Uncharted waters: The challenge of extreme weather for China’s hydropower and the implications on the grid

The recent volatility in hydropower generation, one of the key zero-carbon power sources in China, has weighed on China's grid system in terms of power supply and grid emissions. With up to 370 GW of installed capacity, conventional hydropower was the runner-up to coal by generation in China in 2023. Almost three-fifths of the hydropower plants are clustered in the central and southwestern regions. Hydropower can typically provide up to an 18% share in China's annual generation mix in a year with normal rainfall.

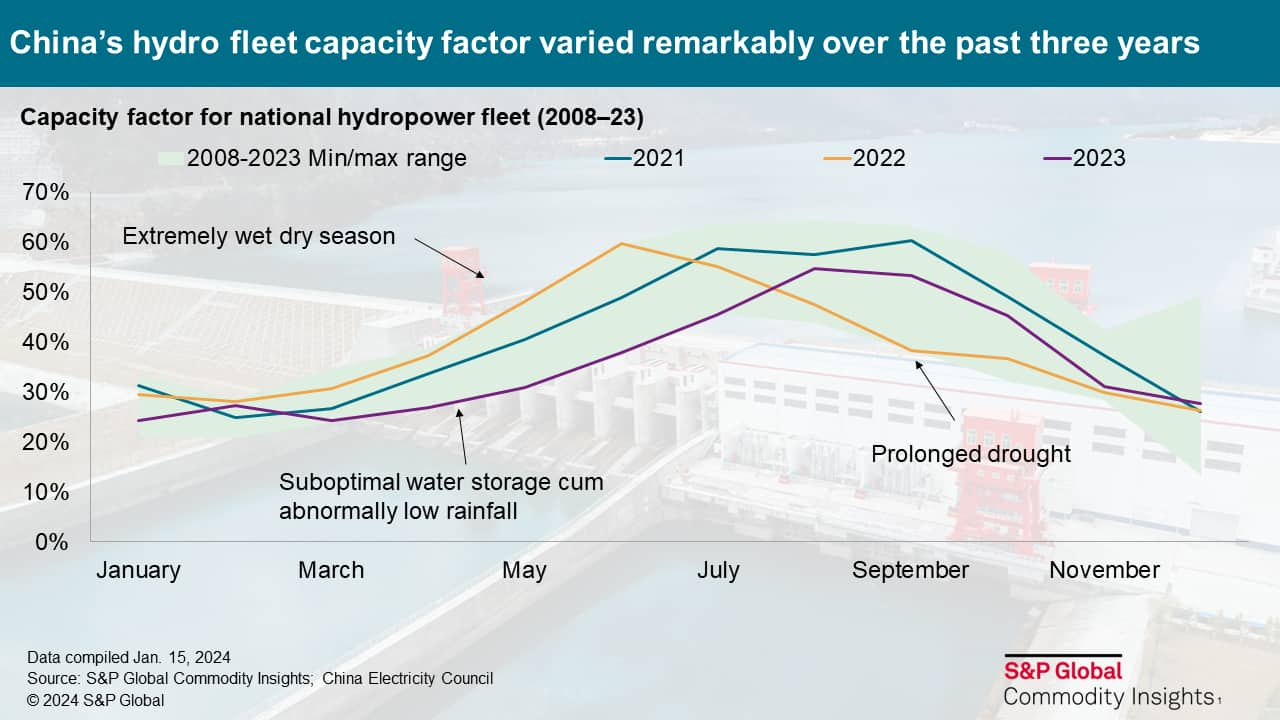

Hydropower performance has cyclical patterns as rainfall in China has distinctive seasonal patterns, and only 42% of China's hydropower plants are equipped with major reservoirs. Hydropower output will heavily influence China's seasonal power balance and thermal generation, with implications far beyond the local power supply as significant amount of hydropower generated is transmitted to the coastal provinces via the national west-east transmission project.

