IRA Bill: Ground set for clean energy technology deployment acceleration in the United States

The Inflation Reduction Act (IRA) is a reconciliation bill that unlocks $370 billion in climate and energy investment in the United States, supporting a diversity of technologies and solutions. It was signed by President Joe Biden on 16 August 2022 and will now become law.

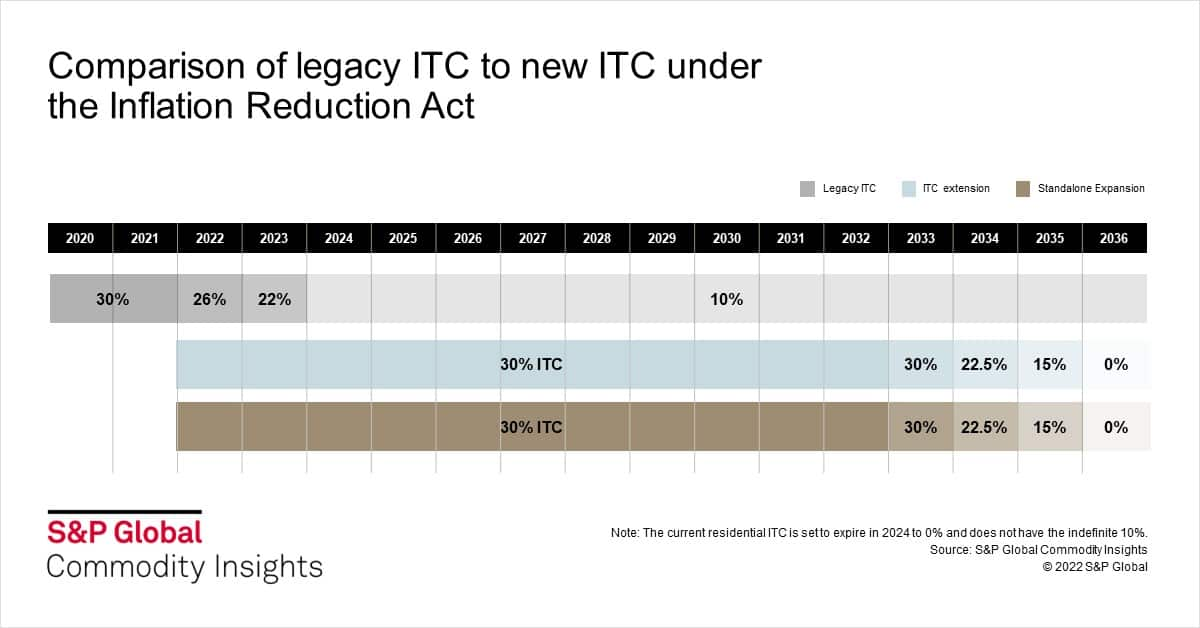

Two major components of the bill are the technology-neutral extensions of the Investment Tax Credit (ITC), which now includes standalone storage for the first time, and the solar Production Tax Credit (PTC), which hasn't been available for solar photovoltaic (PV) projects since 2006. The current ITC was scheduled to expire in 2024, but the IRA will keep both the ITC and PTC at full credit values until 2033 at the earliest. Notably, if the United States has not reduced its emissions by 75% from 2022 levels in 2032, the ITC and PTC will remain at the full credit value until the emissions goal is met.

The IRA dramatically improves PV project economics across all segments, triggering a major upward review of the installation outlook. The utility-scale sector will experience the biggest boost. Previously, the market was expected to record a sharp slowdown following the expiry of the ITC, but the ITC extension and PTC renewal will lead to many new projects and robust additions throughout the second half of the decade.

For energy storage, the game changer is the inclusion of standalone energy storage in the ITC. This will reshape the energy storage market overnight as a litany of projects in new markets will become viable that were not beforehand. The extension of the credits to 2030 or beyond instils confidence in investors and developers to continue building throughout the decade.

