US ethane – swing time in the Rockies

Rockies ethane production

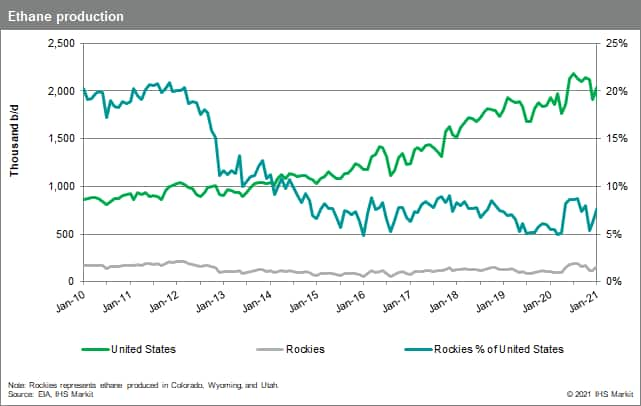

Between 2010 and 2011, the Rockies region (primarily Colorado, Wyoming, and Utah) in the United States produced nearly 20% of total US ethane production (see Figure 1). This was driven by oil and natural gas development in western Colorado and western Wyoming. With the shale boom, oil and natural gas development in the Permian Basin and Eagle Ford play increased and led to a surge in available ethane supplies, resulting in higher ethane production from these regions to meet the growing demand needs in the US Gulf Coast. This shift in ethane supply dropped ethane production in the Rockies, as ethane from the Rockies was less economic, being located farther away from the demand market; ethane production from the Rockies subsequently declined.

Figure 1

Figure 1 shows that total US ethane production more than doubled over the past decade, but the amount of ethane being produced from the Rockies region dropped from an average of 175,000 b/d in 2010-11 to about 140,000 b/d in 2020. In terms of percentage, by 2020, Rockies ethane production fell from about 20% to approximately 7% of the total US production.

Ethane production swings with changing economics

When the Rockies region was producing 20% of US ethane between 2010 and 2011, natural gas processing plants in the region were operating in full ethane recovery mode. But as ethane availability from Eagle Ford and Permian increased, more ethane was produced from those producing plays and basins and reduced the dependency on ethane supply from the Rockies. The ethane content in the total NGL barrel produced dropped to about 25% by 2015, whereas ethane content in NGL barrels from Texas Inland remained above 40%.

The swing in ethane production is also explained by looking at ethane recovery economics. The ethane frac spread, the difference between the value of Mont Belvieu ethane price and local natural gas price in cents per gallon (cpg), indicates the incentive to extract or reject ethane. Rejecting ethane means to not intentionally recover ethane at the gas processing plant from the natural gas stream, but to rather leave it in the natural gas stream to be consumed as fuel. A high ethane frac spread will incentivize more ethane recovery, given that the frac spread is enough to cover the costs to fractionate and deliver ethane from the supply region to demand centers.

The Rockies ethane frac spread was well above 12 cpg between 2010 and 2011, and at the same time, ethane content in total NGL barrels was almost 50%, about 175,000 b/d of ethane production. By 2015, the ethane frac spread dropped to about 2 cpg, and the ethane content in total NGL barrels dropped to 20%, or almost 80,000 b/d of ethane production, indicating a strong correlation between ethane production and the ethane frac spread.

Post-2015, as ethane demand increased with the first wave of new ethane-to-ethylene crackers and waterborne ethane exports, the Rockies region began recovering more ethane. Ethane production from the region increased from 130,000 b/d to approximately 150,000 b/d. The ethane content in total NGL barrels improved to a range of 30-35%.

Fast forwarding to April 2020, the COVID-19 pandemic resulted in the crude price collapse, impacting upstream activity in the key oil-producing plays and basins in the United States. As oil production fell in the Permian Basin, the associated natural gas production fell, correspondingly resulting in some scarcity in ethane supply from the region. Market participants scrambled to source more ethane from other regions to meet their demands. As a result, ethane prices increased, and the ethane frac spread in the Rockies surged from 3 cpg in April 2020 to 12 cpg by July 2020. This increase stimulated more ethane production in the Rockies (from 92,000 b/d to 188,000 b/d), and the ethane content in the total NGL barrels produced for the Rockies increased from 20% in March 2020 to 35% by July 2020.

