 (signed into law by the Nigerian president in August 2021) is expected to encourage gas pipeline development following the projected competitive gas pricing and pipeline security from host communities. Measures are being taken in the power sector to increase the power generation to meet the chronic suppressed demand. The Federal government of Nigeria (FGN) launched the Presidential Power Initiative (PPI) to increase the available generation capacity from 7.6 GW in June 2021 to 25 GW by investing in power transmission and distribution infrastructure and ease the grid congestion. Besides improving the grid capacity, PPI also focuses on the ongoing Abuja, Kaduna, and Kano (AKK) pipeline and the associated 4 GW of the gas-to-power project to unlock the gas potential to the middle of Nigeria. The new gas units potentially offer an increase in power capacity at a cheaper cost, which could open new economic opportunities while unlocking the suppressed power demand. Nigeria's gas-to-power demand is expected to almost triple by 2040, while the share of gas in the power outlook is expected to increase from 45% in 2020 to 57% in 2040.

Learn more about our global coverage of power and renewables.

Vignesh Sundaram, a senior analyst at IHS Markit, conducts research and consulting for the sub-Saharan Africa power and renewables market.

Posted on 27 September 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.