September Power and Renewables Research Highlights

Rolling blackouts return to California's power markets; Evolution of the NEM: Navigating Australia's renewable energy transition; India's new renewable trading platform; EV home charging models; and more

Below is a selection from a wide range of publications issued recently from IHS Markit power and renewables experts. For more information about our power and renewables capabilities, please contact our global power and renewables expert team or visit our Global Power and Renewables service website.

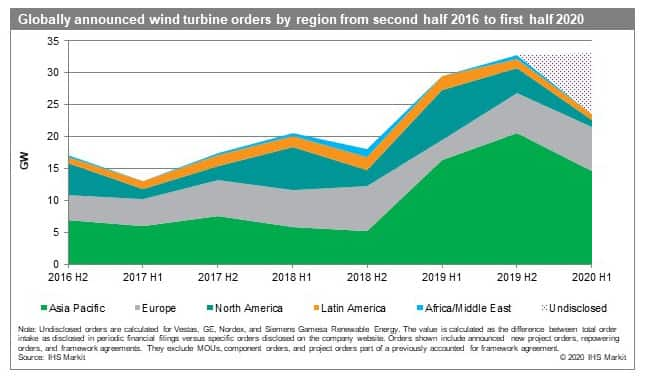

Global wind turbine installation overview and announced wind turbine order tracker

IHS Markit tracked 62.5 GW of new wind installations in 2019, 22% higher than the year before. While over 90% of this was in onshore, the offshore sector also remained strong with annual installations growing by 45%. However, the COVID-19 pandemic resulted in a slow start to 2020 with only 23.5 GW of publicly announced firm wind turbine orders recorded globally in the first half.

Major OEMs have consolidated market share globally with the five largest players comprising Vestas, SGRE, Goldwind, GE, and Envision supplying nearly 70% of the global installations in 2019. In terms of announced turbine contracts in first half 2020, Vestas retained its lead position globally while mainland China's ongoing installation rush resulted in local OEMs taking five of the top ten spots.

In 2020, global wind installations are expected to be driven by the United States and mainland China while significant growth in ordering activity has also been observed in other markets including the Nordics, Vietnam, Poland, and the United Kingdom in first half 2020.

While 2.X MW turbines were the most installed in 2019, announced orders have indicated a growing share of low and medium wind speed models with larger rotor diameters. IHS Markit has tracked orders for onshore turbines rated up to 6.6 MW with rotor sizes of 170 meters across various markets but predominantly in the Nordics, Brazil, Turkey, and Australia.

Read more in our recent blog post, "Wind turbine manufacturers cash in on the ongoing installations rush."

