The turbulent journey of the offshore supply vessel market

Looking back at the past five years in the oil and gas market and subsequently the offshore supply vessel (OSV) market, there have been distinct periods that have resulted in major shifts. 2017 to 2019 saw the industry climb out of the oil price crash that occurred in 2014. From late 2019 to 2021 the world battled coronavirus disease 2019 (COVID-19), which brought a number of variants and waves, leaving the OSV market uncertain when or if it will see a recovery. Vaccination programmes being rolled out globally, among other mitigation measures put in place, have allowed for the resumption of economic activity. Improvement in oil and gas activity enabled oil and gas prices to increase. As a result, it has created a positive motivation for the recovery of the OSV industry moving into 2022. Using data and information from IHS Markit products MarineBase, Global Supply Vessel Forecast, and Offshore Marine Monthly, along with regional expertise from our team of OSV market analysts, this blog aims to look at the challenging nature of the OSV sector in recent years.

Globally, the market began seeing notions of recovery in early 2017 after experiencing 10 quarters of sliding demand and plummeting utilisation. Some of the long-standing challenges that the OSV market faced even before the 2014 price crash included large fleet sizes and the ordering and building of vessels outweighing the projected demand. The market saw newbuilds enter at a slower pace, although this only delayed the inevitable continuous fleet growth. Scrapping levels remained low with the preferred option being to stack the vessels. Duration of contracts shortened considerably along with the spot market becoming popular. Even when the industry began seeing a rise, drilling campaigns, construction projects, and longer-term chartering requirements were kept tight and controlled in a very cautious manner. Globally, recovery was not consistent. By the end of 2019, regions with the most optimistic projections were Northwest Europe, the Middle East, and Asia Pacific. Others remained relatively flat with oversupply being one of the prime reasons.

The market then faced another catastrophe; the COVID-19 pandemic. As the entire world struggled to cope with the effects of the pandemic, lockdowns and restrictions were implemented resulting in vast economic repercussions. Oil demand weakened resulting in projects being suspended, delayed, or cancelled among other consequences. All progress made since the previous downturn was lost. West Africa and the US Gulf of Mexico experienced the greatest drop in term activity of almost 40% year on year, with other regions not being saved from sharp demand cuts. Towards late 2020 and into 2021, demand had picked up with the cautious hope for a recovery. Drilling campaigns and field developments resumed in 2021 resulting in a demand uptick for OSVs. Yet again the positive sentiment was not a blanket one as North America, West Africa, and the Mediterranean continued a relatively flat forecast.

Vaccination programmes have been somewhat of a relief to the global economy allowing for the ease of restrictions and resumption of activity. As a result, demand for oil and gas increased causing prices to strengthen. The first half of 2021 saw the demand for OSVs climb steeply leaving the last two quarters to gradually flatten out. Oversupply remains a dark cloud along with weak day rates, both in turn providing a challenging picture against the hopeful optimism for the OSV industry in 2022.

Region analysis

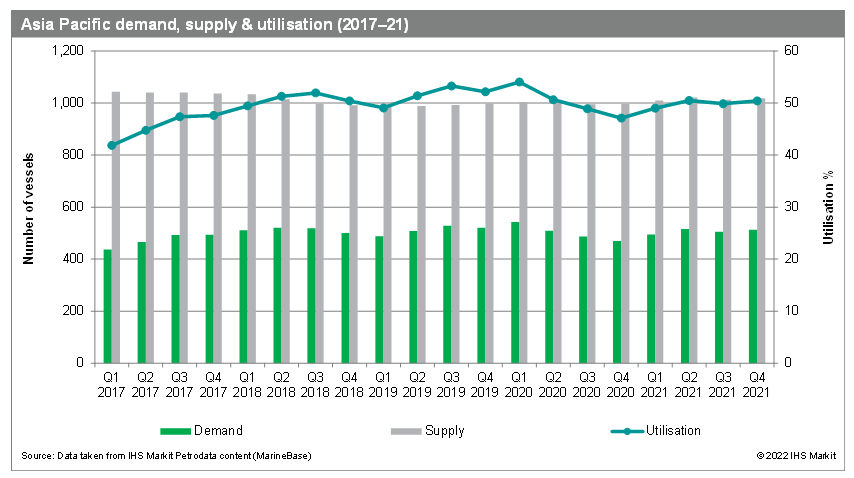

Asia Pacific (Including India, Australia and Far East)

