Will Azerbaijan meet Europe's 2027 gas demand deadline?

On July 18th 2022, European Commission President Ursula Von Der Leyen signed a Memorandum of Understanding (MoU) with Azerbaijan's President Iham Aliyev to double the volume of Azeri gas import capacity into Europe from 10 Bcm/y (Billion cubic meters per year) to 20 Bcm/y by 2027. However, at present, Azerbaijan will not be able to fulfil this agreement without aggressive near-term investment in both the upstream and midstream sectors. Currently, Shah Deniz, Azerbaijan's largest producing gas field, provides gas to the Southern Gas Corridor (SGC) but it is unlikely to fill the gap in the near future. What other near-term options does Azerbaijan have?

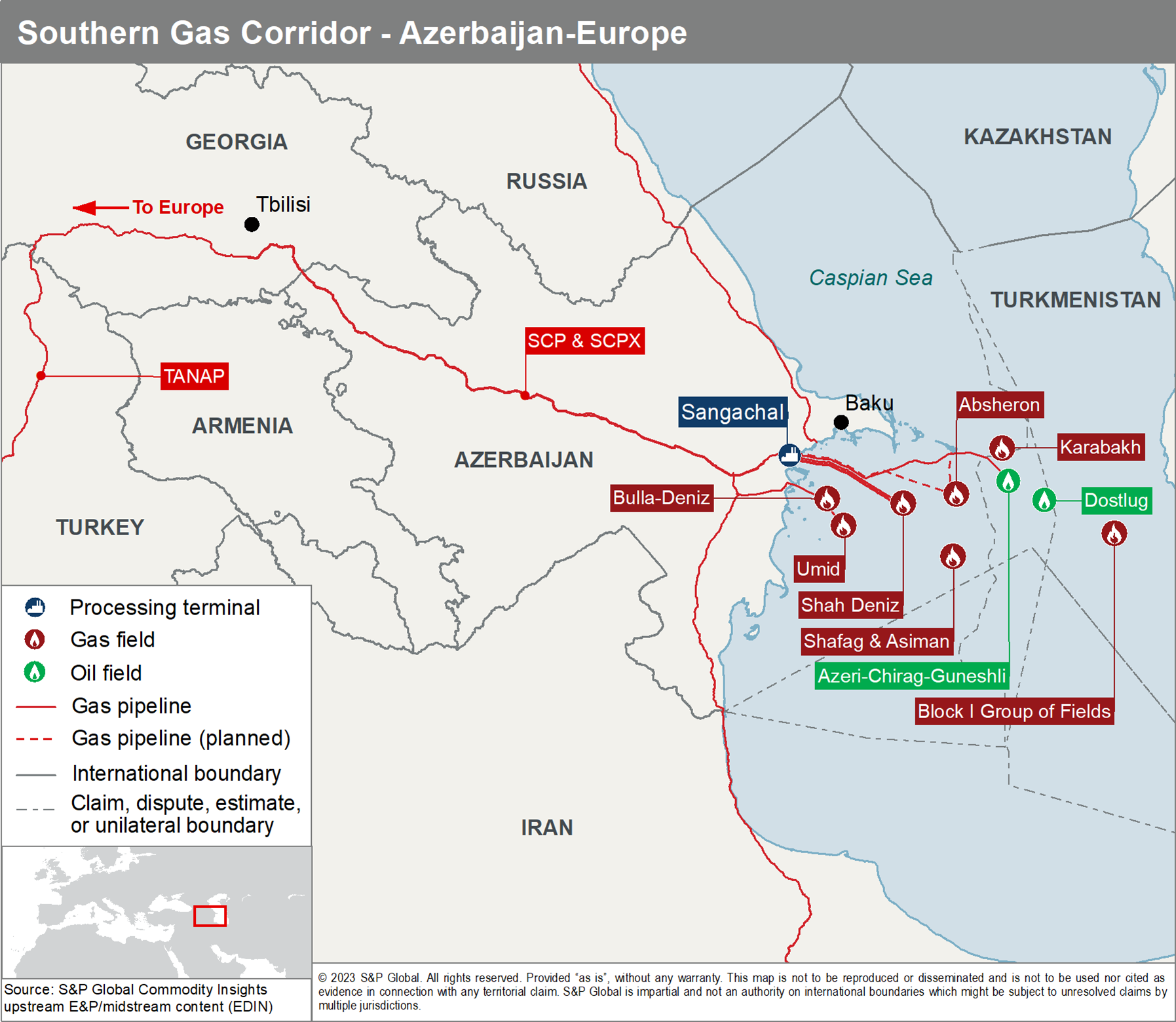

Figure 1:Offshore fields and infrastructure around the Southern Gas Corridor.

