Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 30, 2024

The Eastern region of the North Slope - The next front in Alaskan exploration?

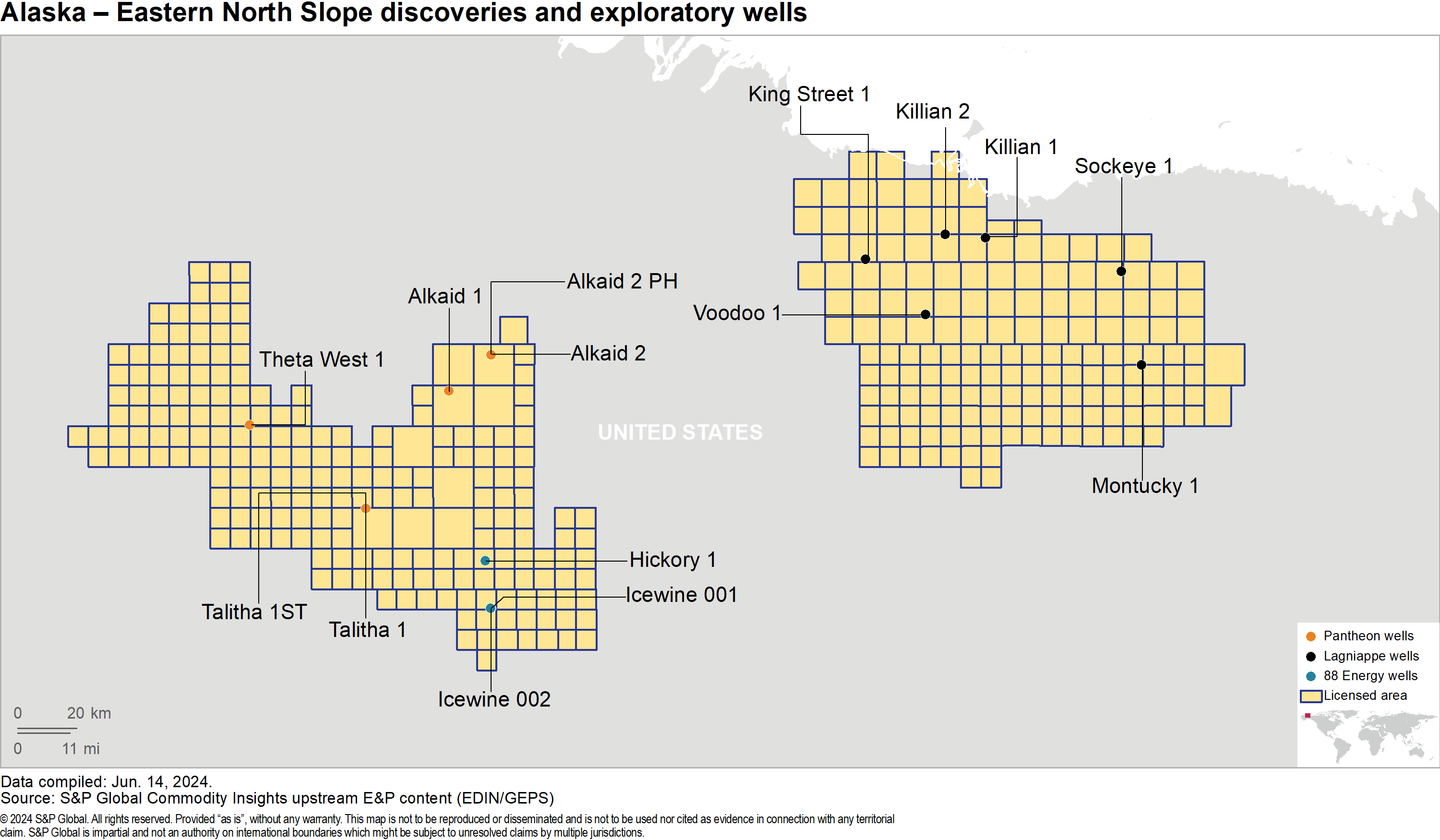

In April 2024, Lagniappe Alaska LLC announced the discovery of hydrocarbons at the King Street 1 new-field wildcat (NFW) in the eastern region of the North Slope Basin in Alaska. Due to the depositional units' complexity, the formation has yet to be reported — but the reservoir is estimated to be sandstone reservoirs of the Brookian Sequence of similar characteristics to the Nanushuk Formation although younger in age. The two NFWs that were spudded with King Street 1, Sockeye 1 and Voodoo 1, have been temporarily suspended but will restart drilling operations in the next drilling season. Additionally, the operator has another three NFWs (Killian 1, Killian 2 and Montucky 1) planned for drilling within the eastern area of the North Slope Basin. The King Street 1 discovery is the fourth in a series of recent discoveries made in the eastern region (Figure 1), that have garnered attention as a new front in the North Slope's already significant place in oil and gas. The other discoveries include Pantheon Resources' Kodiak (formerly Theta West) and Ahpun (formerly Talitha and Alkaid) as well as 88 Energy's Hickory.

The Kodiak discovery was originally named Theta West after the Theta West 1 NFW, which encountered light oil in a basin floor fan depositional sequence that has been interpreted as part of the Cretaceous-aged Seabee Formation. This reservoir was also found in the Talitha 1 NFW, although at greater depths and lower permeability and porosity. The Talitha 1 NFW, along with the Alkaid 1 NFW, formed the basis for the Ahpun discovery located east to Kodiak. The Alkaid 1 NFW confirmed the presence of oil in a depositional sequence called the Shelf Margin Deltaic (SMD) that has been further delineated into three units (SMD-A, SMD-B and SMD-C) and correlated to the Late Cretaceous-aged Schrader Bluff Formation. The Talitha 1 NFW confirmed the extent of the SMD units but, notably, discovered oil bearing reservoirs in the Slope Fan System (SFS), which has been correlated to the Cretaceous-aged Canning Formation. Additionally, the Talitha 1 NFW encountered hydrocarbons in the Late Cretaceous-aged Kuparuk Formation that has been a historically prolific reservoir in the region.