Project delays and cancellations had become the norm, with vessel owners having to react to low oil prices in 2017 and 2018. In 2017 rig utilisation was at 60% which further emphasised the challenges faced by the repercussions of the languishing oil prices. Day rates remained low overall, even with increasing demand. Oversupply played a large factor in holding back the recovery of the industry. Attrition levels lingered at low rates which in turn lowered hopes for oversupply balancing out. India saw the main demand driver, ONGC, offer multi-year contracts which enabled the country to recover at a relatively stable rate.

The Asia Pacific region carried oversupply and a lack of older vessel removals into 2019. Drilling and field development activities by state-owned companies across the region continued to drive the demand for OSVs, especially for countries like Malaysia, Indonesia, and India; this being with the effects of the pandemic not fully experienced as yet. Indonesia saw a high supply of vessels leading to a very competitive market, resulting in exceptionally low day rates remaining longer than expected. Australia saw big players such as Santos, Cooper Energy, and Inpex contribute to OSV demand as their projects created a hopeful future.

The effects of COVID-19 were truly felt well into 2020 both in Australia and across the region. Major projects were cancelled or deferred with companies reducing their workforce as energy demand nosedived and prices were battered. Towards the end of 2020, India appeared to have navigated the pandemic waves well with the OSV market remaining steady, however, 2021 saw a number of jackups cease operations as the country experienced heightened effects of COVID-19. The country now faces pressure to improve production in order to meet demands. This has led to the two biggest players, ONGC and Oil India, being requested by government to improve their production quotas.

In late 2021, demand in the region improved slightly with vaccine programme rollouts. Australia is expected to experience a large wave of offshore development wells approaching the end of their commissioning life, leading to an increase in plug-and-abandonment (P&A) activities which will provide a positive gain for the OSV market, particularly for vessels with at least DP-2 capabilities. The forecast for 2022 looks promising for the industry, however, with the recent developments in Russia, the Asia Pacific OSV market will be affected although the full extent is currently unknown.

Figure 1: Asia Pacific demand, supply & utilisation (2017-21)

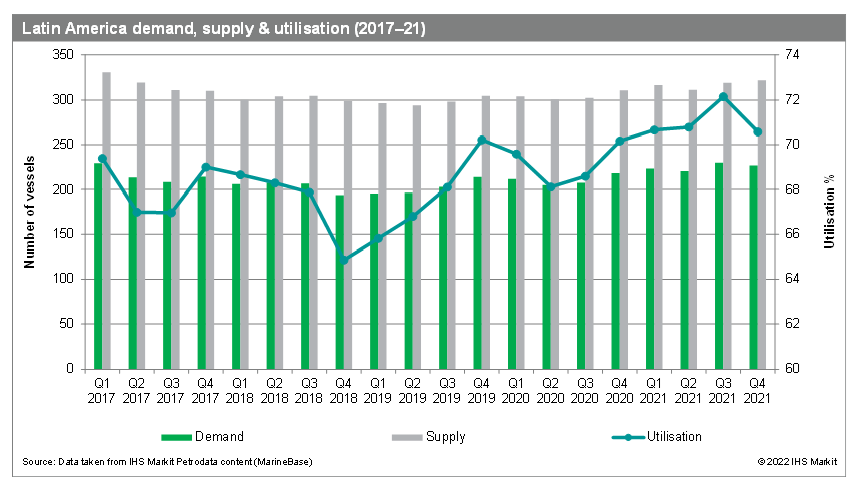

Latin America

The Latin America micro-market bubbled with activity yet remained in tight competition, while the global OSV industry grappled with the 2014 oil price crash. Offshore oil and gas exploration slowly improved in parts of the Americas over the 2017-18 period, but the market recovery was slow and uneven. A commonality throughout the region was the oversupply of vessels. This was mainly due to the great Brazilian ramp up of 2010-13 causing a steep uptick of vessel construction. Mexico and Brazil provided the majority of the offshore activity in the Latin America region, however, other micro-markets in Guyana, Suriname, Trinidad and Tobago, and the likes have provided growing opportunities for vessel owners.

