Underdog to Champion: Unlock the presalt potential

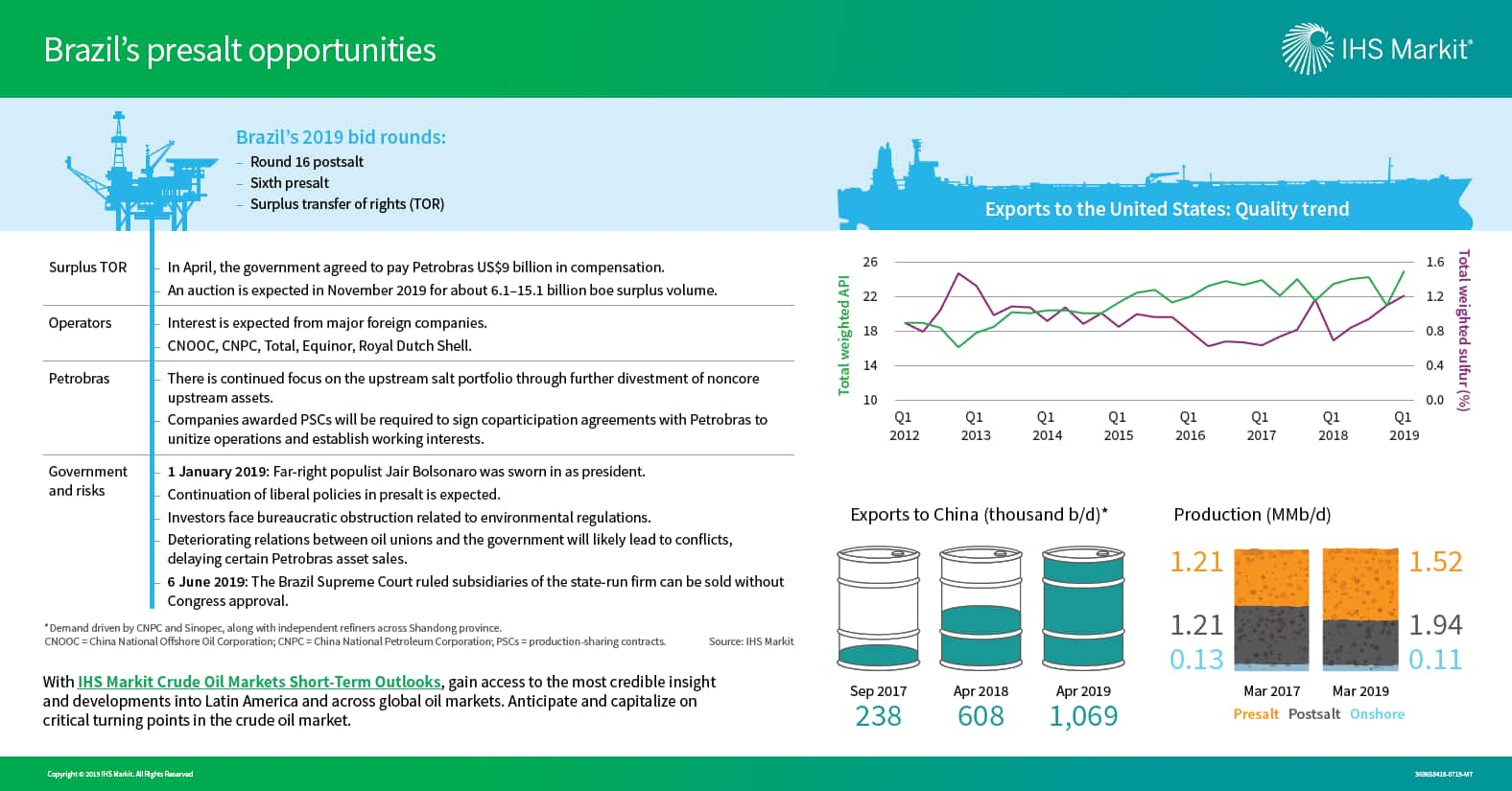

Production is declining at Brazil's aging postsalt fields, but Brazil sees great potential in its presalt fields. In March, crude production increased by 70,000 b/d, reaching 2.56 MMb/d. This growth in production was due largely to the end of maintenance in the Lula presalt region, allowing overall presalt production to reach its highest-ever level of 1.52 MMb/d. As Brazilian President Jair Bolsonaro's administration continues with liberal energy policies, foreign companies will have the opportunity to further tap into Brazil's presalt and postsalt potential in 2019 with the upcoming bid rounds: the 16th postsalt round, the sixth presalt round, and the surplus transfer of rights (TOR) round. The TOR auction, which is expected to occur in November 2019, will likely attract the interests of major foreign companies such as China National Petroleum Corporation, Equinor, and ExxonMobil, which will be vying for access to about 6.1-15.1 billion boe of surplus volume.

Increased production, coupled with slightly lower refining rates, has led to significant growth in crude exports. Specifically, independent "teapot" refineries in China's Shandong region have taken more Brazilian crude as an alternative to the Eastern Siberia-Pacific Ocean pipeline, in addition to filling the gap left by the loss of US barrels due to the trade war. In the first four months of 2019, Brazil's crude exports to China averaged 900,000 b/d, compared with 543,000 b/d in the first four months of 2018. In contrast, imports to the United States have declined owing to the decrease in production from Roncador, Marlim, and Peregrino heavy, sour postsalt crude.

You may also be interested in...

Continue to gain valuable insight into IHS

Markit Latin America Energy coverage

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.