Eastern versus Western Rockies—A closer look at the ethane production variation within these two regions

Within the Rockies itself, natural gas processing plants in the Eastern Rockies have shown a different pattern of ethane recovery compared with some of the natural gas processing plants in the Western Rockies. Ethane production from natural gas processing plants fluctuates based on economics to recover ethane, but the emerging trend reflects that more ethane is being recovered to support volumetric commitments on recent pipeline capacity additions.

Western Rockies contributed to most of the ethane produced in the late 2000s to early 2010s, supported by several large legacy natural gas processing plants. But lack of upstream development through the mid- to late 2010s led to a drop in upstream production, resulting in rationalization of natural gas processing capacity in the region.

Over the last few years, upstream production focus has shifted to crude-directed drilling in the eastern parts of Colorado and Wyoming, the Denver-Julesberg (DJ) Basin and Powder River Basin. Much of the new natural gas processing capacity has also been added in the eastern part of Colorado, about 3 Bcf/d since 2015.

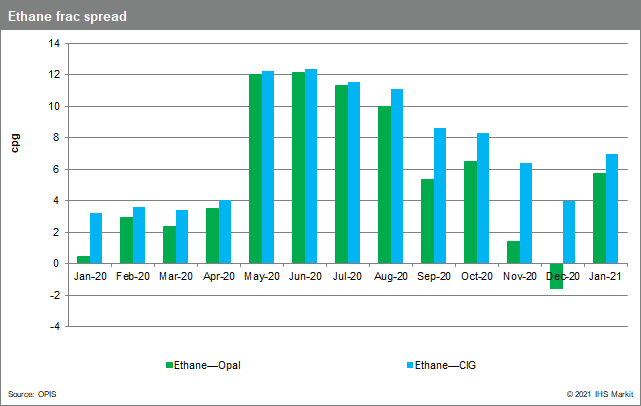

Figure 2

As shown in Figure 2, natural gas processing plants in Western Rockies increased their ethane production when the ethane frac spread between the Mont Belvieu ethane price and local gas (Opal) price equivalent increased to 12 cpg in May 2020 from low levels in January 2020. Improving ethane recovery economics lead to more ethane production, shown by the ethane percent in NGL barrels, which increased from 30% to 55%. Later, as the ethane frac spread fell below 4 cpg in December 2020 owing to an increase in the Opal natural gas price, ethane recovery in the region dropped, and the ethane percentage in the NGL barrels produced correspondingly fell to 20%.

On the contrary, ethane production at natural gas processing plants in Eastern Rockies followed a different trajectory during the same period. Ethane recovery as shown by percentage of ethane content in total NGL barrels moderately decreased when the ethane frac spread increased from 3 cpg (ethane—CIG) in January 2020 to 12 cpg by June 2020. But as the ethane frac spread dropped to 4 cpg by December 2020, the percentage of ethane in NGL barrels produced increased to almost 34%. A plausible explanation of higher ethane recovery with unfavorable ethane frac spread can be attributed to the expansion of Front Range Pipeline from 150,000 b/d to 260,000 b/d, which went into service in early 2020. The Front Range Pipeline is one of the many pipelines (others including Overland Pass, Wattenberg, and Southern Hills extension) that provides NGL takeaway from DJ Basin and connects to Mont Belvieu market through its interconnect with Texas Express Pipeline. It is possible that the expansion of the Front Range Pipeline is based on NGL minimum volume commitments, which could have led to higher ethane recovery from the natural gas processing plants delivering NGLs into the pipeline, even when the ethane frac spread was unfavorable. However, there is still a substantial amount of ethane that is not being recovered at the gas processing plants (as only 35% of the total NGL barrels produced is ethane). A higher ethane frac spread will be needed to incentivize more ethane recovery.

Rockies region will provide the marginal ethane barrel

With overall ethane demand increasing, we expect ethane recovery to grow in the Rockies. The Rockies region has sufficient infrastructure to extract and move ethane to the US Gulf Coast, but ethane production from the region will remain a swing supply. Marginal ethane supplies from the Rockies will be called upon when ethane supplies from regions closer to the US Gulf Coast are insufficient to meet demand and, most importantly, are supported by marginal economics. Based on the historical data, it can be inferred that an ethane frac spread of at least 12 cpg is needed, if not more, to incentivize Rockies natural gas processing plants to operate in full ethane recovery mode.

Gain greater insight into global and regional ethane and NGL markets with IHS Markit Midstream Oil and NGLs research. Learn more here.

Veeral Mehta, Executive Director, Natural Gas Liquids

Research and Consulting, IHS Markit

Manmohan Pozhickal, Associate Director, IHS

Markit