Q4 2020 Power and Renewables Research Highlights

China's carbon neutral pledge, Biden's plans for the US power market, Europe's hydrogen strategy, Oil & Gas companies overheating renewable M&A, Renewables in Eastern Europe, Coal phase-out in OECD Asia, Gas in South Africa, Chile's hydrogen ambition, and the Capacity value of Solar in US power markets

Below is a selection from a wide range of publications issued recently from IHS Markit power and renewables experts. For more information about our power and renewables capabilities, please contact our global power and renewables expert team or visit our Global Power and Renewables service website

Jump to:

- China's carbon neutral pledge: Setting the stage for another four decades of transformation

- The impact of the development of low-carbon hydrogen on the European power sector

- A Biden presidency will hasten the US energy transition, but states remain critical to the pace of change for power and gas markets

- Racing for growth: Are oil and gas companies overheating the renewables sector?

- How will power markets evolve in Australia, Japan, and South Korea amid the phaseout of coal?

- Renewable power in Eastern Europe: Growth potential over the next decade

- Luiperd: A game changer for South African gas monetization?

- Big ambitions: How Chile aims to be among the largest exporters of green hydrogen in the world

- Assessing the capacity value of solar in US power markets

<span/>China's carbon neutral pledge: Setting the stage for another four decades of transformation

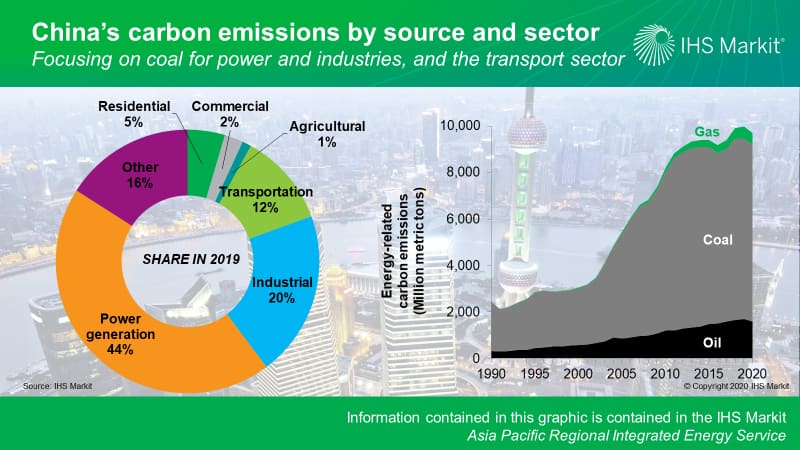

On 22 September 2020 in an announcement to the United Nations, Chinese President Xi Jinping committed China to a carbon-neutral future, to be achieved by 2060. This is the first time that China has pledged a carbon emissions target in absolute terms and is a historic announcement that is bound to effect major changes to its energy sector, with global implications. It will require China to execute a nationwide transformation over the next 40 years, one that is perhaps even more dramatic than over the past four decades. If done right, it would not just create a new energy system, but a new economy.

China will take on the Herculean task of decarbonization when energy demand is still growing. Unlike many other regions that committed to similar targets (such as Europe and Canada), China's per capita energy consumption remains relatively low—roughly 40% below that of Germany and 67% below that of the United States. New investment in carbon-free energy will need to not only replace existing fossil resources but also meet incremental demand.

Reducing coal use and decarbonizing the transport sector will be vital to achieving the goal. In addition, carbon removal as well as transaction mechanisms, such as emission offsets, will be needed to address sectors that are the hardest to decarbonize.

The target will require accelerating technological advancements and radically creative policy formulation, presenting a colossal challenge to many companies but also immense opportunities.

