What is the Key to Kurdistan’s Gas Conundrum?

Kurdistan is a geo-political region located in the heart of the Middle East. Despite its relatively small size, the region is estimated to hold over 21 trillion cubic feet (Tcf) of remaining recoverable natural gas resources, as formulated by IHS Vantage. It is then astonishing to find that, despite its abundance of resources, Kurdistan is only expected to produce a total volume of 0.16 Tcf for the year 2022. In this article, IHS Vantage breaks down the region's unique gas portfolio and the challenges that must be overcome to fulfil its gas potential.

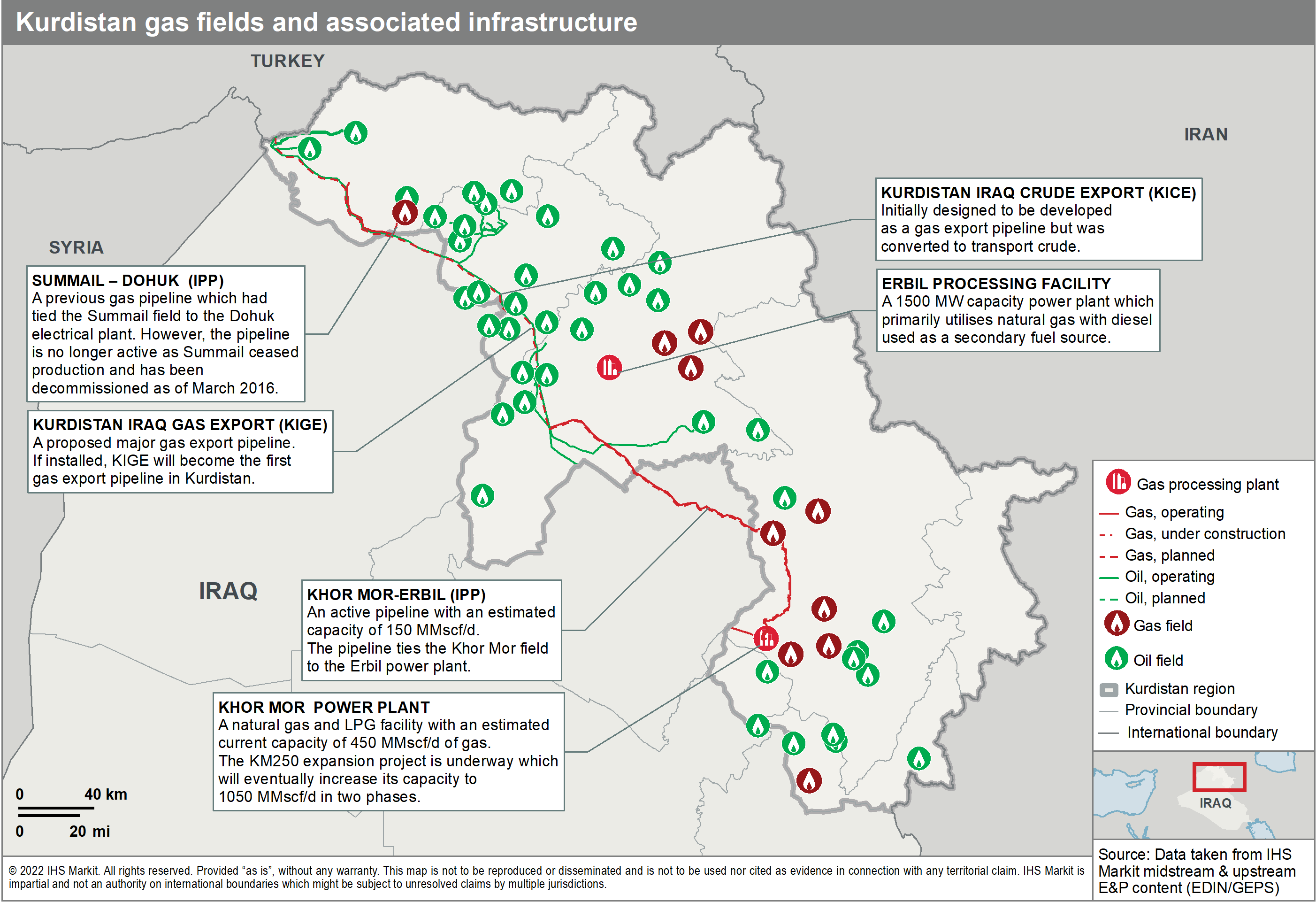

Figure 1: Map highlighting Kurdistan's main gas fields and infrastructure.

