Country risk scores

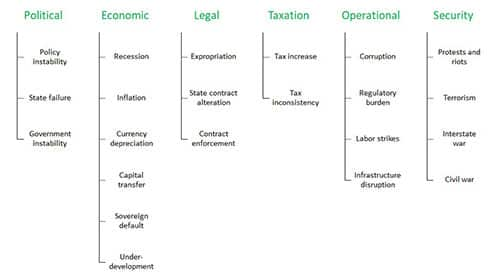

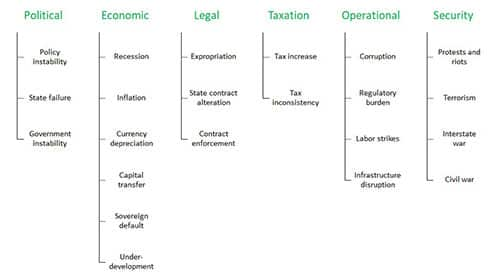

Enhanced country risk scores evaluate the investment environment in 211 countries

- Detailed view of the risk environment with 1 year forward-looking risk scores for 6 aggregate and 22 sub-aggregate risk categories.

Click to enlarge - Customize country risk scores for projects or portfolio analysis by adjusting weights for key risk criteria

- Seven risk bands provide a threshold to compare and contrast risks between countries and regions

Click to enlarge

Sovereign Risk Scores

Independent credit risk assessments for 206 countries to evaluate the potential for default on sovereign debt. You can set country limits for loan and investment portfolios and identify short-term credit opportunities and risks.

One year and five-year Sovereign risk scores as well as one year forward-looking credit risk scores help assess capital transfer, sovereign default, currency depreciation risks.

Detailed scores and analysis for:

- Solvency ratios

- Liquidity (short-term and medium-term)

- Economic policy impacts

- Political factors

- Extensive database of debt indicators with forecast

Click to enlarge

Banking Risk Score

Effectively monitor the world's most intriguing and hard-to-assess banking sectors with detailed analysis, risk scores, data and expertise from our team of banking sector experts

- Risk scores and analysis for 48 key emerging markets

- Five-year banking sector forecasts for 100 countries

- Profiles of top five banks in each country to help you efficiently understand ownership structure and loan performance data

- Daily headline analysis stories help you stay on top of emerging risks and key events.

- Access to dedicated Banking Risk analysts

Country reports

In-depth analysis of the investment environment by country, focusing on six criteria: political context, economic performance, legal environment, tax regime, operational framework, and security risks.

- Consistent coverage of each country with analysis of high-impact market drivers, including domestic politics, economic strategy, inflation, currency, trade, debt and labor, as well as the tax and legal environments, and assessments of the level of corruption and terrorism and other operational and security problems.

- All country reports are fully integrated with the other components of the service:

- Links to intelligence events and headline analysis,

- Full integration with country risk scores.

- Assessment of key business environment strength and weaknesses

- Economic scenarios as well as changes since the last forecast section

Headline analysis

Daily analysis of key developments, events, and trend and their impact on the investment environment in 211 countries by a team of country risk specialist and economists.

- Assess the impact of news and events on country risks and opportunity based on six criteria: economic performance, political context, legal environment, tax regime, operational framework, and security risks. Coverage of economic events includes all commentary on key data releases.

- Stringent editorial process: topics are identified and selected daily by the analyst team, based on their specialized knowledge of local, regional, and global markets.

- Powerful archive search allows historical analysis of events relating to a specific market or topic.

Economic forecasts

30-year economic forecasts on up to 300 key indicators in 206 countries. This provides a comprehensive assessment of the macroeconomic and investment climate:

- Domestic data (GDP, inflation, budget, unemployment, etc.).

- External data (trade and current-account balance, debt, reserves, FDI).

- Global economic outlook updated every month for largest 103 countries

- Analysis of each region and its relationship to the global economy.

- Scenario analysis by country analyzes economic impacts

Monthly forecast updates for the 103 largest economics and detailed quarterly forecasts for all 206 countries. Flexible data retrieval and reporting tools enable client to prepare custom reports and compare large sets of economic data across countries.

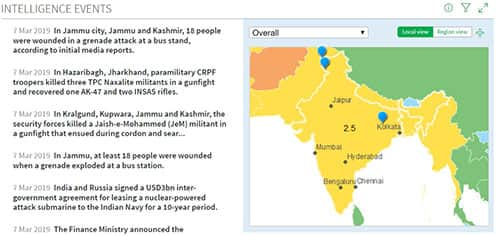

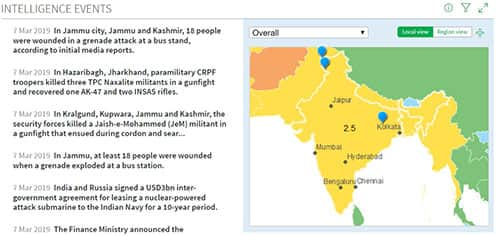

Risk-relevant intelligence events

Intelligence events identify risks impacting the investment climate in a country.

- Track new information with 2,500 new intelligence events published each week

- Evaluate trends over time by leveraging the database of over 1,000,000 events

- Email alerts customized to your interests

Click to enlarge

Maximize your subscription content with S&P Global Connect™ – our online customer platform.

- Customize country risk scores – adjust score weighting to create project or portfolio specific risk indicators

- Refreshable Economic Data Spreadsheets: Create custom data pulls with integrated graphing and charting functions within our DataBrowser tool. Save to your desktop/laptop and update automatically

- Presentation Tools: Build customizable, presentation-ready graphs

- Flexible Export: Export content in multiple formats (Excel, PDF, PowerPoint)

- Automated Content Refreshes: Save searches and update content automatically