Shut-ins: a game changer for the water management market

<span/>It's been a few months since the collapse of the Vienna Alliance talks and the full, global extent of coronavirus (COVID-19) started to become apparent. While oil prices have improved somewhat and some optimism has emerged since then, it's clear that the damage wrought during that short stretch of time will be severe and long-lasting.

<span/>This is certainly true in US upstream activity, which will of course subsequently affect the water market. Our research suggests that US land drilling & completions (D&C) water demand will decrease 48% during 2020 as a result of the capital spending reductions leading to drastic reductions in D&C activity levels. However, with a rebound in activity expected in 2022, the overall D&C water market will in fact grow at a 7% compound annual growth rate from 2020 to 2024.

The Permian activity reduction will significantly affect its market share in terms of drilling water demand. This basin accounted for 41% of total US drilling water requirements in 2019, but during 2020 it is expected to account only for 28%. The Permian Basin and Mid-Continent will be the main drivers for the frac water demand reduction, accounting for 56% of the volume reduction in 2020.

Relative to drilling and frac water, produced water always dominates the total water volumes so it's constantly an area of great interest for our clients. Looking ahead, we anticipate that interest will be amplified this quarter by one very significant twist in the narrative: shut-ins.

While oil prices have recovered since they turned negative at the end of last month, "recovered" is a relative term and clearly few operators will be making much - if any - money at sub-$35/bbl levels of WTI. This has prompted a rush to shut-in wells without a full understanding of exactly what the ramifications will be: there is plenty of literature and historical guidance with regards to shutting in conventional wells, but this course of action for unconventional wells, on such a scale, is unprecedented.

Looking beyond the immediate technical considerations (still being debated) required to select optimal shut-in candidates, there seems to be a consensus that there will be two effects related to water: an initial decline in produced water at the surface due to flow stoppage, and a significant downhole accumulation of produced water that will then need to be removed from shut-in wells if and when they are brought back online.

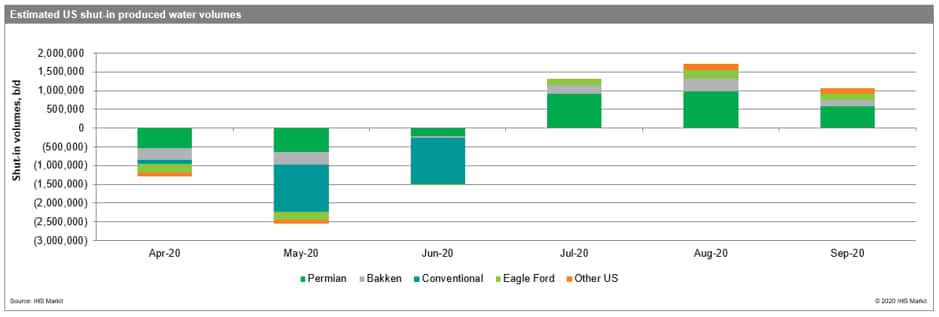

We estimate that flowback and produced water volumes in the US will decrease 13% in 2020, followed by a decline of 16% in 2021 mainly driven by conventional fields. As low oil prices persist, we expect shut-in produced water volumes to exceed 5.3 MMb/d, and in that calculation we presume that conventional well volumes will not return fully (figure 1).

Figure 1: Estimated US shut-in produced water volumes

For companies with Permian operations, the timing of these shut-ins will be critical. We estimate that most of the shut-ins will be restarted during the second half of the year, meaning that produced water volumes could see an increase exacerbated by relatively higher water-to-oil ratios expected from these wells. However, if operators delay the re-starting process, the Permian will be poised to experience even further declines in produced water volumes during 2020.

We provide full details on the upstream water market in our WaterIQ report which is open to clients of IHS Markit's Onshore Services & Materials subscription. Learn more about our WaterIQ service.

Paola Perez-Peña is a Principal Research Analyst at IHS Markit.

Posted 03 June 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.