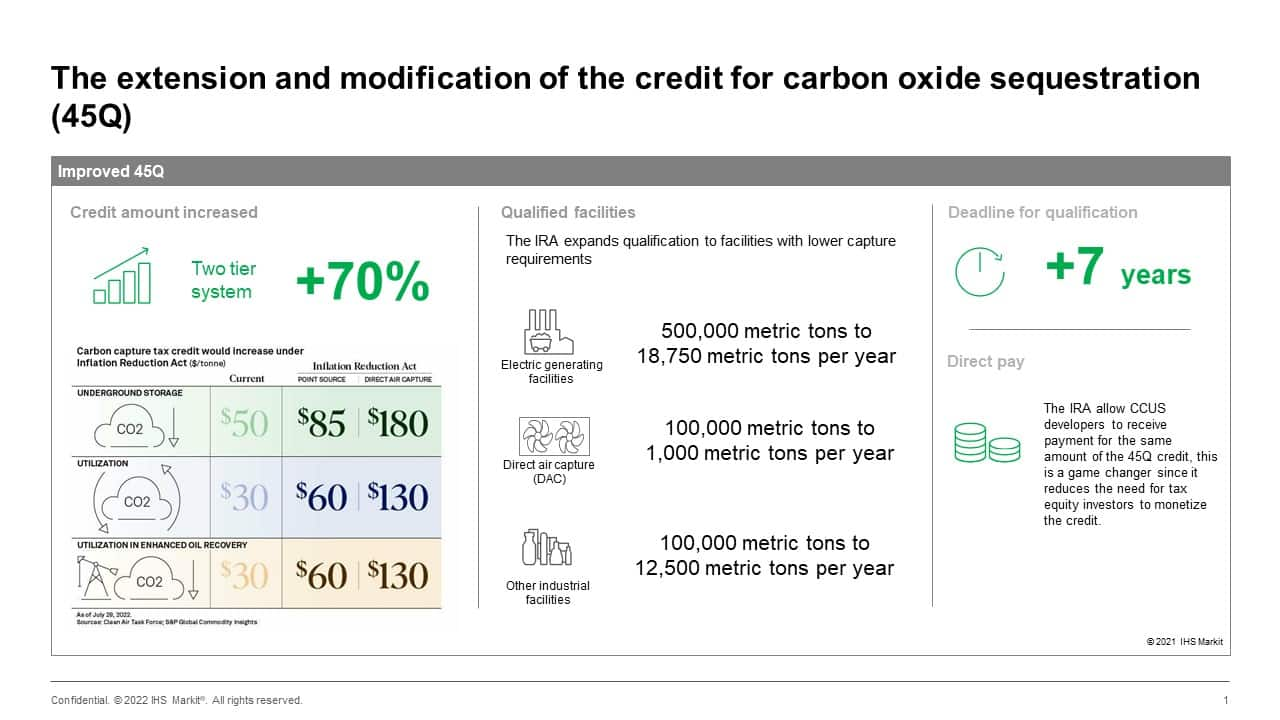

The IRA bill is also a historical win for emerging technologieslike carbon capture, utilization, and storage (CCUS) and hydrogen that will see a significant improvement of economic conditions.

The IRA dramatically improves CCUS project economics across various industries, reducing uncertainty around projects pre-2030. Current credit amount could decrease the cost of CO2 capture by more than 60% for most projects currently in the pipeline.

The IRA impacts the eligibility of the CCUS projects by reducing the capture capacity requirements from the hundreds to the thousand metric tons of CO2 captured and extending the construction deadline by seven years. The changes in facility eligibility will play a significant role for small-scale projects, likely incentivizing projects across new industries, the modular construction of smaller capture units, and more pilot projects.

The IRA will provide hydrogen production with CCUS projects with the option to choose between two different tax credits, giving flexibility to one of the sectors leading the CCUS pipeline of projects.

The IRA will not only change the demand landscape but, in a widely anticipated move to localize supply chains, the bill also provides long-awaited incentives to develop local manufacturing fordiverse clean energy technologiess, in an effort to boost energy security, create local jobs, and reduce supply chain bottlenecks. However, it will take several years for enough local capacity to be built to ease current supply constraints.

You can learn more about the major policies to be introduced by the IRA and main bill provisions impacting the renewables, energy storage, and carbon sequestration industries by attending our upcoming webinar: The IRA supercharges the clean energy industry in the United States - Implications on renewables, battery energy storage, and carbon sequestration outlooks. Click here to register.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.