US Northeast natural gas production management

Demand seasonality and dim prospects for new pipeline capacity make production management vital.

The end of the pipeline expansion era will require US Northeast natural gas production to be more responsive to storage limits, takeaway capacity constraints, and consumption volatility to avoid extreme and prolonged basis blowouts. Historically, Northeast production has increased as a function of growing demand and regional outflows. Opportunities to grow production by increasing outflows are diminishing as takeaway capacity approaches full utilization and large-scale pipeline expansion hurdles become increasingly insurmountable. Appalachian operators will now need to manage production more judiciously.

- Production growth will become increasingly responsive

to local consumption swings between winter and summer months

because takeaway capacity is approaching full utilization.

- Any production growth will become more reliant on local

consumption. Outflows cannot continue to grow from winter

to summer as they have in the past because new projects are

unlikely and takeaway capacity is highly utilized.

- Local storage is limited in the amount of production it can absorb when consumption falls from winter to summer. Appalachian working gas storage capacity normally approaches its limit by end-October.

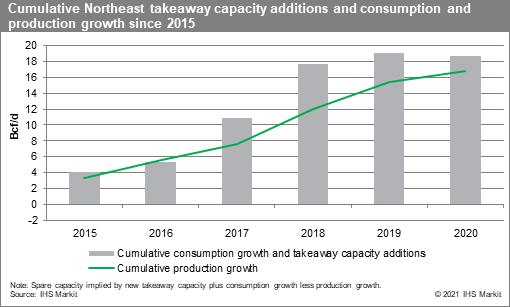

Northeast production growth during 2015-20 had been enabled by new takeaway capacity and resulted in higher regional outflows. Since the Northeast did not become a material gas exporter until 2015, local demand growth plus new takeaway capacity from that time provides a sensible production growth ceiling and marker for how much more gas could flow out of the region. The amount of implied spare capacity narrowed considerably in 2020 relative to the prior year (Figure 1).

Figure 1

In the future, local consumption levels will become even more critical to production growth because major takeaway expansions are becoming increasingly unlikely.

Seasonal production growth up until summer 2019 was afforded by steady takeaway capacity additions. Unlike prior years, new capacity was negligible in 2020. Higher production exiting winter 2019-20, the absence of new capacity, and a storage surplus resulted in winter-to-summer spare capacity declining to very low levels. Limited spare capacity and the storage surplus required production to contract slightly from winter 2019-20 to summer 2020—the first time this has occurred on a seasonal basis since the Northeast became a net exporter of gas.

Local storage is limited in the amount of production it can absorb when consumption falls from winter to summer. Northeast Appalachian storage typically approaches its limit by end-October and an accelerated storage injection pace can fill storage faster than normal and lead to basis blowouts. This occurred in August when Dominion South Point basis discounts dropped below $1.20/MMBtu.

Some Appalachian operators like EQT, Range Resources, and CNX responded to weakening gas prices and the summer-to-winter price spread by scaling back production at various times during summer 2020. Entering summer 2021, Appalachian operators will need to place weight on effectively gauging seasonality and simulating consumption scenarios that inform their production schedule. Contingency plans that adapt production to local conditions cost-effectively will be important to preserving production value.

Stay up-to-date with pipeline flows, production details and demand/supply analytics with our PointLogic service.

Posted 24 February 2021 by Matthew Piatek, Director, Climate and Sustainability, IHS Markit

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.