The Southern Gas Corridor (SGC), aimed at diversifying European energy supply, brings gas from the Azerbaijan sector of the Caspian Sea, specifically from the BP operated Shah Deniz field. Gas is transported across Azerbaijan and Georgia through the South Caucasus Pipeline (SCP) and South Caucasus Pipeline Expansion (SCPX). From there it enters Turkey and into the Trans-Anatolian Natural Gas Pipeline (TANAP). It transects Turkey and onwards into the Trans Adriatic Pipeline (TAP) at the Turkish Greek border, supplying gas to Italy, Greece, Bulgaria and Albania. SCP has a current capacity of approximately 7.41 Bcm/y and SCPX around 16.63 Bcm/y. TANAP operates at a capacity of around 16 Bcm/y and TAP at 10 Bcm/y. With the promise of doubling exports to Europe by 2027 to 20 Bcm/y, significant upgrades on these trunklines will be required to handle additional volumes. Additional compression across the SGC system could increase volumes drastically. The SCP and SCPX systems could reach around 31 Bcm/y combined, TANAP would increase to 31 Bcm/y with the addition of 5 more compression stations, and TAP could operate at 20 Bcm/y. This is good for the partners, countries and the end consumers involved. Additional compression is a relatively quick and efficient way to boost capacity to the desired 2027 requirements without having to construct new pipelines. Pipeline gas has typically provided a cheaper alternative to LNG and therefore will help Europe re-establish its import balance, assuming Russian supplies don't increase in the future. However, with a significant capacity upgrade to the SGC, growing domestic demand and increasing demand from Georgia to move away from Russian imports, demand could reach 50 Bcm/y by the end of the decade. All of this raises questions; does Azerbaijan have the resources and development framework in place to double its exports to Europe by 2027? What resources does Azerbaijan have to fill this extra pipeline capacity, and can it be achieved on time?

Shah Deniz Phase 3 & Shafag-Asiman

Shah Deniz Phase 3 is looking to target deeper reservoirs and the flanks of the existing structure of the field. At the end of January 2023, the consortium spudded an exploration well (SDX-8) using the Heydar Aliyev semi-submersible rig. The well is planned to test formations deeper than those already identified at Shah Deniz, beyond 7,000 m. It is expected that the well could take up to one year to drill, potentially longer if extended testing and significant data collection takes place. If exploration is successful, the new resources could be used to support a third stage of production, Shah Deniz (Phase 3). This stage would require the latest technology in high pressure production systems and well completions and will likely come with significant technical challenges and expense. If the development is sanctioned, S&P Global anticipate that the third phase wouldn't increase capacity at Shah Deniz, but likely be used to extend the fields 26 Bcm/y plateau further into the future. It's also likely that a future phase at Shah Deniz would take priority over BP's deep water Shafag-Asiman discovery. That said, they could be developed together using a network of subsea production systems to extend peak production from the field. This project is of national importance to Azerbaijan, it underpins significant domestic market volumes, strengthens the country's export capacity, and is seen as the backbone of supply for years to come.

Absheron

In the offshore sector of Azerbaijan, there remains large untapped gas reserves. The Absheron field owned by TotalEnergies and the State Oil Company of the Republic of Azerbaijan (SOCAR), is approaching first production from an early production scheme (EPS) aimed at supplying the domestic market only. The estimated 1.5 Bcm/y production capacity supplied by just one well will be tied back to the Oil Rocks processing facility for processing and export. Absheron is one of the largest untapped natural resources in Azerbaijan, TotalEnergies and SOCAR are looking at the possibility of further expansion at the project. Further development could potentially support the addition of 5-6 Bcm/y of gas supply to either the domestic or export market. A second phase of development would be costly, and a decision would need to be made in the next 12 months if the project had any potential of supplying gas to meet Europe's 2027 import target.