In Mexico, the offshore industry experienced a number of discoveries, from companies such as Talos Energy and Eni. Charter rates throughout 2017 into 2018 remained at or close to operating expense levels. PEMEX remained focused on the region, however, this did little to improve day rates. Moving into 2019, the Mexican industry moved into a positive direction as discoveries were made leading to long-term charters and drilling units being fixed, however, this was short-lived as the effects of the pandemic came into play resulting in project delays. Into 2021, the number of chartered units improved slightly with activity in the region growing. This trend is expected to continue into 2022 as drilling plans are scheduled to materialise.

Guyana's industry interest intensified as ExxonMobil's discovery was announced in 2017. The Liza Phase 1 development was confirmed. This success continued creating a favourable environment for PSVs. As of April 2021, ExxonMobil made its 16th discovery, the Uaru-2 well. The Guyana-Suriname basin is and will look to continue being one of the best performing oil and gas regions. For this reason, ExxonMobil will proceed with moving its supply chain base to Guyana from Trinidad and Tobago.

Brazil's OSV demand continued to decrease due to Petrobras downsizing its fleet of PSVs from 2017 into 2018. As Petrobras reduced activity, IOCs like Total, Statoil, Shell, and Chevron have stepped in, but not enough to have filled the gap. The region is a leading market for FPSOs which in turn favours high-power AHTS vessels. A notable trend seen was the spare PSV capacity being modified for more specialised jobs such as oil spill response, ROV, and diving support. Late 2018/early 2019 saw Brazil reach its lowest point of 140 OSV term charters, however, towards the end of the year the view was more optimistic as the pre-salt fields opened up more attraction for international players to invest.

Over the last two years, OSV demand in Brazil has risen steadily due to increasing drilling activity including the arrival of new FPSOs. OSV demand is expected to continue increasing over the next two years. Petrobras also has around six new additional floating rigs starting long-term contracts towards the end of 2022.

FPSO support is one of the leading demand drivers for large AHTS vessels in Brazil. The market for powerful AHTS vessels was not nearly as oversupplied as the PSV sector in 2017, and AHTS owners did not lose as much pricing power as the plentiful PSV fleet following the price crash in 2014. FPSOs create significant vessel demand at installation as well as long-term routine support for loading and offloading.

E&P companies within Latin America, specifically in Brazil, were able to continue operations throughout the oil price dip caused by the pandemic. Day rates improved in 2021 as term fixtures increased along with longer contract durations. This positive activity is further encouraging shipowners to reactivate laid-up units and mobilise others from different regions. Hybrid units are also becoming more popular with clients like PEMEX increasing its requests for this type. This type of vessel makes use of batteries as an energy storage solution in order to improve energy efficiency and reduce emissions.

As for other Central and South American countries, the emergence of Guyana and more recently, Suriname as growing hotspots has diversified the interests of operators, as well as the appetite of other governments around the continent in hopes of finding similar success. To that end, some countries are working to become more than an outlier, but results are mixed so far. Colombia, Argentina, and the Falkland Islands are some of the more active nations chasing investments for their offshore basins. It is expected that offshore production from these countries would triple by the middle of the next decade. The Latin America outlook for 2022 is a positive one as demand and day rates are expected to climb.

