The rise of biological products in the crop protection and plant nutrition markets

The markets for crop protection (CP) products (such as herbicides, insecticides and fungicides) and fertilizers (including nitrogen, phosphorus pentoxide, and water-soluble potash) are generally considered to be mature. In most significant agricultural economies,these markets show single-digit growth at best.

Within these markets, however, are two faster-growing sectors: those based on naturally-derived products. Biological control agents (BCAs) and biostimulants are growing at over 10% a year, according to some estimates. BCAs include products such as plant extracts (for control of pests and diseases), insect pheromones (used primarily for mating disruption), predatory insects, and microbial products (often the output of fermentation processes).

BCAs also address biotic stresses on crops, such as pests, diseases, and weeds. Biostimulants include amino acids, seaweed-based products, and humic and fulvic acids. These products trigger the processes that enhance nutrient use, increase tolerance to abiotic stress such drought and temperature extremes, enhance availability of confined nutrients in soil, and address quality traits beyond the effects of mineral nutrients.

The distinction between BCAs and biostimulants is not always clear. Specific products can exhibit the properties of both categories, as with some plant oils. For regulatory purposes, classification depends on which properties companies claim.

Both markets are still relatively niche, with USD $2 to $3 billion in 2018 sales at the ex-manufacturer level. With hundreds of products, these markets are also complex and fragmented. In comparison, the total CP market is valued at $57 billion and the total chemical fertilizer market has a value of over $100 billion for primary nutrients.

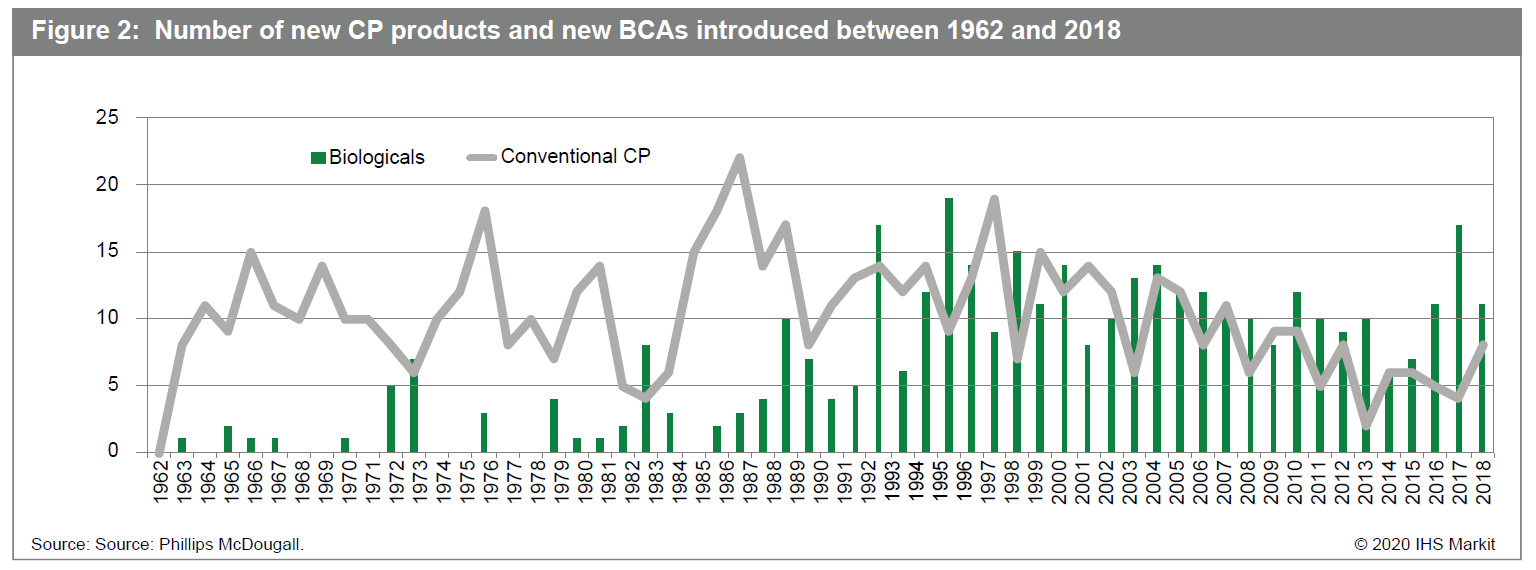

BCAs and biostimulants are not new. In the BCA category, commercial bacillus thuringiensis (Bt)-based products have been around since the 1960s and pheromones were introduced in the 1970s. Only recently, however, has their popularity increased.

Demand drivers

There are common reasons for the growth of these two sectors in the last decade, but there also some significant differences. Among the common reasons:

- The continuing push for more sustainable agriculture. Natural products are perceived to be safer, although this is not always true.

- The growth of organic agriculture. This market favors the use of naturally-derived products and strongly restricts (or even prohibits) most synthetic CP products and chemical fertilizers.

- The relative ease of registration in some regimes. For example, the US has simplified and fast-tracked the process to register BCAs accompanied with conventional CP, although this is not yet the case in Europe. With biostimulants, Europe offers the most favorable regulatory environment. Biostimulants are regulated under the fertilizer legislation, which is much less onerous than that for CP.

