Case Study: In which regions will increasing battery penetration support the captured prices of solar generators the most?

There are striking differences across regions in how the captured price of solar generators reacts to increasing battery penetrations.

Batteries offer many benefits to the electricity grid, ranging from storing excess renewable generation for peak demand periods, acting as a capacity resource, and providing ancillary services (i.e., frequency control). In addition to benefiting the grid overall, batteries can also benefit individual resources, by reducing curtailments or increasing the captured prices of renewable generators. This is especially important for solar generators; owing to the shape of their generating profile solar generators can face significant curtailments and low captured prices at high solar penetrations, as we are seeing in California today and are likely to see more frequently elsewhere in the future as more states adopt and aim to meet aggressive renewables' targets. But the effect of batteries on solar generators is not uniform across markets.

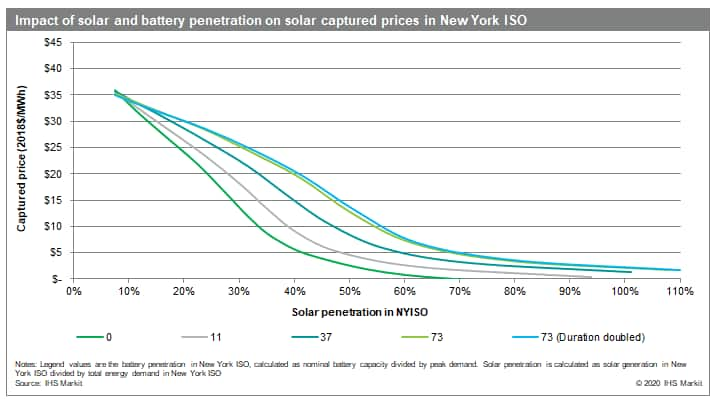

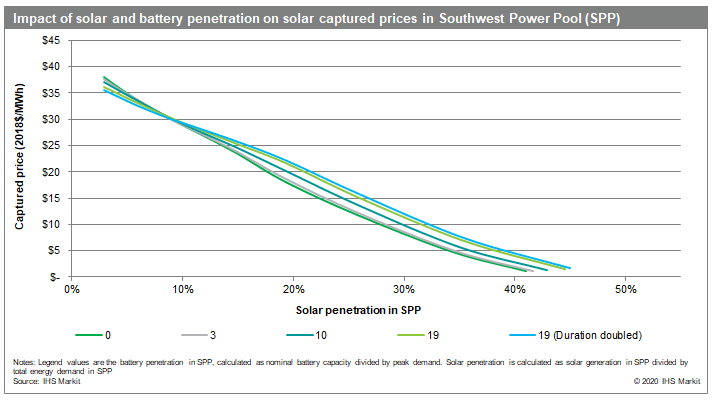

We applied the IHS Markit North American Power Analytics product to look at over 600 sensitivities, varying the renewable and battery penetration across all markets in North America. The analysis revealed striking differences in how the captured price of solar generators reacts to increasing battery penetration. Below are two graphs, showing how the solar captured price in New York ISO (NYISO) and the Southwest Power Pool (SPP) decline with increasing solar penetration:

In both NYISO and SPP, solar captured price decreases steadily as the solar penetration increases (these sensitivities are run in 2035, with everything outside of solar and battery penetration held constant). The different series on each graph represent the different levels of battery penetration in the local power market. In NYISO, a significant spread is evident between the battery penetration lines - up to roughly $15/MWh between the lowest and highest battery penetration levels. In SPP, the spread is much smaller, never increasing above $5/MWh.

One key explanation as to why batteries impact solar captured prices more in NYISO than in SPP is the different penetration level of batteries in the two regions. There is significantly more battery capacity in NYISO than in SPP in our Planning Case outlook. In a sensitivity that triples the battery capacity across the entire Eastern Interconnection, New York will see much higher battery capacity penetration levels than SPP. New York therefore sees more battery charging during high solar generation hours, and thus higher impacts on the captured price received by solar generators.

