Reassessing the role of gas-fired power in China’s regional markets

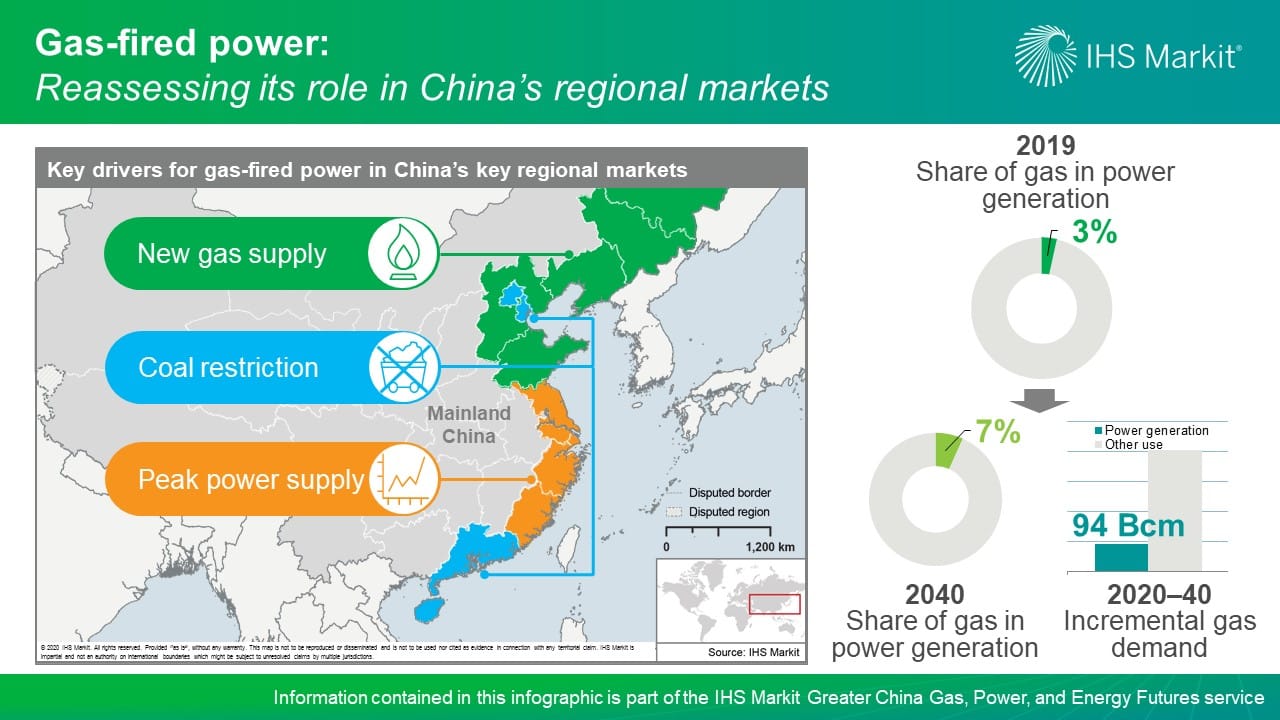

Gas-fired power development in China has been growing rapidly over the past decade. By the end of 2019, installed capacity reached 92 GW, making China the third-largest gas-fired power market in the world after the United States and Russia. However, gas represents only a small share in the Chinese power market, accounting for 5% of capacity and 3% of generation in 2019.

Figure 1: Reassessing its role in China's regional

markets

Gas-fired capacity additions have been cyclical, coinciding with new gas supply and policy push—this trend will continue. Gas-fired power can serve as the foundational customer to utilize new gas supply. In addition, energy policies favor gas-based power, especially combined heat and power plants, as a clean energy source. Despite the recent policy adjustment favoring "clean coal" owing to concerns over gas supply availability and affordability, the long-term government support for natural gas in general and gas-fired power in particular remains unchanged. Furthermore, an increasingly important factor affecting gas-fired power development arises from power market fundamentals, where gas can serve as a peak power supply source to supplement renewable development.

However, the drivers and the strength of the impacts vary across regions.

In Northeast China and the Bohai Bay area, new gas supply from Power of Siberia and the global LNG market and substantial buildout of related midstream infrastructure including pipelines and LNG receiving capacity will improve gas supply availability. Gas-fired power will be a key consumer of the new gas supply.

In Beijing, Tianjin, and the Pearl River Delta region, environmental policies restrict coal consumption, making gas-fired power an important source of local power and heat supply.

The eastern coastal market will increasingly need gas-fired power to provide peak supply and accommodate renewable development. Jiangsu, in particular, has recently switched to a capacity payment scheme for gas-fired plants. This will gradually transform the role of gas in the power market from combined heat and power plants to peak power supply.

IHS Markit is optimistic about the future of gas-fired power in China. We expect gas-fired capacity to reach 341 GW in 2040. Although the share of gas in the power generation mix will remain relatively low at 7%, the estimated incremental gas consumption from the power sector is significant at more than 90 Bcm, accounting for one quarter of total new gas demand during 2020-40.

Note: Unless otherwise specified, all data in this report refer to mainland China.

Learn more about our coverage of the Greater China energy market through our Greater China Gas, Power, and Energy Futures service.

Xiao Lu is a Senior Research Analyst covering Greater

China's gas and power analysis.

Posted 18 February 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.