On 12 December, Chinese President Xi Jinping announced China's new 2030 carbon targets, as a part of China's new Intended Nationally Determined Commitment (INDC). Most of the new targets represent an incremental tightening from those stated five years ago in Paris and seems far less aggressive than the 2060 carbon pledge. However, the new 2030 NDCs reaffirmed China's commitment to the Paris Climate Agreement. In fact, they go beyond the goal of peaking carbon emission before 2030 and signals a progressively accelerated pace of transition towards carbon neutrality in the long run.

Read more in our recent blog posts, "China's carbon neutral pledge: Setting the stage for another four decades of transformation" and " China's new 2030 climate commitments: Beyond peak emissions."

<span/>The impact of the development of low-carbon hydrogen on the European power sector

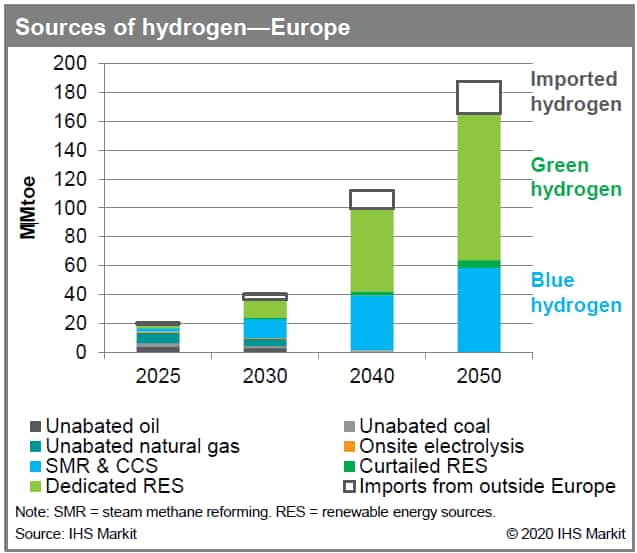

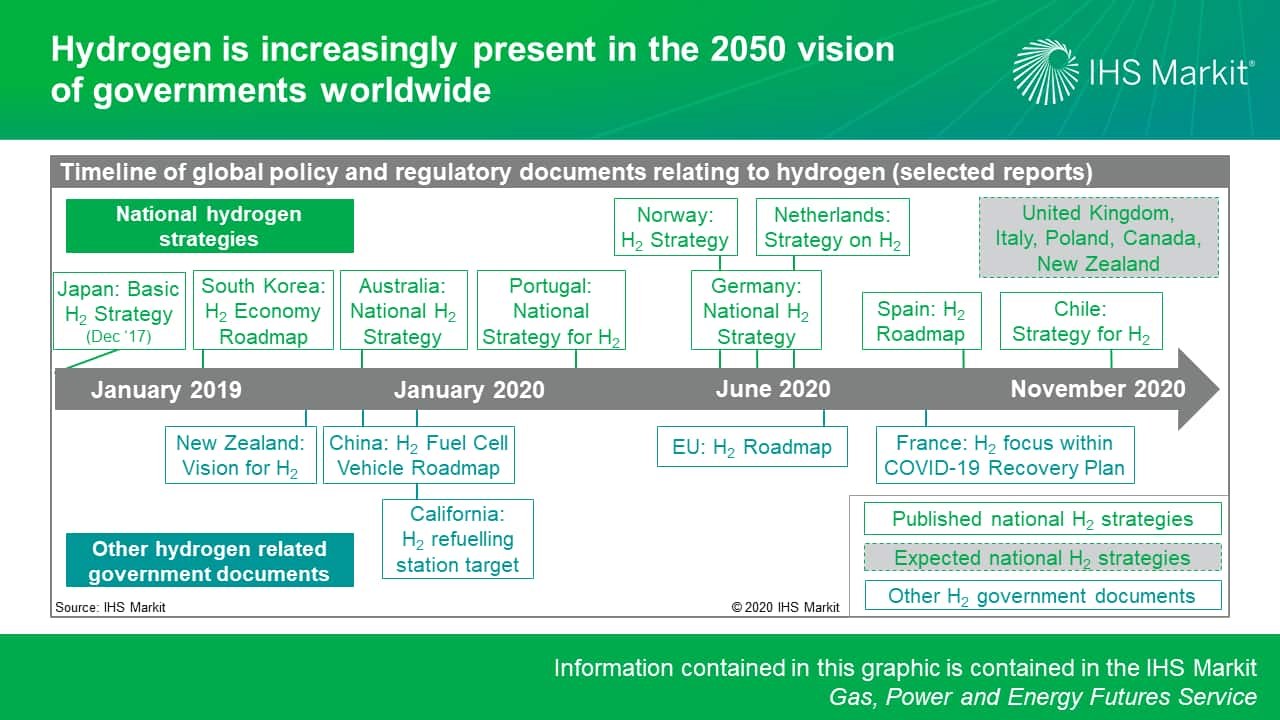

Following the focus on hydrogen in European COVID-19 recovery plans, the issuing of multiple hydrogen strategies, and the growth in the pipeline for power to X (P2X), we have incorporated hydrogen as an energy carrier in the August 2020 version of the European Planning Case.

The Planning Case assumes that major industrial consumers start to convert to hydrogen from 2024 onward and that a diversified supply mix—incorporating green hydrogen, blue hydrogen, and imports—develops. In 2050, hydrogen accounts for 12% of final energy demand in Europe and 40% of direct gas use. However, the uncertainty associated with this outlook is high—particularly in the early years.

Power demand for electrolysis and the renewable capacity required to support green hydrogen are expected to grow strongly throughout the outlook. By 2050, electrolysis is the largest single use of power in Europe, with over 600 GW of renewable capacity and electrolysis developed to supply the sector. Hydrogen production implies development of an additional 10 GW per year of solar photovoltaics (PV) and offshore wind from 2025 through 2050.

<span/>A Biden presidency will hasten the US energy transition, but states remain critical to the pace of change for power and gas markets