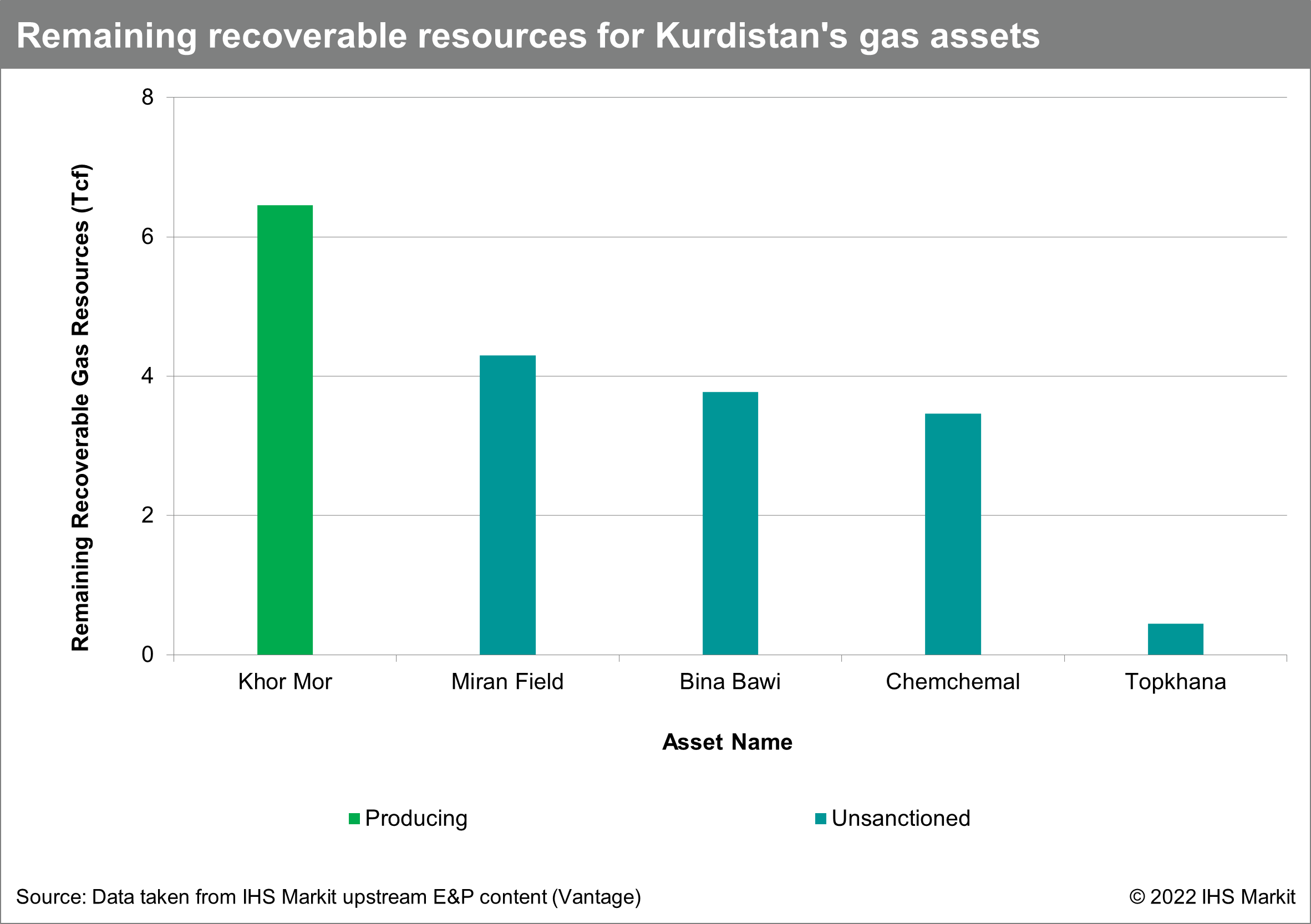

Kurdistan is a semi-autonomous region, under the administration of the Kurdistan Regional Government (KRG). It is situated in Northern Iraq and borders Iran, Syria, and Turkey. This naturally makes the region geospatially landlocked and devoid of offshore export routes. Kurdistan's portfolio comprises several gas fields as shown in figure 1, which are mainly positioned in the south of the region. At present, Khor Mor remains the only gas field in production and supports the generation of around 75% of Kurdistan's domestic electricity supply. The region's reliance on the asset is emphasised in figure 2, whereby, the four alternative gas assets remain unsanctioned. Khor Mor also has 40.2% greater recoverable resources than the second-largest asset, the Miran Field. Associated gas produced from Kurdistan's oil fields is typically flared due to limitations in gas infrastructure.

