The latest survey of the proppant market shows that price and logistics continue to matter most to buyers

IHS Markit recently published the results of our latest survey of the proppant industry. The annual survey was sent to roughly 600 professionals with an association to the proppant market and realized a response rate of roughly 7%, which we feel is favorable compared with typical response rates for this type of survey. Furthermore, we received responses from a cross-section of professionals including proppant providers and operators, providing us with a data set that captures a full industry perspective.

As with last year's edition, this year's ProppantIQ survey was an insightful look into the current mood of the proppant market. Unfortunately, the continuing themes from last year continue to underpin the industry: the situation is dire for proppant miners due to very high oversupply.

While this oversupplied environment may seem to be favorable for operators purchasing proppant, a few comments from market participants throughout the value-chain clearly indicated recognition that this situation is neither sustainable nor healthy: efficiency comes from long-term working relationships between buyers and suppliers, of which cannot be formed if the latter are constantly on the edge of financial disaster.

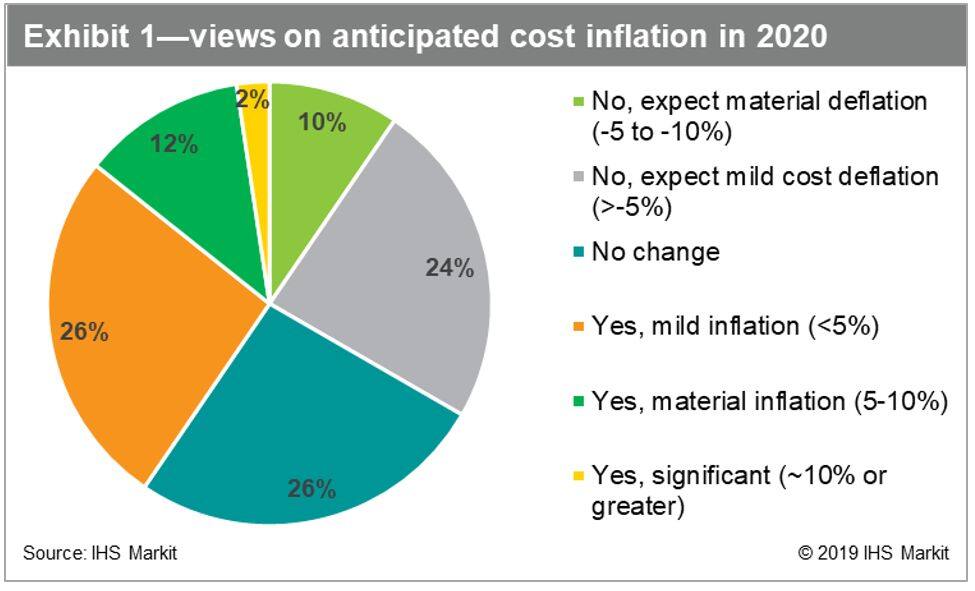

Figure 1: Exhibit 1 - Views on anticipated cost inflation in

2020

Nevertheless, money talks and for both proppant and "last-mile" solutions, pricing remains the most important factor influencing vendor selection. Exhibit 1 portrays the survey respondent's view regarding anticipated inflation. Although the clear majority shows favor for 'no change OR deflation' (60/40 split), our team was expecting an even greater sentiment favoring expected cost deflation.

Along those lines, another continuing theme from the 2018 survey was the increasing dominance of regional sand vs. Northern White Sand (NWS): the jury may still be out with arguable opinions on whether the latter leads to meaningful, long-term well performance on a relative, regional basis; yet it's clear that the immediate, lower cost of regional sand is winning operators over regardless.

Logistics continue to be top-of-mind for survey participants, and constraints around trucking have been particularly challenging. Interestingly, "infrastructure and traffic" was selected as the second most pressing constraint for the first nine months of 2019, indicating that there is only so much private service companies can do before running into tangible structural constraints.

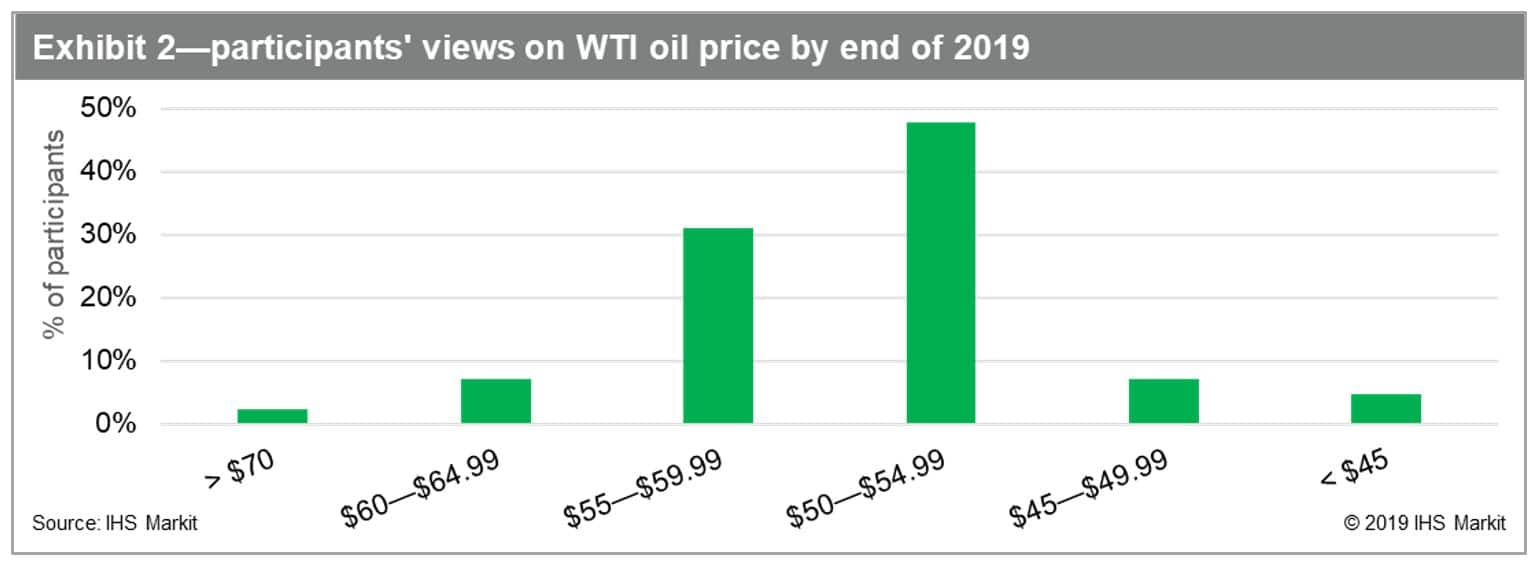

Despite the tepid outlook of the proppant market, there were some bright spots: participants for the most part believe WTI price will remain relatively flat near mid to peak 2019 levels, as seen in Exhibit 2; as well, a majority of respondents expect a range of technology adoptions in the first 6 months of the new year.

Figure 2: Exhibit 2 - Participants' views on WTI oil price by

end of 2019

We provide the results of each year's survey to subscribers of the IHS Markit Onshore Services & Materials subscription (which includes ProppantIQ), and participants in the survey itself. Learn more about our ProppantIQ services.

Brandon Savisky is a Principal Research Analyst at IHS Markit.

Posted 11 December 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.