SEC climate risk rule: Scope 3 exclusion limits US company disclosure of electricity-related emissions abroad

On March 6th, the US Securities and Exchange Commission (SEC) adopted the final rules on The Enhancement and Standardization of Climate-Related Disclosures. The regulation requires publicly traded companies under the SEC's purview to disclose climate-related risks that may materially impact business operations.

Among the rule's final provisions, specified US companies are required to report their scope 1 and 2 emissions. Importantly, this requirement contrasts with the rule's initial proposal of March 2022 that included the reporting of scope 3 emissions as well[1].

This reversal on scope 3 coverage — primarily so the rule adheres closer to judicial precedent and aligns with proliferating international standards — has substantial implications on the visibility of power sector emissions indirectly tied to US companies.

Indeed, scope 3 emissions often make up the largest part of a company's total emissions portfolio. For instance, according to company reporting, about 65% of Apple's emissions stem from scope 3 manufacturing activities and about 75% of Coca-Cola's emissions originate from scope 3 franchises manufacturing.

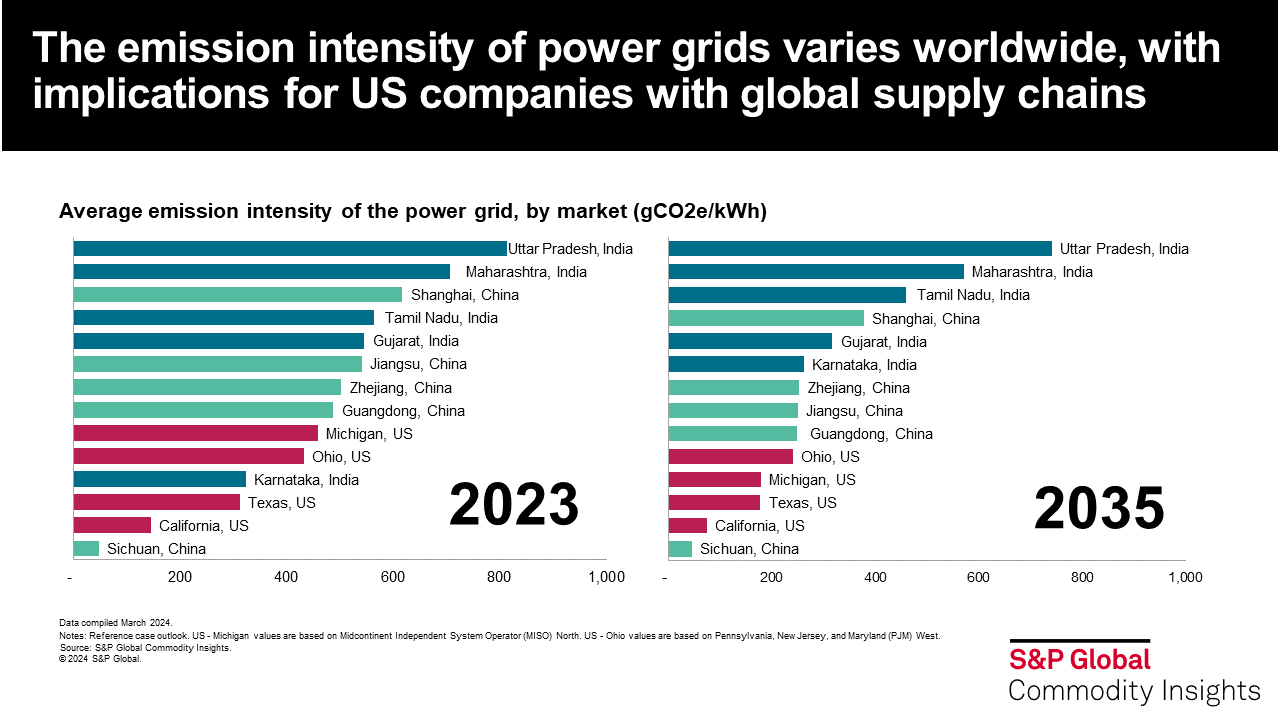

Furthermore, US companies typically have most scope 1 and 2 emissions domestically in the US, but scope 3 emissions pertain to global supply chains and so are more geographically widespread. In particular, the scope 3 emissions of large US companies are often associated with manufacturing operations in regions like China, India, and Southeast Asia — regions with higher emitting power grids than the US.

Case in point, according to Commodity Insights research, the grid emission intensity (i.e., the CO2 emissions per unit of electricity produced) of China's manufacturing-heavy Guangdong and Zhejiang provinces is about 1.6 times higher than in Texas and 3.4 times higher than in California (the top two manufacturing states in the US). However, the hydro-rich Sichuan province (home to iPhone and Toyota factories for example) has a grid intensity lower than in Texas (see graph below).

Likewise, India's industrial states of Gujarat and Tamil Nadu have emission intensities that are 1.8 and 3.8 times higher than Texas and California, respectively. Meanwhile, abundant renewable resources in Karnataka state, home to manufacturers like Volvo and Dell, leads to an emission intensity on par with Texas. Lastly, Vietnam's grid emission intensity is about 60% higher than the US average.

