BLOG

Dec 10, 2021

World Oil Watch: Lost barrels - 4.4 MMb/d of supply won't show up. Will OPEC+ oil supply power strengthen or diminish?

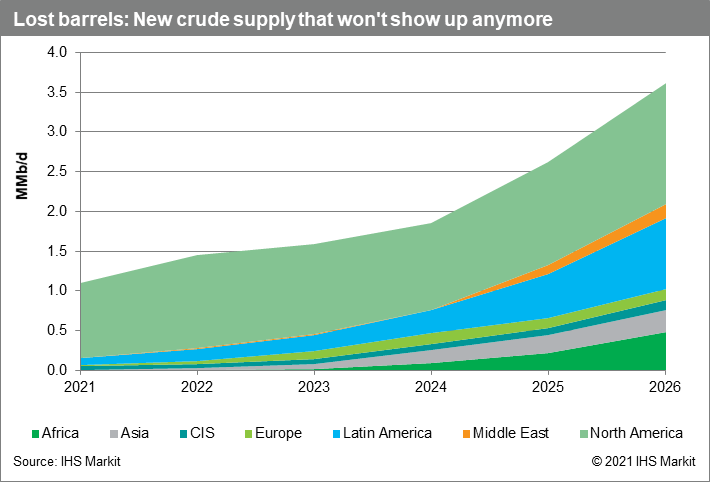

- About 4.4 MMb/d of global oil (crude and liquids) production will not show up until 2027, or later—and might not at all. This is the volume of oil supply "lost" owing to the decline in upstream capex since 2019 brought about by last year's oil price collapse and energy transition-related investment decisions. The volume of lost supply is greater than the entire production from any single OPEC member apart from Saudi Arabia and Iraq.

- About 3.6 MMb/d of the lost supply is crude oil, with the balance consisting of natural gas liquids, and biofuels. The United States accounts for 1.5 MMb/d of lost crude oil supply—the largest share, by far, of any country. The loss of US supply was a key factor, along with a big increase in demand, in OPEC+ enjoying strong oil market power in 2021. However, oil supply power is dynamic—not static. The degree to which US production growth returns, or not, will play a major role, along with the pace of world oil demand growth, in determining the global balance of oil supply power in 2022 and beyond.

- The loss of supply does not predetermine higher prices in the years ahead. Global oil demand was also reset at a lower level because of COVID-19, which is still a threat to demand as illustrated by the new Omicron variant. But the quick reactivity of supply to market conditions, both from OPEC+ and the United States, means oil price cycles—of surplus and deficit—will be shorter than the 8‒18-year cycles of the past.

- The tension between long-term decarbonization aspirations and short-term economic and political concerns will continue—and is a new fundamental variable for the world oil market. Governments of major oil-consuming markets want more oil supply when prices are high, but also discourage oil consumption and thus investment in new supply. It is a recipe for dislocations and mismatches between demand and supply.

Learn more about Crude Oil Market analysis from IHS Markit.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fworld-oil-watch-lost-barrels.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fworld-oil-watch-lost-barrels.html&text=World+Oil+Watch%3a+Lost+barrels+-+4.4+MMb%2fd+of+supply+won%27t+show+up.+Will+OPEC%2b+oil+supply+power+strengthen+or+diminish%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fworld-oil-watch-lost-barrels.html","enabled":true},{"name":"email","url":"?subject=World Oil Watch: Lost barrels - 4.4 MMb/d of supply won't show up. Will OPEC+ oil supply power strengthen or diminish? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fworld-oil-watch-lost-barrels.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=World+Oil+Watch%3a+Lost+barrels+-+4.4+MMb%2fd+of+supply+won%27t+show+up.+Will+OPEC%2b+oil+supply+power+strengthen+or+diminish%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fworld-oil-watch-lost-barrels.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}