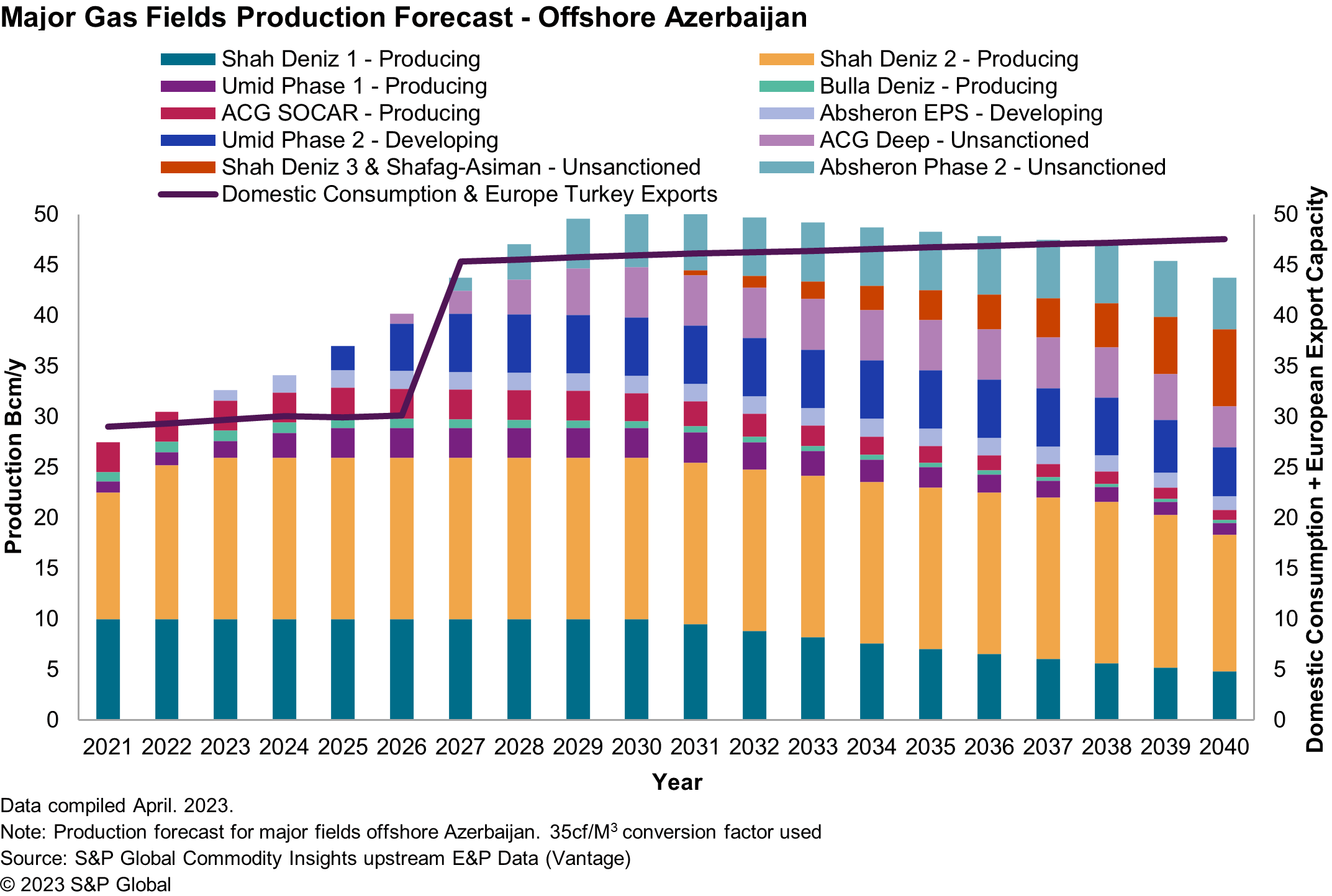

Figure 2: S&P Global Vantage offshore gas supply forecast from the Azerbaijan Caspian sector.

