Global LNG Market Outlook 2021

What will 2021 bring after a chaotic year in which spot LNG prices bounced from record lows to record highs, delaying billions of dollars in final investment decisions (FID)? While the underlying fundamentals indicate that the surplus conditions that characterised much of 2020 would certainly persist, this outcome is not guaranteed.

Participants encounter difficulties in making investment and contracting decisions at an insecure stage of the cycle, as well as a greater emphasis on sustainability and capital discipline.

What impact will the unprecedented winter spot LNG price spike have on the market in 2021?

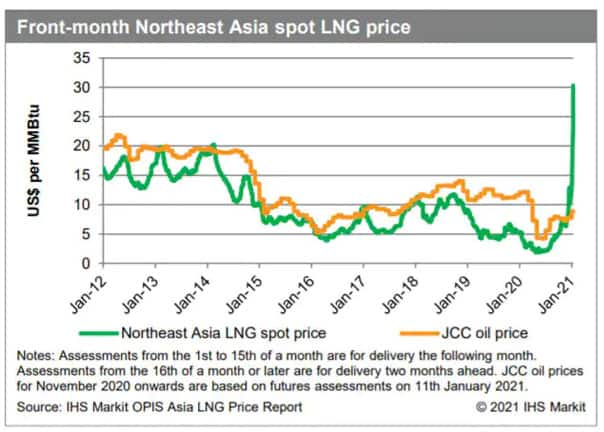

Northeast Asian spot LNG prices for February 2021 delivery reached $33.65/MMBtu on January 12, 2021, a new daily high by far. The increase was a significant surprise, especially as it came just a few months after LNG exports were lowered to balance the market in light global conditions, resulting in record lows of $1.90/MMBtu in June 2020.

Multiple factors converged to push prices up. Owing to several liquefaction outages and a lack of accessible transportation, Asian LNG demand spiked due to the cold weather while supply was constrained. Prices soared past prior highs due to market illiquidity and the inability to redirect supplies where it was required on short notice.

A key question is whether the current price rise is a one-off result of a perfect storm of events, or if it indicates that the LNG excess that arose in summer 2020 has already been worked off much more quickly than planned. Underlying factors, which will be examined in more detail in later questions, continue to indicate to excess circumstances and low prices resurfacing in summer 2021, with supply capacity forecast to rise faster than demand and shipping not projected to be as tight. Because of this year's spot price rise, utilities are expected to designate more long-term supplies and lock up short-term commitments for next winter, easing any squeeze on prompt prices.

Nonetheless, in a market currently characterised by limited trade volumes and difficulties physically responding to quick price signals, there is a possibility of surges in winter 2021-2022, especially if severe cold weather events coincide with supply interruptions once more.

Will COVID-19 continue to dent global LNG demand growth, or should we expect a sharp recovery?

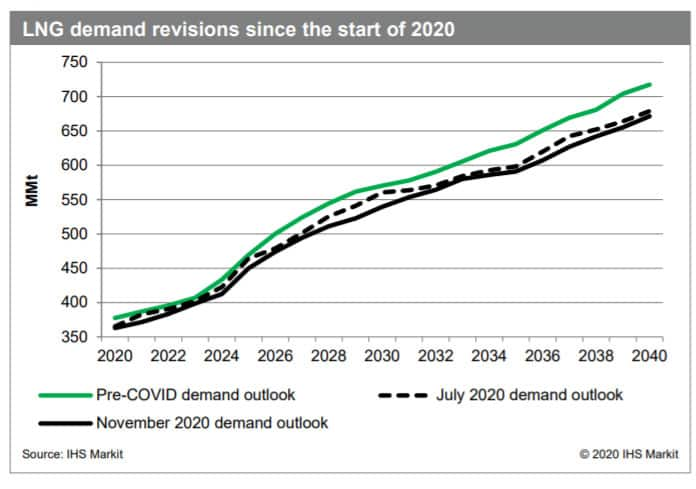

As the impact of COVID-19 aggravated already shaky fundamentals, S&P Global predicts that surplus capacity accounted for 6% of the LNG market in 2020. In 2021, we predict a 3% year-over-year (YOY) increase in demand (assuming normal weather conditions) to be met by a 4% YOY growth in available supply, implying a structural surplus once more.

