The biocides market in the times of Coronavirus

The outbreak of COVID-19 significantly increased the demand for biocides such as sanitation and disinfection products for hands and surfaces. Some estimates anticipate demand increases as high as 600% for 2020. With the long-term prospects for coronavirus unclear, the biocide growth rate for the 2019 to 2025 period may be as much as 17% (CAGR). This demand is good news for major suppliers of hand and surface sanitizers, including 3M, Reckitt Benckiser, Gojo Industries, Henkel, Himalaya Global Holdings, Unilever, CVS Health, Ecolab, Procter & Gamble, and S.C. Johnson & Son.

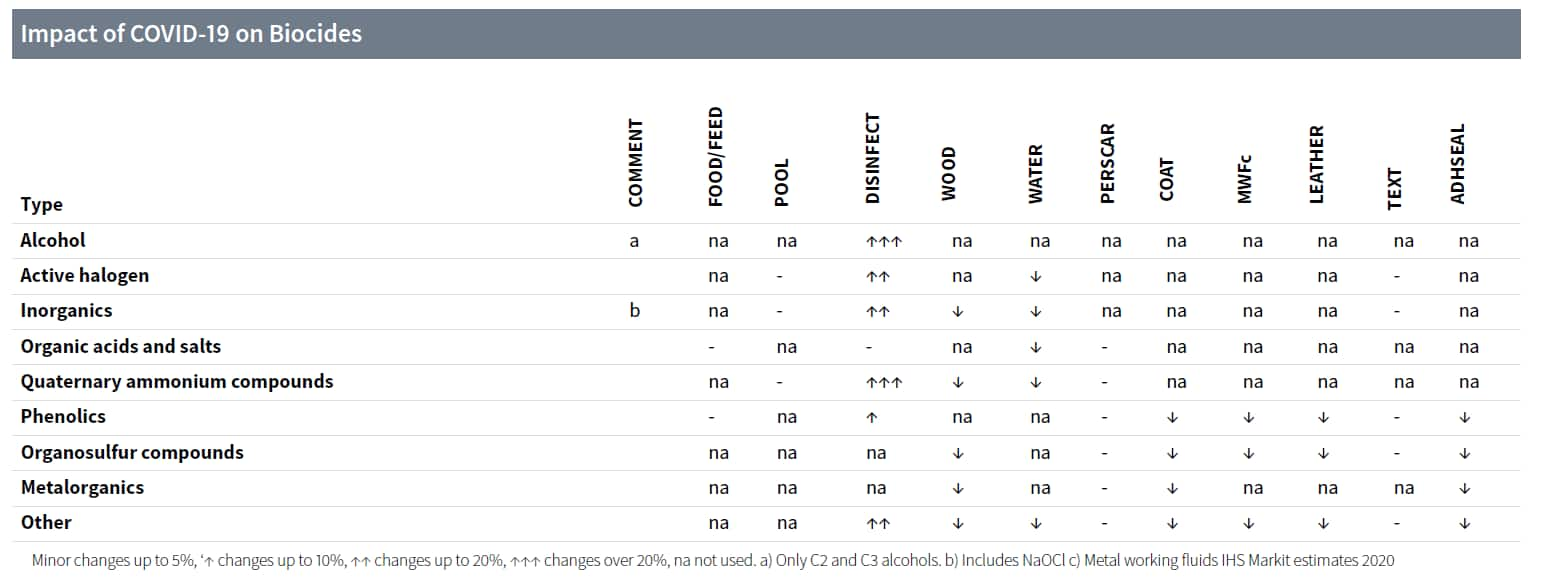

The biocides market is split into two categories: products needed to combat COVID-19 and products used in areas indirectly influenced by the outbreak. The impact of COVID-19 on these products varied widely (see Table).

Disinfecting hands

Hand disinfection is mostly achieved with alcohols. Frequently used are ethanol or isopropanol (alone or in combination). N-propanol is the fastest acting disinfectant alcohol, but it is used less often than ethanol or isopropanol.

In 2020, total global production and consumption of isopropanol is expected to be about 2.1 million tons, about 40 % were pharmaceutical, cosmetic and electronic grade in the major regions. The major producers of isopropanol are Shell, ExxonMobil, INEOS, Kellin Chemicals, Dow Chemical, and LG Chem. Together these firms supply about 50% to 55% of the global output. ExxonMobil increased its production of isopropanol by 3,000 tons per month in April 2020, boosting annual production by 10% at its Baton Rouge, Louisiana (USA) plant. In Germany, Oxea tripled its n-propanol output in the second quarter of 2020. Expanding the production of n-propanol freed large quantities of ethanol - that otherwise would have been used as solvent for the printing industry - for the manufacturing of hand sanitizer.

While n-propanol and isopropanol are produced by chemical synthesis, ethanol is largely produced by fermentation. Globally 85% of ethanol is used as a green fuel for combustion engines. Because the demand for transportation was reduced by the epidemic, manufacturers had enough capacity available to satisfy the demand for ethanol-based sanitizers. Ethanol producers in all regions donated large quantities of ethanol and in many cases produced disinfectant themselves.