Azeri-Chirag-Guneshli

Azeri-Chirag-Guneshli (ACG) has the potential to provide significant gas volumes in the future. Currently gas produced at the field is largely re-injected to maintain reservoir pressure and boost oil production. A small proportion of the gas (2.6 Bcm in 2022) is supplied to SOCAR to meet some of Azerbaijan's existing domestic demand. BP are currently drilling the A22z well from the Chirag platform, a deviation off the existing A22 injection well. This well is targeting the gas focused southern flank of the structure and will reach a depth of around 4,500 m. The well is funded by the ACG consortium ahead of an agreement over who owns the gas, suggesting the operator is confident in discovering significant gas reserves. If large volumes are found this could add significant reserves to the already giant reserve base at the field. Resource estimates suggest around 3.5 Tcf (Trillion cubic feet) for the target interval which could be realised quickly utilising existing infrastructure.

Umid

The Umid field is a large producing gas field operated by SOCAR. To date, production has been limited to around 1 Bcm/y but additional de-bottlenecking, improved pipeline infrastructure and upgrades to the Dashgil-2 terminal mean further volumes can start to be realised. The Umid Phase 1 platform production plateau could reach could around 3 Bcm/y in the foreseeable future. Increasing gas production at the field would be most welcome for SOCAR and could satisfy growing domestic demand over the next few years. It is unlikely that an increase from Umid-1 would provide any significant export volumes to Europe. Umid-2 however, does have the potential to further strengthen supply and increase gas production from the field up to 8-9 Bcm/y. Delays to the project through 2021 and 2022 have resulted in production start-up being pushed back, as well as impacting the exploration of the Babek structure. If the project can be on stream by 2025, then Umid has the potential be a significant gas supplier to Europe.

Turkmenistan

As the EU seeks alternative energy sources, discussions of extending the SGC to Turkmenistan appears to have once again gained traction. Based on existing infrastructure, it's likely that the only supplies from Turkmenistan would come from the Petronas' owned offshore Block I fields. A quick increase in gas production could be realised. Petronas could boost production from the Block I group of fields and supply gas to the ACG facilities by installing a new, 85 km pipeline. An additional 5 Bcm/y would be significant for Azerbaijan in helping them balance a potential deficit. The pipeline could also make up the start of the Trans-Caspian Gas Pipeline, a pipeline that in the future could link Turkmenistan to Azerbaijan and onwards into Europe. However, significant regulatory and contractual negotiations between multiple countries and companies would need to be overcome as well as accounting for technical difficulties at the project. The addition of a new cross border pipeline alongside the current SGC could further boost gas exports to Europe, however Europe's long-term appetite is unlikely to be substantial enough to justify development of this project.