President-elect Joseph Biden will attempt to reset the US energy landscape with several individual targeted policies aimed at decarbonization and rejoining the Paris Agreement. The most likely policy actions will be those that do not require legislation given the uncertainty surrounding control over the US Senate. Likely actions that will have meaningful impact on US power and natural gas sectors this decade are new appointments to the Federal Energy Regulatory Commission (FERC) and Department of the Interior (DOI), as well as a higher level of climate risk scrutiny in financial regulation. While several other plausible actions will be of foundational importance to the long-term energy transition, they are less likely to have a significant impact this decade.

A Democratic FERC majority will likely allow for power sector capacity market constructs that are more accommodative of state policies that encourage new renewable and storage development (ex PJM). Importantly though, a democratic FERC majority is contingent on the Senate confirming Biden nominees. Absent a confirmation vote, FERC could lack a quorum to conduct business after Commissioner Indranil Chatterjee's term expires in June 2021.

Biden's appointment to the Department of Interior will likely accelerate the pace of offshore wind project permitting approvals, which have stalled under the Trump administration. It is also likely that the Biden administration will be more accommodative to the many types of transmission required to integrate offshore wind onto the land-based grid. IHS Markit's expected 18 GW of new US offshore wind capacity by 2030, driven by state policies, looks increasingly likely to materialize

Financial powers assigned to the president under the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank") could intensify pressure and increase the cost of capital for new fossil-fueled power generation development.

Possible longer-term actions include tightening the regulation of GHG emissions from existing fossil-fueled power generation, and the possibility for reviving plans for federal greenhouse gas emission regulations, accelerating the electrification of transportation and other end uses, and energy efficiency investments.

Read more in our recent blog post, " US election implications for a clean energy transition in the power sector."

<span/>Racing for growth: Are oil and gas companies overheating the renewables sector?