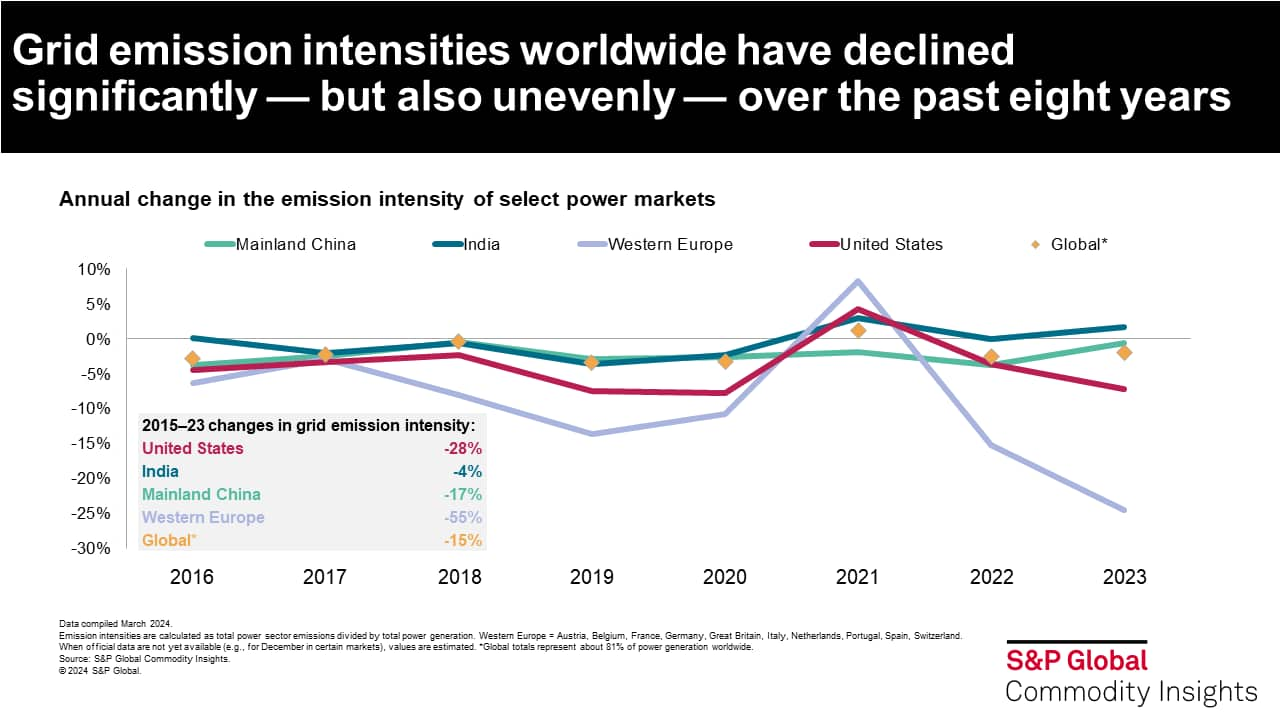

Furthermore, Commodity Insights

analysis shows that the grid emission intensity of APAC industrial

regions often declines slower than in the US. This has been the

case historically (see graph below). Looking forward, the grid

intensity of India's Maharashtra state, for example, is expected to

decline by 19% in the next 10 years, compared with 43% for Texas

and 61% for MISO (where Michigan, Illinois and Indiana are

located). Thailand's grid emissions intensity is expected to fall

28% by 2035. China's grid intensity, however, is expected to

decline rapidly as renewable energies make very rapid inroads.

Furthermore, Commodity Insights

analysis shows that the grid emission intensity of APAC industrial

regions often declines slower than in the US. This has been the

case historically (see graph below). Looking forward, the grid

intensity of India's Maharashtra state, for example, is expected to

decline by 19% in the next 10 years, compared with 43% for Texas

and 61% for MISO (where Michigan, Illinois and Indiana are

located). Thailand's grid emissions intensity is expected to fall

28% by 2035. China's grid intensity, however, is expected to

decline rapidly as renewable energies make very rapid inroads.

These trends in emission intensities have numerous causes — the considerable renewables subsidies in the US Inflation Reduction Act, surging power demand growth in emerging markets forcing the continued buildout of cheap coal plants, etc. — but they point to substantial opportunities to reduce the scope 3 power-related emissions of companies that outsource much of their operations abroad.

Indeed, significant business opportunities to decarbonize power systems exist both in the US and worldwide. The new SEC rule adds to the growing global regulatory regime for corporate climate disclosures, after recent developments in the European Union (with the European Sustainability Reporting Standards) and California (with new rules on climate risk disclosure). Although the SEC rules only require companies to report on scope 1 and scope 2 emissions if the company considers them to be "material" to investors, these initiatives will still likely lead to more corporate actions to procure clean energy, especially through renewable power purchase agreements and the trading of certificates including renewable energy certificates.

Learn more about our Global Power and Renewables research.

Etienne Gabel, senior director at S&P Global Commodity Insights with the Global Power and Renewables team, specializes in the analysis of market and regulatory developments in power sectors worldwide.

Emma Xie He is, senior research analyst in the North American Power and Renewables team at S&P Global Commodity Insights, leads corporate procurement outlook in North America, contributes to the broader power modelling effort, and consults on power market development.

Posted 13 March 2024

[1] Scope 1 covers emissions made directly by a company. Scope 2 represents indirect emissions from the energy that the company uses, most often from electricity generation. Scope 3 covers indirect emissions that value chain suppliers or consumers emit — including their own electricity-related emissions — in connection with the company's products or services.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.