Figure 2: Latin America demand, supply & utilisation (2017-21)

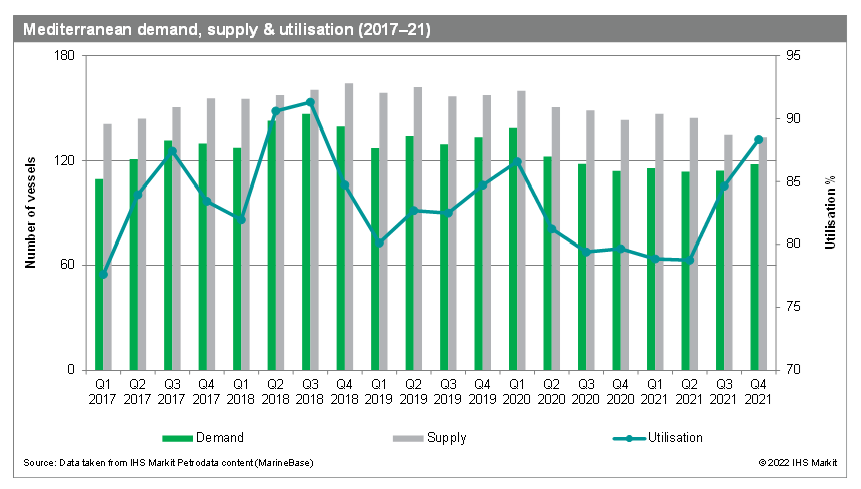

Mediterranean

In the Mediterranean region, 2017 was a relatively stable year in comparison to 2016 with almost a third of the term fixtures occurring in Egypt followed by 17% in Libya and 12% in Italy. Looking further back, 2015 saw approximately eight discoveries made within the region which dropped to approximately three in 2017. The following year, the Mediterranean and Black Sea region experienced slightly higher OSV term demand driven mainly by the offshore work in Egypt and Libya as well as offshore Israel and the Black Sea. However, within the higher-specification PSV segment, activity decreased moving into 2019 as work tapered off. The rise and fall of OSV demand added to the already low day rates and presented vessels in lay-up with an unattractive reactivation value proposition.

Similar to other regions, drilling support charters are one of the main OSV demand drivers in the Mediterranean. A slight increase in the number of drilling units in the region in 2018 provided further evidence for the slight uptick in demand. This increase trend continued into 2019 with the same countries contributing. Noble Energy continued with developing in the Leviathan field contributing to Israel's demand while BP's West Nile Delta Phase and Rashpetco's West Delta Deep Marine (WDDM) provided a significant source of OSV demand in Egypt. The effects of the pandemic hit the region in 2020 causing offshore exploration operations to almost stop entirely. New projects were suspended or cancelled resulting in significant drops in vessel utilisation. Early 2021 saw Eni commence an exploration project offshore Tunisia while Energean continued to develop the Karish field. Noble Energy continuedworking on the Leviathan development in Israel after the first gas was delivered in 2019. Rig tows to Turkey further provided a steady flow of work for AHTS vessels and AHTs. The momentum created by continued projects as well as new ones in the region remained soft and under threat as the economic conditions unfolded. Looking ahead, there are a number of projects in the pipeline involving jackups, semisubmersibles, and drillships being required thus creating a hopeful outlook for OSVs.

Figure 3: Mediterranean demand, supply & utilisation (2017-21)