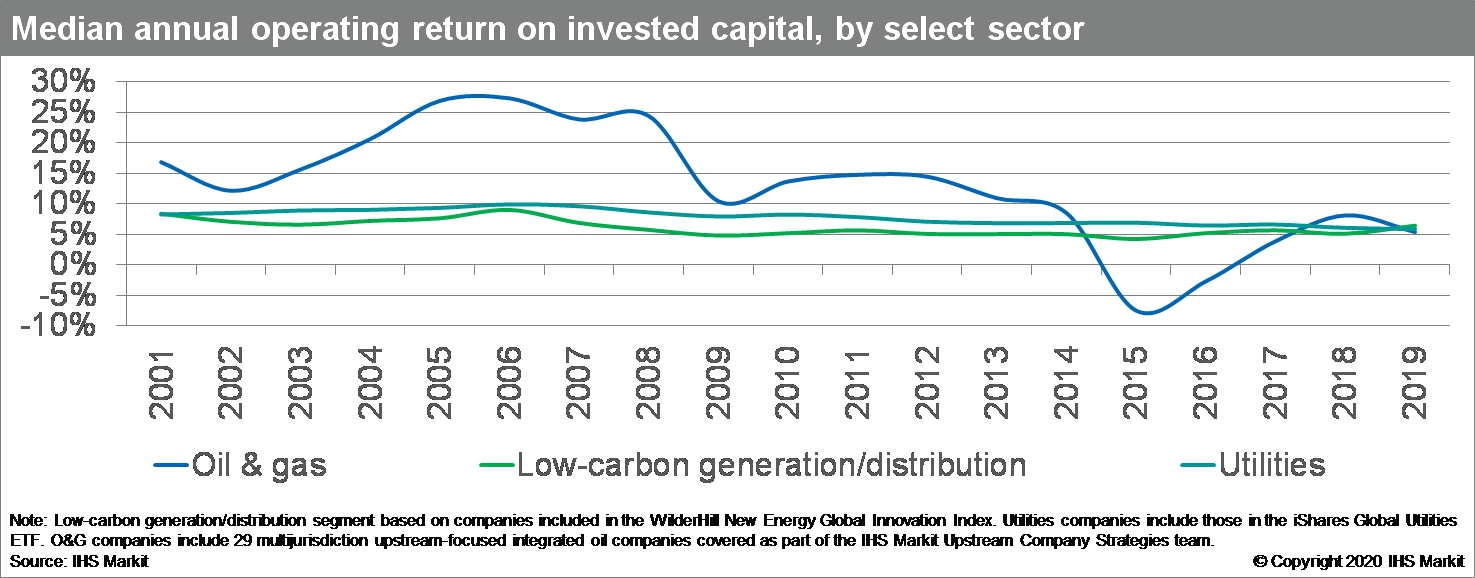

Many large and primarily European oil and gas (O&G) companies have significant expansion plans for renewable energies over the next decade, and the M&A activity of oil and gas companies in the renewables space has recently surged. This uptick comes at a time when many renewable markets globally are suffering from dampened power demand, low wholesale power prices, reduced government support, high competition, and low project margins. This incongruity creates concerns that oil and gas companies are pushing up renewable project valuations and overheating the sector.

Aggressive growth targets, competition from power utilities, and limited experience force O&G

companies to meet their green commitments primarily through M&A. This urgency among some O&G companies reverberates into renewable project and company valuations and could lower profit expectations. But over time, O&G companies can shift renewable investments from the M&A space to their own greenfield projects, hence calming activity in the secondary market.

Read more in our recent blog post, " Racing for growth: Are oil and gas companies overheating the renewables sector?"

<span/>How will power markets evolve in Australia, Japan, and South Korea amid the phaseout of coal?