- The attractiveness of these fast-growing sectors to CP and fertilizer companies. All major and many minor CP companies have significant BCA programs. In the fertilizer sector, Yara has invested significantly in biostimulants. Both sectors have also attracted hundreds of millions of USD in venture capital investment. This is part of a wider boom in agricultural technology.

- Advances in technology. These advances, particularly in formulation technology, can address stability and shelf life challenges common to complex biological molecules.

- The rapid growth of the seed-treatment sector. Applying products to seed rather than spraying them over the whole crop has numerous economic and environmental advantages. Many BCAs and biostimulants are particularly well-suited to being delivered this way.

BCAs are influenced by several additional drivers.

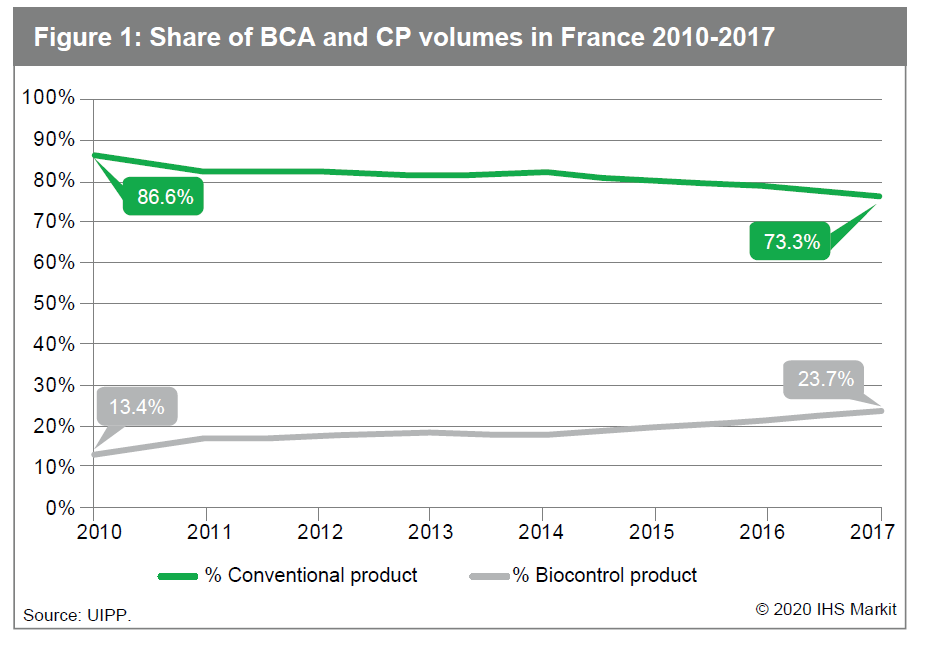

- Increasing regulatory pressure on conventional CP products. This is especially true for conventional CP products in Europe, where over half of the products that existed in the 1990s have now been withdrawn. This creates gaps in the market, which biological control agents can only partially fill. In a strong scenario, the EU could lose many more CP products in the coming years, adding to farmers' pressure to protect their yields. While the industry does have a healthy pipeline, the rate of innovation has been declining and is not yet sufficient to fill all the gaps. In addition to EU-wide regulation, some countries are imposing their own pressures on conventional CP products. In France, for example, the government has a target of reducing CP usage by 50% by 2025 and encouraging the use of BCAs. This reinforces an ongoing trend (see Figure 1).

- Low crop residues. BCAs often leave less residue in crops and thus can be used right up until harvest, unlike many synthetic products. This makes BCAs particularly attractive for food retailers. Resistance management.

- Resistance to conventional CP products has always been a problem. By offering new modes of action, biological products can be used as part of resistance management programs. As a result of these drivers, more BCAs have been introduced into the market than conventional products over the last five decades (see Figure 2).

Future challenges and opportunities

Despite their favorable characteristics, BCAs cannot completely replace conventional CPs. By their nature they are often pest- or disease-specific and cannot be used to control the broad spectrum of pests that attack most crops. Additionally, once a pest is controlled, new pests inevitably occupy the ecological gap. BCAs must be used in combination with conventional products as part of integrated pest management programs.

In some cases, the efficacy of BCAs might be inferior to the synthetic products they are substituting, but farmers have no alternative. Also, not everyone is convinced of the value of both BCAs and biostimulants. In some quarters, they are still considered to be not much more than deceptive marketing; in others, this description in considered outmoded and unfair.

There are also cost challenges. Some BCA products present considerable manufacturing challenges. Fermentation products and pheromones, for example, can be extremely expensive to manufacture, reducing the economic incentive for buyers to replace conventional products. Several companies are working on ways to reduce their production costs.

Because of the lower barriers to entry and market attractiveness, hundreds of companies are involved in both the BCA and biostimulants sectors - including all of the major CP companies as well as many mid-tier companies. With all of the venture capital money flowing into the sector, there are also numerous start-ups - small enterprises challenged to have enough resources to register and develop products and gain market access.

It is likely that the current high level of interest and investment in the BCA and biostimulant sectors will continue over the next few years. Because of their limitations and complexities, however, both product groups are likely to remain niche sectors - albeit large niches - that will not seriously challenge the mainstream products but rather continue to be used alongside them.

Crop Science Market Insights and Forecasting Market consolidation, increasing regulation and sustainability are creating significant change for crop protection and seed companies. Shape your commercial strategy using our proprietary data, in-depth market analysis and long-term forecasts.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.