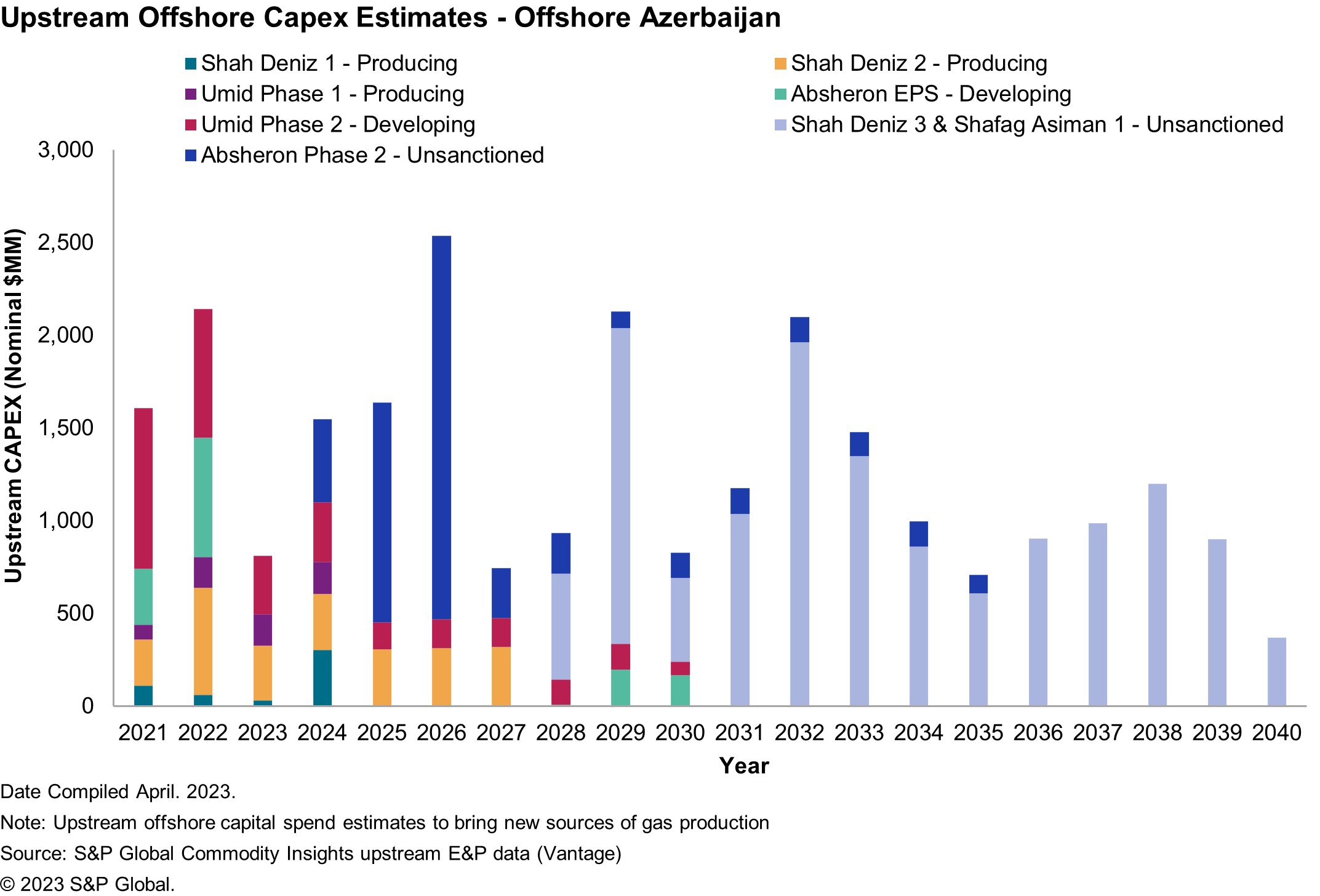

Figure 3:Potential upstream investment required to achieve the desired increase in production offshore in the Caspian.

Striking a balance - Energy Independence vs European Export

Azerbaijan must consider its own domestic requirements alongside strengthening its position in a region dominated by tense geopolitical pressures. Azerbaijan's domestic gas consumption has the potential to top 15 Bcm/y by 2030, an increase of 25% from the end of 2022. As the country strives to supply more gas to Europe, Gazprom announced in November 2022 that it would supply up to 1 Bcm to Azerbaijan through to March 2023, raising concerns that Baku was struggling to meet both domestic and European demand. A gas-swap agreement has been reached with Turkmenistan, through Iran, where 1.5-2 Bcm/y would be supplied to Northeast Iran from Turkmenistan, with the equivalent volume supplied from Northwest Iran to Azerbaijan. The European commission is likely to be concerned over both deals, with European demand still driving exports and revenues for these states. Figure 2 represents an aggressive approach to boosting domestic production; however, it is worth noting that not all these projects will be realised, especially in the timeframe required. It does highlight that without additional volumes supplied by Turkmenistan fields, Azerbaijan will unlikely be able to meet demand growth both domestically and internationally. Significant upstream investment would be required, and quickly, if Azerbaijan is to fulfil this on its own. Substantial future supply in figure 2 comes from unsanctioned projects which have the potential for added complications, especially as we've seen significant delays to current projects already. Nevertheless, even if Azerbaijan can realise these projects in time, the gas balance will remain extremely tight and only imports from Turkmenistan, Iran and Russia will comfortably see Azerbaijan meeting this increased demand.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.