Trends shaping upstream above ground risk in Europe and North America for 2024

As we look ahead to 2024, several trends in above-ground risk with implications for E&P from 2023 remain salient. Russia's invasion of Ukraine still drives NATO cooperation - not least on energy security - while the EU's commitment to emission reductions to meet ambitious transition targets remains resolute in the face of the challenging energy environment. In the US, the IRA ensured opportunities for further licensing, despite delays caused by attempts by the Bureau of Ocean Energy Management (BOEM) to restrict the acreage on offer at the latest Gulf of Mexico (GOM) licensing round. The Biden administration is still definitely pursuing its climate agenda - even ramping up efforts as elections near. Canada, meanwhile, continued its drive to tighten emission regulations, with Alberta and other oil-producing provinces pushing back as expected. Recently announced methane standards and the long-awaited cap-and-trade program for the sector mean these dynamics continue to play out.

While these 2023 trends persist, events on the horizon - elections in particular - represent crucial political junctures that could drive significant shifts and new dynamics.

In 2024, polls in the EU (June), the US (November), and most likely in the UK (probably late in the year though rumors linger about a May poll) mean energy prices and climate change policies are going to be in the spotlight and will be used to further polarize electorates.

E&P licensing has been a contentious issue throughout Biden's term in office. The administration imposed a moratorium on new licensing on federal lands in its first year and, as already mentioned, the BOEM attempted to restrict the acreage on offer in its latest GOM licensing round despite seemingly contrary provisions within the IRA. Federal authorities also canceled seven active oil and gas leases within Alaska's Arctic National Wildlife Refuge (ANWR).

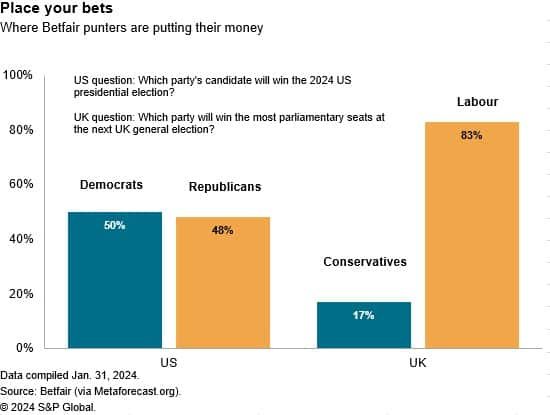

Keen to appeal to youth voters, Biden is likely to leverage his climate-change credentials earned in his first term as the election campaign heats up. This will contrast starkly with any Republican (presumably Trump) campaign, which is likely to promise the dismantling of Biden's flagship IRA and to trumpet American hydrocarbon supremacy instead. Though far too soon to call the election, it's already clear that climate policies and attitudes to oil and gas will be key wedge issues and public attitudes will further diverge along partisan lines.

The contrast in the UK election between the incumbent Conservatives and main rival Labour is subtler, but the implications of a possible change in government for E&P could be even greater. Labour leader Keir Starmer has consistently promised to put an end to new licensing in the North Sea should his party come to power. With a 20-point lead in polls prompting forecasters to predict the biggest Labour win since 1997, the industry is taking his word and the prospect of a production phasedown seriously.

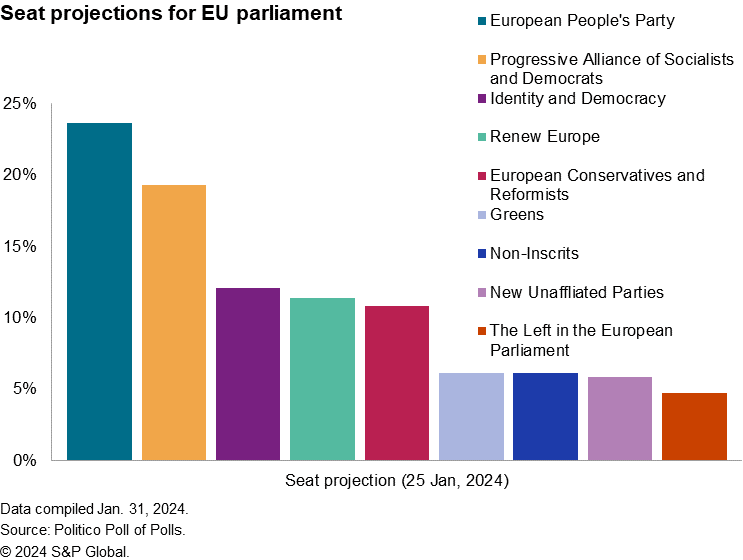

Predicting the impact of a potential rightward jump at the EU parliamentary elections in June is less straightforward, with the Identity and Democracy group expected to become the third biggest group in the bloc's legislature. Populists on the continent have mixed discontent with climate policies that levy a direct cost on the public ('greenlash') with fears over immigration to create a heady and increasingly popular cocktail of grievances (illustrated by the Dutch election last year that brought Geert Wilders' Freedom Party a plurality of votes). An EU parliament with a weakened consensus on how to tackle climate change could have difficulty implementing Green Deal policies like the Net Zero Industry Act (NZIA) - Europe's answer to the IRA.

Meanwhile, an emerging narrative that embraces low-carbon oil and gas production in the North Sea is gaining currency in the wake of the war-induced energy crisis in Europe and green protectionist policies like the NZIA and the Carbon Border Adjustment Mechanism (CBAM). Both the UK and Norwegian governments have sought to defend their industries with the argument that since hydrocarbons will be needed throughout the transition, they ought to be sourced from low-carbon-intensity producers and democratic states. Promoting the use of their carbon capture and storage (CCS) capacity will be part of this pragmatic transition narrative. How much purchase this effort at maintaining the social license to operate will get remains to be seen. Civil society groups calling for supply-side curbs to complement demand reduction en route to phasing out fossil fuels altogether will be up for the challenge.

The final trend takes us back to North America and the prospect for significant regulatory changes that could shake up resource governance. In the US, the Supreme Court's potential reevaluation of the Chevron deference doctrine (relating to the autonomy of federal regulatory agencies) in Loper Bright Enterprises v. Raimondo (decision expected in the first half of 2024) could have wide-ranging implications for the regulatory landscape by reducing the decision-making powers of agencies like the Environmental Protection Agency (EPA). In Canada, the Supreme Court's ruling on the unconstitutionality of parts of the Impact Assessment Act (IAA) in October 2023 points to increased provincial influence over environmental assessments, potentially easing regulatory burdens for upstream projects. Both countries will move forward on implementing methane emission regulations (with likely pushback from oil- and gas-producing states and provinces).

The year ahead presents a mix of continuity and change, as ever, but key elections in the US, UK, and EU, combined with heightened geopolitical tensions globally, mean change may dominate. Indeed, the hierarchical ordering of energy-trilemma priorities is seemingly up for renegotiation, with regulatory and policy implications that will shape the long-term outlook for upstream oil and gas and the energy transition more broadly.

Learn more about our coverage of the upstream investment environment at E&P Terms and Above-Ground Risk. E&P Terms and Above-Ground Risk.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.