In addition, SPP has about twice the wind generation (percent terms) that NYISO has by 2035 in the IHS Markit Planning Case. In New York, with less wind, batteries are more likely to charge mid-day to absorb excess solar generation, giving more opportunities to raise the captured price for solar generators. In SPP, with its relatively high wind penetration, batteries may charge both during high solar hours and high-wind hours. In SPP, batteries effectively split their cycling across both wind and solar excess generation, reducing their ability to support captured solar pricing at given battery penetration level.

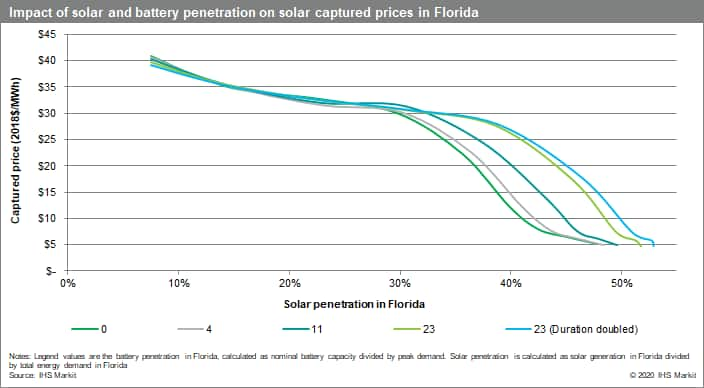

However, there are factors that impact the markets beyond higher solar and battery capacities and penetration. For instance, take Florida's solar captured prices[1] below:

Both SPP and Florida exhibit an approximately linear relationship between solar captured price and solar penetration at low solar penetration levels (however, the solar captured price is about twice as sensitive to increasing solar penetration in SPP). However, unlike SPP, at high solar penetrations Florida becomes very sensitive to solar penetration (sharply increasing downward slope) and to battery penetration (greater spread in the curves due to battery penetration level). Florida has similar solar and battery penetration levels as SPP, so the difference has another explanation.

One important difference between Florida and SPP is their role and position within the regional transmission network. SPP is connected to MISO-North, MISO-South, and indirectly to PJM and SERC due to SPP's central geographic location in the middle of the country. In SPP, excess solar generation can flow to other regions during high-solar hours (assuming well-coordinated inter-regional trading in 2035). Because the interconnected electricity system can handle some excess solar generation naturally, batteries may not provide as much benefit in absorbing excess solar generation and raising/supporting solar captured prices. Florida, on the other hand, is more isolated. Florida's relative isolation means it has less connection to and interactivity with other regions. At high solar penetration levels, excess solar generation is more likely to be trapped within Florida, depressing wholesale prices. This provides batteries an opportunity to charge off the depressed prices during high solar hours, providing more support to the captured solar price than in well interconnected regions such as SPP.

Supporting solar captured prices is only one benefit of batteries for the power system, but it can be an important factor for solar project developers and owners, battery owners, and long-term power system planners alike. Factors that influence the impact of batteries include the level of solar penetration in a market, the wind and solar generation relationships, the level of battery penetration in a market, and the interconnectivity of the region to surrounding regions.

These insights were gained through our North American Power Analytics tool. Learn more about our power analytics research and capabilities.

[1] While "captured price" is a less tangible concept in Florida/FRCC than it is in the restructured markets of NYISO and SPP, it is still a useful concept here because solar PPAs in Florida should hold a direct and close relationship to the captured price, cannibalization of that price, and the price support provided by batteries.

Drew Bobesink, Senior Research Analyst at IHS Markit, focuses on power market simulation and is a member of the North American Power and Renewables team.

Barclay Gibbs, Senior Director of Power and Renewables at IHS Markit, specializes in power market analysis, due diligence, and regulatory advisory for the North American Power and Renewables team.

Posted on 9 September 2020

Learn more about North American Power Analytics in our on-demand webinar:

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.