The Hickory discovery, named after the Hickory 1 NFW, proved the southward continuity of the SMD, SFS and BFF reservoirs encountered by Pantheon Resources as well as the non-commercial hydrocarbon shows from the Icewine 1 NFW within the acreage. However, the net pays of these reservoirs are more favorable compared to Icewine 1 NFW with greater thickness as they increased with depth. With promising results from flow tests out of the SMD-B and Upper SFS reservoir pay zones combined with their location to production infrastructure such as the Trans-Alaska Pipeline System, the changes of development in the region appear promising.

With further exploration drilling planned to de-risk the area, and additional testing of under appraised reservoirs such as the BFF and Kuparuk River Formation, the eastern portion of the North Slope will become a significant factor in the state's oil and gas industry.

The untapped hydrocarbon potential across these leases has been conservatively estimated at over 1,200 million barrels of oil equivalent in 2P resources. However, further exploration and analysis are likely to reveal even greater opportunities, significantly increasing these estimates. The recent discoveries of multiple hydrocarbon reservoirs in fields such as Hickory, Kodiak and Ahpun serve as compelling evidence of the vast, unexploited resources in the eastern region of the North Slope. This region's potential could fundamentally transform industry perceptions, positioning the North Slope as a more attractive and enduring investment opportunity than ever before.

Figure 1: Map of discovery wells organized by operator with associated contract acreage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-eastern-region-of-the-north-slope-the-next-front-in-alaska.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-eastern-region-of-the-north-slope-the-next-front-in-alaska.html&text=The+Eastern+region+of+the+North+Slope+-+The+next+front+in+Alaskan+exploration%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-eastern-region-of-the-north-slope-the-next-front-in-alaska.html","enabled":true},{"name":"email","url":"?subject=The Eastern region of the North Slope - The next front in Alaskan exploration? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-eastern-region-of-the-north-slope-the-next-front-in-alaska.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Eastern+region+of+the+North+Slope+-+The+next+front+in+Alaskan+exploration%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-eastern-region-of-the-north-slope-the-next-front-in-alaska.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}