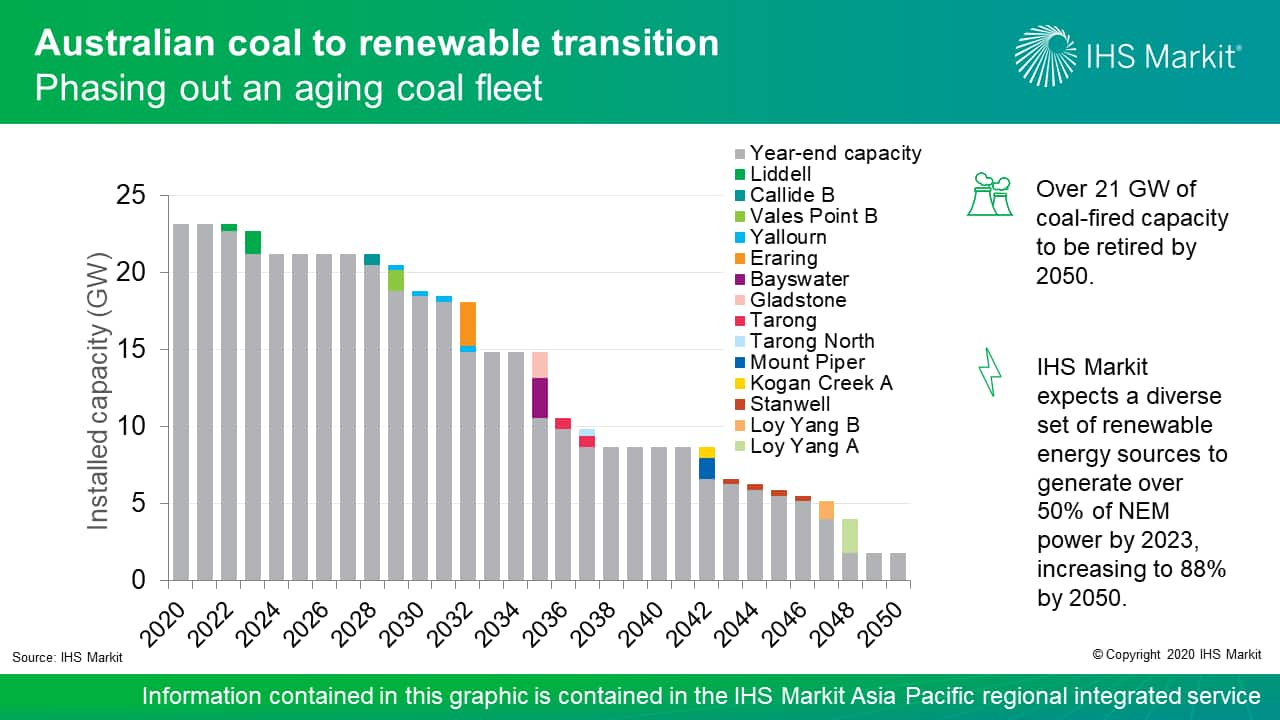

Evolution of the NEM: Navigating Australia's renewable energy transition

The Australian Energy Market Operator (AEMO) released the updated power system roadmap on 30 July 2020 to address future power generation and transmission issues that the National Electricity Market (NEM) is likely to face over the next 20 years. The 2020 Integrated System Plan (ISP) reaffirms Australia's intention to shift away from centralized coal-fired power generation toward a diverse portfolio dominated by distributed solar photovoltaic (PV) and utility-scale wind and solar, but lays out a more aggressive path to achieving this goal compared with the 2018 ISP.

Coal-fired power is projected to lose its dominant position with the phaseout of an aging fleet and the lack of new additions, owing to reduced economic competitiveness and environmental concerns. Despite various grid challenges, wind and solar are expected to register strong growth, together projected to account for over 64% of NEM's total installed capacity and generation in 2050. Pumped storage and batteries would be preferred over gas-fired power to firm the grid in the NEM.

Read more in our recent blog post, "Evolution of the NEM: Navigating Australia's renewable energy transition."

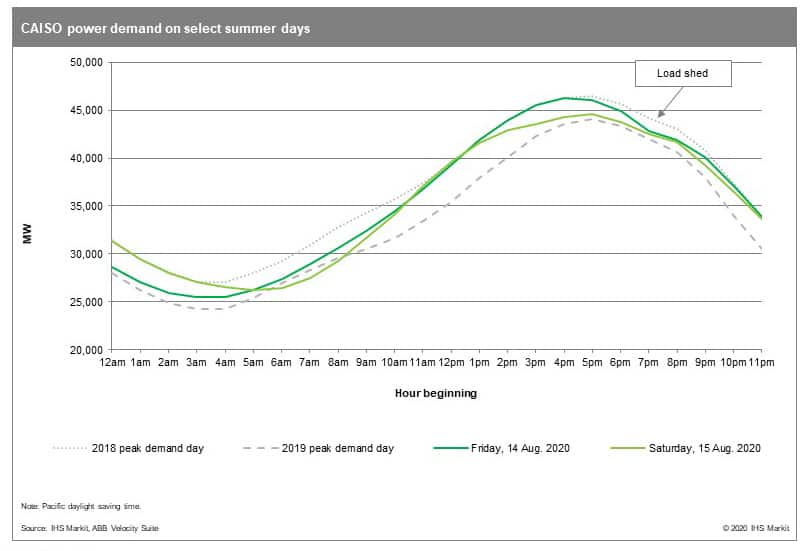

Ghosts from summers past: Rolling blackouts return to California's power market

Friday, 14 August, the California Independent System Operator (CAISO) declared a Stage 3 Emergency for the first time since the 2001 energy crisis, requiring electric utilities to shed 1,000 MW of load between approximately 6:40 pm and 8:40 pm. More than 400,000 customers lost electricity for about an hour at a time. Another Stage 3 Emergency was declared on Saturday, 15 August, requiring nearly 500 MW of intentional blackouts, but it lasted for only 20 minutes—between roughly 6:30 pm and 6:50 pm. CAISO warns that that similar load-shedding events could occur again.

Hot weather pushed power demand to its highest point in 2020, but not atypically so. Low wind generation on 14 August yielded the highest level of net load so far in 2020. Generator outages totaling 5 GW contributed to the supply shortfall on 14 August 2020. Batteries adjusted their performance during the system emergency on 14 August in accordance with their role as capacity resources. As a consequence of these events, a stronger resource adequacy mechanism may emerge in the future.

Read more in our recent blog post, "Ghosts from summers past: Rolling blackouts return to California's power market."

