The Israeli-Lebanese Border Agreement: A Legal Analysis

Introduction

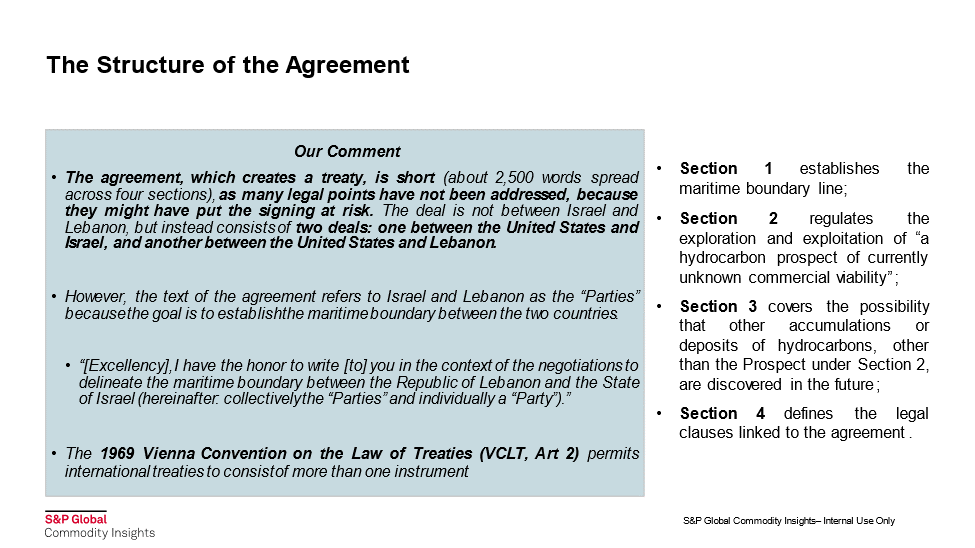

On October 27, 2022, after years of difficult negotiations, Israel and Lebanon established their mutual maritime border (and their Exclusive Economic Zones (EEZs)) except for the first 5 kilometres from the coastline. The purpose of the maritime border agreement is to move ahead with petroleum exploration and production close to and on the maritime border. The agreement between the two adjacent countries, which are still technically in a state of war, was brokered by the United States.

The agreement concerns only the maritime border out from Israel's buoy-marked system, which finishes 5 kilometres (3.1 miles) off the coast of the Israeli city of Rosh Hanikra. The maritime border apparently "mostly" follows what was known as Line 23. The onshore border is not covered by the agreement. For decades, the area around the border onshore has seen confrontations between the Israeli army and Hezbollah, a Lebanese political party and militia.

This analysis examines the clauses of the US-brokered agreement from a legal point of view, as this exercise might be useful to prospective and current investors.

Section I—The Maritime Boundary Line

The decision to opt for a maritime border "mostly" following Line 23, which was the line registered by Lebanon with the United Nations (UN), appears to be a solution aimed at avoiding both Israel's and Lebanon's maximalist positions.

The agreement maintains the status quo of the unresolved land boundary between the two countries and of the near-shore maritime boundary, the latter defined by the current buoy line, which was unilaterally demarcated by Israel in 2000 by positioning the buoys 5 kilometres (3.1 miles) off the coast of the Israeli city of Rosh Hanikra. Despite the presence of the buoy line, Israel and Lebanon do not agree on its positioning.

Section II—The Discovered Prospect

The two countries have established that exploration and exploitation of the Qana Prospect, which straddles the maritime border, will be carried out by the operator of Lebanon's Block 9. This operator will be authorized to transit through some areas south of the maritime boundary line (MBL) in order to carry out petroleum operations in the Qana Prospect, as long as it has previously notified Israel.

The agreement only establishes that Israel's economic rights concerning the Qana Prospect are still to be determined and that Block 9 operator will reimburse Israel for its rights to deposits in the prospect. Specifically, Israel and Block 9 operator will sign a financial agreement before the operator takes its final investment decision (FID).