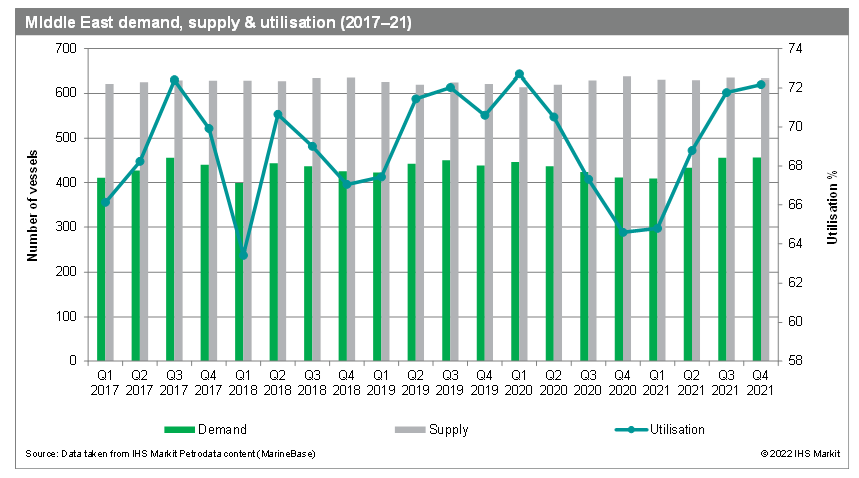

Middle East

As oil prices recovered, the Middle East experienced improved term activity mimicking the slow regain of demand in oil. Prior to 2017, OSV term activity dropped in areas such as the Gulf, Red Sea, and the Gulf of Suez in response to the oil price crash in 2014. The region did not feel the brunt as hard in comparison to other parts of the global market, mainly due to significant discounts offered as opposed to increased vessel requirements. This resulted in a number of expansion and maintenance projects being awarded at low rates. Daily charter rates were at break-even levels as the market remained tight due to oversupply within the region. Commitment of field development projects by national oil companies in Saudi Arabia, Iran, Qatar, United Arab Emirates, and Egypt have driven the overall offshore activity. Demand was relatively stable throughout 2018. The number of stacked units was high, however, attrition levels improved slightly.

In 2019, the Middle East OSV market reached its highest level since the 2014 downturn mainly driven by the considerable increase in contracted rigs. Saudi Aramco awarded 10 AHTS vessels and 10 PSVs as part of its Phase 2 multi-vessel tendering round in mid-2019. In addition to this, large projects in the Gulf and in Qatar contributed to the spiked demand. The region remained a predominately AHTS market along with growth from all vessel types apart from small PSVs. Day rates increased slightly from breakeven to an average of 5-10% improvement on 2018 levels. The large number of stacked vessels and oversupply remained a challenge for the market. As with other regions, activity in the Middle East nosedived as the effects of the pandemic occurred along with the low oil price. Term utilisation in 2020 dropped to below 50% as drilling suspensions, projects delays, tender cancellations, and client renegotiations took place against already low charter rates. Further to that, lockdowns and quarantine processes created additional logistical and operational pressures. Many of the national oil companies were seen as being aggressive in deferring contracts, terminating contracts early or cancelling before their start dates. The year saw the largest employer of jackups, Saudi Aramco, suspend at least six rigs, in turn severely affecting its OSV requirements.

As vaccine rollouts took place in 2021 along with positive developments in oil price, improvement was seen in rigs either resuming or being tendered for work. The year saw some operators reposition their units in other regions targeting new markets such as offshore wind farm projects in Southeast Asia. This trend is particularly strategic for owners of modern, diverse and competitive fleet capacity.

OSV demand in the region is expected to grow significantly in the coming months. Utilisation is expected to rise by at least 10% with day rates looking to grow around 5-10% over the next 12 months. Bullish expectations driven by the USD 100+ oil price and the national oil companies' intention to bring more oil into the global markets are key to the sustained growth of OSV Middle East over the long term.

Figure 4: Middle East demand, supply & utilisation (2017-21)