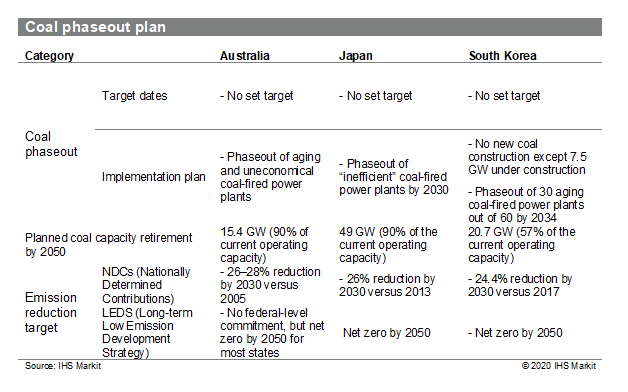

Coal-fired power is projected to lose its position in Australia, Japan, and South Korea with the phaseout of an aging fleet and lack of new additions thanks to the policy push for the energy transition, reduced economic competitiveness, and environmental concerns. Renewable energy is expected to play a more predominant role, but concerns around the challenges that intermittent energy bring to balancing grid operations remain. Gas-fired generation, battery storage, and pumped hydro are expected to firm power grids, but each country's unique circumstances create multiple development paths for the evolving power markets.

In Australia, Japan, and South Korea, operating coal fleets have a combined capacity of 115 GW, of which 106 GW is expected to retire before 2050 based on current government plans. As Japan and South Korea plan to add 18 GW over the next decade, a combined capacity of 27 GW is expected to remain, across the three markets, by midcentury.

To achieve deep decarbonization in the power sector, Japan and South Korea need continued government support to make solar and wind cost -competitive with conventional fuels. Additionally, green ammonia and hydrogen; carbon capture, utilization, and storage (CCUS); and even new nuclear reactors are pivotal for achieving carbon neutrality by 2050.

In Australia, high operating costs associated with running an aging coal fleet, environmental concerns, and the low levelized cost of electricity (LCOE) of renewables mainly due to favorable solar resources (average capacity factor of 22%) will drive coal phaseouts in the next two decades.

As a result of coal phaseouts, countries need bespoke renewable integration measures to improve grid flexibility. In South Korea, improving system reliability through the assessment of renewable energy sources in the capacity credit mechanism is a high priority. In Australia, battery storage has the potential to grow up to 17 GW by 2040, as the Australian Energy Market Commission's (AEMC) new five-minute settlement rule is expected to create increased opportunity for storage.

Learn more in by watching our on-demand webinar, " How a coal-phaseout will force Australia, Japan, and South Korea power markets to evolve."

