Renewables are the cheapest source of electricity in South Asia

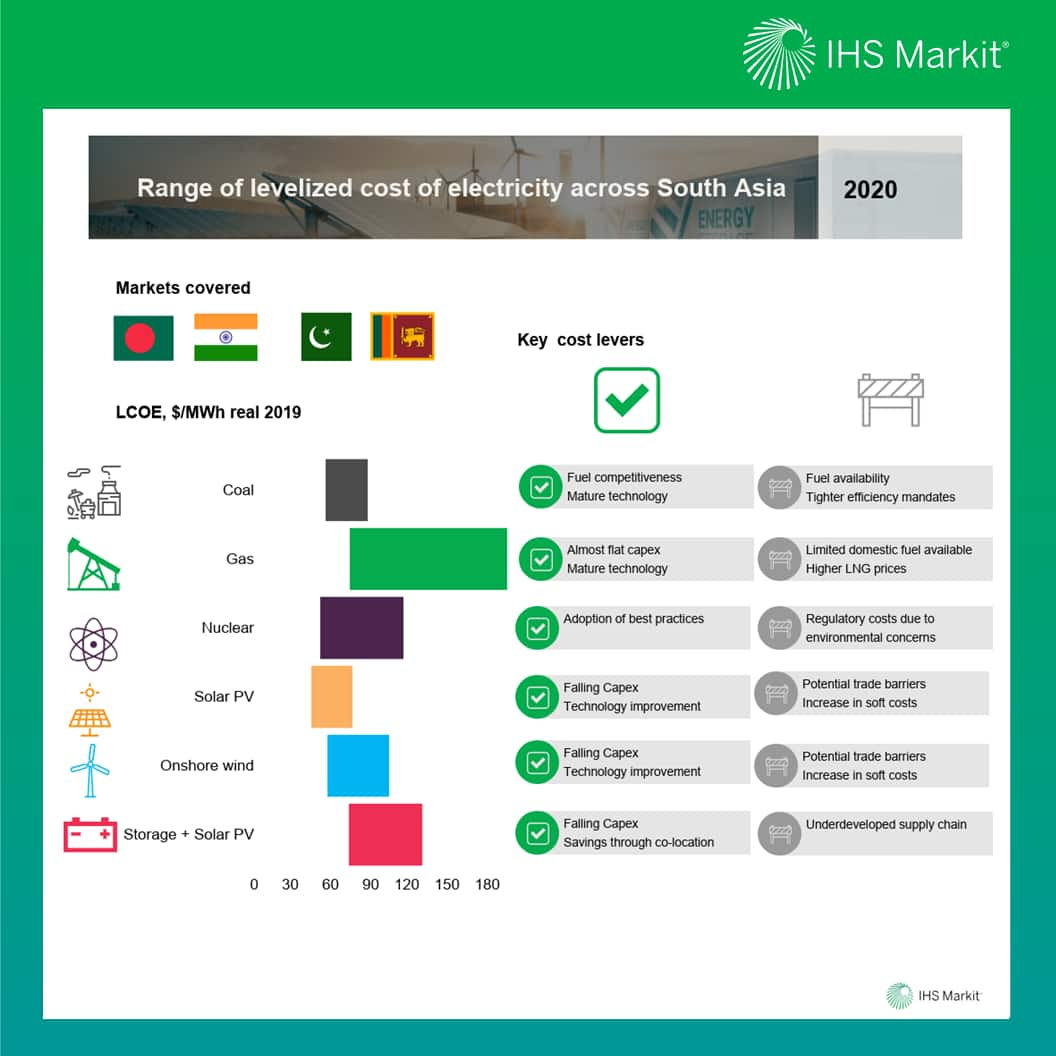

Renewables continue to benefit from a range of drivers for further cost reduction, including adoption of best practices, and maturing global supply chains with a localized hub. However, challenges due to rising trade barriers with more focus being put on local content and the increase in soft costs including land and labor costs are expected to become increasingly important. The LCOE for onshore wind and solar photovoltaic (PV) in 2020 ranges between $35/MWh and $93/MWh across the four South Asian markets and IHS Markit expects the LCOE to decrease by about 40-65% by 2050.

In India, solar PV is the cheapest source of electricity generation in utility-scale applications in 2020, while onshore wind is expected to become the second most cost-competitive technology in terms of levelized cost by 2024. IHS Markit expects the LCOE of solar PV and onshore wind to decline by 40% and 47%, respectively, in 2050 compared with 2020 levels.

As economic viability of battery storage improves significantly in the mid to long term, 8-hour standalone battery storage in India will become cost competitive with combined-cycle gas turbine (CCGT) technology by 2031. Meanwhile, the LCOE of hybrid projects will depend on the project size and the optimal resource mix including wind, solar, and battery storage.

In Bangladesh, utility-scale solar PV is cost competitive with new supercritical coal plants in terms of levelized costs in 2020, at $54/MWh and $56/MWh, respectively. In Pakistan, while utility-scale Solar PV is cost-competitive compared with a new CCGT in terms of the levelized cost, onshore wind will become the second most cost-competitive technology by 2027. While, in Sri Lanka, onshore wind is expected to become the cheapest source of electricity generation in 2021 and will be surpassed by utility-scale solar photovoltaic (PV) in 2025.

In contrast, the LCOE for conventional technologies—coal, gas, hydro, and nuclear—are expected increase by 2050, in comparison to 2020 levels. The increase is forecast to be driven by the surge in capital costs due to growing environmental, social, and security concerns. However, the increase for some technologies will be offset by declining fuel price trends especially in the international coal market. The LCOE for conventional technologies in 2020 ranged between $42/MWh and $181/MWh and is projected to increase by about 5-35% by 2050 across the different markets included in our analysis.

Depleting domestic gas reserves in the country increases the exposure of Pakistan and Bangladesh to LNG; hence, LCOE is directly linked to the LNG price trajectory in the Asian spot market. In Pakistan, the LCOE for CCGTs stood at about $77/MWh in 2020 and is expected to increase by about 23% to reach $94/MWh by 2050. Similarly in Bangladesh, the LCOE of CCGT projects fueled by LNG stood at about $78/MWh; the cost of generation is expected to increase to $93/MWh by 2050, the 20% increase in cost of generation due to the upward trend in Asian LNG prices. The LCOE of CCGTs fueled by domestic/pooled gas is about $32/MWh lower as domestic gas prices are subsidized and regulated.

To learn more about our Asia Pacific energy market research, visit our Asia Pacific Regional Integrated Service page.

Ankita Chauhan is a senior renewable analyst on the Climate and Sustainability team at IHS Markit, covering research and analysis for Indian and South Asian markets.

Rashika Gupta, Ph.D., is a director on the Climate and Sustainability team at IHS Markit, responsible for research and analysis for the India, Sri Lanka, Pakistan, and Bangladesh markets.

Deeksha Wason is a senior power analyst with the Climate and Sustainability team at IHS Markit, with expertise in the Indian power market.

Posted on 3 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.