Still want more on this topic? Listen to our recent podcast episode of "Energy Cents," "Lessons from California Power Markets."

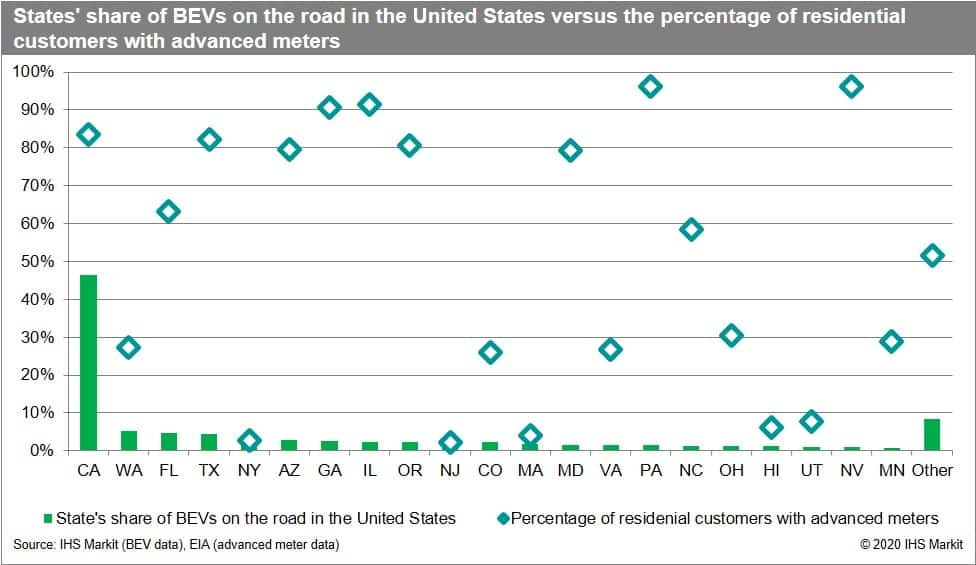

Lowering the cost of charging at home with submetering: One piece to the electric vehicle adoption puzzle

Mass electric vehicle (EV) adoption faces a variety of challenges—consumer preferences, range anxiety, and cost of ownership, to name a few. While automakers are addressing these headwinds, electric power utilities can too by affecting the cost of charging. To date, most utility initiatives have focused on make-ready public charging investments even though more than 80% of charging occurs at home. Xcel Energy's (Xcel) recently approved EV Home Service program is an innovative exception. By enrolling, EV owners can lower the cost of charging at home through time-of-use (TOU) electricity prices and home-charging equipment leases. Xcel will also use the home-charging equipment as the electricity meter (i.e., a submetering scheme). The cost of owning an EV will be lower under the EV Home Service program, making EVs more competitive with internal combustion engines (ICEs). Thus, EV adoption could accelerate relative to the status quo.

EV charging initiatives comply with and support state decarbonization laws and goals. TOU rate structures unlock lower-priced electricity for EVs and submetering with home EV charging stations lowers the cost of implementing TOU rates by avoiding a second utility meter. Submetering could be an effective approach for implementing favorable off-peak EV charging rates at many utilities.

Finding more ways to reduce the cost of owning an EV, like centering submetering schemes around EVs instead of home EVSE, could accelerate adoption relative to the status quo.

India launches an integrated platform for renewable energy trading, offering a market-based alternative to long-term PPAs

The Central Electricity Regulatory Commission (CERC) on 17 August 2020 approved the Indian Energy Exchange (IEX) petition for the introduction of the Green Term-ahead Market (GTAM)—an integrated platform for renewable energy (RE) contracts with a transparent market-based price-discovery mechanism. Currently, RE transactions are dominated by long-term power purchase agreements (PPAs) backed by central and state-level auctions. To boost new renewable additions, the GTAM offers an alternative market-based solution to market participants focused on short-term transactions.

An organized exclusive renewable energy market will facilitate additional RE procurement options and is expected to stimulate new investments in the short-term.

However, despite positive intent around the new framework, there are a few questions that raise concern over GTAM implementation. What is the future of the Renewable Energy Certificate (REC) market? How will this new platform coexist with the existing Term-Ahead Market (TAM)? And finally, an additional market price contradicts recent efforts to create a uniform market-clearing price in the short-term market.

Other hot topics from IHS Markit's September research include:

- Unlocking potential of the offshore wind market in South Korea

- Market Briefing: Global geothermal energy (see our infographic)

- North American microgrids: Market activity and drivers

To learn more about the research and analysis from our power and renewables team, please visit our Global Power and Renewables service website.

Posted on 2 October 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.