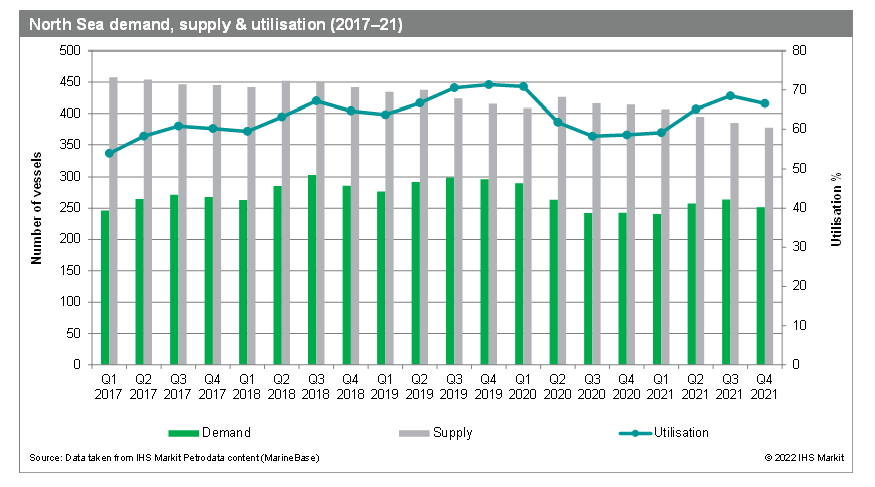

North Sea

The North Sea region was no different in reacting to the effects of the oil price crash from 2014. Three years later and the North Sea still saw a tough environment with poor day rates, lack of demand, and a large number of vessels laid up. Work within the region picked up, however, competition for the work between vessel owners became intense thus leading to lower than normal charter rates to secure contracts. Work outside of the traditional OSV sector were explored by owners. Examples of this were fixtures in the Aquaculture market and providing support and supplying offshore wind farms. The term demand increased in 2018 with several industry players out for long-term charter requirements. The positive effect of this was not fully felt by the OSV market however, as it remained oversupplied with tonnage. Some owners went as far as removing tonnage from lay-up earlier than required for jobs with short durations, further adding to the surge.

A ripple effect of the market caused a number of OSV owners to refinance and carry out debt restructuring. Overall utilisation in 2018 hovered around 60%, a touch higher than the previous year. Summer 2019 allowed the region to achieve satisfactory utilisation rates as well as increased charter rates. Continuing the trend from the previous years, attrition levels remained less than required, although some owners attempted to tackle the oversupply issues by selling tonnage out of the market. As 2020 began, demand in the region had been increasing until the effects of the pandemic hit. Similar to the global OSV market, Northwest Europe saw projects cancelled, unprecedented numbers of vessels laid up, and vessel owners left with no alternative other than to abandon or scrap tonnage that would otherwise have had life left in them. Owners that continued to keep their PSVs on term contracts were forced to negotiate charter rates at discounts of up to 30% due to the large drop in demand. The rig market mimicked similar activity; eight semis were retired and three jackups were taken out of service. This provided some bursts of towage work for AHTS vessels and AHTs. Towards the end of 2020, the region saw some hope as the list of requirements for vessels grew slightly. Aiding the demand improvement, approximately 15 OSVs landed work in the Kara and Pechora Seas with contracts lasting three to four months.

Early 2021 saw term fixtures rise; in the Norwegian area, Equinor led chartering activity with Repsol Sinopec, TotalEnergies, TAQA and others issuing long-term charters on the UK side. Furthermore, April saw a large number of PSVs exit lay-up to satisfy demand requirements indicating the uptick in the market. Day rates followed a similar trend, both on the spot and term markets. As the energy transition becomes more imperative, vessel owners are either exploring or taking action to hybridise their fleet, switch to a more efficient fuel type, and enter offshore wind farm activity.

As 2021 neared the end, the overall feeling within the market was one of cautious optimism, with the hope of 2022 bringing steady growth. Environmental-related upgrades are being spotlighted and considered more and more as the indication is it will be easier to land long-term work in both the oil industry as well as in the wind sector. Major OSV players will also look to take advantage of the increased demand in West Africa and Latin America in 2022.

Figure 5: North Sea demand, supply & utilisation (2017-21)