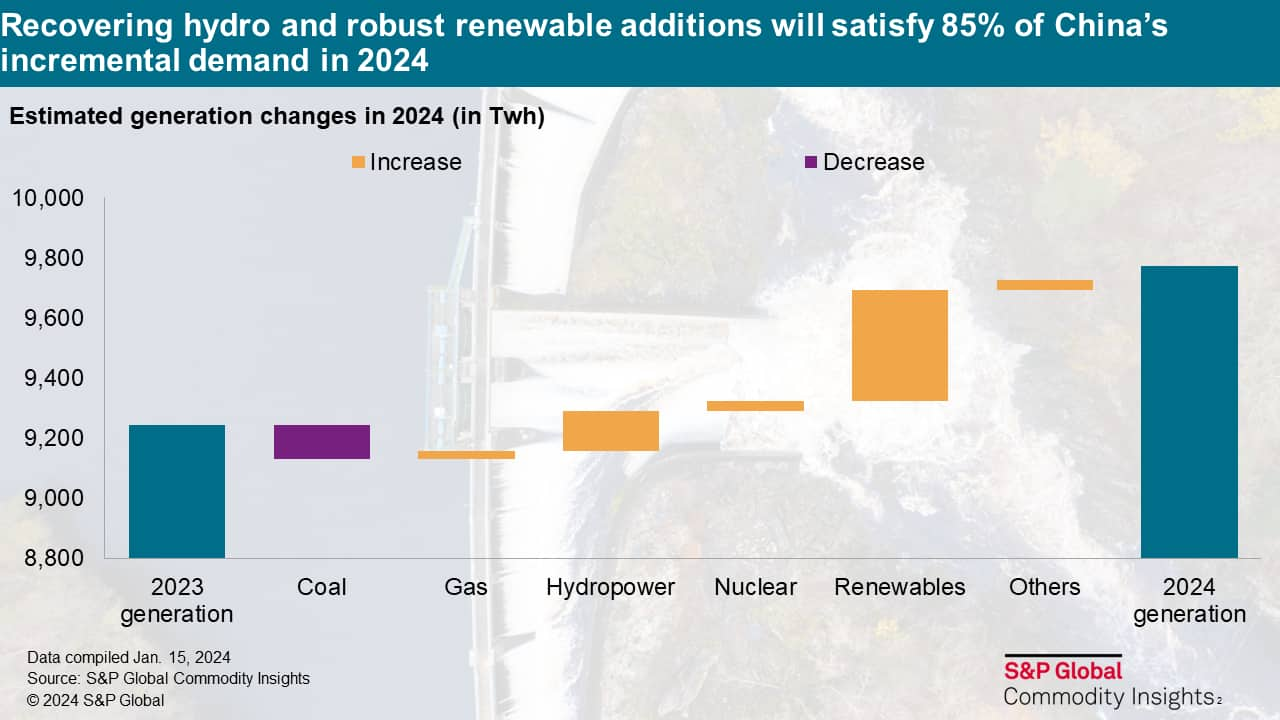

Based on reservoir levels and forecast precipitation, S&P Global Commodity Insight expects the hydropower generation to rebound strongly by 11% in 2024. Together with aggressive additions of renewables, the recovered hydropower will help to mitigate power supply risk and displace more fossil fuel generation. However, unpredictable and disruptive extreme-weather events remain a wild card, while actual monthly precipitation may also result in heightened short-term seasonal and regional supply risks. This is especially true for southwestern and central regions that have a relatively high nonindustrial power demand share and low firm capacities.

On the other hand, more frequent erratic weather is posing immense challenges to China's power supply security, especially if hydro output is lackluster. Extreme weather is also fast becoming a critical swing factor in influencing the annual grid emissions. Strong growth of renewables has caused grid emissions in China to enter into a growth plateau era. As a result, the year-to-year grid emissions is becoming highly sensitive to short-term transient factors such as extreme weather events that may curb output from hydro and renewable fleets as thermal fleet will have to ramp up to fill in the supply gap.

Furthermore, potential changing rainfall patterns and a diminishing gross addition will pile pressure on hydro's share in the future power mix. The possible trend of declining annual precipitation in the southern half of China, where most hydro units are located, will create a mismatch of resource endowment and restrict the potential hydropower generation. On the other hand, slowdown in gross additions will lead to a halved share in both the national hydropower capacity and generation mix from today's level by 2050.

To learn more about our Global Power and Renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.