Southeast Asia decarbonization updates, Q2 2021

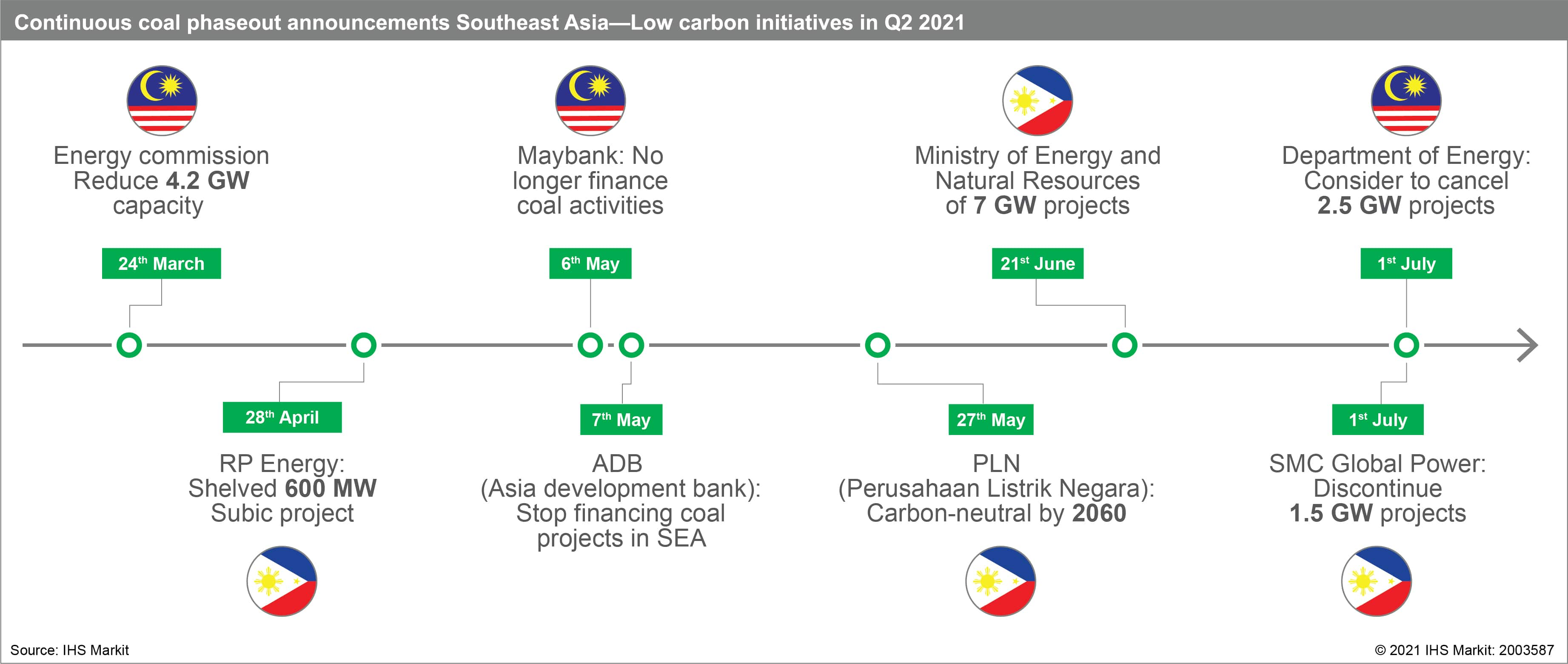

Southeast Asia (SEA) has been actively decarbonize the region's energy mix, with coal power projects being phased out steadily. In the second quarter of 2021, the Philippines and Malaysia have outlined plans to cut coal-fired capacity in pipelines, and Indonesian power utility PLN announced a coal retirement scheme.

Withdrawal of financing in coal power projects by Asian Development Bank

On May 7th, the Asian Development Bank (ADB) published a draft Energy Policy, which ruled out financing for coal projects in SEA for the first time but allows for continued gas finance under strict criteria. The 2021 draft Energy Policy aims to assist developing member countries (DMCs) in developing sustainable and resilient energy systems, to achieve their Paris Agreements pledges. The ADB Energy Policy is expected to be finalized by October 2021.