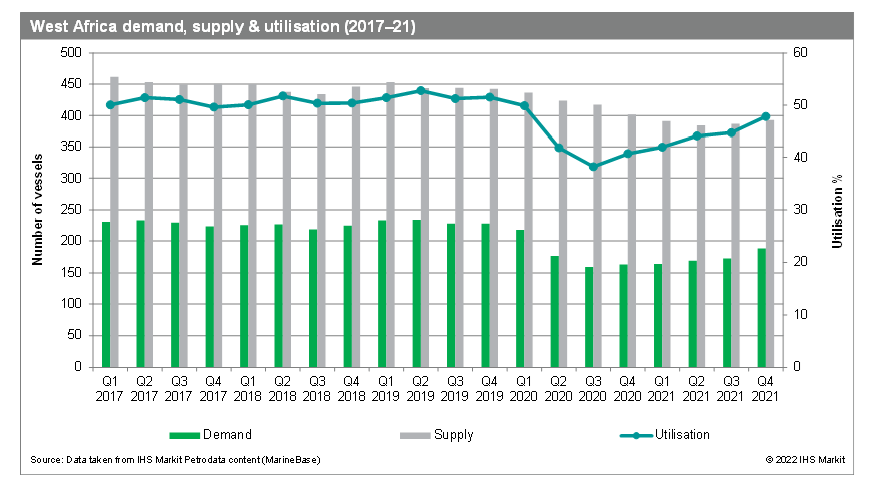

West Africa

The OSV region experienced peak demand in West Africa back in early 2014 and has witnessed a declined turbulence since, following the oil price crash in the same year. In 2017 the term demand moved from an average of 36 to 39 vessels in comparison to the prior year. Exploration remained suppressed throughout the year, heavily contributing to the region's low demand; countries that dominated offshore activity included Angola, Nigeria, Equatorial Guinea, and Ghana. It was not much different in 2018, with demand remaining steady at suppressed levels. Similar to other regions, West Africa held a high number of unchartered OSVs with over 150 units in various states of lay-up.

The start of 2019 provided hope for the region as term demand increased along with slight improvements in day rates. This trend did not carry through with growth stagnating over the summer period and remaining flat as the year closed. The number of laid-up vessels continued to be a high concern for the region. The cold stacked fleet contained over 160 units as the year took off with Nigeria housing approximately half of this number. Throughout the year reactivation levels increased and saw more than 15 vessels re-enter the market. This indicated the willingness of vessel owners in investing capital to secure contracts in the region. The rig market, being a large player in driving OSV demand, provided sufficient development to hold OSV demand steady for 2019.

The little hope that was experienced in 2019 was wiped out in 2020 as the pandemic struck along with the drop in oil prices. The West African region was one of the worst hit, causing vessel owners to succumb to survival mode as the market became oversupplied with little chartering opportunities and low day rates. The rig market experienced approximately 20 drilling units having existing or upcoming contracts being suspended or terminated; a similar path was followed for field developments. This resulted in extremely low utilisation rates for OSVs.

As 2021 commenced, the region showed a continued weakness with demand having plateaued since the final quarter of 2020. One aspect that highlights a potentially optimistic projection is the increasing number of FPSOs scheduled for installation on field development projects in the coming years.

While the recent period has proven challenging for the OSV market in West Africa, current indications are that improvements will be seen across the region and demand can be expected to climb back from the current lows.

Figure 6: West Africa demand, supply & utilisation (2017-21)

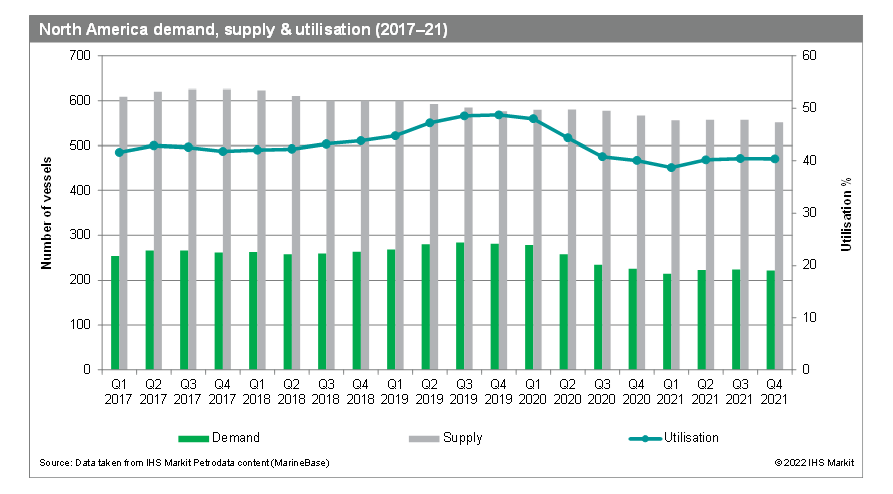

North America

The OSV industry in North America shifted drastically after the oil price crash in 2014; shallow-water activity suffered a virtual collapse while the deepwater side of the market remained more stable. In 2017, onshore unconventional drilling competed for investment with offshore projects, with the former being favoured. Deepwater PSV demand remained at low levels throughout the year. Day rates within the deepwater sector picked up in the following year due to fleet consolidation and a contraction of the spot market availability. The demand in shallow water remained at a steady low; as the major players exited this area of the market, smaller independent oil companies took the opportunity to obtain value from existing fields. The impact on day rates caused levels to remain fairly close to operating costs, providing opportunities for bargaining on term charters.