As the demand for hand disinfectants boomed, products rapidly sold out - but this was not caused by a shortage in the alcohols themselves. Instead, a lack of containers, filling capacity, and logistics problems caused the stock-outs. To address this shortage, companies that produce or store larger quantities of alcohols started producing hand disinfectant for their regions. BASF began manufacturing disinfectants in Germany and luxury brands like LVMH stepped in to alleviate shortages in France.

Sanitizing surfaces

Surface cleaning is needed to sanitize items such as medical instruments, vehicles, rooms, buildings, or streets. Commonly used surface disinfectants include peroxides, halogen compounds, and quaternary ammonium compounds.

The type of biocide to be applied depends on how sensitive the surfaces are. Stables or vehicles can be disinfected with peracetic acid, while hospitals or other inhabited buildings are cleaned with hydrogen peroxide - often in combination with silver salts. About 6 million tons of hydrogen peroxide are consumed every year. All peroxide agents must be handled by professionals. Major global producers are Evonik Industries, Solvay, Kemira Oyj, Eka (Nouryon), and Mitsubishi Gas Chemical.

We estimate that 3% to 5% of the produced hydrogen peroxide is used as a sanitizer or for synthesis of peroxides used as sanitizers. Dow and Solvay donated 600 tons of hydrogen peroxide to the government of Thailand - enough to treat 300 million square meters of risk areas. Yet monthly global trade patterns of countries with substantial monthly imports or exports of hydrogen peroxide show no change as compared to the pre-COVID-19 period. Volumes used for disinfection are too small to impact the overall market. Any lag in hydrogen peroxide availability was more likely caused by production stops in the pulp and paper market, which affected packaging.

Another peroxide compound widely used in hospital disinfection is potassium peroxymonosulfate. Lanxess, one of the major producers of this product, expanded its production significantly and donated several tons of product to hospitals in China and Europe. Halogen compounds like sodium hypochlorite - commonly known as bleach - have long been used as sanitizers in the public and private space. Sodium hypochlorite is relatively cheap, effective, and easily available. Disadvantages are its smell and limited storage time. A huge number of small- and mid-sized producers are present in all regions. Sodium hypochlorite is sold as an aqueous solution with an average chlorine content of 4% to 6 %. Global consumption is about 2.2 million tons (chlorine equivalents), with households representing 35% of total use. About 50% of the consumption is in North America and Western Europe. A general drawback of halogen compounds and peroxides is their potential to corrode metallic surfaces.

Because global production capacity is about 50% higher than consumption, manufacturers had no problem satisfying additional demand generated by COVID-19. Producers and resellers of household bleach reported no supply shortages from hypochlorite producers. The empty supermarket bleach shelfs experienced as the virus started to spread were caused by bottlenecks in logistics, rather than product supply. Monthly trade patterns of countries with significant imports or exports of hypochlorite bleach show no deviation from normal quantities or prices through April and May of 2020. Interestingly, the actual production capacity for hypochlorite bleach is even higher than reported. Reported capacity refers only to marketable product and does not include the capacity that all chlor-alkali producers need to have installed to absorb chlorine gas in case of a technical issue. Quaternary ammonium compounds (quats) can kill many fungi, bacteria, and viruses. The antimicrobial properties of quats have been known for more than 100 years . Their chemical structure can be easily altered, making it possible to maximize their antimicrobial properties. Two types of quats prevail as disinfectants: alkyldimethylbenzylammonium chloride (ADBAC) and dialkyldimethylammonium chloride (DADM). The optimum chain length for ABBAC is in the C12 to C16 range, while DADM has an optimum between C8 and C10. The vast majority of commercial products are within these ranges.

Quats in general are surfactants. Their interaction with the surface of viruses can lead to destruction of the outer hull of the virus or it can form a micelle around the virus. In both cases, the virus is deactivated. Quats are very effective in concentrations as low 30 parts per million for enveloped viruses. They are popular as disinfectants because they are non-corrosive, have a good human toxicology profile, and combat a wide range of microorganisms. They are the preferred disinfectants in medical facilities. Globally about 130,000 tons of quats were consumed as disinfectants or preservatives in 2019. Major producers include Lonza Group, Nouryon, Stepan, and Thor Specialties.

In February 2020, quat producers were challenged by unprecedented demand for their products. At peak times, production capacities were at their limit. Many plants that produced intermediates for biocides were closed. In addition, a lack of available transportation hindered the delivery of both raw materials and finished products.

Achieving a new normal

Helping out with the production of formulated disinfectants on short notice was the best contribution the chemical industry could make to the world's battle with COVID-19. It seems unlikely, however, that this short-lived business will make up for the losses the industry suffered as a result of the coronavirus-driven economic downturn. Assuming that there is no second wave of COVID-19, we expect sales in the biocide market to reach their 2019 levels again in the second half of 2021. Industry sources anticipate that the biocides used in disinfection will normalize at a level about 5% to 15% above the pre-coronavirus consumption.

For more information on how COVID-19 is impacting the specialty chemicals market take a look at: