BLOG

Mar 31, 2022

As the Russia-Ukraine war continues, a divided energy world emerges and ripples through the refining industry

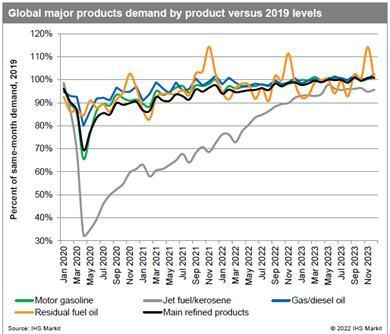

- Unprecedented crude prices and widening product cracks are expected to result in demand destruction of about 1.0 MMb/d (major refined products basis) in 2022, relative to our previous outlook.

- On a major refined product basis, the largest 2022 annual demand destruction will be observed in Europe (-300,000 b/d), CIS (-200,000 b/d), and mainland China (-200,000 b/d). Overall, we still expect global demand to grow, albeit at a slower pace relative to our previous forecast, at 2.6 MMb/d and 2.3 MMb/d year on year for 2022 and 2023, respectively.

- According to our Commodities at Sea data, Russian loadings of residues have been reduced by 43% in March versus February, fuel oil loadings have similarly been reduced, and we anticipate larger reductions in Russian loadings in the upcoming months. At the same time, mainland China is considering introducing an export ban amid high prices

- The Russia-Ukraine conflict amplifies the potentially tightening middle distillate and gasoline markets through 2023.

- Risks to our base case include demand destruction from high prices becoming more pronounced than anticipated, mainland China releasing higher product exports in a high-energy environment, and delays to our projections on the Middle Eastern refinery capacity coming onstream.

- The 2022 environment is still shaping up to be among the highest-margin environments in years, and refiners are expected to respond where possible. Global crude runs are forecast to ramp up through the summer months, although still remaining below pre-pandemic levels as a result of recent rationalization.

- According to the IHS Markit Economics and Country Risk Containment Index, China is experiencing a higher level of containment in response to their localized COVID-19 outbreak in March and April which should have a noticeable impact on product demand.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frussia-ukraine-war-divides-energy-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frussia-ukraine-war-divides-energy-industry.html&text=As+the+Russia-Ukraine+war+continues%2c+a+divided+energy+world+emerges+and+ripples+through+the+refining+industry+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frussia-ukraine-war-divides-energy-industry.html","enabled":true},{"name":"email","url":"?subject=As the Russia-Ukraine war continues, a divided energy world emerges and ripples through the refining industry | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frussia-ukraine-war-divides-energy-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=As+the+Russia-Ukraine+war+continues%2c+a+divided+energy+world+emerges+and+ripples+through+the+refining+industry+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frussia-ukraine-war-divides-energy-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}