The draft energy policy revealed that ADB will not participate in investments to modernize, upgrade, or renovate coal facilities that will extend the life of existing coal-fired power and heating capacity. The only exception is to re-engineer such plants for use of cleaner fuels, such as natural gas or renewable energy sources.

All oil and gas exploration and production (E&P) projects, as well as coal mining funding were axed, while LNG and other natural gas operations will be subject to strict restrictions, which include: (1) able to prove that no other technology can deliver the same energy service at an equivalent economic cost that considers the social cost of carbon; and (2) able to demonstrate alignment with targets to attain carbon neutrality by mid-century (2050).

However, the environmentalist argued that the draft energy policy has a loophole by potentially allowing fossil gas investments, positioning double standard in pursuing net-zero goal by mid-century. The green groups have urged ADB to stop funding all fossil fuels projects, not only coal, in order to meet ADB's commitment to support climate change mitigation targets.

Philippines to discontinue 2.1 GW coal projects

The Philippines government supported the transition from fossil fuel-based technology to cleaner energy sources by introducing coal moratorium in late 2020.

On April 28, the Redondo Peninsula Energy Corp. decided to shelve the 600 MW Subic coal power projects. It was followed by SMC Global Power Holdings Corp on 1 July, to discontinue coal projects in Quezon ((Pagbilao and Sariaya, 600 MW each) and Cebu (300 MW Looc Malabuyoc). These four projects accounted for 24% of the planned capacity in coal moratorium.

Besides, the coal power projects (1,200 MW Orion Pacific and 1,336 MW Atimonan) in Quezon are pending on government's consideration to whether cancel or exempt these projects from coal moratorium 2020.

The huge cancellation of coal-based projects demonstrates the government's intention to support energy transition plan. This was backed by major financial institutions that have withdrawn from financing coal power.

Peninsular Malaysia pledged to reduce 4.2 GW coal capacity

On March 24, Malaysia's Energy Commission announced its 2021-39 Generation Development Plan, which is based on moderate economy recovery scenario, to reduce coal-based power capacity by 4.2 GW by 2039.

The Malaysian energy minister announced that there will be 7 GW retirement of coal-fired capacity. However, the Peninsular Malaysia generation plan still plans for new coal plant build with 2.8 GW capacity, scheduled for 1.4 GW by 2031 and the remaining by 2037. Further on June 21, the Energy and Natural Resources Ministry (KeTSA) announced that the coal plant's PPA that will expire by 2033 will not be renewed or replaced with new coals plants, and early retirement for existing capacity will be enforced. Major financial institution showed support for energy transition program. On May 6, Maybank announced it will no longer finance coal activities in its five-year strategy. Earlier in December 2020, the Maybank rivalry, CIMB bank has unveiled a climate policy to phasing out coal power from its portfolio by 2040, to support Malaysia central bank's agenda to build climate resilience in the country's financial sector. This shows the beginning of coal phase-out preparation in the Malaysian market, as the market transitions into renewable energy.

Indonesia's PLN set coal phase out by 2060

On May 27, Indonesian state-owned electricity company PLN announced that it hopes to achieve carbon-neutral status by 2060. PLN is planning to retire its coal-fired plants in several phases, after the completion of the remaining 16 GW of the mega coal-based projects by 2023, which is planned under 2014 Indonesian 35GW Power Development Plan. However, there appears to be no alignment between PLN's 2060 net-zero target with the Ministry of Energy and Mineral Resources' (ESDM's) 2070 net-zero emission target.

Low carbon programs have been developed in SEA to decarbonize the region's energy use, to meet Paris Agreement commitments and to combat climate change. In addition to the domestic efforts, SEA nations also expect to receive more international financial and technological assistance that would expedite the region's energy transition process.

Learn more about our research and insight on the APAC energy market through our Asia Pacific Regional Integrated Service.

Cecillia Zheng is an associate director with the Climate and Sustainability team at IHS Markit.

Choon Gek Khoo is a Research Analyst with the Climate and Sustainability team at IHS Markit.

Posted on 06 August 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.