Southeast Asia on track for strong but uneven power demand growth amid unexpected supply bottlenecks

IHS Markit published Southeast Asia (SEA) power and renewable market briefing for the first quarter of 2022 (Q1-2022). As usual, it discussed power demand, supply and pricing, as well as major market events in the quarter. In addition, a new policy tracker section was introduced—climate actions by SEA nations, particularly nationally determined contributions (NDCs) and net-zero targets with their respective renewable energy and energy efficiency targets. The report is now accessible for customers via our Connect platform.

Power demand growth trend in Q1-2022

SEA experienced a severe contraction in 2020 because of lockdowns and border closures to control the spread of the COVID-19 pandemic, which halted economic activity and business in the region. Two years after the outbreak of the pandemic, SEA's power demand has begun to recover and, in some cases, has surpassed the pre-pandemic levels (2019). However, the extent of recovery remains uneven across all countries.

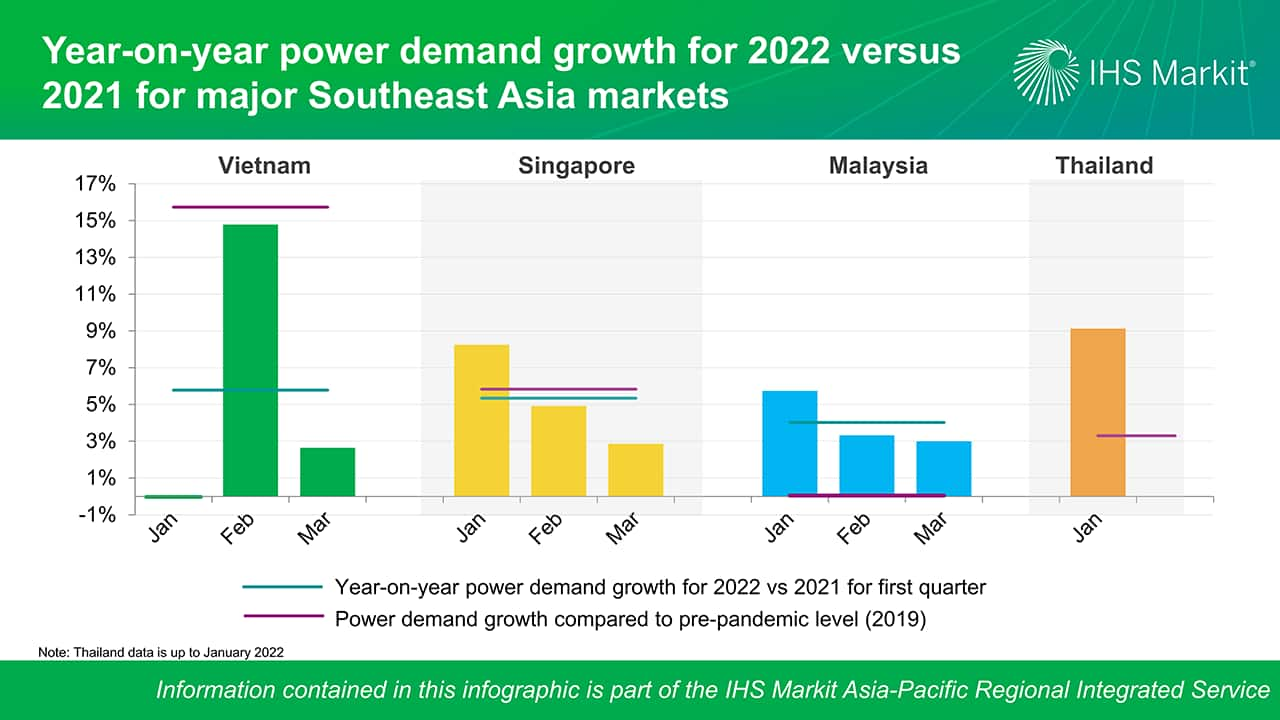

According to published power market statistics, the SEA power market enters Q1-2022 in a strong position, with the major SEA markets—Vietnam, Singapore, Malaysia, and Thailand—on track for strong growth in power demand. The monthly data for 2021-22 year-on-year (y/y) power demand growth rates reported in Q1 ranged from -0.1% y/y and 14.8% y/y (as shown in the figure below). However, the region has seen persistently high-power prices owing to high fuel prices, particularly in Singapore and Malaysia.

