Blog: Strong market growth for seed treatments and coatings boosted by biologicals

Seed treatments are chemicals and/or biological products that are applied to the seed to protect them from early season diseases and pests. The discovery and introduction of systemic fungicides and insecticides revolutionized the use of seed treatments, as they not only protect the germinating seeds, but also the young seedlings. These include the ground-breaking fungicide from Bayer, Baytan (triadimenol) introduced in 1979 and the neonicotinoid insecticide, Gaucho (imidacloprid) introduced in 1994.

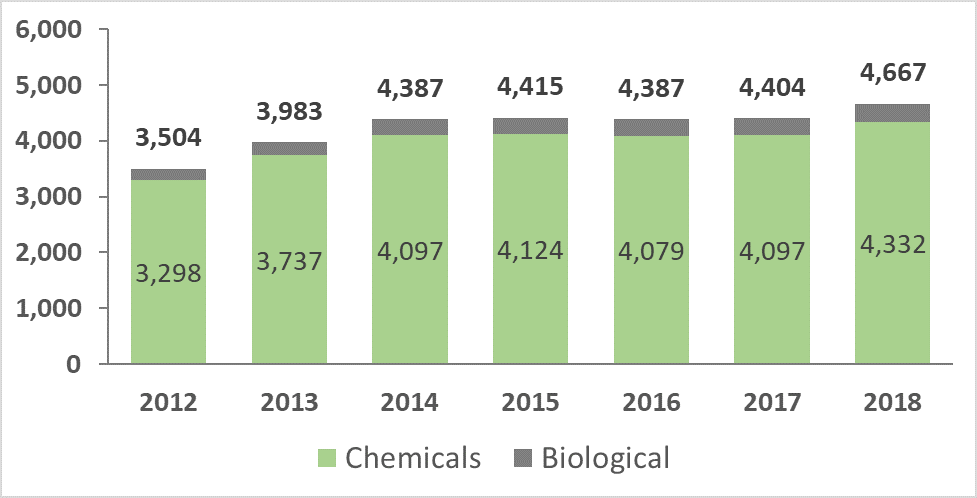

The total seed treatment market was valued at US$4.7 billion in 2018 and had a CAGR of 4.9% between 2012 and 2018. The seed treatment market is made up of chemicals and biologicals. The chemical segment dominates the market representing 93% of the total seed treatment market. However, the biological segment is the fastest growing with a CAGR of 8.4% between 2012 and 2018 (see Figure 1 below).

Technological advancements and increased understanding of plant physiological processes have played an important role in improving the efficacy and reliability of biological agents. Innovation in both chemicals and biologicals will continue to accelerate growth in the seed treatment market that is estimated to reach above $7 billion by 2025.

Figure 1: Seed Treatments Market Size - Sales US$

However, the regulatory environment is challenging and becoming more demanding, particularly in Europe which could constrain the market. In addition, a number of seed treatment active ingredients are off-patent and generic manufacturers have become key players in this market. Applying products to seeds rather than spraying them over the whole crop has numerous economic and environmental advantages. Many Biological Control Agents (BCAs) and biostimulants are particularly well-suited to being delivered this way.

The seed treatment market is dominated by Bayer and Syngenta who have a long history of developing seed treatment products. The recent consolidations in the agrochemical industry, ChemChina's acquisition of Syngenta, Bayer's acquisition of Monsanto and the formation of Corteva Agriscience (merger of Dow Agroscience, DuPont and Pioneer) have benefited other players seed treatment portfolios e.g. BASF and Nufarm.

In 2019, Bayer and Syngenta continued to dominate the market with a combined market share of 46%, with BASF holding a distinct third position with a market share of 15%. Other major players in the seed treatment market include Corteva, FMC, Nufarm, Sumitomo and UPL.

New special report

IHS Markit is pleased to announce the publication of a new edition of its Agrow Seed Treatments report. This is a complete update of a seed treatment study previously written in 2017. It provides a quantitative and qualitative assessment of the global seed treatment market, competitor landscape, products and industry developments, and focuses on seed treatments for key field crops. The 310-page report has 147 tables and 10 figures.

Chapter 1 provides an introduction into the seed treatment market, segments and developments. Chapter 2 outlines the market size and key segments. It discusses the key market drivers, constraints and key players in the industry.

Chapter 3 discusses the formulation, application process and equipment used for seed treatment, including seed coatings. This outlines the types of formulations used such as the evolution from powders towards flowable suspension concentrates and emulsions. It also provides insights into any other types of formulations such as microemulsion, capsule suspension and gels. It discusses application methods such as dressing, encrusting, pelleting and film coating. Much of the development has been in film coating and advanced polymer technology that is discussed. It looks at the future of these technologies and the main company activities in enhancing coating technology in controlling dust. The report also discusses new regulations regarding microplastics.

Chapter 4 provides an in-depth view of the eight major seed treatment companies. Each company profile provides key facts about the company, recent events, performance, product portfolio, research and development activities and strategy.

Chapter 5 profiles the active ingredients from the major seed treatment companies. It provides a summary of the active ingredient, its discovery and launch as a seed treatment, and outlines the regulatory status of the active ingredient in the key markets of the US and Europe. The products section provides a detailed view of all seed treatment products based on that active ingredient with approval dates, target crops and key development by regions: North America, Europe, Latin America and Asia.

For further information, please contact the publisher at alan.bullion@ihsmarkit.com

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.