In 2019 the OSV market battled with the oversupply issue which kept term day rates low. E&P spending increased by 8-14% within the wider offshore sector, however, drilling activity remained short resulting in increased available OSV tonnage in the market. To try and combat the oversupply in the region, many OSV companies sought out work in Latin America and even West Africa which created a thinning of immediate vessel availability in turn increasing spot market rates. The Jones Act AHTS market reached an all-time low in 2019 further indicating the challenges faced by owners.

The OSV demand did not improve throughout 2020 due to the effects of COVID-19. This was particularly visible in Canada and the US Gulf. Eastern Canada term utilisation hovered at around 78% in 2018 with an increase to 83% in the next year and falling drastically in 2020 to 46%. This trend continued into 2021 and long-term prospects will be dependent on sustained production sites. Similar to other markets, operators stalled upcoming projects and suspended current ones as the pandemic engulfed the world and oil prices plunged.

Rig activity in 2021 declined as several units completed their contracts, however, activity is expected to increase in 2022. The same picture is expected for OSV demand for 2022. Recovery from Hurricane Ida will play a large role in near-term demand in the US Gulf. Day rates are looking to follow the same trend, however, operational costs have increased drastically since 2020 mainly due to COVID-19 quarantines. Labour costs further added to the high operating costs as an increase of approximately 7-10% was seen in 2021. As such there are many factors indicating increasing costs along with day rates for the OSV industry over the next year.

Figure 7: North America demand, supply & utilisation (2017-21)

2022 outlook

As the first quarter draws to an end, 2022 has indicated that a cautious approach needs to be taken by OSV players. The outlook is one of hope as a result of high oil prices, mixed with a great deal of uncertainty. Following the chaos caused by the pandemic, vaccinations and other mitigation measures have contributed significantly to a recovery trend for the industry. Recent years have shown that the OSV market conditions do not improve in a unified manner, with some regions seeing recovery and increased demand while others continue to battle challenges.

In the Latin America region, Brazil looks to continue growing as the floating production market progresses in generating long-term OSV requirements. Mexico is expected to see a similar trend as offshore exploration and production activities pick up. Egypt is also expected to experience a number of exploration projects which will assist the soft recovery that the Mediterranean region has been seeing. West Africa has made a handful of discoveries in recent months, creating an optimistic picture for the OSV market as well as the oil and gas industry for the continent.

On the field development, West Africa is holding a positive outlook with several projects in the pipeline and several others expected to be awarded. The Asia Pacific outlook for 2022 includes the continuation of tenders and contracts being issued as the oil price recovery motivates operators to move ahead with projects that were previously postponed. It is expected that operators making final investment decisions will keep the regional tendering activity at a strong pace in the coming years. As such, the overall field and rig markets are hopeful for a continuation of the positive trend in activity which will overflow into the OSV market.

A factor that has and will continue to cause turbulence in the upstream market is Russia's invasion of Ukraine. The full impact on the OSV industry remains unclear but already several offshore players have announced plans to divest their interests in the regions' projects. Vessel owner Viking Supply Ships confirmed in February 2022 it had been awarded a contract for four AHTS vessels and further announced it was for a Russian client in Russian waters. The company stated that it is likely the contract will be postponed or cancelled. This is in accordance with several countries having imposed sanctions as well as the situation remaining unclear and rapidly changing.

Further OSV information, latest updates and trends can be accessed by customers via our MarineBase product as well as the following reports: 1) Offshore Marine Monthly which offers an independent, impartial source for comprehensive analysis, data and news on the global offshore supply vessel market on a region-by-region basis and 2) The biannual Petrodata Global Supply Vessel Forecast which provides a three-year supply, demand and utilisation forecast. The next edition published will be in May 2022.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.