Vietnam has shown the fastest power demand growth, with the average power demand in Q1-2022 increasing by 5.8% compared to Q1 2021 and exceeding the pre-pandemic level (Q1 2019) by a whopping 15.8%. The striking growth in Vietnam's power demand is driven by the strong economic growth, and Vietnam was deemed to be the top-performing Asian economy in 2020—without a single quarter of economic contraction. Fluctuating power demand trend was observed in Q1-2022 as compared to the same period in 2021, owing to the difference in workdays amid Vet holidays between 2021 and 2022, combined with tightened fuel supply in 2022.

Singapore is on track for power demand recovery. The average power demand in Q1-2022 surpassed the pre-pandemic level (2019) by 5.8%. The power demand growth continued, backed up by the lower severity of the Omicron variant. Nonetheless, monthly demand growth in 2022 slowed down compared to 2021, owing to unplanned power outages and supply bottlenecks that persisted since the fourth quarter of 2021.

In Malaysia, the average power demand in Q1-2022 has finally returned to pre-pandemic levels (2019), with marginal increase of only 0.1%. The pandemic seemed to have sent Malaysia's economy into its worst ever recession in 2020. Fortunately, in Q1-2022, Malaysia's power demand returned to a positive rate, averaging 4% y/y compared to 2020, thanks to the gradual reopening of economic activities. Like Singapore, Malaysia also experienced unplanned power outages, which slightly slowed down the demand in February and March.

As for Thailand, based on its January data, the power demand has surpassed the pre-pandemic level (2019) with 3.3% growth. Furthermore, the reopening of business and international borders for tourism activity as early as January 2022 has significantly boosted power demand recovery, with a 9.1% y/y increase compared to 2021. The government's reinstatement of a quarantine waiver for international visitors, combined with high vaccination rates, has resulted in a faster recovery in demand.

Most of the SEA countries have now increased their vaccination coverage, prompting policymakers to be more willing to forego ordering massive lockdowns in favor of gentler pandemic containment measures. Hence, despite the continued disruption of power demand recovery caused by pandemic, the region's power demand growth is expected to continue.

Challenges of coal supply constraints

The power market demand has returned to pre-pandemic level (2019), despite of surging fuel prices and strained supply chains for coal and natural gas. The Indonesian government stunned the global energy market on 1st January 2022, by imposing a temporary one-month ban on coal exports, effective 1-31 January, which has amplified coal supply bottlenecks in SEA region during Q1-2022.

According to IHS Markit's electricity market analysis, historically, the Philippines, Malaysia, and Vietnam, combined purchased more than 30% of their annual coal supply from Indonesia. The coal export ban is most likely to raise the risk of a coal supply crunch in these countries. For instance, at the same time of Indonesia ban, Vietnam's two biggest coal miners Vinacomin and Dong Bac also strugged to have enough coal supply. As a result, Vietnam was hit by coal supply shortage and took 3 GW of coal plants to offline by the end of March 2022.

Lastly, the escalating coal price hike following global energy crisis has pushed up generation cost, and posed upward pressure on power tariff adjustments.

To learn more about Asia Pacific energy research, visit Asia Pacific Regional Integrated Service page.

Choon Gek Khoo is a Research Analyst with our Gas, Power, and Climate Solutions team.

Cecillia Zheng is an Associate Director with our Gas, Power, and Climate Solutions team.

Posted on 10 May 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.