<span/>Renewable power in Eastern Europe: Growth potential over the next decade

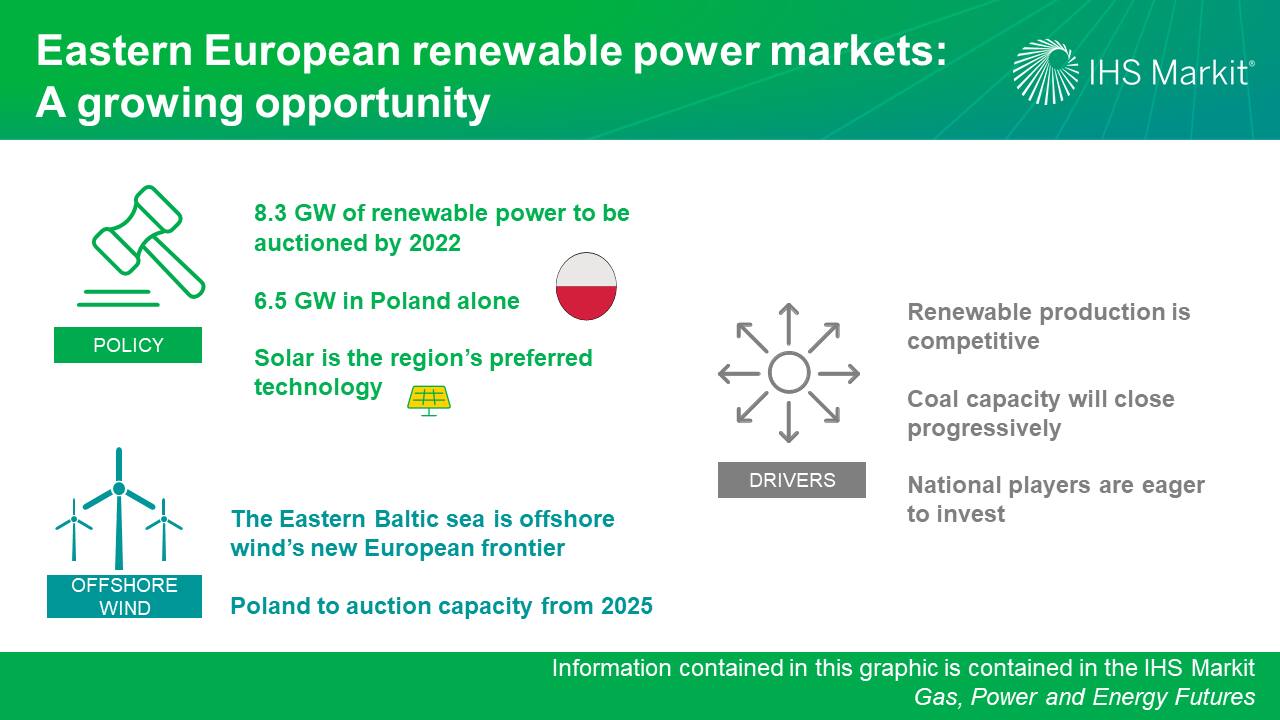

Despite cautious positions on the energy transition adopted by certain governments in the region, the potential for growth in renewable power in Eastern Europe toward 2030 is significant. Even Poland - where the government has so far held off from agreeing to the EU's 2050 net-zero target - activity in the power sector itself gives cause for optimism.

IHS Markit's planning case expects higher renewable capacity deployment than envisaged in the national targets of several countries as a result of government incentives, such as tenders. Approximately 8.3 GW of capacity is expected to be auctioned in Croatia, Hungary and Poland in the next 18 months, with Poland being the single largest constituent with almost 6.5 GW.

Learn more from our blog post, "Renewable power in Eastern Europe: A decade of growth beckons in coal's traditional heartlands".

Want to learn more? Download the full report.