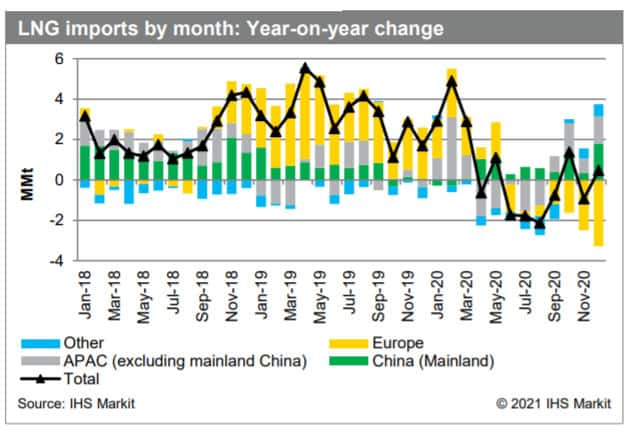

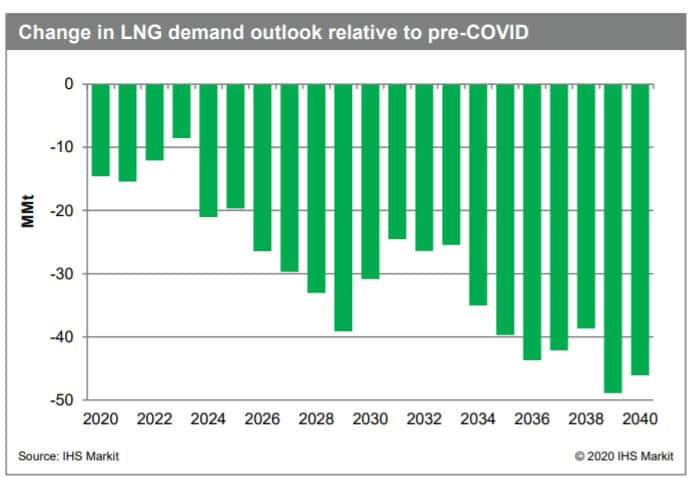

Prior to the global spread of COVID-19, S&P Global expected LNG trade to grow by nearly 5% year on year (YOY) in 2020; however, actual LNG trade growth in 2020 was only 1.5 percent YOY (roughly 13 MMt below our original expectations), owing in part to containment measures put in place to curb the virus's spread and its economic ramifications. COVID-19's continued impact on LNG demand growth is one of the most important elements in how the LNG market will balance in 2021.

With the distribution of vaccines continuing to ramp up around the world, some observers are hopeful for a sharper demand recovery in 2021 given the resiliency some key markets showed last year.

The concern is whether demand will rebound quickly enough to compensate for the growth lost in 2020 and keep up with the rise in available supply. The extent of the demand increases in mainland China, which is expected to be the world's greatest growing market in 2020, will be a crucial determinant of the global balance. The growth of LNG demand in the region was aided by a pricing advantage over oil-indexed pipelines, which is less likely to be repeated in 2021. New pipeline rampups, for example, are likely to prevent any LNG demand rebound in Mexico, which saw the greatest YOY LNG demand reduction in 2020.

Will supply cutbacks be needed again, or will the market remain tighter than anticipated?

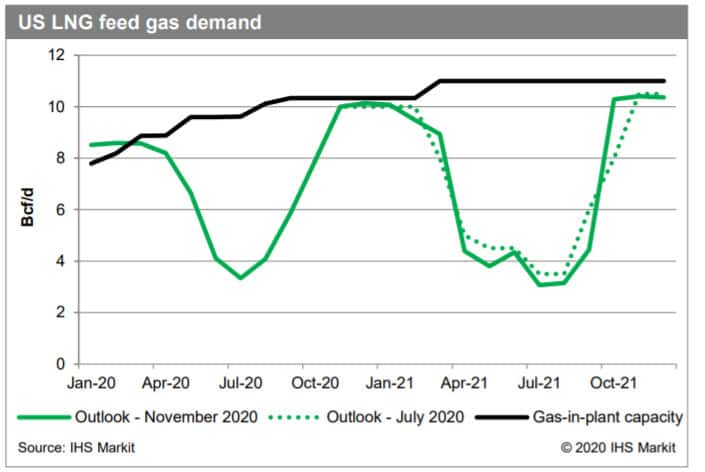

To balance the market in 2020, the surplus conditions resulted in average global liquefaction utilisation plunging to historic lows throughout the summer months as demand failed to keep up with available supply. Flexible producers in two countries, the United States and Egypt, were responsible for most of the supply decreases.

From June to August, average utilisation across the six existing plants in the United States fell to just 40%, while Egypt only exported one cargo from March to September. Due to a seasonal spike in worldwide LNG demand and a strong jump in prices, both countries' export rates rebounded to nearly full capacity by the end of the year.

However, a significant number of supply outages occurred simultaneously in Q4 2020, which took an estimated 6–8% of available export capacity offline at once in some periods—an unusually large volume.

A big question for the LNG market is: Are these short-lived outages or will they continue to affect global supply through the year?

Because of continued feedstock drops (e.g., Equatorial Guinea LNG, Atlantic LNG, and Bontang LNG) and lengthy outages (e.g., Hammerfest LNG and Gorgon LNG), some utilisation decreases are already known to stretch into 2021, but the duration and scale of many of these decreases are unknown.

Furthermore, some of the reduced liquefaction utilisation is likely attributable to acute constraints in the shipping market (e.g., Angola LNG and numerous cancelled cargoes in the US), which should ease as additional newbuild vessels enter the market and the winter demand peak eases.

According to our current demand forecasts for 2021, a significant amount of supply capacity would need to be unavailable throughout the summer to avoid market-related supply cuts in the United States and Egypt. The continuation of current outages—or the occurrence of future ones—might allow for higher utilisation rates than in 2020, but they are unlikely to eliminate the requirement for for some cutbacks. On an annualized average basis, roughly 27 MMtpa of capacity would need to remain offline to balance current expectations of normal-weather demand.

How might capital constraints reshape LNG business models?

Following the 2020 demand and price shocks, IOGCs—which, as LNG aggregators, utilised their financial sheets and worldwide portfolios to propel many of the recent liquefaction investments—are under pressure to minimise capital exposure, generate superior returns, and return cash to shareholders. The LNG industry will face a difficulty in 2021 and beyond as a result of this circumstance.

The challenge is how LNG business models might evolve to attract different sources of lower-cost financing and their varied risk tolerance in a world of low interest rates and government fiscal stimulus. More developers may carve out or spin off segments of the LNG value chain in the future.

Future LNG investments will be under pressure and exposed to many litmus tests, even with a lower cost of capital. Is the project able to deliver a market-competitive cost of supply while still assuring a reasonable risk-adjusted return for the sponsors? Is it better to return funds to shareholders and, if necessary, purchase additional LNG from other parties? Does the project’s environmental footprint fit with the sponsors’ and customers’ sustainability strategies and their views on when LNG demand may peak?

Learn more about the LNG market from our webinar, COVID-19 and low oil price: What’s ahead for the global LNG market?