Figure 2: Graph showing the statistical makeup of Kurdistan's gas assets.

There are two major gas processing facilities in Kurdistan, namely, the Khor Mor and Erbil centres. A large-scale 'K250' expansion project is underway at the Khor Mor facility which aims to increase its gas capacity in two phases. The initial phase is intended to increase capacity from 450 million cubic feet per day (MMcf/d) to 700 MMcf/d. Despite being delayed due to security reasons, it is expected to conclude in 2023. A second phase will further upgrade facilities to reach 1,050 MMcf/d, although a definitive completion date has not been specified. Once phase 1 is complete, Khor Mor's production is expected to fulfil the new processing capacity and meet all of Kurdistan's domestic demand. Therefore, for phase 2, the most appropriate solution would be to export the excess gas.

However, Kurdistan currently does not have an available export option. A pipeline was constructed in 2014 which aimed to export gas to Turkey but was converted into the current Kurdistan Iraq Crude Export pipeline (KICE). Rosneft signed a deal in May 2018 for the construction of the Kurdistan Iraq Gas Export (KIGE) pipeline which would tie Khor Mor gas to Turkey, although no progress has been made. This could be due to the significant capital costs associated with the development. There is already an intraregional gas pipeline in place from Khor Mor to Erbil. The proposed KIGE pipeline could therefore be installed directly from the endpoint of the Erbil pipeline at a reduced cost, in addition to any pipeline capacity expansion expenses. A more comprehensive development plan, however, would require an extensive gas pipeline network for the unsanctioned gas fields to tie into KIGE. An initial breakthrough was made in November 2013 when the KRG successfully signed a 50-year Gas Sales Agreement (GSA) with Turkey, but almost a decade later, there has been no substantial progress.

To complicate matters further, the Federal Iraq Supreme Court has, as of February 2022, officially adjudged that all Production Sharing Contracts (PSCs) awarded by the KRG be deemed unconstitutional and relinquished. Kurdistan profoundly disagrees with Federal Iraq's court ruling and has continued to operate as usual.

The politics extend internally as well, with high-profile court cases relating to disputes over gas prices in Kurdistan's PSCs. In October 2013, the operator Dana Gas filed a case against the KRG regarding Khor Mor. In 2017, the London Court of International Arbitration (LCIA) ordered KRG to pay US$1 billion for a fiscal breach of agreement, of which US$400 million was re-invested in the field. Genel Energy similarly expressed concerns regarding its Bina Bawi and Miran Field assets. The KRG terminated the company's PSCs in 2020 following a failed GSA. In response, Genel Energy appealed to the LCIA regarding a possible repudiatory breach, with the case ongoing. These examples have highlighted the complications in agreeing on contract fiscal terms which could deter future investors.

Overall, Kurdistan's gas profile holds significant resource volumes but is heavily reliant on the production of Khor Mor. There are several other gas fields, but these have not been sanctioned due to contractual disputes and limited gas infrastructure. The Kurdistan gas industry is developing at a slower pace than the KRG would like due to a vicious cycle whereby; limited investment in gas infrastructure has provided little incentive for field development and vice versa. There has been a degree of progress through the ongoing K250 expansion project at Khor Mor which has guaranteed to fulfil feedstock requirements for the region's future domestic electricity demand. A long-term GSA was also signed with Turkey for gas exports but has failed to materialise as a new export pipeline would require significant funding. All in all, the Kurdistan gas industry is making slow, patient progress but requires a coordinated effort from multiple parties to truly make its mark in the Middle East market.

***

Want to access more upstream content? Visit Vantage for in-depth valuations of over 18,000 global assets.

Posted 15 December 2022 by Kishore Thamilselvan, Senior Technical Research Analyst, S&P Global Commodity Insights.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.