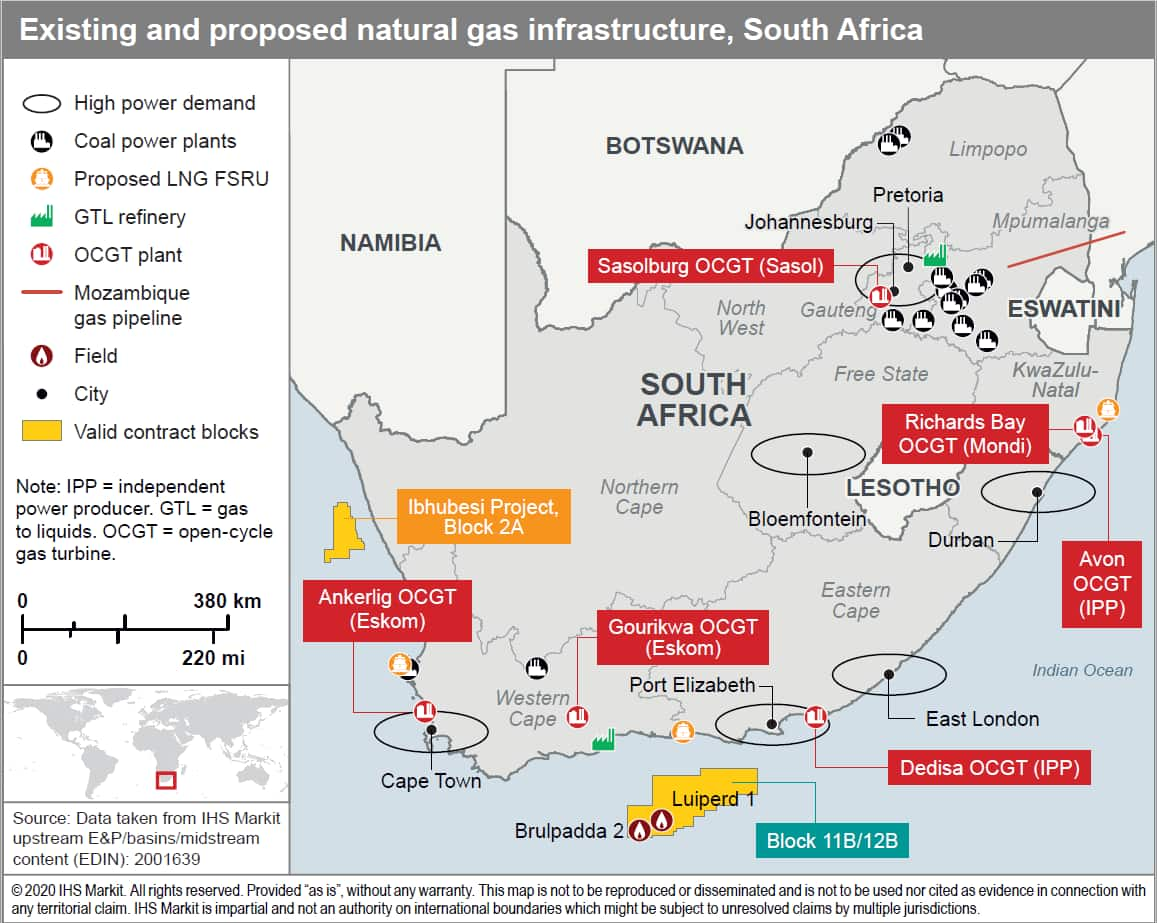

<span/>Luiperd: A game changer for South African gas monetization?

In October 2020, the Luiperd discovery was announced, leading to a potential twofold increase in South African gas reserves. To date, South African gas consumption has been predominantly limited to PetroSA's gas-to-liquids refinery and Sasol's chemical plants and today only accounts for 1% of the power generation mix. However, pervasive power outages and an aging coal fleet have created a need for new base-load power. The discovery of large gas volumes, so close to the recent Brulpadda discovery, has the potential to ease the country's security of supply concerns, but discovery is only the start of the gas monetization process. A challenging technical operating environment and an unclear domestic monetization route could delay the near-term development of these reserves and maintain the country's expected reliance on pipeline and potential LNG imports into the 2020s and beyond.

While the expected production rate from the joint development is currently uncertain, any gas monetization will need to be underpinned by robust offtake contracts in excess of 450 MMcf/d.

IHS Markit estimates approximately 2.5 GW of gas capacity, serving 11TWh of demand in 2025, an amount that can be supplied by 240 MMcf/d under 50% plant utilization. If the Ankerlig, Avon, Gourikwa, and Dedisa OCGT plants are converted to run on gas, then 571 MMcf/d may be absorbed, including Sasol's current gas demand.

Read more in our recent blog post, " Luiperd: A game changer for South African gas monetization?"

<span/>Big ambitions: How Chile aims to be among the largest exporters of green hydrogen in the world

On 3 November, Chile's Ministry of Energy presented a "National Strategy for Green Hydrogen for Chile" with three main objectives: have 5 GW of electrolysis capacity under development by 2025; produce the cheapest green hydrogen in the world by 2030; and be among the world's three largest hydrogen exporters by 2040. These grand ambitions come with proposed measures including extending US$50 million to pilot projects, promoting hydrogen in end-user applications, and launching "green hydrogen diplomacy" to position Chile internationally.

Chile has the renewable resources and power market environment to produce among the cheapest hydrogen in the world, but favorable new legislation and international partnerships will be essential to launch a dominant hydrogen industry. Debate over a new constitution and the global economic crisis threaten Chile's ability to attract foreign investment for its hydrogen ambitions.

