Seeing the trees rather than the forest: hydrogen around the world

Interest in hydrogen has soared in every region of the world and in all sectors of the economy. This widespread momentum is proving to be both a blessing, and a curse. A blessing, as every end-use case is being tested somewhere. A curse, as the absence of one dominant use-case and the presence of many ways of producing and transporting hydrogen make it hard to determine what will trigger mainstream use of hydrogen as an energy carrier. It is also challenging to identify where there is real progress and where there is just hype.

Europe—a proving ground for economy wide development of low-carbon gas

While hydrogen can be used as an energy carrier for all sectors of the economy, in the US and in Asia, the primary focus is simply transport. In mainland China, Japan and South Korea, a combination of local and central government works with industry to drive development of fuel cell vehicles and the associated infrastructure. On the other side of the world, California's "low-carbon fuel standard" provides a clear mechanism to lower the cost of retail hydrogen and to develop a refueling infrastructure open to all.

In Europe, there is interest in transport, but there are many other projects underway to look at the use of hydrogen, and other low-carbon gases, in buildings, industry and power. In Europe there is a patchwork approach, with individual countries focusing on different aspects.

For each country a different focus

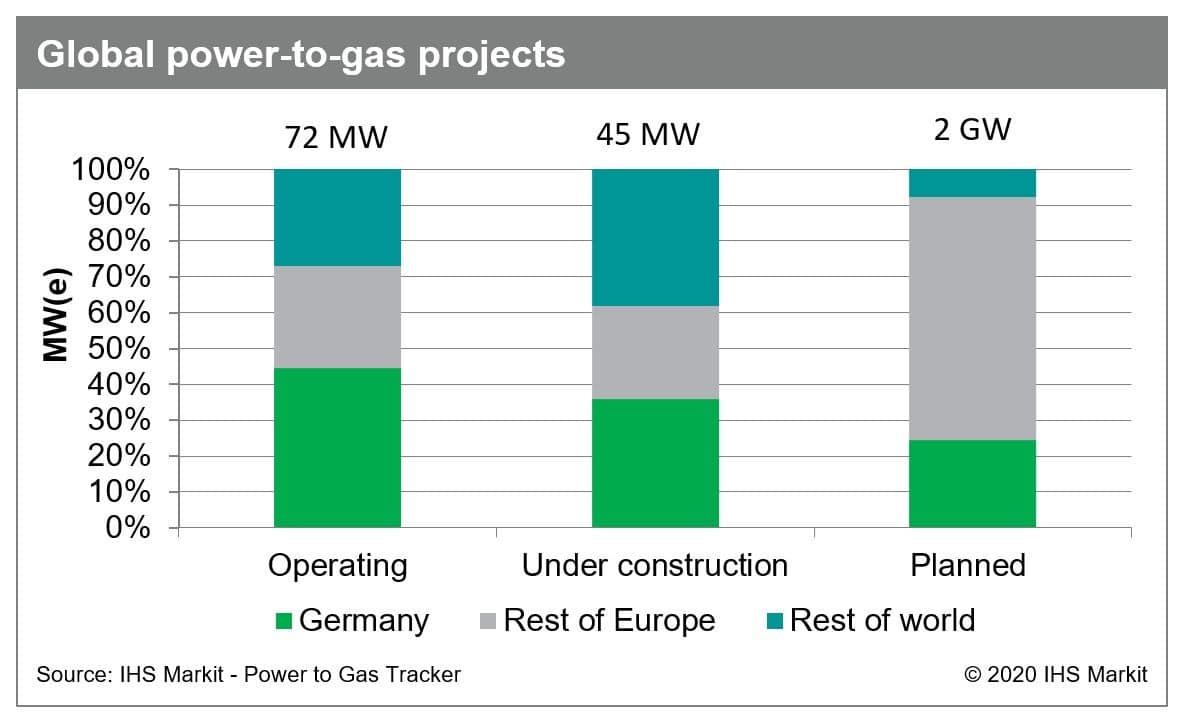

- Germany is the world leader in power-to-gas. Of the 113 operating projects in IHS Markit's power-to-gas database 34 are in Germany. Germany accounts for approximately 45% of the installed electrolyser capacity worldwide, 28% are in the rest of Europe, with the remaining 27% in the rest of the world. The number of projects in Germany reflects the ability to use electrolysers as a means to balance a power grid with high levels of intermittent renewables and increasing geographic constraints. Although Germany's dominance in power-to-gas will decline (see figure 1), it will remain the key proving ground for the commercialization of power-to-gas as a means of integrating variable renewables.

Figure 1: Global power-to-gas projects

- France, which has the greatest biomass potential in the European Union, is taking a lead on grid injection of renewable and synthetic methane. We estimate that 11% of Europe's total biomass potential of 250 million metric tons is in France. Currently, less than 2% of European biomass is converted into grid-injectable methane. This is due to an incentive structure which has in the past favored the use of biomass in power generation or as an additive to liquid fuels. The incentive structure for grid injection is now changing, and experience gained in France will provide clear insights in the path to lower production costs—for renewable methane from biomass and for synthetic methane from electricity. It may also demonstrate what is needed to develop the latent potential of intermediate crops and of other less established biomass production methods.

- The Netherlands and UK, which border the gas reserves of the North Sea, have long been "gas countries". Natural gas provides more than 90% of space and water heating and dominates industrial process heat and power generation. Both countries have signed up to mid-century net-zero carbon goals and are looking at options to replace natural gas in buildings and industry. Projects include the H21 North of England, which seeks to convert 3.7 million British homes to hydrogen-based heating and H-vision, which seeks to replace natural gas and coal used in the Rotterdam industrial cluster with hydrogen. Importantly for the global development of hydrogen, methane reforming with very high levels of carbon capture and storage is at the heart of the plans. However, neither country is focusing exclusively on hydrogen from natural gas—the largest pipeline of electroyiser projects today is in the Netherlands where there are plans to add over 700MW by 2024. The pipeline in the UK exceeds 100MW.

A unique set of circumstances?

The characteristics of the European market—different national markets with varied energy mixes, strong environmental policies including net-zero carbon goals in 14 EU member states, a dense electricity and gas infrastructure and offshore depleted fields available for carbon sequestration—may not be directly replicated everywhere else in the world. But experience gained from the projects that are underway in Europe today can be applied globally. Among the large number of global hydrogen-related announcements, a close and special watch should be kept on developments in North-west Europe.

For more information on the Hydrogen and Renewable Gas forum, watch this complimentary webinar.

Catherine Robinson is an executive director on the Gas, Power, and Energy Futures team at IHS Markit.

Posted 07 February 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.