The agreement points out that the legal entity carrying out petroleum operations in Block 9 must be one or more reputable international oil companies (IOCs, and their successors), which is/are not under international sanctions, not hindering the US facilitation between the two countries, and not either Israeli or Lebanese.

Section III—Other Possible Accumulations or Deposits

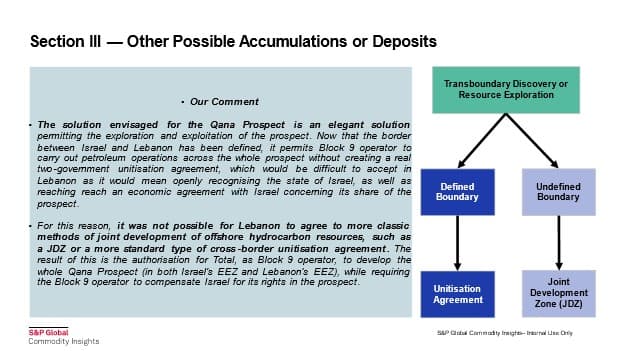

If other accumulations or deposits of natural resources (petroleum or minerals) other than the Qana Prospect are found to straddle the MBL, and if either Israel or Lebanon, by exploiting the related reserves, would encroach upon the other country's rights, the Parties may wish (though, there is no obligation) to request the United States to facilitate dialogue on the exploitation of these reserves between Israel and Lebanon (including the operators). The goal would, again, probably be to find an understanding for allocating the rights to the reserves.

However, the agreement establishes that if there are other possible accumulations or deposits of natural resources straddling the maritime border, the United States will again have to act as facilitator between the two countries, as they do not have diplomatic relationships. Specifically, it seems burdensome to always replicate the architecture envisaged for the Qana Prospect—i.e., through the United States acting as a facilitator, permitting the operator on one side of the cross-border reservoir to carry out petroleum (or mineral) operations on the whole reservoir and having this operator reach an economic agreement with the government of the other side of the cross-border reservoir—for each other future accumulation or deposit straddling the maritime border (in addition to the Qana Prospect).

Section IV—The Agreement's Legal Clauses

Given the limited details provided in the agreement, it is quite possible that in the future there might be some issues concerning both the interpretation and the implementation of the agreement (for example, how to quickly organize a response to an environmental problem between two countries not having mutual diplomatic relationships).

The agreement only states that the United States will act as a facilitator for the resolution of differences between Israel and Lebanon. In other words, there is no mechanism to arrive at a binding solution, possibly in a commercially acceptable timeframe. So, the risk of an impasse is quite high.

Conclusion

This agreement is, first of all, an economic agreement for moving ahead with the exploration for and exploitation of hydrocarbons on both sides of the maritime border—Lebanon is facing an economic crisis, and Israel wants to export more natural gas. It is now the right time for Israel and Lebanon to try to monetize the oil and gas reserves that they might have in their respective EEZs. As we have pointed out, the agreement (effectively two agreements) is quite basic, and various legal issues might emerge in the future. In our opinion, it is likely that the United States might be forced to play a role larger than just that of facilitator. The result of this agreement is the grant to Block 9 operator of the authorization to develop the whole Qana Prospect (in both Israel's and Lebanon's EEZs) while requiring Block 9 operator to compensate Israel for its rights in the Qana Prospect (those on the Israeli side). Replicating this scheme for all future accumulations and/or deposits straddling the maritime border seems like it may be a byzantine task.

This article is an excerpt from the longer, more detailed legal insight "A Legal Analysis of the Israeli-Lebanese Border Agreement for Petroleum Investors" which was published on December 16, 2022, and it is available only to our subscribers.

***

Want to learn more on this topic and access similar

reports? Try free access to the

Upstream Demo Hub to explore selected energy research,

analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.