The upcoming and highly anticipated Gazania-1 well has the potential to create significant value for both investors and South Africa

The Gazania-1 new-field wildcat is targeting the up-dip extension of the proven 1988 Soeker oil-bearing A-J 1 discovery, located within the Orange Sub-basin. The discovery well encountered lacustrine sandstones with fair reservoir quality, exhibiting porosities between 10-15%. Although deemed sub-commercial, A-J 1 proved the presence of a working oil-prone hydrocarbon system within the A-J graben, significantly de-risking the Gazania prospect and the overlying Namaqualand prospect.

Upside potential to the Gazania prospect is found in an overlying, separate package of fluvial-deltaic sandstones of the Namaqualand prospect. Both prospects rely on an updip trapping geometry where the sandstones pinch-out against impermeable basement and are believed to be overlain by marine shales above the Early Aptian unconformity. The Gazania-1 well will test both prospects.

Eco Atlantic has contracted the semi-submersible "Island Innovator" for the drilling which is expected to start in September 2022. The water depth at the drilling location is 149 m and drilling will last in the region of 25 days for the 2,800 m well.

If successful and of sufficient size and quality to be developed, a likely scenario would involve a Floating Storage Unit (FSU) - produced gas would be re-injected and oil exported via tankers to Cape Town's Astron refinery. The refinery is due to restart in Q4 2022. Africa Energy Corp (Partner in the group) estimates the targeted prospects to hold in excess of 350 MMbbls (35% within Gazania and 65% within Namaqualand).

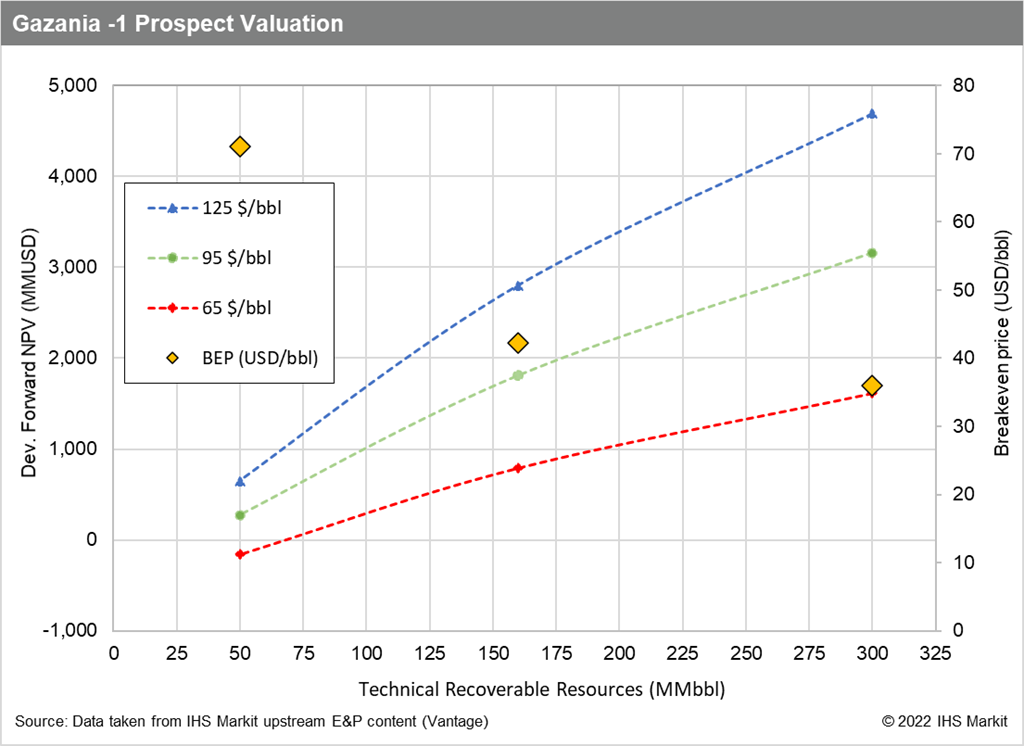

At a conservative oil price estimate of $65/bbl, the minimum economic field size is estimated to be around 70 MMbbls recoverable, while a discovery in the region of 300 MMbbls is expected to have a Net Present Value (NPV) of ~ USD 1.6 billion.

With Brent Oil prices forecasted to remain above 90 USD/bbl for the next decade, a discovery of 300 MMbbls is expected to have an NPV above USD 3 billion and expected payback within 5 years. The breakeven price (BEP) for a discovery of between 160 to 300 MMbbls remains below 45 USD/bbl, but the BEP increases dramatically below 160 MMbbls. This is attributed to the fact that even for a small field size with far fewer wells, the required OPEX to run the infrastructure at lower rates remain largely unchanged.

Should Gazania-1's findings be a success, the positive economics point to a relatively low-risk project for which FID is expected to follow soon after.

Figure 1: Gazania Prospect Valuation

For more information regarding well,

field & basin summaries, please refer to EDIN

For more information regarding asset

evaluation, portfolio view, and production forecasts, please refer

to Vantage

For more information regarding our

country activity reporting, please refer to our Upstream

Intelligence solutions

For more information regarding

E&P costs please refer to IHS Markit Que$tor

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.