Read more in our recent blog post, " Big ambitions: How Chile aims to be among the largest exporters of green hydrogen in the world."

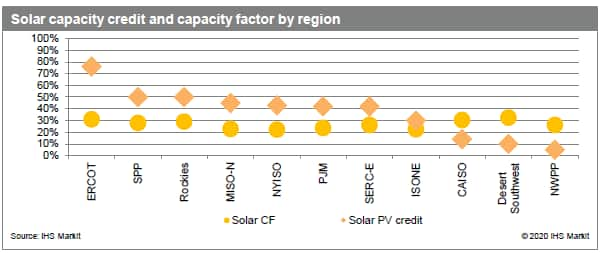

<span/>Assessing the capacity value of solar in US power markets

Solar is expected to be the fastest-growing technology in the US power sector in the future. Understanding how solar impacts resource adequacy will be crucial to system planners, and the decisions made about how to credit solar's capacity contribution will be key to developers attempting to monetize that value.

Regional transmission organizations (RTOs) value solar through a wide range of methods to estimate how much capacity solar contributes to capacity needs. Currently, solar capacity credits typically range from 30-70% in the summer, while solar is assumed to provide little capacity or none in the winter. However, most RTOs are already discussing future market rules or capacity credit changes to address growing volumes of intermittent resources.

IHS Markit has developed a methodology for adjusting the capacity credit for solar across regions and over time. In our Planning Case, average capacity credits for solar drop below 20% by 2035 for most regions as solar deployment weakens its ability to provide capacity. Yet, all regions will continue to add solar capacity long after it stops adding meaningful amounts of firm capacity.

The dynamics of rising solar capacity penetration levels in power markets have implications for both system planners and investors in solar capacity. Failing to anticipate the reduction in the solar capacity credit would increase the risk of load shedding as solar penetration levels increase. The value for investors will vary substantially depending on the project completion year and method used to develop capacity credits.

Other hot topics from IHS Markit's fourth quarter research include:

Client reports:

- Europe's energy market embarks on a decade of growth and opportunity ( Blog post)

- Cathedrals in the desert: The outlook for Concentrating Solar Power ( Blog post)

- US utilities ramp up EV infrastructure spending and shape evolving power demand

- South Korea's new net-zero target: Transforming the energy economy

- US utility capital allocation trends: Assessing the shift to safety ( Blog post)

- Cloudy future for solar under Italy's renewables support scheme

- Japan announces a 2050 net zero emissions target

- Gas-fired power tariff reduction in some Chinese provinces: Not a sign of less government support

- Right-of-way? The increasingly troubled legal route for pipeline projects in North America

- Will Spanish solar PV survive the fallout of COVID-19?

- How batteries are making money in US power markets ( Blog post)

- Portuguese solar auction: Innovative design and zero-subsidy contracts

- COVID-19 pressures Egypt's power and gas sectors ( Blog post)

- Green, flexible, and economical: India's strategies for large-scale renewable integration ( Blog post)

- Corporate US renewable procurement outlook: Optimism amid a pessimistic year

- Ireland's renewable auction unlocks solar PV pipeline ( Blog post)

- Selling renewable power in California's decarbonizing power market: Deliverability and bundling value streams

- Pakistan's draft Indicative Generation Capacity Expansion Plan 2047: Unrealistic and overambitious ( Blog post)

Client webinars:

- North American power and renewable markets in the decade ahead: Navigating a new policy and fundamentals landscape

- Global renewable power outlook to 2050: What has changed?

- Waste to power in China—What are the future opportunities?

- Europe's proposed new 2030 emissions target—What impact for Europe's proposed new 2030 emissions target?

- Major reforms seek to transform South America's large gas and power markets—where will they lead to?

To learn more about the research and analysis from our power and renewables team, please visit our Global Power and Renewables service website.

Posted on 5 January 2021.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.